Improving profitability in Municipal & Industrial - Kemira

Improving profitability in Municipal & Industrial - Kemira

Improving profitability in Municipal & Industrial - Kemira

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Improv<strong>in</strong>g</strong> <strong>profitability</strong> <strong>in</strong> <strong>Municipal</strong> & <strong>Industrial</strong>Hannu Virola<strong>in</strong>enPresident, <strong>Municipal</strong> & <strong>Industrial</strong>

<strong>Municipal</strong> & <strong>Industrial</strong> segmentCustomersF<strong>in</strong>ancials<strong>Municipal</strong> dr<strong>in</strong>k<strong>in</strong>g and waste water treatment plants,<strong>in</strong>dustrial waste and process water plants2011 revenue EUR 665 millionMarket positionMarketsProduct range#1 <strong>in</strong> coagulants and#3 <strong>in</strong> flocculants worldwide<strong>Kemira</strong>’s accessible market size is EUR 26 billion, of whichEUR 7.5 billion* is relevant for <strong>Kemira</strong>’s M&I segmentMa<strong>in</strong> products coagulants and flocculants (polymers)Water l<strong>in</strong>kReliable water treatment for municipalities and <strong>in</strong>dustries.Cop<strong>in</strong>g with challenges like water scarcity, cost andquality as well as stricter regulations for discharges.*Management estimateHannu Virola<strong>in</strong>en 2

Raw and waste water applications are the core forboth, municipal and <strong>in</strong>dustrial customer segments• Water treatment is a stable bus<strong>in</strong>ess with susta<strong>in</strong>able long-term outlook• General demand cont<strong>in</strong>ues to grow as a result of basic need for watercomb<strong>in</strong>ed with stricter regulations with<strong>in</strong> the water sectorCustomer segments Key applications Product l<strong>in</strong>es<strong>Municipal</strong> ~60%<strong>Industrial</strong> ~40%Raw water treatment ~45%Waste water treatment ~45%Sludge treatment ~10%Coagulants ~60%Polymers ~40%<strong>Municipal</strong> & <strong>Industrial</strong> revenue EUR 665 million <strong>in</strong> 2011Hannu Virola<strong>in</strong>en3

Well positioned for conventional water treatmenttechnologies with basic chemicalsAccessible market by product l<strong>in</strong>e 2011 (B€)7.5B€ <strong>in</strong> totalMiscellaneouschemicals1.7Polymers2.6Market position #3Market share ~5%Currently limitedmarket shareAntiscalants,Biocides,Defoamers1.7Coagulants1.6Market position #1Market share ~26%Hannu Virola<strong>in</strong>enSource: Comb<strong>in</strong>es <strong>in</strong>formation from various sources: McIlva<strong>in</strong>e 2011, Frost & Sullivan 2011,PPG 2011, SRI 2010, Booz&Company, and management estimation.4

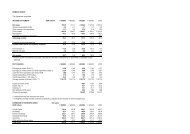

”Fit for Growth” driv<strong>in</strong>g <strong>profitability</strong> turnaround• “Fit for Growth” sav<strong>in</strong>gs expected to exceed EUR 20 million for M&I• Consolidat<strong>in</strong>g coagulant manufactur<strong>in</strong>g network; site / plant closures<strong>in</strong> EMEA and NAFTA• F<strong>in</strong>aliz<strong>in</strong>g <strong>in</strong>vestments to <strong>in</strong>crease coagulant manufactur<strong>in</strong>g competitiveness• Simplify<strong>in</strong>g structure <strong>in</strong> all areas <strong>in</strong>clud<strong>in</strong>g organization,customer base, product l<strong>in</strong>es and SKUs*EUR million700600500400300200100010.9 %9.2 %7.1 %5.6 %FY 2009 FY 2010 FY 2011 YTD 201212%11%10%9%8%7%6%5%4%3%2%RevenueOperative EBIT*Stock-keep<strong>in</strong>g unitHannu Virola<strong>in</strong>en5

Consolidate and <strong>in</strong>vest to <strong>in</strong>crease competitivenessDetailed plan to consolidate the manufactur<strong>in</strong>g network:• M<strong>in</strong>imiz<strong>in</strong>g manufactur<strong>in</strong>g and logistic cost through footpr<strong>in</strong>t optimization• Access to key raw materials and by-products determ<strong>in</strong>es feasible plant locations• Invest <strong>in</strong> selected sites to ensure long term competitiveness• Several sites under reviewEuropeM&I segment has 45 sitesGermanyCoagulantsSpa<strong>in</strong>SouthAmericaAsiaIndiaNew production sitesunder constructionHannu Virola<strong>in</strong>en6

Increase efficiency by reduc<strong>in</strong>g complexity andfocus resources on key profit contributorsFocusresourcesStreaml<strong>in</strong>e, develop channel partnersor exit*) Stock-keep<strong>in</strong>g unitHannu Virola<strong>in</strong>en 7

Growth driven by R&D <strong>in</strong> new water treatment technologies• Focus R&D efforts <strong>in</strong>to product l<strong>in</strong>es with high market growth – driven bynew water treatment technologies• <strong>Industrial</strong>ization and sludge de-water<strong>in</strong>g drive growth for Polymer products• Antiscalants, Biocides and Defoamers are the fastest grow<strong>in</strong>g product l<strong>in</strong>esAccessible market by product l<strong>in</strong>e 2011-2020 (B€)20117.5bn€202010.0bn€MiscellaneousMiscellaneouschemicalschemicals1.7 Polymers2.2 Polymers2.63.4Antiscalants,Biocides,Defoamers1.7Coagulants1.6Antiscalants,Biocides,Defoamers2.2Coagulants1.9Hannu Virola<strong>in</strong>enSource: Comb<strong>in</strong>es <strong>in</strong>formation from various sources: McIlva<strong>in</strong>e 2011, Frost & Sullivan 2011,PPG 2011, SRI 2010, Booz&Company, and management estimation.8

Generat<strong>in</strong>g growth on stable core bus<strong>in</strong>ess, largecustomer base and R&DGeographical <strong>in</strong>itiatives• Market entry to India coagulants• Localized product sourc<strong>in</strong>g <strong>in</strong> Ch<strong>in</strong>a• Resourc<strong>in</strong>g for growth especially <strong>in</strong> APACEUR millionExample: EMEA <strong>Industrial</strong> growth basedon R&D and application bus<strong>in</strong>ess*Product l<strong>in</strong>es and applications• Re<strong>in</strong>forc<strong>in</strong>g strong coagulant position through selected <strong>in</strong>vestments <strong>in</strong> maturemarkets, <strong>in</strong>clud<strong>in</strong>g f<strong>in</strong>alization of green field <strong>in</strong>vestments <strong>in</strong> Germany and Spa<strong>in</strong>• Polymer product l<strong>in</strong>e competitiveness and product development• Formulation and application capability development for new water treatmenttechnologies <strong>in</strong> Ch<strong>in</strong>a, MEA and NAFTAR&D programme• Projects for membrane technologies, desal<strong>in</strong>ation, water reuse and advancedwater treatment*2012 annualized H1 revenueHannu Virola<strong>in</strong>en 9

<strong>Improv<strong>in</strong>g</strong> fitness for growth• Growth to be achieved through strong market positionand exist<strong>in</strong>g R&D programs• In l<strong>in</strong>e with the average <strong>Kemira</strong> accessible marketgrowth of 3.3%• Cost sav<strong>in</strong>gs from ”Fit for Growth” measures isexpected to exceed EUR 20 million <strong>in</strong> <strong>Municipal</strong> &<strong>Industrial</strong> by 2014Hannu Virola<strong>in</strong>en10

DISCLAIMERThis presentation conta<strong>in</strong>s, or may be deemed to conta<strong>in</strong>, forward-look<strong>in</strong>g statements. These statements relate to future events or our future f<strong>in</strong>ancial performance,<strong>in</strong>clud<strong>in</strong>g, but not limited to, strategic plans, potential growth, planned operational changes, expected capital expenditures and future cash sources and requirements,that <strong>in</strong>volve known and unknown risks, uncerta<strong>in</strong>ties and other factors that may cause <strong>Kemira</strong> Oyj’s or its bus<strong>in</strong>esses’ actual results of operations, levels of activity,performance or achievements to be materially different from those expressed or implied by any forward-look<strong>in</strong>g statements. In some cases, such forward-look<strong>in</strong>gstatements can be identified by term<strong>in</strong>ology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “<strong>in</strong>tend,” “believe,” “estimate,” “predict,”“potential,” or “cont<strong>in</strong>ue,” or the negative of those terms or other comparable term<strong>in</strong>ology.By their nature, forward-look<strong>in</strong>g statements <strong>in</strong>volve risks and uncerta<strong>in</strong>ties because they relate to events and depend on circumstances that may or may not occur <strong>in</strong>the future. Future results may vary from the results expressed <strong>in</strong>, or implied by, the forward-look<strong>in</strong>g statements conta<strong>in</strong>ed <strong>in</strong> this presentation, possibly to a materialdegree. All forward-look<strong>in</strong>g statements made <strong>in</strong> this presentation are based on <strong>in</strong>formation presently available to management and <strong>Kemira</strong> Oyj assumes no obligationto update any forward-look<strong>in</strong>g statements, unless obligated to do so under applicable law or regulation.11