Prospectus - Manulife Insurance Berhad

Prospectus - Manulife Insurance Berhad

Prospectus - Manulife Insurance Berhad

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

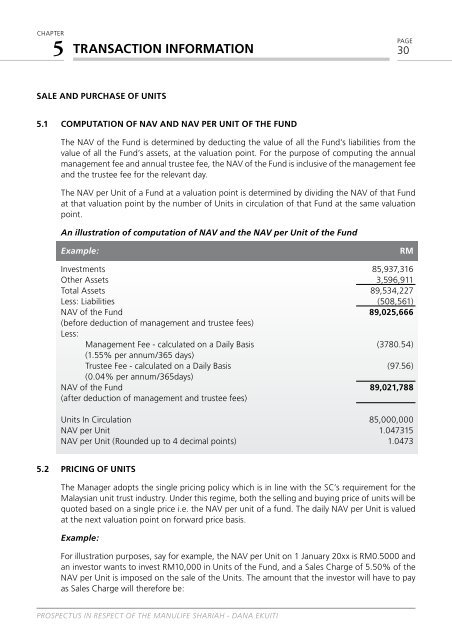

chapter5 TRANSACTION INFORMATIONpage30SALE AND PURCHASE OF UNITS5.1 Computation of NAV and NAV per Unit of the FundThe NAV of the Fund is determined by deducting the value of all the Fund’s liabilities from thevalue of all the Fund’s assets, at the valuation point. For the purpose of computing the annualmanagement fee and annual trustee fee, the NAV of the Fund is inclusive of the management feeand the trustee fee for the relevant day.The NAV per Unit of a Fund at a valuation point is determined by dividing the NAV of that Fundat that valuation point by the number of Units in circulation of that Fund at the same valuationpoint.An illustration of computation of NAV and the NAV per Unit of the FundExample:RMInvestments 85,937,316Other Assets 3,596,911Total Assets 89,534,227Less: Liabilities (508,561)NAV of the Fund 89,025,666(before deduction of management and trustee fees)Less:Management Fee - calculated on a Daily Basis (3780.54)(1.55% per annum/365 days)Trustee Fee - calculated on a Daily Basis (97.56)(0.04% per annum/365days)NAV of the Fund 89,021,788(after deduction of management and trustee fees)Units In Circulation 85,000,000NAV per Unit 1.047315NAV per Unit (Rounded up to 4 decimal points) 1.04735.2 Pricing of UnitsThe Manager adopts the single pricing policy which is in line with the SC’s requirement for theMalaysian unit trust industry. Under this regime, both the selling and buying price of units will bequoted based on a single price i.e. the NAV per unit of a fund. The daily NAV per Unit is valuedat the next valuation point on forward price basis.Example:For illustration purposes, say for example, the NAV per Unit on 1 January 20xx is RM0.5000 andan investor wants to invest RM10,000 in Units of the Fund, and a Sales Charge of 5.50% of theNAV per Unit is imposed on the sale of the Units. The amount that the investor will have to payas Sales Charge will therefore be:<strong>Prospectus</strong> in respect of the <strong>Manulife</strong> Shariah - Dana Ekuiti