BEST â Bilfinger

BEST â Bilfinger

BEST â Bilfinger

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

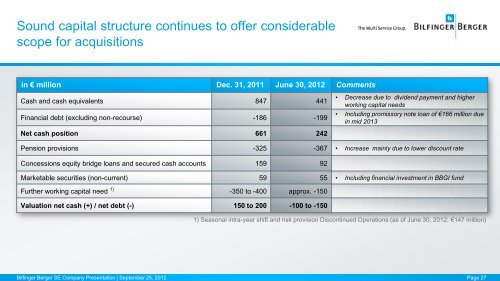

Sound capital structure continues to offer considerablescope for acquisitionsin € million Dec. 31, 2011 June 30, 2012 CommentsCash and cash equivalents 847 441Financial debt (excluding non-recourse) -186 -199• Decrease due to dividend payment and higherworking capital needs• Including promissory note loan of €166 million duein mid 2013Net cash position 661 242Pension provisions -325 -367 • Increase mainly due to lower discount rateConcessions equity bridge loans and secured cash accounts 159 92Marketable securities (non-current) 59 55 • Including financial investment in BBGI fundFurther working capital need 1) -350 to -400 approx. -150Valuation net cash (+) / net debt (-) 150 to 200 -100 to -1501) Seasonal intra-year shift and risk provision Discontinued Operations (as of June 30, 2012: €147 million)<strong>Bilfinger</strong> Berger SE Company Presentation | September 25, 2012 Page 27