Annual Report 2006 - JAL | JAPAN AIRLINES

Annual Report 2006 - JAL | JAPAN AIRLINES

Annual Report 2006 - JAL | JAPAN AIRLINES

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

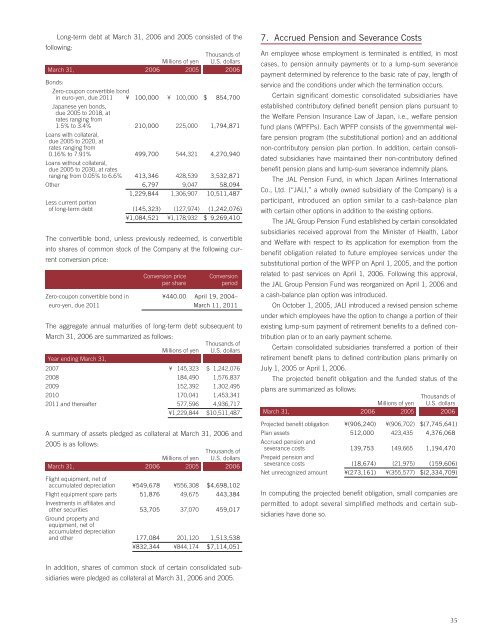

Long-term debt at March 31, <strong>2006</strong> and 2005 consisted of thefollowing:Thousands ofMillions of yen U.S. dollarsMarch 31, <strong>2006</strong> 2005 <strong>2006</strong>Bonds:Zero-coupon convertible bondin euro-yen, due 2011 ¥ 100,000 ¥ 100,000 $ 854,700Japanese yen bonds,due 2005 to 2018, atrates ranging from1.5% to 3.4% 210,000 225,000 1,794,871Loans with collateral,due 2005 to 2020, atrates ranging from0.16% to 7.91% 499,700 544,321 4,270,940Loans without collateral,due 2005 to 2030, at ratesranging from 0.05% to 6.6% 413,346 428,539 3,532,871Other 6,797 9,047 58,0941,229,844 1,306,907 10,511,487Less current portionof long-term debt (145,323) (127,974) (1,242,076)¥1,084,521 ¥1,178,932 $ 9,269,410The convertible bond, unless previously redeemed, is convertibleinto shares of common stock of the Company at the following currentconversion price:Conversion priceper shareConversionperiodZero-coupon convertible bond in ¥440.00 April 19, 2004–euro-yen, due 2011 March 11, 2011The aggregate annual maturities of long-term debt subsequent toMarch 31, <strong>2006</strong> are summarized as follows:Thousands ofMillions of yen U.S. dollarsYear ending March 31,2007 ¥ 145,323 $ 1,242,0762008 184,490 1,576,8372009 152,392 1,302,4952010 170,041 1,453,3412011 and thereafter 577,596 4,936,717¥1,229,844 $10,511,487A summary of assets pledged as collateral at March 31, <strong>2006</strong> and2005 is as follows:Thousands ofMillions of yen U.S. dollarsMarch 31, <strong>2006</strong> 2005 <strong>2006</strong>Flight equipment, net ofaccumulated depreciation ¥549,678 ¥556,308 $4,698,102Flight equipment spare parts 51,876 49,675 443,384Investments in affiliates andother securities 53,705 37,070 459,017Ground property andequipment, net ofaccumulated depreciationand other 177,084 201,120 1,513,538¥832,344 ¥844,174 $7,114,0517. Accrued Pension and Severance CostsAn employee whose employment is terminated is entitled, in mostcases, to pension annuity payments or to a lump-sum severancepayment determined by reference to the basic rate of pay, length ofservice and the conditions under which the termination occurs.Certain significant domestic consolidated subsidiaries haveestablished contributory defined benefit pension plans pursuant tothe Welfare Pension Insurance Law of Japan, i.e., welfare pensionfund plans (WPFPs). Each WPFP consists of the governmental welfarepension program (the substitutional portion) and an additionalnon-contributory pension plan portion. In addition, certain consolidatedsubsidiaries have maintained their non-contributory definedbenefit pension plans and lump-sum severance indemnity plans.The <strong>JAL</strong> Pension Fund, in which Japan Airlines InternationalCo., Ltd. (“<strong>JAL</strong>I,” a wholly owned subsidiary of the Company) is aparticipant, introduced an option similar to a cash-balance planwith certain other options in addition to the existing options.The <strong>JAL</strong> Group Pension Fund established by certain consolidatedsubsidiaries received approval from the Minister of Health, Laborand Welfare with respect to its application for exemption from thebenefit obligation related to future employee services under thesubstitutional portion of the WPFP on April 1, 2005, and the portionrelated to past services on April 1, <strong>2006</strong>. Following this approval,the <strong>JAL</strong> Group Pension Fund was reorganized on April 1, <strong>2006</strong> anda cash-balance plan option was introduced.On October 1, 2005, <strong>JAL</strong>I introduced a revised pension schemeunder which employees have the option to change a portion of theirexisting lump-sum payment of retirement benefits to a defined contributionplan or to an early payment scheme.Certain consolidated subsidiaries transferred a portion of theirretirement benefit plans to defined contribution plans primarily onJuly 1, 2005 or April 1, <strong>2006</strong>.The projected benefit obligation and the funded status of theplans are summarized as follows:Thousands ofMillions of yen U.S. dollarsMarch 31, <strong>2006</strong> 2005 <strong>2006</strong>Projected benefit obligation ¥(906,240) ¥(906,702) $(7,745,641)Plan assets 512,000 423,435 4,376,068Accrued pension andseverance costs 139,753 149,665 1,194,470Prepaid pension andseverance costs (18,674) (21,975) (159,606)Net unrecognized amount ¥(273,161) ¥(355,577) $(2,334,709)In computing the projected benefit obligation, small companies arepermitted to adopt several simplified methods and certain subsidiarieshave done so.In addition, shares of common stock of certain consolidated subsidiarieswere pledged as collateral at March 31, <strong>2006</strong> and 2005.35