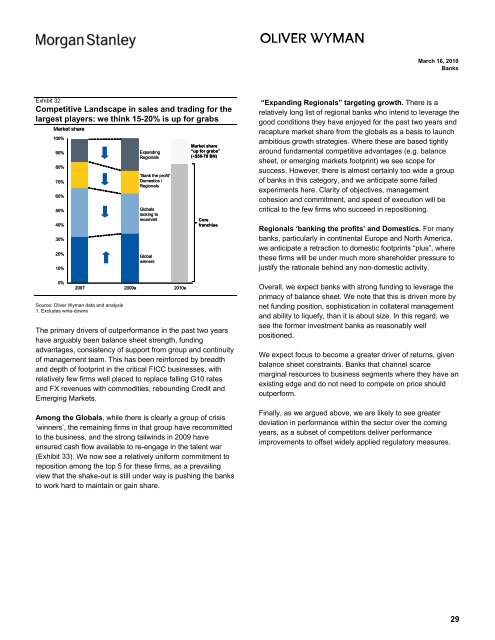

March 16, 2010Banks10. Who Will Be the Winners? Flow monsters, EM regionals, transactionbanks <strong>and</strong> non-banks st<strong>and</strong> outWe estimate that 15-20% of market share has changed h<strong>and</strong>ssince the onset of the crisis <strong>and</strong> arguably remains ‘up <strong>for</strong>grabs’. This will be a key competitive battleground over thenext year or two. We see the biggest risk <strong>for</strong> incumbents as adraconian regulatory environment that caps upside <strong>and</strong>pushes more industry profits to migrate to the non-bank sectoror creates any sort of two tier regulatory regime. The risks oftalent <strong>and</strong> assets migrating to less regulated entities remainshigh.Key trends – the rise of the non-banksWe think greater regulation of deposit-regulated institutions islikely to drive more talent <strong>and</strong> opportunity into the non-banksector. The key issue is how much regulation of the non-bankfinancials will develop. Our hunch is that protection oftaxpayer supported deposit institutions will be key, <strong>and</strong>several waves of re<strong>for</strong>ms on market infrastructure (clearing,funding ratios, supervision, alternative fund managerregulation <strong>and</strong> so on) as well as new capital <strong>and</strong> fundingrules, will drive the detail of where the balance will lie.Blossoming of boutiques. Near term, we expect theindustry shake-out to result in a host of boutiques (supplydriven) <strong>and</strong> niche firms gaining market share. This isparticularly likely in agency businesses, where the abilityto offer a transparent <strong>and</strong> mechanistic compensationstructure will be highly attractive. Capital-light areas, suchas research, some sales <strong>and</strong> trading <strong>and</strong> advisory (bothM&A <strong>and</strong> restructuring), are all areas where we see anincreasing pull of boutiques.Shift of principal investment to the buy-side <strong>and</strong> fundmodels. Shareholder pressure, regulation, <strong>and</strong> talentpressures will drive much embedded private equity <strong>and</strong>real estate investing to the buy-side. This will be driven inpart by banks looking to reduce capital allocation toprincipal investment. In addition, disintermediation, riskreduction <strong>and</strong> balance sheet reduction from the bankscreates an array of opportunities. The next wave is likely toinclude: 1) purchases of assets in shipping, infrastructure,commodity finance; 2) direct fixed income investment inthe loan sector; <strong>and</strong> 3) a further shift in alpha-tradingplat<strong>for</strong>ms from the banks into the alternatives sector.IDBs. As a result, we expect the interdealer brokers willevolve their business models to pseudo-exchanges with aheavy bias in electronic plat<strong>for</strong>ms <strong>and</strong> seek greater posttradeopportunities. We see the risks of discontinuitiesfrom m<strong>and</strong>ated exchange trading as low, though broaderregulatory pressures (<strong>for</strong> example, on bank capital) couldsubdue OTC market recovery.Trading specialists. High capital requirements <strong>for</strong> tradingbusinesses in systemically relevant firms may acceleratetwo processes: 1. the transition of proprietary tradingbusinesses into asset management constructs; <strong>and</strong> 2. thetransition of client facilitation businesses to technologydrivenspecialists.Exchanges. Exchanges have seen material pressure fromMTFs on their privileged position of flow. In our view, thisbattle <strong>for</strong> price, scale <strong>and</strong> efficiency has few easy answers,<strong>and</strong> competition <strong>for</strong> low-cost execution will remain veryintense. Building scale through M&A is a plausibleoutcome.Asset managers. Greater disintermediation of corporatecredit is likely to provide yet more opportunities <strong>for</strong> creditmanagers. Asset managers should be readyingthemselves to be more active in derivatives as marketsbecome more centrally cleared. We also think thepolarisation of cheap beta by scale providers (that is,index, ETFs, swaps) <strong>and</strong> alpha or alternative beta(particularly absolute returns or thematic investing) bymodern asset managers will persist. We believe firmsshould look to take decisions along this range <strong>and</strong> avoidthe muddling middling.Key trends – the regional <strong>and</strong> large cap banksThere has been a material reshuffling in the competitiveenvironment over the past two years, <strong>and</strong> there is plenty ofevidence to suggest a shake-out is still under way. At thispoint, we estimate that 15-20% of market share has changedh<strong>and</strong>s <strong>and</strong> arguably remains ‘up <strong>for</strong> grabs’. This is likely to bea key competitive battleground over the next year or two (seeExhibit 32).Repositioning of the IDBs. We think regulatory trendsover time will rein<strong>for</strong>ce the shift to electronic trading at28

March 16, 2010BanksExhibit 32Competitive L<strong>and</strong>scape in sales <strong>and</strong> trading <strong>for</strong> thelargest players: we think 15-20% is up <strong>for</strong> grabsMarket share100%90%80%70%60%50%40%30%20%10%0%Exp<strong>and</strong>ingRegionals“Bank the profit”Domestics /Regionals<strong>Global</strong>slooking torecommit<strong>Global</strong>winners2007 2009e 2010eSource: Oliver Wyman data <strong>and</strong> analysis1. Excludes write-downsMarket share“up <strong>for</strong> grabs”(~$50-70 BN)CorefranchiseThe primary drivers of outper<strong>for</strong>mance in the past two yearshave arguably been balance sheet strength, fundingadvantages, consistency of support from group <strong>and</strong> continuityof management team. This has been rein<strong>for</strong>ced by breadth<strong>and</strong> depth of footprint in the critical FICC businesses, withrelatively few firms well placed to replace falling G10 rates<strong>and</strong> FX revenues with commodities, rebounding Credit <strong>and</strong>Emerging Markets.Among the <strong>Global</strong>s, while there is clearly a group of crisis‘winners’, the remaining firms in that group have recommittedto the business, <strong>and</strong> the strong tailwinds in 2009 haveensured cash flow available to re-engage in the talent war(Exhibit 33). We now see a relatively uni<strong>for</strong>m commitment toreposition among the top 5 <strong>for</strong> these firms, as a prevailingview that the shake-out is still under way is pushing the banksto work hard to maintain or gain share.“Exp<strong>and</strong>ing Regionals” targeting growth. There is arelatively long list of regional banks who intend to leverage thegood conditions they have enjoyed <strong>for</strong> the past two years <strong>and</strong>recapture market share from the globals as a basis to launchambitious growth strategies. Where these are based tightlyaround fundamental competitive advantages (e.g. balancesheet, or emerging markets footprint) we see scope <strong>for</strong>success. However, there is almost certainly too wide a groupof banks in this category, <strong>and</strong> we anticipate some failedexperiments here. Clarity of objectives, managementcohesion <strong>and</strong> commitment, <strong>and</strong> speed of execution will becritical to the few firms who succeed in repositioning.Regionals ‘banking the profits’ <strong>and</strong> Domestics. For manybanks, particularly in continental Europe <strong>and</strong> North America,we anticipate a retraction to domestic footprints “plus”, wherethese firms will be under much more shareholder pressure tojustify the rationale behind any non-domestic activity.Overall, we expect banks with strong funding to leverage theprimacy of balance sheet. We note that this is driven more bynet funding position, sophistication in collateral management<strong>and</strong> ability to liquefy, than it is about size. In this regard, wesee the <strong>for</strong>mer investment banks as reasonably wellpositioned.We expect focus to become a greater driver of returns, givenbalance sheet constraints. Banks that channel scarcemarginal resources to business segments where they have anexisting edge <strong>and</strong> do not need to compete on price shouldoutper<strong>for</strong>m.Finally, as we argued above, we are likely to see greaterdeviation in per<strong>for</strong>mance within the sector over the comingyears, as a subset of competitors deliver per<strong>for</strong>manceimprovements to offset widely applied regulatory measures.29

- Page 4 and 5: March 16, 2010BanksIn this report:1

- Page 6 and 7: March 16, 2010Banks2009 core revenu

- Page 8 and 9: March 16, 2010BanksExhibit 7Base ca

- Page 10 and 11: March 16, 2010Banks2) Margins - Tig

- Page 13 and 14: March 16, 2010BanksExhibit 13We saw

- Page 15 and 16: March 16, 2010Banks4) Regulatory Ch

- Page 17 and 18: March 16, 2010BanksExhibit 18Regula

- Page 19 and 20: March 16, 2010Banks5) Funding - dri

- Page 21 and 22: March 16, 2010Banks6) Derivatives M

- Page 23 and 24: March 16, 2010Banks7) Sustainable I

- Page 25 and 26: March 16, 2010BanksExhibit 26We hav

- Page 27: March 16, 2010Banks9) Compensation

- Page 31 and 32: March 16, 2010BanksReturn character

- Page 33 and 34: March 16, 2010BanksPart 2 - Investm

- Page 35 and 36: March 16, 2010BanksThe key point we

- Page 37: March 16, 2010Banksestimated normal

- Page 40 and 41: March 16, 2010BanksExhibit 43Indust

- Page 42 and 43: March 16, 2010BanksExhibit 45Europe

- Page 44 and 45: March 16, 2010BanksExhibit 50FICC:

- Page 46 and 47: March 16, 2010BanksExhibit 57Our ba

- Page 48 and 49: March 16, 2010BanksExhibit 61FICC r

- Page 50 and 51: March 16, 2010Banks3. Regulatory ou

- Page 52 and 53: March 16, 2010BanksBasel III: Expec

- Page 54 and 55: March 16, 2010Banks4. Derivatives m

- Page 56 and 57: March 16, 2010BanksKey stock callsB

- Page 58 and 59: March 16, 2010BanksExhibit 78Gap ha

- Page 60 and 61: March 16, 2010BanksOur 2010e EPS mo

- Page 62 and 63: March 16, 2010BanksExhibit 86Group

- Page 64 and 65: March 16, 2010Bankscutting measures

- Page 66 and 67: March 16, 2010Banksis possible if r

- Page 68 and 69: March 16, 2010BanksExhibit 971Q pro

- Page 70 and 71: March 16, 2010Banksupside to fundra

- Page 72 and 73: March 16, 2010BanksImperial Bank of

- Page 74 and 75: March 16, 2010Banksis 30% or more d

- Page 76: MORGAN STANLEY RESEARCHThe Americas