Annual Report 2000 - Kemira

Annual Report 2000 - Kemira

Annual Report 2000 - Kemira

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Europa im Blick – EU-Förderungen im Land Brandenburg Seite 1Europa im Blick –EU-Förderungen im Land Brandenburg- Unterrichtsmaterial -GEKO e.V.www.geko-bb.de„Konkurrenz für den Laser“Wer heute die leistungsstärkste Plasma-Trennschneidanlageder Welt ordern will, der kommt an Kjellberg inder Lausitz nicht vorbei. In wenigen Tagen stellt dieKjellberg Finsterwalde Plasma und Maschinen GmbHihre neue Anlage HiFocus 440i auf der Messe „Euroblech“in Hannover vor. Mit 440 Ampere Stromstärke und 100Kilowatt Leistung kann sie einen Brenner so mit Energie versorgen, dass er bis zu 100Millimeter starkeEdelstahlbleche sauber zu durchtrennen vermag. In ihren Leistungsparametern ist sie so abregelbar,dass sich mit ihr sogar Gravuren (Beschriftungen) ausführen und ganz dünne Bleche schneidenlassen. Diese Technologie ist heute so vielseitig, dass sie zur ernsten Konkurrenz für die Laserschneidtechnikwurde. Etwa ab einer Blechstärke von 30 Millimetern sei für den Laser praktischSchluss, erläutert Krink. Plasma-Trennschneidanlagen hätten aber noch einen anderen entscheidendenVorteil: Sie kosteten in der Regel nur ein Sechstel dessen, was für eine Laseranlage (etwa 300000 Euro) gezahlt werden müsse. Der Exportanteil des Unternehmens liegt mittlerweile bei 55 Prozent.Die Unternehmensgruppe ist dabei mit 1,75 Millionen Euro Fördermitteln unterstützt worden.Warum investiert die Europäische Union Millionen in Elbe-Elster?Das Beispiel des EFRE-geförderten Kjellberg FinsterwaldePlasma und Maschinen GmbH istnur eines von vielen, das die Bedeutung der EU-Förderpolitik für das Land Brandenburg aufzeigt.Allein über den Europäischen Sozialfonds wurden in der Förderperiode <strong>2000</strong> bis 2006rund 26.000 kleinere und größere Projekte in Brandenburg gefördert.Brandenburg erhält EU-Fördermittel, weil das so genannte Bruttoinlandsprodukt (BIP) proEinwohner unter 75% des EU–Durchschnitts liegt. Dieses BIP-Kriterium haben die EU-Staaten im Rahmen ihrer „Konvergenz“-Politik festgelegt.„Konvergenz“ heißt „Annäherung“. Es bedeutet, dass innerhalb der EU versucht wird, dieLebensverhältnisse aller Mitgliedsstaaten – bis hin zu einzelnen Regionen – einander anzugleichen.Diese Politik ist eine Konsequenz, die vor mehr als fünfzig Jahren aus den verheerendenKriegen des 20 Jahrhunderts gezogen wurde: Zentrales Ziel der Europäischen Union, die1957 noch als „Europäische Wirtschaftsgemeinschaft EWG“ gegründet wurde, war der Erhaltdes Friedens. Man war überzeugt: Wirtschaftlicher Wohlstand ist ein wichtiger Garant fürden Frieden. So war die „Schaffung annähernd gleicher Lebensverhältnisse“ zentraler Bestandteilder „Römischen Verträge“, dem Gründungsdokument der EWG von 1957.Also mussten diejenigen unterstützt werden, denen es auch damals schon wirtschaftlichnicht so gut ging. Zum Beispiel den Regionen im Süden Italiens, die „Mezzogiorno“ genanntwerden.Die Förderpolitik hat sich über die Jahrzehnte geändert. Seit <strong>2000</strong> gibt es längerfristige Förderperioden.Nach der Förderperiode <strong>2000</strong>-2006 befinden wir uns aktuell in der Förderperiode2007 bis 2013.

CompanyTikkurilaTikkurila OyTikkurila Paints OyTikkurila ABAS Baltic Color 1)UAB Baltic ColorZAO FinncolorOOO Kraski TikkurilaTikkurila Festék KFTImagica LtdA/S Baltic Color 1)Tikkurila Polska Sp. z o.o. 2)Spetra S.r.l.Tikkurila Coatings OyTikkurila Coatings B.V.Tikkurila Coatings (Ireland) LtdTikkurila Coatings LtdTikkurila ABAS Tikkurila CoatingsTikkurila Coatings KFTZAO Tikkurila CoatingsSiA Tikkurila CoatingsTikkurila Services OyTikkurila Finance OyAlcro-Beckers ABAlcro-Beckers Norge A/SAlcro-Beckers Poland LtdAlcro-Beckers Danmark A/SPolifarb Becker Debica SANokian Laatumaalit OyPigrol Farben GmbHHolmbergs Färg i Skövde ABFärghuset i Bollnäs ABSundsvalls Färghandel ABTapetlagret Öbergs Färghus i Västerås ABGemptus ABFärgmästaren J E Englund ABHässleholms Färg & Miljö ABRF Golventreprenader ABRunes Färger ABGamol Försäljnings ABFärghuset i Malmö ABFärgservice i Malmö ABFärghuset i Kristinehamn ABBilldals Färghus ABGolv & Färghuset Peter Alvefelt AB<strong>Kemira</strong> Agro<strong>Kemira</strong> Agro Oy<strong>Kemira</strong> Agro Holdings Ltd<strong>Kemira</strong> Agro U.K. Ltd<strong>Kemira</strong> Ltd<strong>Kemira</strong> Ireland Ltd<strong>Kemira</strong> S.A./N.V.Battaille S.A.Engrais Battaille S.A.<strong>Kemira</strong> Engrais S.A.<strong>Kemira</strong> Agro Holding B.V.2

OUR CORE VALUES• Respect for individuals• Innovation• Working together• Goal orientation(More about our values on page 55.)OUR VISIONWe are the preferred partner to our customers, offeringcomplete solutions.WE AIM TO BE• The leading chemical and integrated serviceprovider for the pulp & paper industry.• The world leader in chemical water purification.• A leading European paint and coatings company.• A world-class performer in industrial chemicals.• The preferred partner in the food supply chain,offering novel solutions and integrated services.OUR CORE COMPETENCIESWater management andchemistry• Water treatment applicationsfor both drinkingwater and wastewater.• Water treatment knowhowbased on expertiseand cost-effectiveness thatcan also be exploited withinour core businesses.FINANCIAL OBJECTIVES<strong>2000</strong> TargetYear of change from 2001Net sales growth, % (continuing operations) 11 Over 10Operating income, % of net sales (continuing op.) 8 Over 10Earnings per share, growth % 217 Over 10Cash flow return on capital invested, % 11 Over 10Gearing, % 37 40–100Environmental know-how and recycling• Integrated solutions aimed at recycling raw materialsor utilizing waste.• Environmentally friendlier alternatives for chemicalsand their applications.• Increasingly sustainable integrated solutions.Internal and external networking• Our organization is flexible, allowing us to reactquickly to changes.• We implement the best practices throughout the Group.• We continuously create closer links to ourexternal networks.Brands and integrated services• Integrated services and quality products tocreate added value.• Brand products and services.• Cooperation and networking in our capital-intensiveoperations.4

<strong>Kemira</strong>’s business areas arechemicals, tikkurila and agroKEMIRA CHEMICALS OFFERS PRODUCTS ANDTOTAL SOLUTIONS FOR INDUSTRIAL CUSTOMERS<strong>Kemira</strong> Chemicals’ most important customers are the pulpand paper industry, water treatment plants and other industry(notably, the paints, printing ink, detergent and finechemicals industries). Pulp and paper chemicals as well aswater treatment chemicals are growth areas for the <strong>Kemira</strong>Group. <strong>Kemira</strong> Chemicals has production facilities in 27countries.Net sales in <strong>2000</strong>, EUR million 767% of Group net sales 30Operating income, EUR million 69% of Group operating income 40Personnel at 31.12. 3,329TIKKURILA SERVES PAINT CUSTOMERSTikkurila is a modern paint manufacturer whose brands arehousehold names in its home markets. In its marketing,Tikkurila draws on the advantages of the latest in tintingtechnology. It is an industry forerunner as a manufacturer ofenvironmentally sound products. Tikkurila has productionfacilities in 10 countries. Paints are one of the <strong>Kemira</strong>Group’s growth areas.Net sales in <strong>2000</strong>, EUR million 345% of Group net sales 13Operating income, EUR million 27% of Group operating income 15Personnel at 31.12. 1,506KEMIRA AGRO IS PART OF THE FOOD-SUPPLY CHAINAgro is one of Europe’s largest producers of specialty fertilizers.Its products are used in crop cultivation, greenhousesand horticultural applications. <strong>Kemira</strong> Agro is focussing onnew product and service packages, such as growth-promotingprogrammes for specific plants and varieties. <strong>Kemira</strong>Agro has production facilities in 11 countries.Net sales in <strong>2000</strong>, EUR million 1,116% of Group net sales 43Operating income, EUR million 23% of Group operating income 13Personnel at 31.12. 2,7595

CEO’s reviewDuring the past year we at <strong>Kemira</strong> have moved structurally in the direction wepromised, securing a lower level of capital-intensive operations and a reducedsusceptibility to the effect of business cycles. We have thus created possibilitiesfor both better earnings and faster growth.Although the forecasts for the trend in the world economy are partly conflicting- even downbeat - in the current year we expect the favourable trend to continuein our growth areas of operations: paper, pulp and water treatment chemicalsas well as paints. We shall continue to search actively for growth potentialthrough acquisitions as a continuation of last year’s Alcro-Beckers AB and KremsPaper Chemicals deals. Our aim in so doing is again to exceed our 10 per centannual growth target in our continuing business areas. In <strong>2000</strong> we achievedgrowth of 11 per cent.In all our business operations we have decided to focus on the total solutionsour customers require. We want to be more than just a supplier of chemicals.This will call for strengthening our R&D activities as we extend our networkingto encompass both customers and research institutes and universities.Environmental and recycling solutions occupy a central position within ouroperations. To meet these needs we have established competence centres inOulu to do water research and in Helsingborg, Sweden, to work on recycling solutions.We wish to underscore the objective of “the Quality of Life” in all sectorsof our operations. We are doing our part to ensure that the world has an adequatesupply of pure water and nutrition, a pleasing environment and a foundationfor culture and leisure pursuits.In developing our own products and processes, we want to stress the potentialfor achieving a balance between man, nature and industry. We want to abideby high ethical principles and to honour our commitment to international environmental,health and safety programmes, such as Responsible Care. Our environmentalbusiness will grow further from the level we have now reached: 14per cent of net sales.We also stress the importance of the quality of life in our working environment.This is why we have drawn up a set of shared values underpinning ouroperations. Our objective is a corporate culture in which each person’s knowhowand ability can develop and contribute to reaching our joint objectives.I wish to extend my warmest thanks to our customers, shareholders and otherstakeholders for their good cooperation during the past year. A special vote ofthanks goes to our personnel, who have actively and efficiently carried out ourfar-reaching process of transformation. I believe that the work we do togetherwill yield even better results in the year ahead.Tauno Pihlava6

In November an agreement wassigned on the acquisition of Alcro-BeckersAB, Sweden’s largest manufacturer ofdecorative paints. The deal entered intoforce 1 January 2001. <strong>Kemira</strong>’s positionin the UK was strengthened by purchasingthe industrial coatings business ofMason Coatings.The purchase of Krems PaperChemicals was completed in Septemberand it will increase the volume ofthe <strong>Kemira</strong> Chemicals’ Pulp & Paperunit by a good 10% annually. The watertreatment chemicals business wasbeefed up by acquiring a 15% interestin Kemiron Inc., one of the largest fullrangemanufacturers of coagulants inthe United States.It was decided to streamline theGroup’s business structure by combining<strong>Kemira</strong> Pigments Oy, which manufacturestitanium dioxide, with <strong>Kemira</strong>Chemicals’ Industrial Chemicals unit.The Kemphos phosphorus business,the Bolifor feed phosphates and thepotassium sulphate business, all ofwhich are connected with the foodsupply chain, would be transferredfrom <strong>Kemira</strong> Chemicals to <strong>Kemira</strong> Agro.<strong>Kemira</strong> Chemicals’ formic acid businesswould be transferred from the Pulp &Paper unit to the Industrial Chemicalsunit, as would the previously independentChemicals’ unit <strong>Kemira</strong> FineChemicals. The transfers aim tostrengthen the strategic focus accordingto which <strong>Kemira</strong> Chemicals will concentrateon industrial customers, Agroon customers who are part of the foodsupply chain and Tikkurila on paintcustomers. The transfers of businessescame into effect on 1 January 2001.Following these realignments,<strong>Kemira</strong> Chemicals’ net sales will increaseby about EUR 50 million and itsoperating income will improve substantiallybecause Pigments’ operating incomeis significantly better than that ofbusinesses transferred to Agro. Agro’snet sales will increase by about EUR120 million and its operating income isexpected to improve.KEMIRA CHEMICALSThe Group’s fastest growing area wasagain <strong>Kemira</strong> Chemicals, whose netsales rose by 10% to EUR 767 million(697 million). Of the strategic businessunits, Pulp & Paper Chemicals andKemwater continued to grow, whereasIndustrial Chemicals’ net sales wereslightly below the previous year’s figure.<strong>Kemira</strong> Fine Chemicals also grew.<strong>Kemira</strong> Chemicals posted operatingincome of EUR 69 million (83 millionin 1999), or 9% of net sales (12%).This figure included about EUR 13 millionof non-recurring write-downs onassets as well as about EUR 4 millionof additional costs arising from thestrikes in the spring. The greater expenseof raw materials and transportcosts due to the high price of oil hasled to higher overall costs, whichcould not in all cases be passed oninto product prices.Sales by the Pulp & Paper Chemicalsunit, which has been named oneof the Group’s strategic growth areas,increased by 14%. The growth waslargely organic because the industrywhich Pulp & Paper Chemicals servesexperienced a period of strongly risingsales in <strong>2000</strong>. It was not until right atthe end of the year that signs of aslight slowdown began to appear. Thehydrogen peroxide market has improved,particularly in North America.The other products of the Pulp andPaper unit have also performed welland the unit has succeeded in maintainingits good profitability.By way of a deal concluded at thebeginning of September, <strong>Kemira</strong>Chemicals purchased Krems PaperChemicals from Neste Chemicals Oy.The sizing agent business of the FinnishOy Chemec Ab was a part of thisdeal. The purchase price was aboutEUR 34 million and the companieshave net sales of EUR 35 million.Through this acquisition, <strong>Kemira</strong> willbecome the world’s most integratedand versatile manufacturer of papersizings and gained a strong footholdwithin speciality chemicals for the paperindustry in Europe’s Germanspeakingregion.Expansion investments continued inmany areas. An extension to the specialtychemicals plant was completed inVaasa, Finland, and in Helsingborg, Swedendebottlenecking projects will be carriedout at the hydrogen peroxide plant.The capital expenditure project for thepaper sizing plant in Brazil is movingahead according to plans.The markets of the Kemwaterbusiness unit developed as expectedand growth continued in Eastern andSouthern Europe. Kemwater’s net salesgrew by 7%, though operating incomewas below last year’s figure owing tonon-recurring write-downs on assets.Kemwater is another of the <strong>Kemira</strong>Chemicals units which belong to theGroup’s strategic growth areas.The most important of Kemwater’sgrowth projects was the purchase of a15% stake in Kemiron Inc, the UnitedStates’ largest manufacturer of a fullrange of coagulants. The company hadnet sales last year of USD 50 million.By way of the deal Kemwater gainedentry into the world’s largest singlemarket area for water treatment chemicals.At the company in China, Kemwater(Yixing) Co. Ltd, the shareholdingwas increased to 60%.Two acquisitions were made in Europe.The market position was furtherstrengthened by purchasing Luebnyzávody a.s., a Czech manufacturer ofaluminium sulphate, and the ferrichloridebusiness of Solvay S.A. of Spain.In Pori, Finland the manufacture ofmagnesium-free iron coagulant wasexpanded. Kemwater Services Oy concludeda major agreement for developingthe water supply in Kosovo. In StPetersburg, studies are being made ofpossibilities to team up with local suppliersto carry on cooperation in wastewater treatment.It was a difficult year for IndustrialChemicals. The only unit that faredNet salesOther countriesFinland96 97 98 99 00EURmillion2500<strong>2000</strong>150010005000Net sales by business area<strong>Kemira</strong>Chemicals30 %Tikkurila13 %Other 2 %<strong>Kemira</strong>Agro43 %<strong>Kemira</strong>Pigments12 %Operating income bybusiness area<strong>Kemira</strong>Chemicals40 %Tikkurila15 %Other 1 %<strong>Kemira</strong>Agro13 %<strong>Kemira</strong>Pigments31 %8

well was Kemphos, which manufacturesphosphoric acid in Siilinjärvi, Finland.Its result too was burdened bythe lower price of phosphoric acid,though this was partially offset by thehigh exchange rate of the US dollar.The units that manufacture animalfeeds and detergent chemicals had difficultiesadjusting the market prices tocompensate for the rises in raw materialcosts. The markets for phosphoric acidand calcium chloride have evened outand the fall in prices has come to a haltor has swung upwards in some markets.Of the detergent chemicals units,Industrial Chemicals sold its sodiumtripolyphosphate business, which hadnet sales of about EUR 39 million andreported a loss on operations. Followingthe divestment, <strong>Kemira</strong> Chemicalswill close its sodium tripolyphosphatemanufacturing operations in Helsingborg,Sweden, resulting in a non-recurringcharge of about EUR 10 million.Within detergent raw materials theaim is to concentrate on bleachingchemicals, notably sodium percarbonate.Demand for the product hasgot off to a good start and its productionin Helsingborg will be more thandoubled.<strong>Kemira</strong> Fine Chemicals increasedboth its net sales and operating income.TIKKURILAOf Tikkurila’s businesses, tinting systemswere sold, causing net sales tofall by 3% from last year’s figure, toEUR 345 million. Tikkurila Paint’s netsales grew by 6%, whereas Coatings’net sales fell by 9% as a consequenceof disposals of businesses in Great Britain.Operations improved markedly inRussia, Poland and Sweden. TikkurilaCPS was sold in the autumn. The figuresfor CPS’s tinting machines are includedin net sales up to the end ofAugust and colourants up to the end ofSeptember.Tikkurila’s operating income improvedand was EUR 27 million (23million), or 8% of net sales (6%). Operatingincome includes EUR 1.4 millionof other operating income fromthe Tikkurila Coatings’ arrangementsin the UK as well as EUR 0.9 millionfrom the disposal of the Italian companyMatherson S.p.A., a previous CPSunit which manufactures colour cards.As part of the arrangements connectedwith the operations in Poland, a oneoffwrite-down was made to cover theclosure of alkyd production. In Finland,Tikkurila Paints revamped itsmarketing. The cost impact of thesemeasures was a total of about EUR 4million.The sale of Tikkurila CPS’s tintingsystem business took place in twoparts. CPS sold a 50% portion of itsholding in the tinting machine businessto Swisslog AG of Switzerland. Inanother transaction, the colourantbusiness was sold to a newly foundedcompany, in which <strong>Kemira</strong> retained a28% holding. In the first part of theyear, the net sales of the operations divested,including Swisslog’s share ofthe tinting machine business, amountedto about EUR 118 million. The saleprice totalled about EUR 200 million,or nearly twice the units’ net sales lastyear, calculated on <strong>Kemira</strong>’s proportionalinterest in the units. The capitalgain on the deals before taxes wasabout EUR 96 million, taking into account<strong>Kemira</strong>’s remaining minority interestin the new company.The disposal of Tikkurila CPS eliminatedany conflict of interests, whichin certain cases has been detrimentalto the sales of tinting systems toTikkurila’s global competitors in thepaints business and which furthermoreconstrained the growth of TikkurilaPaints and Coatings.In November an agreement wassigned on the acquisition Alcro-BeckersAB, Sweden’s largest manufacturer ofdecorative paints. Alcro-Beckers hadnet sales in <strong>2000</strong> of about EUR 190 million,including the industrial coatingsbusiness in Poland that was included inthe deal. The purchase price was aboutEUR 180 million. Alcro-Beckers’ largestproduction plants are in Sweden andPoland and it also has operations inDenmark, Norway, Germany and Finland.Via this deal, the combined decorativepaints business is now the largestin the Nordic countries and one of thelarge players in Europe. The businesswas made a part of the <strong>Kemira</strong> Groupas from 1 January 2001.Tikkurila’s OOO Kraski Tikkurilasubsidiary in Moscow started up operationsin the spring. In line with itsgrowth strategy, Tikkurila purchasedthe 40% stake in Tikkurila BaltcolorSp. z o.o. held by the Polish partnerBaltchem S.A. Tikkurila Paints andTikkurila Coatings now own 100% ofthe company’s shares on a 50-50 basis.The company, which is now calledTikkurila Polska Sp. z o.o., producesand markets both decorative paintsand industrial coatings on the Polishmarket. As part of the Alcro-Beckersdeal, Tikkurila acquired Polifarb Debica,an important unit in Poland.Tikkurila strengthened its positionin the UK by purchasing the industrialcoatings business of Mason Coatings.Manufacture of its products will bemoved to the plants in Bury and WestBromwich.KEMIRA AGROImplementation of <strong>Kemira</strong>’s new strategy,according to which Agro is prioritizingspecialty fertilizers, was set in motionright from the beginning of theyear by dividing Agro into two newstrategic business units: <strong>Kemira</strong> AgroSpecialties (KAS) and <strong>Kemira</strong> Agro Nitrogen(KAN). <strong>Kemira</strong> aims to peel off<strong>Kemira</strong> Agro Nitrogen in line with itsstrategy.<strong>Kemira</strong> Agro’s vision is to be a primarypartner in cooperation and supplierwithin the food supply chain. Toimplement the new strategy, the partsof <strong>Kemira</strong> Chemicals which are connectedwith the food supply chain wereNet sales by regionAsia 6 %Americas8 %OtherEurope10 %Other 2 %Finland19 %Other EU55 %Operating income and result%1086420Operating incomeIncome after financial itemsOperating margin, %96 97 98 99 00EURmillion250200150100500Return on capitalReturn on equity, %Return on capital invested, % %1412108642096 97 98 99 009

transferred to Agro as from 1 January2001. The businesses transferred wereanimal feed phosphates, phosphoricacid and potassium sulphate.<strong>Kemira</strong> Agro had net sales of EUR1,116 million (1,015 million) and operatingincome of EUR 23 million (an operatingloss of EUR 39 million). Fertilizerprices headed upwards in the firstquarter of the year and kept risingthroughout the rest of the year. Pricesof nitrogen fertilizers were 40-90%higher in different markets at the endof the year and prices of NPK fertilizers20-35% higher in the EU than theywere a year earlier. Competition in thearea of NPK compound fertilizers gottougher in Agro’s main markets outsideEurope. Within raw materials, the priceof natural gas rose sharply, taking a bigbite out of the upside brought by theprice increases, though part of the naturalgas purchases are hedged througha fixed-price contract.In order to improve its position inthe Russian and Baltic markets, <strong>Kemira</strong>Agro has increased its holding in theLithuanian company UAB <strong>Kemira</strong>-Lifosafrom 33% to 51%. The joint venturesproducing compound fertilizers both inLithuania and Malaysia got up to speedand the NPK plant in Zhanjiang, China,was completed in December, when itstarted up trial production. A plant thatwill manufacture water-soluble ureaphosphate will go into operation in theUnited Arab Emirates in February. Thejoint project that was started togetherwith Arab Potash Company to producepotassium nitrate and dicalcium phosphatein Jordan has moved ahead accordingto plans and production willstart up in the summer 2002.Major structural changes took placein Western Europe, <strong>Kemira</strong> Agro’s mainmarket area. Owing to the reduced demandfor products and to cheap imports,the European fertilizer industryclosed about 30 plants by the end of<strong>2000</strong>. About 3 million tonnes of nitrogenfertilizer capacity and 1 milliontonnes of NPK fertilizer capacity cameoff the market. In June, <strong>Kemira</strong> Agroclosed the Pernis plant in the Netherlandsand in December the Rozenburgplant, bringing about a total reductionof 560,000 tonnes of NPK/DAP capacityand nearly 1 million tonnes of nitrogenfertilizer capacity. The latter closure resultedin charges to income in <strong>2000</strong> totallingabout EUR 82 million, which arepresented in the income statement line:“Non-recurring items from discontinuingoperations”. All these moves are believedto improve the health of the sectorand to enable Agro’s fertilizer operationsto develop as part of WesternEurope’s high-quality and competitivefood supply chain.KEMIRA PIGMENTSAs a consequence of divestments ofbusinesses, <strong>Kemira</strong> Pigments’ net salesdeclined by 37% to EUR 307 million.Sales volumes were about 44% smallerthan they were a year ago after the unitin the United States was divested at thebeginning of April and the unit in theNetherlands at the beginning of May.The divested units had net sales in thefirst part of the year of EUR 97 millionand posted an operating loss of EUR 3million. In 1999 the net sales of the divestedunits were EUR 326 million. Thesales volumes of the remaining unit inPori grew by 9% and average pricesrose by nearly 14% on the same perioda year ago.<strong>Kemira</strong> Pigments posted operatingincome of EUR 54 million (35 million in1999).Demand for titanium dioxide pigmentgrew significantly in <strong>2000</strong> comparedwith the previous year in all themarket areas, but most of all in WesternEurope. The strong growth in demandled to a tight delivery situation, pushingup prices several times during the year.The latest price increase notificationswere made towards the end of <strong>2000</strong>.From the beginning of 2001,<strong>Kemira</strong> Pigments is part of <strong>Kemira</strong>Chemicals’ Industrial Chemicals unit.OTHER UNITS<strong>Kemira</strong> Metalkat, which manufacturescatalytic converters, reported net salesgrowth of 14% to EUR 40 million. Operatingincome was EUR 2.8 million, asagainst EUR 3.1 million a year earlier.<strong>Kemira</strong> Safety, which manufacturespersonal respiratory protective devices,was sold to the American company ScottTechnologies Inc. for USD 17 million,resulting in a capital gain of EUR 12 million.The business was transferred to thebuyer as from the beginning of May.FINANCIAL PERFORMANCEConsolidated operating income wasEUR 175 million (111 million), representing7% of net sales. Income beforetaxes and minority interests was EUR307 million (59 million), includingnon-recurring income in a net amountof EUR 162 million. Net financial expenseswere EUR 31 million (52 million).Income after taxes was EUR 208million (30 million). The cash flow returnon invested capital was 11%.CAPITAL EXPENDITUREThe Group’s capital expenditures totalledEUR 218 million (168 million),or 9% of net sales. Capital expendituresincreased on the previous year,when no major acquisitions weremade. The Alcro-Beckers acquisitiondoes not yet show up in the figuresfor <strong>2000</strong>. Depreciation on fixed assetsamounted to EUR 171 million. Disposalsof assets including the sales of subsidiariesgenerated EUR 527 million(18 million). The Group’s investmentsin environmental protection amountedto EUR 9 million (13 million). All themost important capital expendituresare discussed in the reviews of thebusiness areas.The Group spent about EUR 48million on research and development,or about 2% of net sales. The figuredoes not include capital expenditures.Capital expenditureEURmillion300250200150100500Capital expenditure bybusiness areaOther6 %<strong>Kemira</strong>Agro30 %Net debt and financing expenses%1512Net debtNet financing expenses, % of liabilitiesEURmillion1000800% As % of net sales12108642096 97 98 99 00<strong>Kemira</strong>Chemicals46 %<strong>Kemira</strong>Pigments12 %Tikkurila6 %963096 97 98 99 00600400<strong>2000</strong>10

ENVIRONMENTAL PROTECTIONAND MANAGEMENT OF RISKSEnvironmental protection is an essentialpart of the Group’s operations. Theverified Environmental <strong>Report</strong> is includedin this <strong>Annual</strong> <strong>Report</strong> (pp. 56-62).The Group continually pays particularattention to ensuring that its operationsare safe and its plants run withoutdisturbances. Operations are alsoevaluated together with the risk managementunits of insurance companies.During the year the 12 largest productionsites were thus evaluated. Boththe environmental protection and riskmanagement organizations werestrengthened and centralized withinGroup Administration.FINANCINGThe Group’s financial position strengthenedsubstantially as a consequence ofthe divestments of businesses. Interestbearingnet debt at the end of <strong>2000</strong>stood at EUR 425 million (934 million).New loans were not raised during theyear and a substantial part of the shortterm-loans was repaid.Cash flow before financing was EUR523 million (31 million). The Group’sequity ratio was 48% at the end of theyear (38%). The gearing ratio (net debtas a ratio of shareholders’ equity) was37%. The amount of liquid funds grewmarkedly on the previous year, totallingEUR 247 million at the end of the year.Unused agreed credit facilities amountedto about EUR 422 million.Net financing expenses were EUR31 million (52 million). The increase incosts due to the rise in interest rateswas compensated by lower net debts,a gain on foreign exchange and bymeasures taken to hedge interest raterisks. The proportion which fixed-interestloans represent within the totalamount of the Group’s interest-bearinglong-term loans (including pensionloans, which are considered to befloating rate loans) was about 51% atthe end of the year. Foreign exchangegains amounted to EUR 1.5 million (aforeign exchange loss of EUR 1.6 million).PARENT COMPANY’S FINANCIALPERFORMANCEThe parent company’s net sales comeonly from the sale of energy in Finlandboth within and outside the Group.The parent company had net sales ofEUR 21 million (27 million). Operatingloss was EUR 0.3 million (a profit of3.5 million). The parent companybears the cost of Group managementand administration.The reason for the fall in net saleswas that in the previous year the parentcompany sold a substantial part ofits electric power business.The parent company’s net financialexpense totalled EUR 7.4 million(income 16.5 million). Income beforetaxes and appropriations was EUR 170million (102 million). Capital expendituresamounted to EUR 20 million, includingincreases in the equity of subsidiaries.PERSONNELThe Group employed an average of9,644 people, or 1,099 less than in theprevious year. Of the total personnel,an average of 4,736 were employed byGroup companies outside Finland.The parent company had an averagepayroll of 120 employees, 12 lessthan a year ago.During the year under review thefollowing persons served on the Boardof Directors of <strong>Kemira</strong> Oyj: Sten-OlofHansén (Chairman), Niilo Pellonmaa(Vice Chairman), Timo Kaisanlahti, EijaMalmivirta, Anssi Soila and Tauno Pihlava.At its meeting on 13 December<strong>2000</strong> the Supervisory Board electedthe previous directors to seats on theBoard for the term beginning 1 January2001, except for Timo Kaisanlahti,who was replaced by Ritva Hainari. Ofthe members of the Board of Directors,only CEO Tauno Pihlava is employedby the <strong>Kemira</strong> Group.A large part of the Group’s personnelare covered by various bonus systemsthat vary from country to country.In addition, the Group has a share optionsystem for top management. This isdiscussed in greater detail on page 13.OWNERSHIPThe Finnish government’s holding in<strong>Kemira</strong> was 53.4% at 31 December<strong>2000</strong>. The proportion held by institutionalinvestors outside Finland was15.1%, whereas Finnish institutional investorsand mutual funds held 20.8%of the shares. Private investors’ holdingsamounted to 6.7% of the sharesoutstanding.In accordance with the authorizationgranted by the <strong>Annual</strong> GeneralMeeting, the company repurchased atotal of 4,155,000 of its own shares(share buyback) by 31 December <strong>2000</strong>at an average price of EUR 5.54/share.In addition, the company has in itspossession 1,000,000 shares which itpurchased in 1999, giving the companya total holding of 4.0% of <strong>Kemira</strong>’sshares outstanding.CHANGES IN THE GROUPSTRUCTUREVarious companies or participationswere established, acquired or divestedduring the year, as discussed in the reviewof the business areas above. Thechanges in the Group structure arepresented in more detail on page 37-38. Because the changes made duringthe financial year were major in sizeand import, the financial statement informationof both continuing and discontinuingoperations are given separatelyin the Notes to the consolidatedfinancial statements.GearingNet debt divided by net debt plus equity.Target96 97 98 99 00%100806040200Cash flowCash flow from operationsCash flow after capital expenditure96 97 98 99 00EURmillion6005004003002001000–100–200Personnel 31.12.<strong>2000</strong>Othercountries2529Holland370Sweden803Finland4495UK66811

OUTLOOK FOR THE FUTURE<strong>Kemira</strong> Chemicals. The market outlookfor the Pulp & Paper Chemicals unit remainsgood thanks to continuing strongdemand in the Pulp and Paper industry.Recently, however, there has been increaseduncertainty concerning economicgrowth. The transfer of the formicacid business to Industrial Chemicalswill take with it both net sales and operatingincome, thereby cutting into Pulp& Paper Chemicals’ growth.The Kemwater unit is expected tocontinue growing at a strong rate and itsstrategy will be implemented by centralizingoperations within larger units.The titanium dioxide pigment businessthat was transferred to IndustrialChemicals has continued to enjoy gooddemand, though the slowing economicgrowth in the United States may lowerdemand in the North American market.New titanium dioxide capacity willcome on stream to a limited extent andthe price level of the product is expectedto hold up well throughout the currentyear too. In addition, IndustrialChemicals’ result will be improved bythe formic acid business that was transferredfrom Pulp & Paper Chemicals, aswell as by the melding of <strong>Kemira</strong> FineChemicals into Industrial Chemicals. Onthe other hand, a factor that will lowernet sales and operating income is thetransfer of the Kemphos phosphoricacid business, feed phosphates and potassiumsulphate business, which areconnected with the food supply chain,to <strong>Kemira</strong> Agro from the beginning of2001.Of Industrial Chemicals’ other products,the sales volumes of calcium chlorideare expected to grow and its pricelevel to move in a better direction. Inline with an agreement that has beensigned, Industrial Chemicals will get outof its detergent phosphate business, thuseliminating the loss that was booked lastyear. The other detergent raw material,sodium percarbonate, has done well onthe market and operations are expectedto show further favourable development.As a consequence of the structural arrangementscarried out and the strengthof the operating environment, <strong>Kemira</strong>Chemicals’ full-year operating incomewill increase markedly on last year’s.Tikkurila. The divestment of TikkurilaCPS will make possible strongergrowth of the mainline paints business.An example in point is the net salesgenerated by Alcro-Beckers, which becamea part of Tikkurila from the beginningof the year. The joint growth prospectsof Tikkurila and Alcro-Beckers arebetter than ever before, especially inRussia, the Baltic countries and Poland,where the growth potential of the overallmarket is substantial.The paints business is estimated toreport better earnings this year than itdid in <strong>2000</strong>.<strong>Kemira</strong> Agro. Grain stocks aroundthe world were smaller at the end of<strong>2000</strong> than they have been in recentyears. Owing to the prohibition on theuse of meat and bone meal (MBM),there will probably be an increasingneed for soy beans and cheap feedgrain in Europe in step with an acceleratingshift to feed phosphates. Globalnutrient demand is forecast to grow by1%. In Western Europe the quantitiesare still declining slightly, but thanks tothe closures of local fertilizer industrycapacity and limitations on cheap imports,fertilizer supply and demand willbe in better balance than they havebeen for a long time. This is also reflectedby the fact that the stocks ofWest European producers are smallerthan they were last year. The positiveexpectations are also strengthened bythe agreement between China and theWorld Trade Organization, WTO.<strong>Kemira</strong> Agro will continue its preparationsaimed at getting out of nitrogenfertilizer production. Although prices, especiallyof nitrogen fertilizers, have risenmarkedly, the high price of natural gasand the strong dollar will push up rawmaterial costs, thereby eating into theupside brought by higher prices, especiallyin the first half of the year. Thereafterthe price of natural gas too is expectedto stabilize at a lower level.On the horticultural and specialtyfertilizer side as well as within processchemicals, the favourable trend is expectedto continue.<strong>Kemira</strong> Agro’s full-year operatingincome is expected to improve on lastyear’s figure.<strong>Kemira</strong> Group. The most significantof the external factors of uncertainty influencing<strong>Kemira</strong>’s result are the trendin the United States economy and theresultant exchange rate of the dollar aswell as the global trend in the price ofenergy. Furthermore, the solution leadingto the divestment of <strong>Kemira</strong> Agro’snitrogen fertilizer business may alsohave an important impact. This year the<strong>Kemira</strong> Group’s operating income is expectedto exceed last year’s figure. As aconsequence of acquisitions that willbe made, net debt and net financingcosts will increase this year, but the netoperational result is nevertheless expectedto improve on last year’s.EARNINGS AND PERSONNEL BY BUSINESS AREA IN <strong>2000</strong>EUR million Net sales Operating Income after Personnel,income financial items average<strong>Kemira</strong> Chemicals 767 69 53 3,210Tikkurila 345 27 26 2,049<strong>Kemira</strong> Agro 1,116 23 6 2,833<strong>Kemira</strong> Pigments 307 54 50 1,084Others* 76 2 9 468Intra-Group sales –125Group, total 2,486 175 144 9,644* Includes other businesses, Group administration and eliminations from operating income and income before extraordinary items.All forecasts and estimates mentioned in this report are based on the current judgement ofthe economic environment, and the actual results may be significantly different.12

Shares and shareholdersSHARES AND VOTING RIGHTS<strong>Kemira</strong> Oyj has 128,800,000 sharesoutstanding and each share carriesone vote at general meetings of theshareholders. According to the Articlesof Association, the company’s sharecapital can be in the range of fromEUR 217 to 850 million. The sharecapital can be changed within theselimits without amending the Articles ofAssociation. The share capital of<strong>Kemira</strong> Oyj at present is EUR 217 million.<strong>Kemira</strong> Oyj shares are registeredwithin the book-entry system.DIVIDEND POLICY<strong>Kemira</strong> aims to distribute a dividendwhich is 30% - 50% of its operativenet income. The company’s Board ofDirectors will propose to the <strong>Annual</strong>General Meeting that a dividend ofEUR 0.30 per share, or EUR 37.1 million,be paid for the <strong>2000</strong> financialyear. This corresponds to a dividendpayout of 41% of the net income withoutnon-recurring items, or 18% of thenet income for the year. Taking intoaccount the Finnish tax base, thisamounts to a taxable dividend of EUR0.42. The record date for the dividendpayout will be 6 April 2001, and thedividend will be paid on 18 April2001.INCREASE IN SHARE CAPITALThe Board of Directors of <strong>Kemira</strong> Oyjdoes not at present have authorizationsto increase the company’s sharecapital.PURCHASE OF OWN SHARESThe <strong>Annual</strong> General Meeting held on11 April <strong>2000</strong> resolved to authorizethe company’s Board of Directors topurchase a maximum of 5,440,000 ofthe company’s own shares on themarket (share buyback). The authorizationis valid for one year from thedate of the <strong>Annual</strong> General Meeting.Including shares previously boughtback, the company can have in itspossession a total of 6,440,000 of itsown shares, representing 5% of theentire shares outstanding. On the basisof the new authorization, by 31December <strong>2000</strong> the number of sharesbought back was 4,155,000 and thecompany had in its possession a totalof 5,155,000 of its own shares.INSIDER RULESThe insiders regulations issued by HelsinkiExchanges on 28 October 1999are observed within the <strong>Kemira</strong>Group. A list of insiders including theirshareholdings at 31 December <strong>2000</strong> isgiven on page 66.LISTING AND SHARE TRADING<strong>Kemira</strong> Oyj’s shares have been listedon Helsinki Exchanges since 10 November1994. In addition to Helsinki,trading in the shares is done throughthe SEAQ International trading systemoperated by the London Stock Exchange.<strong>Kemira</strong> is also part of thePORTAL system in the United States.In the United States, <strong>Kemira</strong>’s shareswere issued under Regulation 144A,whereby only qualified institutionalbuyers permitted under this legislationare allowed to buy and sell the shares.<strong>Kemira</strong>’s shares can also be traded inthe United States in the form of ADSshares. One ADS share corresponds totwo <strong>Kemira</strong> shares.PRICE AND TRADING VOLUMEThe price of <strong>Kemira</strong>’s share on HelsinkiExchanges weakened by 12.3% during<strong>2000</strong>, whereas the HEX index fellby 10.6%. The highest price of theshare was EUR 6.80 and the lowestprice was EUR 4.92. The price of theshare at the end of the year was EUR5.36. The taxation value of the sharefor year <strong>2000</strong> Finnish tax declarationsis EUR 3.605. Turnover of the share onHelsinki Exchanges totalled 17,366,406shares, and in euro terms the turnoverwas EUR 98 million. The market capitalizationat the end of <strong>2000</strong> was EUR663 million.DISTRIBUTION OF OWNERSHIP 31.12.<strong>2000</strong>MANAGEMENT BOND ISSUE WITHWARRANTS, STOCK OPTIONS ANDSHARE OWNERSHIPOn 26 April, 1995, the <strong>Annual</strong> GeneralMeeting of <strong>Kemira</strong> Oyj passed a resolutionto float an issue of bonds withwarrants targeted at the managementof the <strong>Kemira</strong> Group. The amount ofthe bond loan was EUR 100,912.76.Each member of the Board of Directorswho was employed by <strong>Kemira</strong>Oyj was entitled to subscribe for amaximum of EUR 13,455.03 of thebond loan with warrants. The maturityof the issue was five years beginningon 2 May 1995, the interest is 6% andthe issuing price was 100%. The optionsgive management the right tosubscribe for a maximum of 1,200,000shares in the company between 1 December1998 and 31 January 2002 at aprice of EUR 6.73 per share. Thesesubscriptions can increase the company’sshare capital by a maximum ofEUR 2.02 million. The bonds with warrantswere subscribed for by 16 persons.At present, no one had sold theirwarrants or converted them intoshares.The conditions for exercise of the1998 share option programme werenot fulfilled.The members of the Board of Directorsand the Supervisory Board aswell as the Managing Director and theManaging Director’s Deputy owned37,580 <strong>Kemira</strong> Oyj shares at the end ofthe year. This represents 0.03% of thecompany’s shares and voting rights.The issue of bonds with warrants entitlingholders to <strong>Kemira</strong> Oyj shares hasbeen subscribed for by the ManagingDirector and the Managing Director’sDeputy in the amount of EUR16,818.79, which corresponds to200,000 share options.Number of Number of % of Shares % of sharesshares shareholders shareholders total and votes1 – 50 1,063 8.09 41,817 0.0351 – 100 1,038 7.90 81,477 0.06101 – 1,000 8,828 67.22 3,830,372 2.971,001 – 5,000 1,914 14.57 3,725,920 2.895,001 – 10,000 135 1.03 1,017,858 0.7910,001 – 100,000 115 0.88 3,291,920 2.56100,001 – 500,000 24 0.18 5,480,100 4.25500,001 – 1,000,000 6 0.05 4,037,563 3.14Over 1,000,000 11 0.08 89,971,374 69.85Total 13,134 100.00 111,478,401Nominee-registered shares 17,321,599 13.46Grand total 128,800,000 100.0013

Distribution of shareholders31.12.<strong>2000</strong>Non-profitorganizations1 %Public sectorentities62 %Earnings/shareEUR1,00,80,6Cash flow/shareEUR2,52,01,5Households7 %Foreignshareholders 15 %Financialinstitutionsand insurancecompanies 9 %Privatecompanies 6 %96 97 98 99 000,40,2096 97 98 99 001,00,50Shareholders’ equity/share96 97 98 99 00EUR109876543210Share price* 1996–<strong>2000</strong>*monthly average<strong>Kemira</strong>HEX96 97 98 99 00EUR706050403020100Share turnover on HelsinkiExchanges 1996–<strong>2000</strong>96 97 98 99 00Millionshares654321020 LARGEST SHAREHOLDERS 31.12.<strong>2000</strong>Shareholder Number of % of sharesshares (1000) and votes1. Finnish State 68,754 53.382. Franklin Resources Inc. 1) 6,425 4.993. Sampo Group 3,539 2.75Industrial Insurance Company Ltd 1,480,000 sharesSampo Enterprise Insurance Company Ltd 450,000 sharesSampo Life Insurance Company Ltd 1,609,000 shares4. Ilmarinen Mutual Pension Insurance Company Ltd 3,435 2.675. Pohjola Group 2,920 2.27Pohjola Non-Life Insurance Company 1,780,000 sharesPohjola Life Insurance Company Ltd 1,140,000 shares6. Varma-Sampo Mutual Pension Insurance Company 2,514 1.957. Odin Group 1,956 1.52Odin Norden 1,538,000 sharesOdin Finland 418,000 shares8. Tapiola Mutual Pension Insurance Company 1,562 1.219. Suomi Mutual Life Assurance Company 1,260 0.9810. Local Government Pensions Institution 800 0.6211. Tapiola General Mutual Insurance Company 714 0.5512. Norvestia Oyj 705 0.5513. Kaleva Mutual Insurance Company 700 0.5414. Pension Foundation Neliapila s.r. 577 0.4515. Mutual Insurance Company Pension-Fennia 542 0.4216. Tapiola Mutual Life Assurance Company 455 0.3517. The LEL Employment Pension Fund 348 0.2718. Seligson & Co. Fund Management Company Plc 314 0.2419. Neste Pension Foundation s.r. 270 0.2120. Finnish Broadcasting Company Pension Foundation s.r. 246 0.19<strong>Kemira</strong> Oyj 5,155 4.00Nominee-registered shares 10,897 8.46Other, total 14,712 11.43Total 128,800 100.001)As announced by Franklin Resources Inc. 30 November <strong>2000</strong>. In addition the company has assets managed under agreement asfollows: 3,788,620 shares, or 2.94 % of shares and votes.14

Definitions of key ratiosPER-SHARE DATAEarnings per share (EPS)Income before extraordinary items +/– minority interest– taxesAdjusted average number of sharesNet income per shareNet incomeAdjusted average number of sharesCash flow from operationsCash flow from operations, after change in net workingcapital and before capital investmentsCash flow from operations per shareCash flow from operationsAdjusted average number of sharesDividend per shareDividends paidNumber of shares at end of yearDividend payout ratioDividend per share x 100Earnings per shareDividend yieldDividend per share x 100Share price at end of yearEquity per shareEquity at end of yearNumber of shares at end of yearFINANCIAL RATIOSNet liabilitiesInterest-bearing liabilities – cash and bank – securitiesEquity ratio, %Shareholders’ equity + minority interest x 100Total assets – advance payments receivedGearing, %Net liabilities x 100Shareholders’ equity + minority interestInterest coverOperating income + depreciationNet financial expensesReturn on capital invested, % (ROI)Income before extraordinary items + interest expenses +other financing expenses x 100Total assets – interest-free liabilities(average)Return on equity, % (ROE)Income before extraordinary items – taxes+/– tax effect of extraordinary items x 100Shareholders’ equity + minority interests(average)Cash flow return on capital invested (CFROI), %Cash flow from operations x 100Total assets – interest-free liabilities(average)Share price, year averageShares traded (EUR)Shares traded (volume)Share price, end of yearWeighted average share price of the last trading dayPrice per earnings per share (P / E)Share price at end of yearEarnings per sharePrice per equity per shareShare price at end of yearEquity per sharePrice per cash flow per shareShare price at end of yearCash flow from operations per shareShare turnoverNumber of shares traded during the year and the proportionalshare of number of shares traded to weighted average numberof shares during the year15

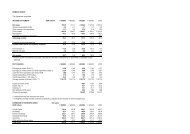

Key figuresPER-SHARE DATA<strong>2000</strong> 1999 1998 1997 1996Per-share dataEarnings per share, EUR 1) 4) 0.73 0.23 0.61 0.81 0.86Net income per share, EUR 1) 1.64 0.23 0.61 0.81 0.86Cash flow from operations per share, EUR 1.69 1.41 0.96 2.00 2.05Dividend per share, EUR 2) 0.30 0.23 0.29 0.29 0.27Dividend payout ratio, % 2) 18.2 100.0 47.2 35.3 31.4Dividend yield 2) 5.6 3.8 4.6 3.3 2.7Equity per share, EUR 1) 9.08 7.57 7.27 7.16 6.53Price per earnings per share (P/E) ratio 1) 7.34 26.57 10.30 10.60 11.43Price per equity per share 1) 0.59 0.81 0.90 1.20 1.50Price per cash flow per share 3.17 4.33 6.50 4.30 4.78Dividend paid, EUR million 2) 37.1 29.6 36.8 36.8 34.7Share price and turnoverShare price, year high, EUR 6.80 6.90 10.60 10.34 10.09Share price, year low, EUR 4.92 5.20 5.21 7.65 6.05Share price, year average, EUR 5.67 5.85 8.06 9.01 8.06Share price, end of year, EUR 5.36 6.11 6.24 8.61 9.81Number of shares traded (1000), Helsinki 17,366 20,703 30,277 33,241 33,276% of number of shares 13 16 24 26 27Market capitalization, end of year, EUR million 663.0 780.9 803.6 1,109.2 1,262.9Increase in share capitalAverage number of shares (1000) 3) 126,623 128,318 128,800 128,800 122,090Number of shares at end of year (1000) 3) 123,645 127,800 128,800 128,800 128,800Increases in number of shares (1000) – – – – 8,000Share capital, EUR million 217.0 217.0 216.6 216.6 216.6Increases in share capital, EUR million – – – – 13.51)The change in accounting practice (IAS 12) reduced 1998 taxes by EUR 14.0 million.2)The <strong>2000</strong> dividend is the Board of Directors’ proposal to the <strong>Annual</strong> General Meeting.3)Weighted average number of shares outstanding, adjusted by the number of shares bought back.4)Net income before gain/loss on discontinuing operations.16

FINANCIAL RATIOS<strong>2000</strong> 1999 1998 1997 1996Income statementNet sales, EUR million 2,486 2,526 2,413 2,420 2,266Foreign operations, EUR million 2,024 2,073 1,916 1,955 1,764Sales in Finland, % 19 18 21 19 22Exports from Finland, % 24 20 19 22 24Sales generated outside Finland, % 57 62 61 59 54Operating income, EUR million 175 111 148 198 210% of net sales 7 4 6 8 9Net financing income and expenses, EUR million 31 52 51 53 67% of net sales 1 2 2 2 3Interest cover 11 6 6 7 6Income before extraordinary items, EUR million 144 59 97 145 143% of net sales 6 2 4 6 6Extraordinary income and expenses, EUR million – – – – –Discontinuing operations 162 – – – –Income before taxes and minorityinterests, EUR million 307 59 97 145 143% of net sales 12 2 4 6 6Net income, EUR million 1) 208 30 79 104 104Return on capital invested, % 10 6 8 11 12Return on equity, % 1) 9 3 8 12 14Cash flowCash flow from operations, EUR million 214 181 123 257 250Sales of subsidiaries and fixed assets,EUR million 527 18 14 61 26Capital expenditure, EUR million 218 168 255 211 202% of net sales 9 7 11 9 9Cash flow after capital expenditure, EUR million 523 31 –119 107 73Cash flow return on capital invested, % 11 9 7 14 14Balance sheetNon-current assets, EUR million 1,277 1,486 1,444 1,404 1,366Shareholders’ equity, EUR million 1) 1,122 968 936 923 840Liabilities, EUR million 1,259 1,620 1,504 1,458 1,601Total assets, EUR million 2,399 2,603 2,453 2,389 2,447Net liabilities, EUR million 425 934 892 745 798Equity ratio, % 1) 48 38 39 39 35Gearing, % 37 95 94 80 94PersonnelPersonnel (average) 9,644 10,743 10,785 10,392 10,631of whom in Finland 4,908 5,090 5,155 5,176 5,945Exchange ratesKey exchange rates (31 December)USD 0.93050 1.00460 1.16674 1.09686 1.28033GBP 0.62410 0.62170 0.70547 0.66122 0.75559NLG 2.20371 2.20371 2.20371 2.12352 2.23322SEK 8.83130 8.56250 9.48736 8.66346 8.81110DKK 7.46310 7.43300 7.44892 7.48079 7.61395BEF 40.3399 40.3399 40.33990 40.50225 41.03333FIM 5.94573 5.94573 5.94573 5.94573 5.945731)The change in accounting practice (IAS 12) reduced 1998 taxes by EUR 14.0 million.17

Consolidated income statement1.1. – 31.12.Note <strong>2000</strong> 1999EUR million EUR millionNet sales 1, 28 2,486.0 2,526.2Share of associates’ net income 2, 28 –0.5 2.8Other income from operations 3 30.9 32.6Cost of sales 4, 5 –2,170.3 –2,262.5Depreciation 6, 28 –171.3 –188.1Operating income 28 174.8 111.0Financing income and expenses 7 –30.5 –52.4Income before non-recurring items, taxes andminority interest 144.3 58.6Non-recurring items from discontinuing operations 8, 22 162.2 –Income before taxes and minority interests 306.5 58.6Direct taxes 9 –96.3 –27.8Income before minority interests 210.2 30.8Minority interest –2.4 –0.9Net income 207.8 29.9Earnings per share, EUR 10 0.73 0.23The income statement has been split into continuing and discontinuing operations in Note 22.18

Consolidated balance sheet31.12.Note <strong>2000</strong> 1999EUR million EUR millionASSETSNon-current assetsIntangible assets 11 88.7 79.7Tangible assets 12 1,049.5 1,328.2Investments 13Holdings in associates 63.4 50.7Other shares and holdings 19.6 8.4Other investments 55.3 18.5Total investments 138.3 77.6Total non-current assets 1,276.5 1,485.5Current assetsInventories 14 348.7 455.9Receivables 15Interest-bearing receivables 11.2 23.4Other interest-free receivables 515.9 549.7Total receivables 527.1 573.1Securities 21, 26 199.0 42.4Cash and bank 21, 26 47.7 46.0Total current assets 1,122.5 1,117.4Total assets 2,399.0 2,602.9LIABILITIES AND SHAREHOLDERS’ EQUITY31.12.Note <strong>2000</strong> 1999EUR million EUR millionShareholders’ equityShare capital 217.0 217.0Share premium account 252.5 252.5Revaluation reserve 8.0 8.3Own shares –28.8 –5.8Other reserves 2.6 4.2Retained earnings 463.2 461.6Net profit for the financial year 207.8 29.9Total shareholders’ equity 1,122.3 967.7Minority interests 18.0 15.2Long-term liabilitiesInterest-bearing long-term liabilities 17,21 573.3 848.8Deferred tax liabilities 18 52.6 56.6Provision for liabilities and charges 19 74.4 39.2Total long-term liabilities 700.3 944.6Current liabilities 20Interest-bearing short-term liabilities 98.2 173.5Interest-free short-term liabilities 460.2 501.9Total current liabilities 558.4 675.4Total liabilities 1,258.7 1,620.0Total liabilities and shareholders’ equity 2,399.0 2,602.919

Consolidated cash flow statement<strong>2000</strong> 1999EUR million EUR millionFunds from operationsOperating income 174.8 111.0Adjustments to operating income 1 ) –1.4 –6.5Depreciation 171.3 188.1Interest income 15.5 6.4Interest expense –47.6 –56.2Dividend received 2.0 4.2Other financing items –8.3 0.1Taxes –72.5 –31.5Total funds from operations 233.8 215.6Change in net working capitalInventories 15.6 –26.7Short-term receivables –45.3 –83.5Interest-free short-term liabilities 9.8 75.5Change in net working capital, total –19.9 –34.7Cash flow from operations 213.9 180.9Capital expenditureAcquisitions of Group companies –5.9 –4.1Acquisitions of associated companies –17.1 –Purchase of other shares –12.1 –9.9Purchase of other fixed assets –183.2 –154.1Disposal of Group companies 513.8 –Disposal of associated companies – –Sales of other shares 0.1 0.3Sales of other fixed assets 13.3 18.2Total capital expenditure 308.9 –149.6Cash flow before financing 522.8 31.3FinancingChange in long-term loans (increase +, decrease -) –223.2 18.6Change in long-term loan receivables (increase -, decrease +) –37.0 0.6Short-term financing, net (increase +, decrease -) –53.1 –20.2Dividend paid –29.4 –36.8Own shares –23.0 –Other 1.2 –0.6Financing, total –364.5 –38.4Increase / decrease in liquid funds 158.3 –7.1Liquid funds at end of year 246.7 88.4Liquid funds at beginning of year 88.4 95.5Increase / decrease in liquid funds 158.3 –7.1The above figures cannot be directly delivered from the balance sheets owing to changes, e.g., in the Groupstructure and foreign exchange rates.The cash flows of the business areas are shown with the segment data.1)Non-cash flow items included in operating income (e.g. results of associated companies) and gains and losses on thesale of fixed assets.20

Statement of changes in equityEUR millionShare capitalShare premiumfundRevaluationand other fundsExchangedifferencesOwn sharesRetainedearningsTotalShareholders’ equityat 1 January 1999 216.6 252.9 12.3 –36.9 – 491.0 935.9Change in accounting principles 1) – – – – – 18.6 18.6Net profit for the financial year – – – – – 29.9 29.9Dividends paid – – – – – –36.8 –36.8Exchange differences – – – 26.6 – – 26.6Repurchase of own shares – – – – –5.8 – –5.8Other changes – – 0.2 – – –0.9 -0.7Transfers 0.4 –0.4 – – – – –Shareholder’s equity at 31 Dec. 1999 217.0 252.5 12.5 –10.3 –5.8 501.8 967.7Shareholders’ equityat 1 January <strong>2000</strong> 217.0 252.5 12.5 –10.3 –5.8 501.8 967.7Change in accounting principles – – – – – – –Net profit for the financial year – – – – – 207.8 207.8Dividends paid – – – – – –29.4 –29.4Exchange differences – – – –1.4 – – –1.4Repurchase of own shares – – – – –23.0 – –23.0Other changes – – –1.9 – – 2.5 0.6Transfers – – – – – – –Shareholders’ equity at 31 Dec. <strong>2000</strong> 217.0 252.5 10.6 –11.7 –28.8 682.7 1,122.31)The change in the accounting principles in 1999 includes a charge of EUR 18.6 million after taxes for a change in the accounting policy for majormaintenance works (IAS 37). The change in the accounting policy for maintenance works, after tax, in 1999 was a charge of EUR -0.1 million.The Group’s non-restricted shareholders’ equity, which limits the parent company’s dividend payout, was EUR 507.8 million in<strong>2000</strong> and EUR 351.4 million in 1999. This figure is obtained by adding to retained earnings the net income for the financial yearand subtracting from it the proportion of voluntary untaxed reserves which has been transferred to shareholders’ equity and ownshares. Research, establishment and development expenses that have a limiting effect on the distribution of profits have not beencapitalized in the balance sheet.Details of the company’s breakdown of shareholders’ equity and the regulations of the Articles of Association are given on page13. In <strong>2000</strong> the company purchased 4,155,000 of its own shares, which represent 3.2% of the aggregate votes conferred by all theshares and 3.2% of the share capital. By 31.12.<strong>2000</strong> the company had totally 5,155,000 shares in its possession, which represent4.0% of the aggregate votes conferred and 4.0% of the share capital.21

Summary of significant accounting policiesBasis of presentationThe <strong>Kemira</strong> Group’s financial statements have been prepared incompliance with the relevant acts and regulations in force in Finlandand in accordance with the Group’s uniform accountingprinciples. The Group’s accounting principles are based on InternationalAccounting Standards (IAS). Accordingly, the financialstatements also correspond to IAS, with the exception of accountingfor pension expenses, IAS 19, which entered into force on 1January 1999. Its effects on the consolidated income statementand shareholders’ equity are discussed and presented in Notes 23and 24 to the consolidated financial statements.Principles of consolidationThe consolidated financial statements include the accounts of theparent company, <strong>Kemira</strong> Oyj, and companies in which it owns, directlyor indirectly through subsidiaries, over 50 percent of the votingrights. Certain real estate and housing companies, and captiveinsurance companies, as well as companies that had no operationsduring the financial year, have not been consolidated. However,the effect of these companies on the Group’s results and distributablereserves, in cases of any significance, has been consolidatedusing the equity method of accounting. Companies acquired duringthe accounting period are consolidated from the date the responsibilityfor their operations was transferred to the Group. Similarly,units or companies sold during the fiscal year are included inthe income statement up to the date of disposition.All intra-Group transactions have been eliminated as part of theconsolidation process. Acquisitions of companies are accounted forunder the purchase (past-equity) method of accounting. The excessof the acquisition cost over fair value of the net assets acquiredis partly allocated to the identifiable assets and liabilities.Any excess is recorded as goodwill. Goodwill is amortized overthe useful life of the assets acquired, which has as a rule been amaximum of 5 years. Should a longer amortization period be justified,it is a maximum of 20 years. The interests of minority shareholdersin the net assets and profit and loss of consolidated subsidiariesis reflected as a separate item in the Group’s consolidatedbalance sheet and income statement.Derivative financial instruments to hedge currency and interestrate risks have been recorded in the income statement simultaneouslywith the commitment hedged. Derivative financial instruments,which are not considered as hedging instruments, are valuedin the financial statements at the market price in accordancewith conservative accounting practice. The interest portion ofcurrency forwards is recorded as interest income and expenseover the terms of the contract, and the differences in the foreignexchange rates are booked as a credit or charged to incomewhen the underlying hedged transaction has been credited orcharged to income in the financial statements.In the consolidated financial statements, the income statements offoreign subsidiaries have been translated into euro amounts usingthe average exchange rates and the balance sheets have beentranslated using the year-end exchange rates. The translation difference,which arises in translating the income statement and balancesheet using the different exchange rates, is entered in nonrestrictedequity.The Group seeks to hedge the translation risk of its investment inthe net assets of foreign subsidiaries. Accordingly, the foreign currency-denominatedshareholders’ equity in the subsidiaries ishedged against exchange rate changes using long-term foreign currency-denominatedloans as well as forward and currency swapcontracts. In the consolidated financial statements, the exchangerate gains and losses of such loans and forward and currency swapcontracts are credited or charged against the translation differencesarising from the translation of the shareholders’ equity amounts ofthe last confirmed balance sheets of the subsidiaries. Other translationdifferences affecting shareholders’ equity are stated as an increaseor decrease in the non-restricted shareholders’ equity.Management of financial risks is discussed in greater detail in theNotes to the financial statements. The notes furthermore presenta discussion of compliance with the rules of IAS 39, which governthe recording in the accounts of financial instruments and enteredinto force as from 1 January 2001. The foreign exchangerates on the balance sheet date are given on page 17.Pension arrangementsCompanies in which the Group has a participating interest are associatedcompanies, in which the interest is 20-50%. Holdings inassociated companies are presented in the consolidated financialstatements using the equity method of accounting. The Group’sproportionate share of the associated companies’ net income forthe financial year is a separate item in the consolidated incomestatement. Joint ventures that are owned on a fifty-fifty basis withanother shareholder and in which the voting rights and managementresponsibility are divided evenly between the shareholdershave been consolidated according to the proportionate method ofaccounting. Other companies (voting rights owned less than 20percent) are stated at cost in the balance sheet and dividends receivedare included in the income statement.Items denominated in foreign currency, and foreigncurrency and interest rate derivativesIn day-to-day accounting of each Group company, transactions inforeign currencies are translated at the rates of exchange prevailingon the dates of the transactions. At the end of the accountingperiod the unsettled balances of foreign currency transactions arevalued at the rates of exchange prevailing on the balance sheetdate. Foreign exchange gains and losses related to normal businessoperations are treated as adjustments to sales and purchases,while those gains and losses associated with financing and hedgingof the total foreign exchange position are recorded as financingincome and expenses.The Group has various pension schemes in accordance with thelocal conditions and practices in the countries in which it operates.The schemes are generally funded through payments to separatefunds or to insurance companies. Contributions are basedon periodic actuarial calculations and are charged against profits.The parent company’s pension arrangements have been handledwithin the separate pension funds. The uncovered liabilities ofpension funds are presented in the parent company’s financialstatements in short-term interest-free receivables and in shortterminterest-free liabilities.In <strong>2000</strong>, IAS 19 was not applied, but the effect of applying thestandard on the Group’s net income and retained earnings hasbeen calculated and stated in Notes. The liability resulting fromthe changeover to applying IAS 19, which came into force in1999, has been calculated at the Group level such that the accumulatedentitlement has been periodized over the time of theemployment according to the accrual rules for pension arrangements(Projected Unit Credit method). The pension calculationsare based on studies carried out by actuaries.Net salesNet sales include the total invoicing value of products sold andservices provided less sales tax, discounts, rebates and foreignexchange differences in accounts receivable.22

Direct taxesThe consolidated financial statements include direct taxes, whichare based on the taxable results of the Group companies for theaccounting period calculated according to local tax rules, and thechange in the deferred tax liabilities and assets.The Group’s deferred tax liabilities and assets have been calculatedaccording to IAS 12 which came into force from the beginning of1998 and which is allowed by the Finnish legislation. The deferredtax liability has been calculated for all significant temporary differences,which have been obtained by comparing the book value ofeach balance sheet item and the taxation value. Deferred tax assetsare included in the financial statements only if the company considersthat the temporary difference or tax loss will probably be realizedin the near future and that the taxable unit will probablygenerate a sufficient amount of taxable income in order to be ableto make use of the tax claim. Tax assets on confirmed losses havebeen stated observing particular caution. In calculating the deferredtax liability, the tax base in force at the time of preparingthe financial statements has been applied.The tax charged in the income statement of the parent companycomprises direct taxes calculated on an accrual basis. The untaxedreserves of the parent company are shown as a separateitem. Provision for deferred tax liability for the untaxed reserveshas not been made in the balance sheet of the parent company.Research and development expenditureResearch expenditure is expensed. Development expenditure isalso expensed except for major projects for which investment decisionshave been made. These are capitalized. Capitalized developmentcosts are presented in the item “Other long-term expenditures”and amortized over their economic life, not exceeding,however, five years.Fixed assets and depreciationNon-current (fixed) assets are generally stated at cost, except forcertain land and water areas and buildings, which are stated atrevalued amounts, less accumulated depreciation, as applicable.Depreciation is calculated on a straight-line basis so as to writeoff carrying value of fixed assets over their expected useful lives.The depreciation periods adopted are as follows:Machinery and equipmentBuildings and constructionsOther capitalized expensesGoodwill on consolidation3–15 years25 years5–10 years5–20 yearsAs a general rule, interest expense is not capitalized. However,interest expenses related to capital borrowed to finance majorcapital investment projects can, when specifically approved bythe Board, be capitalized as part of the total investment costs.Gains and losses on the sale of fixed assets are included either inincome and expenses of operations with the exception of gainsand losses on discontinuing operations. They are presented as aseparate item. In recent years, new revaluations have not beenmade within the Group.Large, seldom performed maintenance worksLarge, seldomperformed maintenance works are treated as a capitalexpenditure as from 1999 and acquisition costs are depreciatedover their useful lifetimes (IAS 37). Previously, provisions forexpenses were booked for them in advance. The effect of thechange on net income and shareholders’ equity is stated in thestatement of changes in equity.LeasingLeasing payments are treated as rental expenses except for financeleasing agreements, in which the leased property is presentedas part of the Group’s fixed assets and the leasing debt isshown as a long-term liability. In respect of finance leasingagreements, the depreciation on the leased property and the interestexpense on the debt are shown in the income statement insteadof leasing rents.InventoriesInventories are stated at the lower of cost or net realizable value.Cost is determined on a first in first out (FIFO) basis. Net realizablevalue is the amount, which can be realized from the sale ofthe asset in the normal course of business, after allowing for thecosts of realization. The cost of finished goods and work in processinclude an allocable proportion of production overheads.Securities and other short-term investmentsSecurities and other short-term investments are a part of the Group’scash management and are stated at lower of cost or market.Discontinuing operationsBusinesses to be discontinued include those major businesseswhich according to the strategy decided in the autumn 1999 haveeither been divested or wound up, or a decision has been taken towind them up. These are <strong>Kemira</strong> Pigments Inc. in Savannah, USA,and <strong>Kemira</strong> Pigments B.V. in the Netherlands, as well as Tikkurila’sCPS unit, i.e. the colour processing systems business. The <strong>Kemira</strong>Pigments companies were sold in the spring <strong>2000</strong> and the CPSbusiness in the late summer <strong>2000</strong>. Businesses to be discontinuedalso include <strong>Kemira</strong> Agro Rozenburg. A decision was taken towind up its operations, and production was closed in December<strong>2000</strong>. Rozenburg’s operations are part of <strong>Kemira</strong> Agro’s nitrogenbusiness, which is to be divested in line with the strategy adopted.The final solution involves the disposal of the remainder of the nitrogenbusiness and, because the alternatives are currently beingstudied, the remaining nitrogen business is still included in continuingoperations.The income statement and cash flow statements are presented separatelyfor continuing operations and the above-mentioned businesseswhich are to be discontinued, presenting the figures forboth the current year and the comparison year. The businessesdivested in <strong>2000</strong> are not included in the balance sheet at the endof the year. In respect of the comparison year, their impact onthe 1999 balance sheet is discussed in the Notes to the financialstatements and the exact dates of the divestments are given.Non-recurring items for discontinuing operationsIn the consolidated income statement, the capital gains and lossesresulting from the above-mentioned discontinued major businessesare stated as a separate item before taxes and minority interests.Extraordinary income and expensesThere were no extraordinary items in the income statement. Extraordinaryitems of the parent company include Group contributionsreceived and paid.23

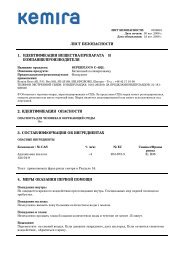

Notes to consolidated financial statementsINCOME STATEMENT (EUR million) <strong>2000</strong> 19991. NET SALESNet sales by division<strong>Kemira</strong> Chemicals 766.9 697.0Tikkurila 345.3 357.5<strong>Kemira</strong> Agro 1,115.5 1,014.7<strong>Kemira</strong> Pigments 306.8 488.5Other operations 76.6 84.5Intra-Group invoicing –125.1 –116.0Total 2,486.0 2,526.2Distribution of net sales by geographic market areas, as a percentage of total net salesFinland 19 18Other European Union countries 55 52Other European countries 10 8North and South America 8 13Asia 6 7Other countries 2 2Total 100 1002. SHARE OF ASSOCIATES’ NET INCOMEShare of associates’ profits 4.8 4.9Share of associates’ losses –5.3 –2.1Total –0.5 2.83. OTHER INCOME FROM OPERATIONSGains on the sale of fixed assets 17.5 14.1Sales of scrap and waste 0.5 0.5Insurance compensation 2.8 10.1Income from royalties, knowhow and licences 0.7 0.5Rent income 3.7 3.0Other income 5.7 4.4Total 30.9 32.6Gains on the sale of the fixed assets in <strong>2000</strong> include a capital gain of EUR 12 million on the sale of<strong>Kemira</strong> Safety Oy and a gain of EUR 9.2 million on the sale of shares in electric power utilities in1999.4. COST OF SALESChange in inventories of finished goods 17.6 –6.1Own work capitalized 1) –6.6 –6.6Materials and servicesMaterials and suppliesPurchases during the financial year 1,059.5 1,075.9Change in inventories of materials and supplies –9.4 1.1External services 64.5 85.7Total materials and services 1,114.6 1,162.7Personnel expenses 421.6 456.6Rents 24.4 34.3Losses on the sales of fixed assets 0.7 0.3Other expenses 598.0 621.3Total 2,170.3 2,262.5In <strong>2000</strong> costs included an increase in long-term provisions for liabilities and charges in a totalamount of EUR 35.2 million (a reduction of EUR 4.8 million in 1999)1)Own work capitalized comprises mainly wages, salaries and other personnel expenses and changes ininventoriesrelating to self-constructed fixed assets for own use.24

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSINCOME STATEMENT (EUR million) <strong>2000</strong> 19995. PERSONNEL EXPENSES AND NUMBER OF PERSONNELEmoluments of the Supervisory Board 0.1 0.1Emoluments of boards of directors and managing directors 1) 7.8 8.3Other wages and salaries 316.7 344.7Pension expenses 38.1 40.6Other personnel expenses 58.9 62.9Total 421.6 456.61)Profit sharing bonuses to the management were EUR 0.2 million in <strong>2000</strong> and EUR 0.5million in 1999.The non-executive members of the Board of Directors are paid a monthly emolument; other compensationis not paid to the members of the Board. Persons belonging to the Company’s management,including parties closely associated with them, are not involved in substantial business relationshipswith the Company.Management’s pension commitmentsThe managing director and deputy managing directors of <strong>Kemira</strong> Oyj are entitled to retire at the ageof 60. This possibility is based on the benefits of the supplementary pension foundation that hasbeen closed to new members since 1 January 1991. The supplementary pension foundation’s benefitsconcern all the personnel whose years of service and other conditions concerning the grantingof a pension have been fulfilled. Similar arrangements have been made in the other Group companies.Personnel, average<strong>Kemira</strong> Chemicals 3,210 3,138Tikkurila 2,049 2,301<strong>Kemira</strong> Agro 2,833 2,951<strong>Kemira</strong> Pigments 1,084 1,752Other companies 468 601Total 9,644 10,743Personnel in Finland, average 4,908 5,090Personnel outside Finland, average 4,736 5,653Total 9,644 10,743The total personnel of joint ventures that have been consolidated according to the proportionatemethod of accounting was in average 134 (279 in 1999).Personnel at year end 8,865 10,4366. DEPRECIATIONScheduled depreciationIntangible assetsIntangible rights 2.3 2.0Goodwill 1.9 1.2Goodwill on consolidation 3.8 4.5Other long-term expenditures 7.6 6.1Tangible assetsBuildings and constructions 24.7 23.5Machinery and equipment 125.4 145.5Other tangible assets 5.6 5.3Total 171.3 188.1Scheduled depreciation for goodwill on consolidation was EUR 3.8 million (EUR 4.5 million in 1999).No reductions have been made in the Group reserve in <strong>2000</strong> and 1999.7. FINANCING INCOME AND EXPENSESFinancing incomeDividend income 0.6 0.7Interest income from long-term investments 1.3 1.1Other interest income 14.2 5.3Other financing income 1.0 0.5Exchange gains 1.5 –Total 18.6 7.625