Annual report 2006

Annual report 2006

Annual report 2006

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> Financial Statements49¬ Report of the independentauditors 50¬ Secretarial certification 50¬ Directors’ responsibility statement 51¬ Directors’ <strong>report</strong> 52¬ Balance sheets 54¬ Income statements 55¬ Statements of changes in equity 56¬ Reconciliation of previous SA GAAPto IFRS and restated SA GAAP 57¬ Cash flow statements 58¬ Notes to the cash flowstatements 59¬ Accounting policies 61¬ Notes to the annual financialstatements 67¬ Annexure 1 91¬ Linked unitholders’ information– diary 92¬ Linked unitholders’ information– notice of meeting 94¬ Administration 98¬ Form of proxy– linked unitholders 99¬ Notes to proxy 100<strong>Annual</strong> financial statementsASTRAPAK ANNUAL REPORT <strong>2006</strong>

Report of the independent auditorsTo the linked unitholders of Astrapak LimitedWe have audited the annual financial statements and groupannual financial statements of Astrapak Limited set out on pages52 to 90 for the year ended 28 February <strong>2006</strong>. These financialstatements are the responsibility of the Company’s directors.Our responsibility is to express an opinion on these financialstatements based on our audit.We conducted our audit in accordance with InternationalStandards on Auditing. Those Standards require that we plan andperform the audit to obtain reasonable assurance about whetherthe financial statements are free of material misstatement. Anaudit includes examining, on a test basis, evidence supportingthe amounts and disclosures in the financial statements. Anaudit also includes assessing the accounting principles used andsignificant estimates made by management, as well as evaluatingthe overall financial statement presentation. We believe that ouraudit provides a reasonable basis for our opinion.In our opinion, the financial statements present fairly, in all materialrespects, the financial position of the Company and the Groupat 28 February <strong>2006</strong>, and the results of their operations and cashflows for the year then ended in accordance with InternationalFinancial Reporting Standards, South African Statements ofGenerally Accepted Accounting Practice AC 500 series and in themanner required by the Companies Act of South Africa.Deloitte & ToucheRegistered AuditorsPer L Taljaard – Partner30 August <strong>2006</strong>Buildings 1 and 2, Deloitte PlaceThe Woodlands Office Park, Woodlands DriveSandtonNational Executive: GG Gelink Chief Executive, AE SwiegersChief Operating Officer, GM Pinnock Audit, DL Kennedy Tax,L Geeringh Consulting, MG Crisp Financial Advisory,L Bam Strategy, CR Beukman Finance, TJ Brown Clients & Markets,SJC Sibisi Public Sector and Corporate Social Responsibility,NT Mtoba Chairman of the Board, J Rhynes Deputy Chairmanof the BoardA full list of partners and directors is available on request.Secretarial certificationIn accordance with section 268G(d) of the Companies Act, it is hereby certified that the Company has lodged with the Registrar ofCompanies all such returns as are required of a public company in terms of the Act and that such returns are true and correct for thefinancial period ended 28 February <strong>2006</strong>.Y CowleyG KingCompany SecretaryCompany SecretarySandtonSandton14 July <strong>2006</strong> 30 August <strong>2006</strong>50ASTRAPAKANNUAL REPORT <strong>2006</strong>

Directors’ responsibility statement51The directors of the Company are responsible for the maintenanceof adequate accounting records and the preparation and integrityof the annual financial statements and related information. Theannual financial statements have been prepared in accordancewith the Companies Act in South Africa, International FinancialReporting Standards and the AC 500 standards as required by theAccounting Practices Board.The Group’s independent auditors, Deloitte & Touche, haveaudited the annual financial statements and their unqualified<strong>report</strong> appears above.The directors are also responsible for the systems of internalcontrol. These are designed to provide reasonable, but notabsolute, assurance as to the reliability of the annual financialstatements, and to adequately safeguard, verify and maintainaccountability of assets, and to prevent and detect materialmisstatement and loss. The systems are implemented andmonitored by suitably trained personnel with an appropriatesegregation of authority and duties. Nothing has come tothe attention of the directors to indicate that any materialbreakdown in the functioning of these controls, procedures andsystems has occurred during the year under review.The annual financial statements are prepared on a goingconcern basis. Nothing has come to the attention of thedirectors to indicate that the Group will not remain a goingconcern for the foreseeable future.The annual financial statements set out on pages 52 to 90were approved by the Board of Directors and are signed on theirbehalf by:R Crewe-BrownHA ToddChief Executive OfficerFinancial DirectorSandtonSandton30 August <strong>2006</strong> 30 August <strong>2006</strong>ASTRAPAK ANNUAL REPORT <strong>2006</strong>

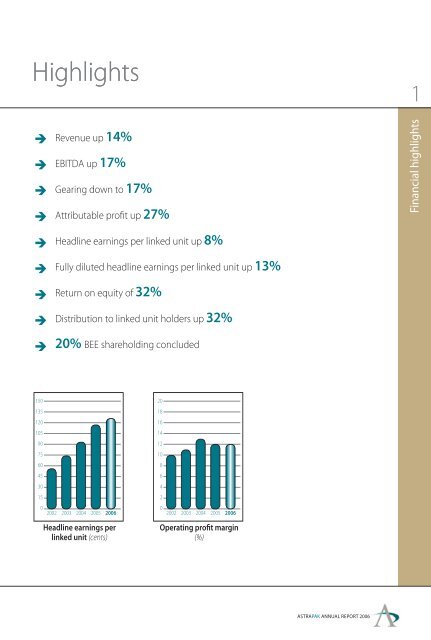

Directors’ <strong>report</strong>52ASTRAPAKThe directors’ <strong>report</strong> on the Company and the Group for the yearended 28 February <strong>2006</strong> is as follows:Nature of businessThe Group is engaged in the plastic packaging industry,providing products and packaging solutions to manufacturersand retailers of consumer products.Trading resultsA summary of the Group’s trading results is set out below:RestatedR million <strong>2006</strong> 2005Revenue 1 874,0 1 650,2Trading income 221,7 182,7Profit after taxation 147,6 115,1Attributable to linked unit holders 139,0 109,3Earnings per linked unit (cents) 122,5 121,0Headline earnings per linked unit (cents) 125,9 116,6Share capitalDetails of the authorised and issued share capital are given innote 10 to the annual financial statements.Ten percent of the unissued share capital was placed underthe control of the directors in terms of section 221 of theCompanies Act 61 of 1973 at the annual general meeting heldon 22 September 2005.During the current year, 15 014 583 deferred ordinary par valueshares of 0,1 cent each in the authorised and issued shares wereconverted into 15 014 583 ordinary par value shares of 0,1 cent each.There were no other share issues during the year.Linked unitsThe ordinary shares are linked to the debentures to form a linkedunit in Astrapak Limited. As at 28 February <strong>2006</strong>, each linkedunit comprised one ordinary share of 0,1 cent each and onedebenture of 50 cents each.The holder of a linked unit will be entitled to receive dividendson the equity portion of the linked unit and will receive intereston the debenture portion of the linked unit.SubsidiariesDetails of operating entities are set out in note 29 to the financialstatements.A number of special resolutions were passed by subsidiarycompanies. None of these resolutions is of significance to the linkedunitholders in assessing the state of affairs of the Group.DirectorsThe names of the directors of the Company are listed on pages12 to 13 of this <strong>report</strong>.No appointments have been made or resignations acceptedduring the financial year under review.In accordance with the Company’s Articles of Association,one-third of the directors shall retire at the forthcoming <strong>Annual</strong>General Meeting but, being eligible, offer themselves for reelectionand shall be deemed not to have vacated their respectiveoffices. (Refer to notice of meeting on page 94 for further details).Directors’ remunerationThe aggregate remuneration and benefits paid to the executiveand non-executive directors of the Group for the year ended28 February <strong>2006</strong> are set out in the Remuneration Report onpages 46 to 48 of this annual <strong>report</strong> and notes 17 and 33 to theannual financial statements.Astrapak Limited Linked Unit Trust SchemeFurther details on the Astrapak Limited Linked Unit Trust Scheme(“the scheme”) and the number of options issued to executiveand non-executive directors in terms of such scheme are set outin the Remuneration Report on pages 46 to 48 of this annual<strong>report</strong>. Mr PC Botha resigned as a trustee of the scheme on17 January <strong>2006</strong> and Mr AM Chait was appointed in his place,along with the current trustee Mr M Ball.Profit and losses of subsidiary companiesThe total after-tax profit by subsidiaries attributable to the Groupwas R197 297 235 (2005: R143 039 939). Subsidiaries incurredlosses of R49 685 087 (2005: R27 972 953).Distribution to linked unitholdersDebenture interest of 5,25 cents (2005: 6,20 cents) per linked unitwas paid, totalling R7,1 million (2005: R8,4 million). The interestpayment approximates the average prime rate of interest forthe financial year ended 28 February <strong>2006</strong>. In addition, Astrapakpaid an ordinary dividend of 24,75 cents (2005: 16,50 cents) perlinked unit totalling R33,4 million (2005: R22,3 million) to linkedunitholders for the year ended 28 February <strong>2006</strong>. The totalcombined dividend and debenture interest was 30,00 cents(2005: 22,70 cents) per linked unit totalling R40,5 million(2005: R30,7 million).Both distributions were paid on Monday, 5 June <strong>2006</strong> to linkedunitholders recorded in the register on Friday, 2 June <strong>2006</strong>. Thelast date to have traded cum-distribution was Friday, 26 May<strong>2006</strong> and the linked units commenced trading ex-distributionon Monday, 29 May <strong>2006</strong>. Linked unit certificates could not bedematerialised or rematerialised between Monday, 29 May <strong>2006</strong>and Friday, 2 June <strong>2006</strong>, both days inclusive.Post balance sheet eventsSubsequent to 1 March <strong>2006</strong>, the following events have takenplace:• Astrapak KwaZulu-Natal acquired a further 25% of the sharesbelonging to the minority shareholders of Tamperpak.Astrapak KwaZulu-Natal now holds 100% of the shares inTamperpak.• Astrapak Limited acquired 100% of the shares of Alex WhiteHoldings.• Astrapak has made an offer, subject to approval by theCompetitions Commission, for the assets of Plastform, whichforms part of Consol.ANNUAL REPORT <strong>2006</strong>

Directors’ <strong>report</strong> (continued)53Directors’ interestDirector Beneficial direct Non-beneficial indirect Unitholding (%)Interest in linked units as at 28 February 2005 822 673 15 129 348 11,8RAP Upton 53 333 – 0,0R Crewe-Brown 210 460 595 648 0,6M Baglione 153 100 56 700 0,2WJ Venter 190 780 – 0,1PC Botha* – 14 337 000 10,6RT Dalais – 140 000 0,1G Petzer 126 000 – 0,1M Diedloff 89 000 – 0,1Net (sales)/purchases from 1 March 2005 to 28 February <strong>2006</strong> (1 385 706) (14 198 256) (11,5)RAP Upton (219 999) – (0,2)R Crewe-Brown (137 670) – (0,1)M Baglione (143 100) – (0,1)WJ Venter (76 667) – (0,1)PC Botha* – (14 327 000) (10,6)RT Dalais – 128 744 0,1G Petzer (292 000) – (0,2)HA Todd (220 833) – (0,2)M Diedloff (295 437) – (0,2)Exercise of options from 1 March 2005 to 28 February <strong>2006</strong> 1 372 500 – 1,0RAP Upton 166 666 – 0,1R Crewe-Brown 150 000 – 0,1WJ Venter 116 667 – 0,1G Petzer 506 667 – 0,4HA Todd 220 833 – 0,2M Diedloff 211 667 – 0,2Interest in linked units as at 28 February <strong>2006</strong> 809 467 931 092 1,3R Crewe-Brown 222 790 595 648 0,6M Baglione 10 000 56 700 0,0WJ Venter 230 780 – 0,2PC Botha* – 10 000 0,0RT Dalais – 268 744 0,2G Petzer 340 667 – 0,3M Diedloff 5 230 – 0,0* During the year Mr PC Botha resigned as a trustee of the Astrapak Limited Linked Unit Trust Scheme and the linked units previously allocated to him as non-beneficial indirect, as a result of his position astrustee, are now ignored.# The number of linked units held by directors changed as follows between 1 March <strong>2006</strong> and the date of this <strong>report</strong>:Interest in linked units as at the date of this <strong>report</strong> 2 458 570 1 046 092 2,6R Crewe-Brown 472 790 595 648 0,8M Baglione 676 667 56 700 0,5WJ Venter 564 113 – 0,4PC Botha* – 125 000 0,1RT Dalais – 268 744 0,2G Petzer 450 000 – 0,3HA Todd 78 333 – 0,1M Diedloff 216 667 – 0,2Service contractsIndefinite-term contracts based on a notice period of three months by either party, have been signed by the following directors:Messrs R Crewe-Brown, HA Todd, WJ Venter, M Baglione and G Petzer. Mr M Diedloff has signed an indefinite-term contract based on anotice period of one month by either party.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Balance sheetsat 28 February <strong>2006</strong><strong>2006</strong>Group CompanyRestated2005 R’000 Notes <strong>2006</strong>Restated2005ASSETS764 323 571 967 Non-current assets 453 111 209 333615 821 480 971 Property, plant and equipment 1 876 97690 201 42 086 Goodwill 2 – –27 – Trademarks 3 – –41 017 32 111 Deferred tax assets 4 12 037 6 73717 080 16 724 Investments and loans 5 47 744 43 946177 75 Investment in associate company 6 – –– – Investment in subsidiaries 7 392 454 157 674690 916 540 561 Current assets 45 457 53 553245 192 186 960 Inventories 8 – –291 183 250 883 Accounts receivable 9 13 685 498144 456 98 224 Cash and short-term investments 14 31 772 53 05510 085 4 494 Taxation receivable – –1 455 239 1 112 528 Total assets 498 568 262 886EQUITY AND LIABILITIES731 739 520 530 Total equity 444 177 246 471135 135 Share capital 10 135 135199 367 84 302 Share premium 10 199 367 84 302523 109 405 438 Retained income 171 779 99 17317 858 Non-distributable reserves 11 – –5 331 2 803 Capital reserve 5 331 2 803(79 450) (48 950) Treasury linked units 12 – –648 509 444 586 Ordinary shareholders’ fund 376 612 186 41359 616 52 409 Debentures 13 67 565 60 058708 125 496 995 Equity attributable to linked unitholders of the parent 444 177 246 47123 614 23 535 Minority interest – –222 795 194 886 Non-current liabilities – –144 371 145 058 Long-term interest-bearing debt 14 – –78 424 49 828 Deferred tax liabilities 4 – –500 705 397 112 Current liabilities 54 391 16 415320 614 235 080 Accounts payable 15 35 516 7 30335 901 41 896 Provisions 16 4 188 2 2706 260 5 883 Linked unitholders for debenture interest 7 094 6 742122 173 105 299 Short-term interest-bearing debt 14 7 593 10015 757 8 954 Taxation payable – –1 455 239 1 112 528 Total equity and liabilities 498 568 262 88654ASTRAPAKANNUAL REPORT <strong>2006</strong>

Income statementsfor the year ended 28 February <strong>2006</strong>55<strong>2006</strong>GroupRestated2005 R’000 Notes <strong>2006</strong>CompanyRestated20051 873 962 1 650 227 Revenue – –(1 376 059) (1 214 518) Cost of sales – –497 903 435 709 Gross profit – –– – Dividends received 61 921 31 83519 044 17 441 Other operating income 38 264 31 501(149 923) (129 015) Distribution and selling costs – –(148 882) (145 060) Administrative and other operating expenses 702 (13 920)3 530 3 619 Share of results of associate company and joint venture – –221 672 182 694 Trading income 17 100 887 49 416– 12 783 Exceptional items 18 – –221 672 195 477 Profit from operations 100 887 49 4163 665 2 416 Investment income 19 11 642 12 166(40 865) (49 428) Finance costs 19 (18 436) (20 049)184 472 148 465 Profit before taxation 94 093 41 533(36 859) (33 396) Taxation (charge)/credit 20 2 414 1 222147 613 115 069 Profit for the year 96 507 42 755Attributable to:139 001 109 241 Linked unit holders of the parent8 612 5 828 Minority interest147 613 115 069 Profit for the year122,5 121,0 Earnings per linked unit (cents) 21111,8 105,5 Diluted earnings per linked unit (cents) 21ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Statements of changes in equityfor the year ended 28 February <strong>2006</strong>56ASTRAPAKR’000Sharecapital andpremiumRetainedincomeNondistributablereserveDividendreserveCapitalreserveTreasurylinked units DebenturesAttributableto linkedunitholders’parentMinorityinterestsGROUPBalance as at 1 March 2004 108 298 172 2 878 6 215 – (23 208) 47 804 331 969 55 301 387 270SA GAAP and IFRS adjustments (1 975) 1 080 (895) (895)Restated balance as at 1 March 2004 108 296 197 2 878 6 215 1 080 (23 208) 47 804 331 074 55 301 386 375Net profit for the year 109 241 109 241 5 828 115 069Net ordinary dividends paid (6 215) (6 215) (2 740) (8 955)Adjustments to minority interest (34 854) (34 854)Decrease in foreign currencytranslation reserve (683) (683) (683)Transfer to deferred tax asset (1 337) (1 337) (1 337)Acquisition of treasury shares (25 742) (25 742) (25 742)Expensing of share-based payments forthe year 1 723 1 723 1 723Issue of shares at a premium 84 329 84 329 84 329Issue of debentures 4 605 4 605 4 605Restated balance as at 28 February 2005 84 437 405 438 858 – 2 803 (48 950) 52 409 496 995 23 535 520 530Net profit for the year 139 001 139 001 8 612 147 613Net ordinary dividends paid (21 330) (21 330) (4 103) (25 433)Adjustments to minority interest (4 430) (4 430)Increase in foreign currencytranslation reserve 497 497 497Transfer to deferred tax asset (1 338) (1 338) (1 338)Acquisition of treasury shares (30 500) (30 500) (30 500)Expensing of share-based payments forthe year 2 528 2 528 2 528Issue of shares at a premium 115 065 115 065 115 065Issue of debentures 7 207 7 207 7 207Balance as at 28 February <strong>2006</strong> 199 502 523 109 17 – 5 331 (79 450) 59 616 708 125 23 614 731 739COMPANYBalance as at 1 March 2004 108 57 498 – 6 215 – – 54 053 117 874 – 117 874SA GAAP and IFRS adjustments (1 080) 1 080 – –Restated balance as at 1 March 2004 108 36 418 – 6 215 1 080 – 54 053 117 874 – 117 874Net profit for the year 42 755 42 755 42 755Expensing of share-based payments forthe year 1 723 1 723 1 723Net ordinary dividends paid (6 215) (6 215) (6 215)Issues of shares at a premium 84 329 84 329 84 329Issue of debentures 6 005 6 005 6 005Balance as at 28 February 2005 84 437 99 173 – – 2 803 – 60 058 246 471 – 246 471Net profit for the year 96 507 96 507 96 507Expensing of share-based payments forthe year 2 528 2 528 2 528Net ordinary dividends paid (23 901) (23 901) (23 901)Issue of shares at a premium 115 065 115 065 115 065Issue of debentures 7 507 7 507 7 507Balance as at 28 February <strong>2006</strong> 199 502 171 779 – – 5 331 – 67 565 444 177 – 444 177ANNUAL REPORT <strong>2006</strong>Totalequity

Reconciliation of previous SA GAAP to IFRSand restated SA GAAP57GroupCompanyIFRS transitionIFRS transition2005 2004 R’000 2005 2004Balance sheet522 338 387 270 Equity as previously <strong>report</strong>ed – SA GAAP 246 525 117 874– – IFRS adjustments – –2 803 1 080Adoption of IFRS 2 – Introduction of capital reserve in respect ofshare-based payments 2 803 1 080(2 803) (1 080)Adoption of IFRS 2 – Retained income effect in respect of sharebasedpayments (2 803) (1 080)(1 808) (895) SA GAAP adjustments (54) –3 957 3 957 Property, plant and equipment depreciation adjustment – –(5 765) (4 852) Straight-lining of operating leases adjustment (54) –520 530 386 375 Restated equity – IFRS 246 471 117 874Income statement111 877 Profit attributable to linked unit holders of the parent – SA GAAP 44 532(1 723) IFRS adjustment (1 723)(1 723) Adoption of IFRS 2 – Share-based payments (1 723)(913) SA GAAP adjustments (54)(913) Straight-lining of operating leases adjustment (54)– Deferred tax impact on IFRS adjustments –109 241Restated profit attributable to equity holders ofthe parent – IFRS 42 755ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Cash flow statementsfor the year ended 28 February <strong>2006</strong><strong>2006</strong>Group CompanyRestated2005 R’000 Notes <strong>2006</strong>Restated2005Cash flows from operating activities327 843 283 577 Cash generated from operations A 58 755 25 8343 665 2 416 Interest received 11 642 12 166(33 881) (43 545)Interest paid (excluding interest distributionto linked unitholders) (10 509) (13 307)(20 527) (10 755) Net dividends (paid)/received 38 019 25 620(31 990) (39 308) Taxation paid B (2 886) (878)(6 608) (6 834) Interest distribution to linked unitholders (7 575) (7 727)238 502 185 551 Net cash inflow from operating activities 87 446 41 708Cash flows from investing activities– – Increase in investment in subsidiary companies (98 815) (63 049)(82 883) (17 505) Acquisition of subsidiary companies C – –1 012 804 Decrease in investment in joint ventures – –(183 863) (155 398) Additions to property, plant and equipment D (217) (313)(13 019) (36 616) Decrease in minority shareholders’ interest – –(7 625) (6 039)Goodwill on acquisition of minority shareholders’interests – –1 574 (11 358) Increase/(decrease) in investment and loans (3 798) 6 417– 12 500 Proceeds on disposal of investments – –6 819 11 977 Proceeds on disposal of plant and equipment E – 5(277 985) (201 634) Net cash outflow from investing activities (102 830) (56 940)Cash flows from financing activities– 27 Increase in share capital – 27115 064 84 302 Increase in share premium 115 065 84 3027 207 4 605 Increase in debentures 7 507 6 005(30 500) (25 742) Acquisition of treasury linked units – –– – Decrease in loans by Group companies (135 964) (33 908)(12 347) (38 725) Decrease in long-term liabilities – –(3 014) 7 926 (Decrease)/increase in short-term interest-bearing debt 6 932 (5 685)76 410 32 393 Net cash inflow/(outflow) from financing activities (6 460) 50 74136 927 16 310 Net increase/(decrease) in cash and cash equivalents (21 844) 35 50983 040 66 730 Cash and cash equivalents at the beginning of the year 52 955 17 446119 967 83 040 Cash and cash equivalents at the end of the year F 31 111 52 95558ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the cash flow statementsfor the year ended 28 February <strong>2006</strong>59<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated2005A. CASH GENERATED FROM OPERATIONS184 472 148 465 Profit before taxation 94 093 41 533Adjustments for:– – Dividends received (61 921) (31 835)102 072 89 962 Depreciation 317 28018 4 666 Amortisation of goodwill and trademarks – –– (9 171) Profit on disposal of investments – –– 4 388 Impairment of assets – –1 773 (5 380) Loss/(gain) on disposal of property, plant and equipment – (5)494 1 251 Translation differences on investments and loans – –(3 530) (3 619) Share of results of associates and joint venture – –2 528 1 723 Equity accounted share option expenses 2 528 1 723(3 665) (2 416) Interest received (11 642) (12 166)40 865 49 428 Finance costs (including debenture interest distribution) 18 436 20 049325 027 279 297 Operating income before working capital changes 41 811 19 579Adjustments for working capital changes:(45 907) (44 479) Increase in inventories – –(16 834) 19 891 (Increase)/decrease in accounts receivable (13 187) 1 48265 557 28 868 Increase in accounts payable 30 131 4 7732 816 4 280 16 944 6 255327 843 283 577 58 755 25 834B. TAXATION PAID4 460 12 416 Amounts unpaid at the beginning of the year – –3 919 460 Taxation balances acquired – –29 283 30 892 Amounts charged to income statement 2 886 878(5 672) (4 460) Amounts unpaid at the end of the year – –31 990 39 308 2 886 878ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the cash flow statements (continued)for the year ended 28 February <strong>2006</strong>Group Company<strong>2006</strong>Restated2005 R’000 <strong>2006</strong>Restated2005C. ACQUISITION OF SUBSIDIARY COMPANIESFair value of assets acquired61 651 10 817 Property, plant and equipment – –(11 292) (656) Deferred taxation – –(11 662) (6 026) Long-term liabilities – –23 466 7 480 Accounts receivable – –23 401 2 973 Cash resources – –12 325 4 460 Inventory – –(12 933) (7 429) Accounts payable – –(3 919) (460) Taxation – –(10 584) (2 873) Current portion of long-term liabilities – –(247) – Dividends payable – –21 – Investments – –(4 478) – Minority shareholders – –45 – Trademarks – –65 794 8 286 – –Less:(23 401) (2 973) Cash resources acquired – –Add:40 490 12 192 Goodwill on acquisition – –82 883 17 505 Cash outflow arising on acquisition – –D. ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT168 898 151 819 Plant, equipment and furniture 217 2133 071 1 740 Motor vehicles – 8810 764 1 675 Leasehold improvements – 121 130 164 Land and buildings – –183 863 155 398 217 313The above-listed additions to property, plant andequipment consist of:166 026 118 525 Expansion – –17 837 36 873 Replacement 217 313183 863 155 398 217 313E. PROCEEDS ON DISPOSAL OFPLANT AND EQUIPMENT8 592 6 597 Net book value of disposals – –(1 773) 5 380 (Loss)/gain on disposal of property, plant and equipment – 56 819 11 977 – 5F. CASH AND CASH EQUIVALENTSAT THE END OF THE YEAR144 456 98 224 Cash and short-term investments 31 772 53 055(24 489) (15 184) Bank overdrafts (661) (100)119 967 83 040 31 111 52 95560ASTRAPAKANNUAL REPORT <strong>2006</strong>

Accounting policiesfor the year ended 28 February <strong>2006</strong>611. GENERAL INFORMATIONAstrapak Limited is a company incorporated underthe Companies Act of South Africa. The address of theregistered office is given on page 98. The nature of theGroup’s operations and its principal activities are set out onpages 6 to 11 and the operating and financial review onpages 21 to 31.These financial statements are presented in South AfricanRands because that is the currency of the primaryeconomic environment in which the Group operates.The financial statements have been prepared in accordancewith International Financial Reporting Standards (‘IFRS’) forthe first time.The impact of these changes in accounting policies isdiscussed in detail later in note 31. The impact on basic anddiluted earnings per share is disclosed in note 21.The adoption of these new and revised Standards andInterpretations has resulted in changes to the Group’saccounting policies in the following areas that haveaffected the amounts <strong>report</strong>ed for the current or prior years:• share-based payments (IFRS 2);• goodwill (IFRS 3); and• property, plant and equipment (IAS 16).The financial statements have been prepared on thehistorical cost basis except for revaluation of certainfinancial instruments. The principal accounting policiesadopted are set out below.2. BASIS OF CONSOLIDATIONThe consolidated financial statements incorporate thefinancial statements of the Company and entities controlledby the Company (its subsidiaries) made up to 28 Februaryeach year. Control is achieved where the Company has thepower to govern the financial and operating policies of aninvestee entity so as to obtain benefits from its activities.On acquisition, the assets and liabilities and contingentliabilities of a subsidiary are measured at their fair valuesat the date of acquisition. The acquisition of subsidiariesis accounted for using the purchase method. Any excessof the cost of acquisition over the fair values of theidentifiable net assets acquired is recognised as goodwill.Any deficiency of the cost of acquisition below the fairvalues of the identifiable net assets acquired (i.e. discounton acquisition) is credited to profit and loss in the period ofacquisition. The interest of minority shareholders is stated atthe minority’s proportion of the fair values of the assets andliabilities recognised. Subsequently, any losses applicable tothe minority interest in excess of the minority interest areallocated against the interests of the parent.The results of subsidiaries acquired or disposed of duringthe year are included in the consolidated income statementfrom the effective date of acquisition or up to the effectivedate of disposal, as appropriate.Where necessary, adjustments are made to the financialstatements of subsidiaries to bring the accounting policiesused into line with those used by the Group.All intra-group transactions, balances, income and expensesare eliminated on consolidation.3. INVESTMENTS IN ASSOCIATESAn associate is an entity over which the Group is in aposition to exercise significant influence, but not controlor joint control, through participation in the financial andoperating policy decisions of the investee.The results and assets and liabilities of associates areincorporated in these financial statements using the equitymethod of accounting except when classified as held for sale,in which case it is accounted for under IFRS 5.Investments in associates are carried in the balance sheetat cost as adjusted by post-acquisition changes in theGroup’s share of the net assets of the associate, less anyimpairment in the value of individual investments. Lossesof the associates in excess of the Group’s interest in thoseassociates are not recognised.Any excess of the cost of acquisition over the Group’sshare of the fair values of the identifiable net assets ofthe associate at the date of acquisition is recognised asASTRAPAK ANNUAL REPORT <strong>2006</strong>

Accounting policies (continued)for the year ended 28 February <strong>2006</strong>goodwill. Any deficiency of the cost of acquisition belowthe Group’s share of the fair values of the identifiablenet assets of the associate at the date of acquisition (i.e.discount on acquisition) is credited in profit and loss in theperiod of acquisition.Where a Group company transacts with an associate of theGroup, profits and losses are eliminated to the extent ofthe Group’s interest in the relevant associate. Losses mayprovide evidence of an impairment of the asset transferred,in which case appropriate provision is made for impairment.4. JOINT VENTURESA joint venture is a contractual arrangement whereby theGroup and outside parties undertake an economic activity,which is subject to joint control.Joint venture arrangements undertaken in a separate entityare referred to as jointly-controlled entities. The Group<strong>report</strong>s its interests in jointly-controlled entities using theequity method, in terms of which the post-acquisitionresults of the joint venture are included in the incomestatement.5. GOODWILLGoodwill arising on consolidation represents the excessof the cost of acquisition over the Group’s interest inthe fair value of the identifiable assets and liabilities of asubsidiary, associate or jointly-controlled entity at the dateof acquisition.Goodwill is initially recognised as an asset at cost andreviewed for impairment at least annually. Any impairmentis recognised immediately in profit or loss and is notsubsequently reversed.On disposal of a subsidiary, associate or jointly-controlledentity, the attributable amount of goodwill is included inthe determination of the profit or loss on disposal.Goodwill arising on acquisitions before the date oftransition to IFRS has been retained at the previousSouth African GAAP amounts, subject to being tested forimpairment at that date.Goodwill written off to share premium under South AfricanGAAP in 1998 has not been reinstated and is not includedin determining any subsequent profit or loss on disposal.6. REVENUE RECOGNITIONRevenue is measured at the fair value of the considerationreceived or receivable and represents amounts receivablefor goods and services provided in the normal course ofbusiness, net of trade discounts, VAT and other sales-relatedtaxes.Sales of goods are recognised when goods are deliveredand title has passed.Interest income is accrued on a time basis, by reference tothe principal outstanding and at the effective interest rateapplicable.Dividend income from investments is recognised whenthe shareholders’ rights to receive payment have beenestablished.7. LEASINGLeases are classified as finance leases whenever the termsof the lease transfer substantially all the risks and rewardsof ownership to the lessee. All other leases are classified asoperating leases.Assets held under finance leases are recognised as assetsof the Group at their fair value or, if lower, at the presentvalue of the minimum lease payments, each determinedat the inception of the lease. The corresponding liabilityto the lessor is included in the balance sheet as a financelease obligation. Lease payments are apportioned betweenfinance charges and reduction of the lease obligation soas to achieve a constant rate of interest on the remainingbalance of the liability. Finance charges are charged directlyagainst income, unless they are directly attributable toqualifying assets, in which case they are capitalised inaccordance with the Group’s general policy on borrowingcosts (see below).62ASTRAPAKANNUAL REPORT <strong>2006</strong>

Accounting policies (continued)for the year ended 28 February <strong>2006</strong>63Rentals payable under operating leases are charged toincome on a straight-line basis over the term of the relevantlease.Benefits received and receivable as an incentive to enterinto an operating lease are also spread on a straight linebasis over the lease term.8. FOREIGN CURRENCIESTransactions in currencies other than South African Randsare recorded at the rates of exchange prevailing on thedates of the transactions. At each balance sheet date,monetary assets and liabilities that are denominated inforeign currencies are retranslated at the rates prevailingon the balance sheet date. Non-monetary assets andliabilities carried at fair value that are denominated inforeign currencies are translated at the rates prevailing atthe date when the fair value was determined. Gains andlosses arising on re-translation are included in net profit orloss for the period, except for exchange differences arisingon non-monetary assets and liabilities where the changesin fair value are recognised directly in equity.To hedge its exposure to certain foreign exchange risks, theGroup enters into forward contracts and options (see belowfor details of the Group’s accounting policies in respect ofsuch derivative financial instruments).9. BORROWING COSTSBorrowing costs directly attributable to the acquisition,construction or production of qualifying assets, which areassets that necessarily take a substantial period of timeto prepare for their intended use or sale, are added tothe cost of those assets, until such time as the assets aresubstantially ready for their intended use or sale. Investmentincome earned on the temporary investment of specificborrowings, pending their expenditure on qualifyingassets, is deducted from the borrowing costs eligible forcapitalisation.All other borrowing costs are recognised in profit or loss inthe period in which they are incurred.10. GOVERNMENT GRANTSGovernment grants are recognised as income over theperiods necessary to match them with the related costs.11. PROFIT FROM OPERATIONSProfit from operations is stated after the share of results ofassociates but before investment income and finance costs.12. RETIREMENT BENEFIT COSTSPayments to defined contribution retirement benefitschemes are charged as an expense as they fall due.13. IMPAIRMENT, EXCLUDING GOODWILLOn an annual basis, the Group reviews all assets, bothtangible and intangible, carried on the balance sheet forimpairment. Where the recoverable amount of an assetor cash-generating unit is estimated to be lower than itscarrying amount, its carrying amount is reduced to itsrecoverable amount. Impairment losses are charged againstincome in the period in which they are identified.Where an impairment loss subsequently reverses thecarrying amount of the asset or cash-generating unit isincreased to the revised estimate of its recoverable amount,such increase in carrying amount is limited to the orignialcost. A reversal of an impairment loss is recognised inincome in the period in which such reversal is identified.14. TAXATIONThe tax expense represents the sum of the tax currentlypayable and deferred tax.The tax currently payable is based on taxable profit for theyear. Taxable profit differs from net profit as <strong>report</strong>ed in theincome statement because it excludes items of income orexpense that are taxable or deductible in other years and itfurther excludes items that are never taxable or deductible.The Group’s liability for current tax is calculated using taxrates that have been enacted or substantively enacted bythe balance sheet date.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Accounting policies (continued)for the year ended 28 February <strong>2006</strong>Deferred tax is the tax expected to be payable orrecoverable on differences between the carrying amountsof assets and liabilities in the financial statements andthe corresponding tax bases used in the computation oftaxable profit, and is accounted for using the balance sheetliability method.Deferred tax liabilities are generally recognised for alltaxable temporary differences and deferred tax assets arerecognised to the extent that it is probable that taxableprofits will be available against which deductible temporarydifferences can be utilised. Such assets and liabilities are notrecognised if the temporary difference arises from goodwillor from the initial recognition (other than in a businesscombination) of other assets and liabilities in a transactionthat affects neither the tax profit nor the accounting profit.Deferred tax liabilities are recognised for taxable temporarydifferences arising on investments in subsidiaries andassociates, and interests in joint ventures, except wherethe Group is able to control the reversal of the temporarydifference and it is probable that the temporary differencewill not reverse in the foreseeable future.The carrying amount of deferred tax assets is reviewed ateach balance sheet date and reduced to the extent that itis no longer probable that sufficient taxable profits will beavailable to allow all or part of the asset to be recovered.Deferred tax is calculated at the tax rates that are expectedto apply in the period when the liability is settled or theasset is realised. Deferred tax is charged or credited in theincome statement, except when it relates to items chargedor credited directly to equity, in which case the deferred taxis also dealt with in equity.15. PROPERTY, PLANT AND EQUIPMENTProperty, plant and equipment are accounted for at costless accumulated depreciation and any accumulatedimpairment. All direct costs, including finance costs relatingto major capital projects, are capitalised up to the date ofcommissioning.Depreciation is charged so as to write off the cost of assets,other than freehold land, over their estimated economicuseful lives, using the straight-line method. Depreciation isnot provided for on freehold land.Owner-occupied property, defined as property held for usein the supply of services or for administration purposes,is valued at cost less provisions for impairment of value,where appropriate. Depreciation is provided against thegross cost of the properties, taking into account the residualvalue and estimated life of the property.Residual values and estimated useful lives are assessed onan annual basis.The gain or loss arising on the disposal or scrapping ofproperty, plant and equipment is recognised in the incomestatement.16. TRADEMARKSTrademarks are measured initially at purchase cost andare amortised on a straight-line basis over their estimateduseful lives.17. INVENTORIESInventories are stated at the lower of cost and netrealisable value. Cost comprises direct materials and, whereapplicable, direct labour costs and those overheads thathave been incurred in bringing the inventories to theirpresent location and condition. Cost is calculated usingthe first-in first-out method. Net realisable value representsthe estimated selling price less all estimated costs ofcompletion and costs to be incurred in marketing, sellingand distribution.18. FINANCIAL INSTRUMENTSFinancial assets and financial liabilities are recognised onthe Group’s balance sheet when the Group has become aparty to contractual provisions of the instrument.Trade receivables and payables are measured at initialrecognition at fair value, and are subsequently measuredat amortised cost using the effective interest rate method.64ASTRAPAKANNUAL REPORT <strong>2006</strong>

Accounting policies (continued)65Appropriate allowances for estimated irrecoverable tradepayables are recognised in profit or loss when there isobjective evidence that the asset is impaired.Cash and cash equivalents comprise the net of cash onhand and overdrafts, demand deposits, and other shorttermhighly liquid investments that are readily convertibleto a known amount of cash and are subject to aninsignificant risk of changes in value.Interest-bearing bank loans and overdrafts are recordedat the proceeds received, net of direct issue costs. Financecharges, including premiums payable on settlement orredemption, are accounted for on an accrual basis to theincome statement using the effective interest rate methodand are added to the carrying amount of the instrument tothe extent they are not settled in the period in which theyarise.Equity instruments are recorded at the proceeds received,net of direct issue costs.The Group uses derivative financial instruments, primarilyforeign currency forward contracts, to hedge its risksassociated with foreign currency. The Group does not usederivative financial instruments for speculative purposes.The fair value of these derivatives is recorded andremeasured at each <strong>report</strong>ing date.Changes in fair value of derivative financial instrumentsthat are designated and effective as hedges of futurecash flows relating to firm commitments and forecastedtransactions are recognised directly in equity. If the hedgedfirm commitment or forecast transaction results in therecognition of an asset or a liability, then, at the time theasset or liability is recognised, the associated gain or losson the derivative that had previously been recognised inequity is included in the initial measurement of the asset orliability.Hedge accounting is discontinued when the hedginginstrument expires or is sold, terminated, exercised orno longer qualifies for hedge accounting. At that time,any cumulative gain or loss on the hedging instrumentrecognised in equity is retained in equity until theforecast transaction occurs. If a hedged transaction is nolonger expected to occur, the net cumulative gain or lossrecognised in equity is transferred to net profit or loss forthe period.Changes in fair value of derivative financial instruments thatdo not qualify for hedge accounting are recognised in theincome statement as they arise.19. PROVISIONSProvisions are raised when a present obligation exists asa result of a past event and it is probable that an outflowof resources will be required to settle the obligation, anda reliable estimate can be made of the amount of theobligation.20. SHARE-BASED PAYMENTSThe Group has applied the requirements of IFRS 2 SharebasedPayments. In accordance with the transitionalprovisions, IFRS 2 has been applied to all grants of equityinstruments after 7 November 2002 that were unvested asof 1 March 2005.The Group issues equity-settled share-based payments tocertain employees.Equity-settled share-based payments are measured at fairvalue at the date of grant. The fair value determined at thegrant date of the equity-settled share-based payments isexpensed on a straight-line basis over the vesting period,based on the Group’s estimate of shares that will eventuallyvest.Fair value is measured by use of a binomial model. Theexpected life used in the model has been adjusted,based on management’s best estimate, for the effects ofnon-transferability, exercise restrictions, and behaviouralconsiderations.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Accounting policies (continued)for the year ended 28 February <strong>2006</strong>21. SEGMENTAL REPORTINGFor management purposes, the Group is organised intobusiness clusters on the basis of operational types. Theseclusters are the basis on which the Group <strong>report</strong>s its primarysegment information. The principal activities of the clustersare as follows:• FilmsManufacturers of high-density polyethylene films, lowdensitysingle- and multi-layered films, plain and printedfilms, co-extruded film, blown film, film for pallet stretchwrap and industrial pallet shrink shroud.22. HEADLINE EARNINGS PER LINKED UNITThe Group has followed the recommendation contained inCircular 7/2002 Headline Earnings issued by SAICA and haspublished headline earnings per linked unit in addition toattributable earnings per linked unit. Headline earnings perlinked unit have been calculated in accordance with therequirements of Circular 7/2002. Attributable profit per linkedunit has been based on earnings attributable, includinginterest, to linked unitholders.• RigidsManufacturers of plastic closures for rigid containers andjars, clear packaging containers, industrial cores, tubesand composite cans, paper edgeboard used for palletstabilisation, and blow-moulding and decoration of rigidplastic containers and jars.• FlexiblesManufacturers of high-tech polyethylene stretch labels,PVC shrink labels, wraparound polypropylene labels,tamper-evident seals, decorated stand-up pouches andconverters and distributors of specialist printed mono- andcomposite films.In addition, the businesses are grouped by geographicallocation. The main geographic regions identified are:• Gauteng;• Cape; and• KwaZulu-Natal.Geographic split is determined by location of the operatingassets.66ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statementsfor the year ended 28 February <strong>2006</strong>67R’000LandandbuildingsPlant,equipmentand furnitureMotorvehiclesLeaseholdimprovementsTotal1. PROPERTY, PLANT AND EQUIPMENTGroup <strong>2006</strong>CostBalance at the beginning of the year 68 585 828 952 11 730 9 242 918 509Additions 1 130 168 898 3 071 10 764 183 863Acquisition of business – 103 539 3 378 – 106 917Disposals – (69 538) (1 410) – (70 948)Balance at the end of the year 69 715 1 031 851 16 769 20 006 1 138 341Accumulated depreciationBalance at the beginning of the year 21 122 403 504 7 993 4 919 437 538Acquisition of business – 43 719 1 547 – 45 266Charge for the year 2 963 95 335 2 272 1 502 102 072Depreciation on disposals – (62 360) 4 – (62 356)Balance at the end of the year 24 085 480 198 11 816 6 421 522 520Net book value at 28 February <strong>2006</strong> 45 630 551 653 4 953 13 585 615 821Restated net book value at 28 February 2005 47 463 425 448 3 737 4 323 480 971Group 2005CostBalance at the beginning of the year 74 277 661 698 11 266 7 567 754 808Additions 164 151 819 1 740 1 675 155 398Acquisition of business – 22 547 1 112 – 23 659Disposals (5 856) (7 112) (2 388) – (15 356)Balance at the end of the year 68 585 828 952 11 730 9 242 918 509Accumulated depreciationBalance at the beginning of the year 19 840 312 112 7 461 4 080 343 493Acquisition of business – 12 227 615 – 12 842Charge for the year 3 162 84 610 1 351 839 89 962Depreciation on disposals (1 880) (5 445) (1 434) – (8 759)Balance at the end of the year 21 122 403 504 7 993 4 919 437 538Restated net book value at 28 February 2005 47 463 425 448 3 737 4 323 480 971Restated net book value at 29 February 2004 54 437 349 586 3 805 3 487 411 315ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>R’000 CostAccumulateddepreciationNet bookvalue68ASTRAPAK1. PROPERTY, PLANT AND EQUIPMENT (continued)Reconciliation of net book value at 28 February <strong>2006</strong>Land and buildings 69 715 24 085 45 630Plant, equipment and furniture 1 031 851 480 198 551 653Motor vehicles 16 769 11 816 4 953Leasehold improvements 20 006 6 421 13 5851 138 841 522 520 615 821R’000MotorvehiclesPlant,equipmentand furnitureLeaseholdimprovementsCompany <strong>2006</strong>CostBalance at the beginning of the year 88 1 389 346 1 823Additions – 217 – 217Balance at the end of the year 88 1 606 346 2 040Accumulated depreciationBalance at the beginning of the year 15 689 143 847Charge for the year 17 246 54 317Balance at the end of the year 32 935 197 1 164Net book value at 28 February <strong>2006</strong> 56 671 149 876Net book value at 28 February 2005 73 700 203 976Company 2005CostBalance at the beginning of the year – 1 179 334 1 513Additions 88 213 12 313Disposals – (3) – (3)Balance at the end of the year 88 1 389 346 1 823Accumulated depreciationBalance at the beginning of the year – 487 83 570Charge for the year 15 205 60 280Disposals – (3) – (3)Balance at the end of the year 15 689 143 847Net book value at 28 February 2005 73 700 203 976Net book value at 29 February 2004 – 692 251 943AccumulateddepreciationANNUAL REPORT <strong>2006</strong>TotalNet bookvalueR’000 CostReconciliation of net book value at 28 February <strong>2006</strong>Motor vehicles 88 32 56Plant, equipment and furniture 1 606 935 671Leasehold improvements 346 197 1492 040 1 164 876Assets are encumbered as detailed in note 14.Details of land and buildings are included in annexure 1.Assets held under finance lease are depreciated over the lesser of the expected useful life or the term of the related lease.Plant and equipment8 yearsFurniture and computer equipment3 to 5 yearsMotor vehicles5 yearsLeasehold improvements5 yearsBuildings20 yearsTrademarks3 to 5 years

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>69<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated20052. GOODWILL42 086 28 521 Balance at the beginning of the year – –Purchases during the year:7 625 6 039 • minority interests purchased – –24 209 – • acquisition of 100% of Hilfort Plastics – –16 281 – • acquisition of 60% of Consupaq – –– 2 347 • acquisition of 50% of Marcom Plastics – –– 9 845 • acquisition of 70% of Knilam Packaging– (4 666) Amortisation for the year – –90 201 42 086Cost after elimination of amortisation accumulated prior tothe adoption of IFRS 3 – –Reconciliation of net goodwill as at 28 February90 201 56 509Cost (<strong>2006</strong>: after elimination of amortisation accumulatedprior to the adoption of IFRS 3) – –– (14 423) Accumulated amortisation – –90 201 42 086 Net carrying value – –3. TRADEMARKS45 – Acquisition of 60% of Consupaq – –(18) – Amortisation for the year – –27 – Total – –Reconciliation of net trademarks as at 28 February45 – Cost – –(18) – Accumulated amortisation – –27 – Net carrying value – –4. DEFERRED TAX83 247 26 901Accelerated wear and tear for tax purposeson plant and equipment – –(4 823) 22 927 Other temporary differences – –(41 017) (32 111) Estimated tax losses (12 037) (6 737)37 407 17 717 Net deferred tax liability/(asset) (12 037) (6 737)Reconciliation betweeen deferred tax openingand closing balances:17 717 13 268 Net deferred tax liability/(asset) at the beginning of the year (6 737) (4 637)(8 906) (9 945) Increase of tax losses (5 300) (2 100)56 346 15 209Net originating temporary differenceson plant and equipment – –1 338 1 337 Transfer from non-distributable reserve (note 11) – –(29 088) (2 152) Other temporary differences – –37 407 17 717 Net deferred tax liability/(asset) at the end of the year (12 037) (6 737)Analysed between:(41 017) (32 111) Deferred tax assets (12 037) (6 737)78 424 49 828 Deferred tax liabilities – –37 407 17 717 Net deferred tax liability/(asset) at the end of the year (12 037) (6 737)ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>70ASTRAPAK<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>5. INVESTMENTS AND LOANSInvestmentsUnlistedANNUAL REPORT <strong>2006</strong>Restated2005Investment in label printing Mauritian Joint Venture(49,5% interest held) – –7 452 5 441776 776 Investment to date at cost – –14 494 11 578 Equity accounted profit to date (after tax) – –(5 533) (4 520) Dividends received to date – –(2 285) (2 393) Foreign exchange translation differences to date – –10 949 057 (2005: 12 500 125) cumulative redeemablepreference shares at R1 each in Really Useful InvestmentsNo 43 (Pty) Ltd – –9 589 11 28317 041 16 724 – –Listed28 – First Rand Limited (1 505 ordinary shares) – –3 – Sanlam Limited (499 ordinary shares) – –8 – Old Mutual Limited (700 ordinary shares) – –39 – – –17 080 16 724 Total investments – –Loans– – Loan to/(from) Astrapak Property Development (Pty) Limited 6 620 (2 112)– – Loan to Astrapak Limited Linked Unit Trust Scheme 41 124 46 058The loans are non-interest bearing, unsecured and haveno fixed terms of repayment17 080 16 724 Total 47 744 43 94617 041 16 724 Directors’ valuation of unlisted investments – –50 – Market value of listed investments – –Included in the financial results of the Mauritian JointVenture, Standard Labels Limited, at 28 February is:13 901 14 376 Current assets8 028 8 983 Non-current assets4 118 5 483 Current liabilities9 783 5 183 Non-current liabilities21 697 19 300 Revenue12 930 11 134 Retained profit for the year6. INVESTMENT IN ASSOCIATE COMPANY177 75 Unlisted – Izakhamzi Plastics (Pty) Ltd (20% interest held) – –4 970 3 940 Current assets – –563 583 Non-current – –3 681 3 223 Current liabilities – –444 400 Non-current liabilities – –20 946 23 898 Revenue – –177 75 Equity accounted profit to date – –177 75 Directors’ valuation of unlisted investment – –7. INVESTMENT IN SUBSIDIARIES– – Shares at cost 384 761 285 945– – Indebtedness 7 693 (128 271)– – Total 392 454 157 674– – Directors’ valuation 392 454 157 674Refer note 29 for further detailsInventories amounting to R485 981 (2005: R857 716) are carried at net realisable value.

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>71<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated20058. INVENTORIES114 667 79 174 Raw materials – –31 006 24 866 Work in progress – –87 393 74 158 Finished goods – –12 126 8 762 Consumable stores – –245 192 186 960 Total – –9. ACCOUNTS RECEIVABLE268 182 239 744 Trade receivables – –(8 903) (10 420) Less: Provision for bad debts – –259 279 229 324 – –11 180 10 387 Prepayments 128 –20 724 11 172 Other (including VAT receivable, deposits, etc) 13 557 498291 183 250 883 Total 13 685 49810. SHARE CAPITAL AND SHARE PREMIUMAuthorised share capitalOrdinary share capital200 185200 000 000 (2005: 184 985 417)shares of 0,1 cent per share 200 185Deferred ordinary share capital– 15 Nil (2005: 15 014 583) shares of 0,1 cent per share – 15Issued share capitalOrdinaryshares of 0,1 centper shareNumberof shares R’000Deferred ordinaryshares of 0,1 centper shareNumberof shares R’000SharepremiumR’000Balance at the beginning of the year 120 116 667 120 15 014 583 15 84 302Conversion of deferred ordinary sharesissued during the year at a premium 15 014 583 15 (15 014 583) (15) 117 556135 131 250 135 – – 201 858Less: Share issue expenses – – – – (2 491)Balance at the end of the year 135 131 250 135 – – 199 367Group Company<strong>2006</strong> 2005 R’000 <strong>2006</strong> 200511. NON-DISTRIBUTABLE RESERVES858 2 878 Balance at the beginning of the year – –(841) (2 020) Movements in non-distributable reserves – –17 858 Balance at the end of the year – –Comprising:1 336 2 673Non-distributable reserve created in previous years as aresult of a change in accounting policy relating to theamortisation of intangible assets – –(1 319) (1 815) Foreign currency translation reserve – –17 858 – –ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong><strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200512. TREASURY LINKED UNITS39 648 41 35812 085 006 (2005: 14 327 000) linked unitsregistered in the name of the Astrapak LimitedLinked Unit Trust Scheme – –39 802 7 5923 814 132 (2005: 971 125) linked units purchasedby nominee – –79 450 48 950 – –13. DEBENTURESAuthorised100 000 100 000200 000 000 unsecured variable rate redeemabledebentures of 50 cents each 100 000 100 000Issued67 565 60 058135 131 250 (2005: 120 116 667) unsecured variablerate redeemable debentures of 50 cents each 67 565 60 058(6 042) (7 164)12 085 006 (2005: 14 327 000) unsecured variable rateredeemable debentures of 50 cents each held in treasurylinked units – –(1 907) (485)3 814 132 (2005: 971 125) unsecured variable rateredeemable debentures of 50 cents each held by nominee – –59 616 52 409 67 565 60 05814. INTEREST-BEARING DEBT AND CASH14.1 Long termSecured debt183 539 147 826 Instalment sale agreements (variable rate) – –Other variable rate loans:7 215 1 063 • monthly instalments 6 932 –Other fixed rate loans:2 257 10 451 • quarterly instalments – –49 045 75 833 • bi-annual instalments – –242 056 235 173 Total secured debt 6 932 –(97 685) (90 115)Current portion transferred to short-terminterest-bearing debt (6 932) –144 371 145 058 Net long-term interest-bearing debt – –The instalment sale agreements and other variable rate loans are secured by the related property, plant and equipment with net bookvalues of R193 337 718 (2005: R177 486 893). Refer note 1.Variable rate loansThese loans bear interest at variable money market rates ruling at the roll-over dates. Redemption is reviewed and rolled forward. Securityis provided by the underlying property and cession of key man insurance policies.Fixed rate loansThe loan repayable in quarterly instalments bears interest at 11,85% per annum, and is repayable at R2 292 322 per quarter.The loan repayable in bi-annual instalments bears interest at 16% per annum, and is repayable in bi-annual instalments of R18 855 416.The fixed rate loans are secured by a group security pooling arrangement over the assets of the business.The directors consider the carrying amounts of all loans to approximate their fair values.72ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>73Group Company<strong>2006</strong> 2005 R’000 <strong>2006</strong> 200514. INTEREST-BEARING DEBT AND CASH (continued)14.1 Long term (continued)Analysis of repaymentsRepayable during the twelve months to:– 90 115 28 February <strong>2006</strong> – –97 685 98 651 28 February 2007 6 932 –96 208 31 090 29 February 2008 –26 253 10 594 28 February 2009 – –15 479 5 123 28 February 2010 – –6 431 – Thereafter – –242 056 235 173 Total repayments 6 932 –14.2 Short-term interest-bearing debt24 488 15 184 Bank overdrafts 661 10097 685 90 115 Current portion of long-term interest-bearing debt 6 932 –122 173 105 299 7 593 100(144 456) (98 224) 14.3 Cash and short-term investments (31 772) (53 055)14.4 Net interest-bearing debt/(cash)144 371 145 058 Long-term interest-bearing debt – –122 173 105 299 Short-term interest-bearing debt 7 593 100(144 456) (98 224) Cash and short-term investments (31 772) (53 055)122 088 152 133 (24 179) (52 955)The Group evaluated numerous capital allocation opportunities during the year under review and invested to achieve an optimal resultfor linked unitholders. The opportunities that were pursued were funded partly by debt and partly by the cash generated from within theGroup. This resulted in a net interest-bearing debt of R122,1 million (2005: R152,1 million). The major capital allocations were as follows:• R183,4 million for plant replacement as well as expansionary capital expenditure;• R13,0 million for the purchase of certain minority interests; and• R82,9 million for the purchase of subsidiaries.Where possible the effect of these capital allocations on headline earnings has been disclosed in note 21 of the <strong>report</strong>. In accordancewith the provisions of the Articles of Association adopted by the Company on 17 September 1997, the borrowing powers of the directorsare unlimited.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong><strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200515. ACCOUNTS PAYABLE223 671 177 624 Trade payables – –96 943 57 456 Accruals 35 516 7 303320 614 235 080 Total 35 516 7 303R’000 RoyaltiesLeavepay BonusesDistributorcommissionsCreditnotes Other Total<strong>2006</strong>16. PROVISIONS – GROUPOpening balance – 6 701 16 285 5 261 2 070 11 579 41 896Additions 57 8 802 17 405 940 1 404 7 293 35 901Usage – (6 701) (16 285) (5 261) (2 070) (11 579) (41 896)Closing balance 57 8 802 17 405 940 1 404 7 293 35 901PROVISIONS – COMPANYOpening balance – 244 2 026 – – – 2 270Additions – 201 3 987 – – – 4 188Usage – (244) (2 026) – – – (2 270)Closing balance – 201 3 987 – – – 4 188Other provisions consist of provisions for repairs and maintenance, volume discounts andsettlement discounts. All the provisions are expected to be utilised in full during the nextfinancial year.Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200517. TRADING INCOMETrading income has been determined after taking intoaccount the items detailed below:Income:1 430 132 Government grants – –641 586 Foreign exchange gains – –– 5 380 Net gain on disposal of property, plant and equipment 5– 9 171 Profit on disposal of investments – –372 – Reversal of write-down of inventory to net realisable value – –Expenses:Auditors’ remuneration2 315 1 536 • audit fees 269 106100 24 • prior year under provision – –149 42 • tax advisory services – –– 658 Write-down of inventory to net realisable value – –2 564 1 602 269 10674ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>75<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200517. TRADING INCOME (continued)Directors’ emolumentsNon-executive directors• Number of non-executive directors 5 5• Fees for services as a director 510 375• Fees for services as committee members 195 200• Fees for consulting services 851 9731 556 1 548Executive directors• Number of executive directors 6 6• Basic remuneration 8 061 6 101• Bonus and performance-related payments 4 195 1 992• Contributions to retirement and medical aid funds 60 59• Other incentives and benefits 809 80913 125 8 961Less: Paid by subsidiary and non-subsidiary companies (13 125) (8 961)– –(Refer to the remuneration <strong>report</strong> on pages 46 to 48 for a further analysis ofaggregate remuneration and benefits paid to executive and non-executive directors.)– 4 666 Amortisation of goodwill – –18 – Amortisation of trademarks – –– 4 388 Impairment of assets – –1 773 – Net loss on disposal of property, plant and equipment – –Depreciation –2 963 3 162 • Land and buildings – –95 335 84 610 • Plant, equipment and furniture 246 2052 272 1 351 • Motor vehicles 17 151 502 839 • Leasehold improvements 54 60102 072 89 962 317 2802 510 3 298 Foreign exchange losses –Operating lease charges22 479 19 274 • Land and buildings 679 5961 850 711 • Plant, equipment and motor vehicles 50 81153 138 • Other – –24 482 20 123 729 677Staff costs296 583 261 930 • Salaries and wages 14 481 12 61017 285 16 918 • Pension and provident fund costs 1 164 86610 516 9 287 • Other 244 2123 195 2 991 Number of employees 13 12ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>R’000Net profitbeforetaxationTaxationMinorityinterestsNetprofit18. EXCEPTIONAL ITEMSThe exceptional items consist of:Group 2005:Surplus on replacement of destroyedplant and equipment from the insuranceclaim relating to the fire that occurredat Plastop (Proprietary) Limited,Bronkhorstspruit on 1 August 2003 8 000 (208) – 7 792Gain on disposal of empowermentshareholding in PAK 2000 9 171 (1 271) – 7 900Non-recurring costs incurred in respectof the sinkhole at Cinqpet (Pty) Ltd’sfactory (4 388) – 219 (4 169)12 783 (1 479) 219 11 523<strong>2006</strong>Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200519. NET INVESTMENT INCOME/(FINANCE COSTS)(33 881) (43 545) Interest paid (excluding debenture interest distribution) (10 509) (13 307)(6 984) (5 883) Debenture interest distribution (7 927) (6 742)3 665 2 416 Interest received 11 642 12 166(37 200) (47 012) (6 794) (7 883)76ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>77Group Company<strong>2006</strong>Restated2005 R’000 <strong>2006</strong>Restated200520. TAXATION26 083 27 696 Current tax – Current year – –– 1 839 – Capital gains tax – –7 576 2 484 Deferred taxation (5 300) (2 100)3 200 1 377 Secondary tax on companies 2 886 87836 859 33 396 Total (2 414) (1 222)%Reconciliation of rate of taxation29,0 30,0 South African normal tax rate on companies 29,0 30,0– (0,1) • Change in tax rate – –0,1 0,1 • Tax rate difference in respect of trusts – –(2,2) (1,1) • Incentive allowances – –3,8 7,7 • Disallowable expenses – –(10,4) (12,5) • Non-taxable income (34,7) (34,8)(2,0) (1,3) • Prior year losses utilised – –– (1,2) • Capital gains tax – –1,7 0,9 • Secondary tax on companies 3,1 2,020,0 22,5 Effective rate of taxation (2,6) (2,8)R’000Tax losses201 385 139 788 Estimated tax losses available to offset future profits 101 452 63 46059 945 40 229Tax losses against which no deferred taxation asset wasraised 59 945 40 229ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>Group<strong>2006</strong>Restated2005 R’00021. EARNINGS AND HEADLINE EARNINGSPER LINKED UNIT (CENTS)122,5 121,0 Earnings per linked unit (cents)116,6 114,8 Net profit attributable to linked unitholders5,9 6,2 Debenture interest125,5 123,8Prior to IFRS and other adjustments, earnings per linkedunit would have been reflected as125,9 116,6 Headline earnings per linked unit (cents)120,0 110,4 Net headline earnings attributable to linked unitholders5,9 6,2 Debenture interest128,8 119,3Prior to IFRS and other adjustments, earnings per linkedunit would have been reflected as111,8 105,5 Earnings per linked unit – fully diluted (cents)105,9 99,3 Attributable income5,9 6,2 Debenture interest114,3 100,8 Headline earnings per linked unit – fully diluted (cents)108,4 94,6 Attributable income5,9 6,2 Debenture interest119 187 95 158 Weighted average number of linked units in issue (000)131 272 110 018Weighted average number of linked units inissue – fully diluted (000)Number of shares119 187 95 158Weighted average number of ordinary shares for thepurposes of basic earnings per share12 085 14 860 Effect of dilutive potential ordinary shares – share options131 272 110 018Weighted average number of ordinary shares for thepurposes of diluted earnings per shareReconciliation between attributableprofit and headline earnings139 001 109 241 Net profit attributable to linked unitholders6 984 5 883 Distribution to linked unitholders – debenture interestAmortisation of goodwill relating to acquisitions– 4 666 after 15 June 2000, before 31 March 20041 773 (5 380) Loss/(profit) on disposal of property, plant and equipment– (9 171) Profit on disposal of 25% investment in PAK 20002 289 (41) Exercise of options– 4 388 Sinkhole costs(71) 1 437 Tax effect(2) (127) Attributable to minorities149 974 110 896 Headline earnings attributable to linked unitholdersHeadline earnings per linked unit increased by 7,98% to 125,9 cents. The increase was attributable to increased volumes, improvedmargins and greater efficiencies.78ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>7922. DISTRIBUTION POLICYThe profits available for distribution by way of debenture interest and dividends(‘distributable profits’) will be covered approximately three times by after tax-earnings beforedebenture interest.Debenture interestDebenture interest will be calculated at the lower of:• the prime rate of interest of the face value of the debentures; and• the distributable profits.<strong>2006</strong>Dividend policyThe dividend policy will be to declare and pay the excess of the distributable profits, ifany, over the debenture interest. The distribution policy will be reviewed by the Board ofDirectors of Astrapak from time to time, in light of prevailing circumstances and future cashrequirements.Group CompanyRestated2005 R’000 <strong>2006</strong>Restated200523. CAPITAL COMMITMENTS21 265 19 641 Authorised, contracted not spent – –Capital commitment funding will be sourced fromcash generated from operations or other financingarrangements as required.24. LEASE COMMITMENTSOperating leases18 775 12 919 • due within one year 118 62476 238 51 667 • due thereafter – 28795 013 64 586 Total 118 91125. RETIREMENT BENEFITSWith effect from 1 March 1999, the Astrapak Provident and Astrapak Pension Funds wereestablished for the purpose of consolidating the Group’s funds, by transferring all employeesin the Group onto the Astrapak Provident and Pension Funds. All the funds are definedcontribution funds as governed by the Pension Funds Act, 1956 (Act no 26 of 1956).All eligible employees are members of either the Astrapak Provident and Pension Funds, orare members of funds within the various industries in which they are employed.The assets of the funds, at 28 February 2005, are held in administered trust funds, separatefrom the Group’s assets, and are administered by various pension fund administrators.The cost of retirement benefits charged to the income statement during the financial periodunder review amounts to R17 284 897 (2005: R16 918 170).26. CONTINGENT LIABILITIESThe Group has no material contingent liabilities. The Company has contingent liabilitiesin respect of guarantees issued to bankers and other creditors for normal businesscommitments of subsidiaries.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>27. FINANCIAL RISK MANAGEMENTThe Group purchases financial instruments in order to finance its operations and to manage the interest rate and currency risks thatarise from normal business operations. In addition, financial balances, for example, trade debtors, trade creditors, bank balances,accruals and prepayments arise from normal business operations within the Group.The Group finances its operations mainly through retained profits, bank credit borrowings and long-term bank loans.The Group also enters into derivative transactions, principally, forward currency contracts, forward rate agreements and interest rateswaps in order to manage currency and interest rate risks that may arise.The risk areas the Group is exposed to are credit risk, treasury risk, interest rate risk, liquidity risk and foreign currency risk. Compliancewith the Group’s policies is reviewed at Executive Committee meetings. These policies have remained unchanged throughout theyear ended 28 February <strong>2006</strong>.Treasury risk managementThe Group’s treasury risk is managed through the Executive Committee <strong>report</strong>ing to the Board of Directors. One of the roles of thiscommittee is to decide the appropriate philosophy to be adopted within the Group regarding the management of treasury risksand for considering and managing the Group’s existing financial market risks by adopting strategies within the guidelines set by theBoard.Interest rate risk managementInterest rate risk is the possibility that the Group may suffer financial loss if either a fluctuating interest rate or fixed interest rateposition is entered into and interest rates move adversely. The Group uses swaps, options, forward rate arrangements and otherstandard market instruments to manage this risk. The risk profile of financial liabilities and assets at balance sheet date is detailedbelow, which excludes short-term receivables and non-interest bearing short-term payables:R’000Floating rateassetsFixed rateliabilitiesFloating rateliabilitiesNetliabilitySouth African Rand (144 456) 51 302 190 754 122 088Total at 28 February <strong>2006</strong> (144 456) 51 302 190 754 122 088South African Rand (98 224) 86 284 164 073 152 133Total at 28 February 2005 (98 224) 86 284 164 073 152 13380ASTRAPAKANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>8127. FINANCIAL RISK MANAGEMENT (continued)Liquidity risk managementLiquidity risk is the possibility that the Group may suffer financial loss through liquid funds not being available or that excessivefinance costs must be paid to obtain funds to meet payment requirements. The Group manages this risk through forecasting andmonitoring cash flow requirements on a regular basis, and by maintaining sufficient undrawn facilities. Significant liquid resourceswere held at year-end. The Group had the following undrawn facilities available at the balance sheet date:RestatedR’000 <strong>2006</strong>2005Expiry period at 28 FebruaryWithin one year 139 614 149 380Within two to five years 90 005 250 017229 619 399 397The facilities expiring within one year are of a general banking nature and thus subject to review at various dates (usually on anannual basis), and it is expected that this profile will continue.The facilities expiring beyond two years are of a project and structured finance nature, and are utilised primarily to finance capital expenditure.Foreign currency risk managementForeign currency risk is the risk that the Group may suffer financial loss as a consequence of depreciation in a <strong>report</strong>ing currencyrelative to a foreign currency prior to payment of a commitment in that foreign currency, or of the <strong>report</strong>ing currency strengtheningprior to receiving payment in that foreign currency.The Group has transactional exposures in currencies other than South African Rands. These exposures arise from sales, or purchases,of inventory and capital expenditure.The Group uses swaps, options and other financial instruments, in particular forward contracts, to manage transactional currencyrisks. Specific translation risks are managed through the Group’s individual operating units. Speculative positions are not permitted.All imports and exports are fully covered at balance sheet date. The values of forward contracts entered into at 28 February are:R’000Averagecontract rate <strong>2006</strong>Restated2005US Dollars 6,28 5 324 21Euro 11,1239 12 414 4 546UK Pounds 7,588 829 318 567 4 570Spot rate at 28 FebruaryUS Dollars 6,1659 5,8888Euro 7,3134 7,8358UK Pounds 10,7274 11,3865Credit risk managementPotential concentrations of credit risk consist principally of cash investments and trade receivables. The Group only deposits cashsurpluses with major banks of high standing.Trade receivables comprise a large, widespread customer base. Ongoing credit evaluations on the financial condition of customersare performed and, where appropriate, credit guarantee insurance cover is purchased or provisions made.The Group does not consider there to be any significant concentration of credit risk that had not been insured or adequatelyprovided for at balance sheet date.An allowance is made for impairment where there is an identified loss event which, based on previous experience, is evidence of areduction in the recoverability of the cash flows.Fair value of financial instrumentsThe carrying amounts <strong>report</strong>ed in the balance sheet for liquid resources, trade and other receivables and trade payables approximatefair value.ASTRAPAK ANNUAL REPORT <strong>2006</strong>

Notes to the annual financial statements (continued)for the year ended 28 February <strong>2006</strong>R’000 Films Rigids Flexibles Group28. SEGMENTAL ANALYSIS28.1 Business segment <strong>report</strong> (primary <strong>report</strong>)Revenue – <strong>2006</strong> 809 752 739 535 324 675 1 873 962Revenue – 2005 774 623 608 853 266 751 1 650 227Trading income – <strong>2006</strong> 63 261 116 017 42 392 221 670Trading income – 2005 64 752 91 842 26 100 182 694Depreciation – <strong>2006</strong> 22 669 67 196 12 207 102 072Depreciation – 2005 28 986 48 817 12 159 89 962Capital expenditure – <strong>2006</strong> 67 026 100 550 16 287 183 863Capital expenditure – 2005 24 826 116 563 14 009 155 398Total assets – <strong>2006</strong> 629 997 627 047 198 195 1 455 239Total assets – 2005 464 449 481 906 166 173 1 112 528Total liabilities – <strong>2006</strong> 370 103 240 553 112 844 723 500Total liabilities – 2005 292 311 204 457 95 230 591 998R’000 GautengKwaZulu-Natal Cape Group28.2 Geographical <strong>report</strong> (secondary <strong>report</strong>)Revenue – <strong>2006</strong> 984 846 484 075 405 041 1 873 962Revenue – 2005 949 814 421 185 279 228 1 650 227Trading income – <strong>2006</strong> 84 395 71 295 65 980 221 670Trading income – 2005 103 922 56 529 22 243 182 694Depreciation – <strong>2006</strong> 62 052 17 095 22 925 102 072Depreciation – 2005 58 690 18 152 13 120 89 962Capital expenditure – <strong>2006</strong> 99 647 40 957 43 259 183 863Capital expenditure – 2005 125 100 17 843 12 455 155 398Total assets – <strong>2006</strong> 838 805 302 947 313 487 1 455 239Total assets – 2005 736 578 225 435 150 515 1 112 528Total liabilities – <strong>2006</strong> 418 907 172 769 131 824 723 500Total liabilities – 2005 390 901 128 642 72 455 591 99882ASTRAPAKANNUAL REPORT <strong>2006</strong>