Global Forest, Paper & Packaging Industry Survey - Financiera Rural

Global Forest, Paper & Packaging Industry Survey - Financiera Rural

Global Forest, Paper & Packaging Industry Survey - Financiera Rural

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

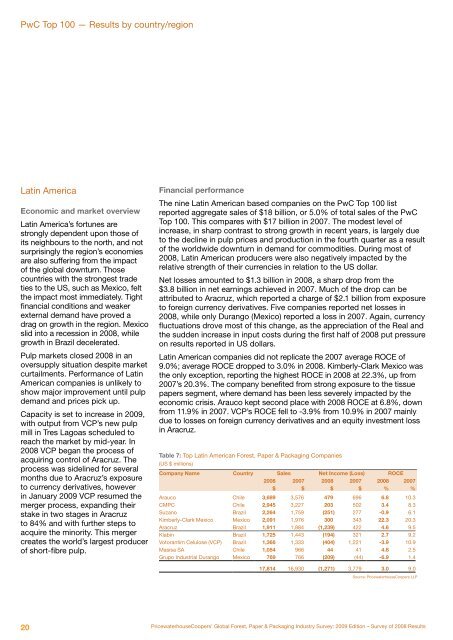

PwC Top 100 — Results by country/regionLatin AmericaEconomic and market overviewLatin America’s fortunes arestrongly dependent upon those ofits neighbours to the north, and notsurprisingly the region’s economiesare also suffering from the impactof the global downturn. Thosecountries with the strongest tradeties to the US, such as Mexico, feltthe impact most immediately. Tightfinancial conditions and weakerexternal demand have proved adrag on growth in the region. Mexicoslid into a recession in 2008, whilegrowth in Brazil decelerated.Pulp markets closed 2008 in anoversupply situation despite marketcurtailments. Performance of LatinAmerican companies is unlikely toshow major improvement until pulpdemand and prices pick up.Capacity is set to increase in 2009,with output from VCP’s new pulpmill in Tres Lagoas scheduled toreach the market by mid-year. In2008 VCP began the process ofacquiring control of Aracruz. Theprocess was sidelined for severalmonths due to Aracruz’s exposureto currency derivatives, howeverin January 2009 VCP resumed themerger process, expanding theirstake in two stages in Aracruzto 84% and with further steps toacquire the minority. This mergercreates the world’s largest producerof short-fibre pulp.Financial performanceThe nine Latin American based companies on the PwC Top 100 listreported aggregate sales of $18 billion, or 5.0% of total sales of the PwCTop 100. This compares with $17 billion in 2007. The modest level ofincrease, in sharp contrast to strong growth in recent years, is largely dueto the decline in pulp prices and production in the fourth quarter as a resultof the worldwide downturn in demand for commodities. During most of2008, Latin American producers were also negatively impacted by therelative strength of their currencies in relation to the US dollar.Net losses amounted to $1.3 billion in 2008, a sharp drop from the$3.8 billion in net earnings achieved in 2007. Much of the drop can beattributed to Aracruz, which reported a charge of $2.1 billion from exposureto foreign currency derivatives. Five companies reported net losses in2008, while only Durango (Mexico) reported a loss in 2007. Again, currencyfluctuations drove most of this change, as the appreciation of the Real andthe sudden increase in input costs during the first half of 2008 put pressureon results reported in US dollars.Latin American companies did not replicate the 2007 average ROCE of9.0%; average ROCE dropped to 3.0% in 2008. Kimberly-Clark Mexico wasthe only exception, reporting the highest ROCE in 2008 at 22.3%, up from2007’s 20.3%. The company benefited from strong exposure to the tissuepapers segment, where demand has been less severely impacted by theeconomic crisis. Arauco kept second place with 2008 ROCE at 6.8%, downfrom 11.9% in 2007. VCP’s ROCE fell to -3.9% from 10.9% in 2007 mainlydue to losses on foreign currency derivatives and an equity investment lossin Aracruz.Table 7: Top Latin American <strong>Forest</strong>, <strong>Paper</strong> & <strong>Packaging</strong> Companies(US $ millions)Company Name Country Sales Net Income (Loss) ROCE2008 2007 2008 2007 2008 2007$ $ $ $ % %Arauco Chile 3,689 3,576 479 696 6.8 10.3CMPC Chile 2,945 3,227 203 502 3.4 8.3Suzano Brazil 2,264 1,759 (251) 277 -0.9 6.1Kimberly-Clark Mexico Mexico 2,091 1,976 300 343 22.3 20.3Aracruz Brazil 1,911 1,884 (1,239) 422 4.6 9.5Klabin Brazil 1,725 1,443 (194) 321 2.7 9.2Votorantim Celulose (VCP) Brazil 1,366 1,333 (404) 1,221 -3.9 10.9Masisa SA Chile 1,054 966 44 41 4.8 2.5Grupo Industrial Durango Mexico 769 766 (209) (44) -6.9 1.417,814 16,930 (1,271) 3,779 3.0 9.0Source: PricewaterhouseCoopers LLP20PricewaterhouseCoopers’ <strong>Global</strong> <strong>Forest</strong>, <strong>Paper</strong> & <strong>Packaging</strong> <strong>Industry</strong> <strong>Survey</strong>: 2009 Edition – <strong>Survey</strong> of 2008 Results