Prospectus - Manulife Insurance Berhad

Prospectus - Manulife Insurance Berhad

Prospectus - Manulife Insurance Berhad

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

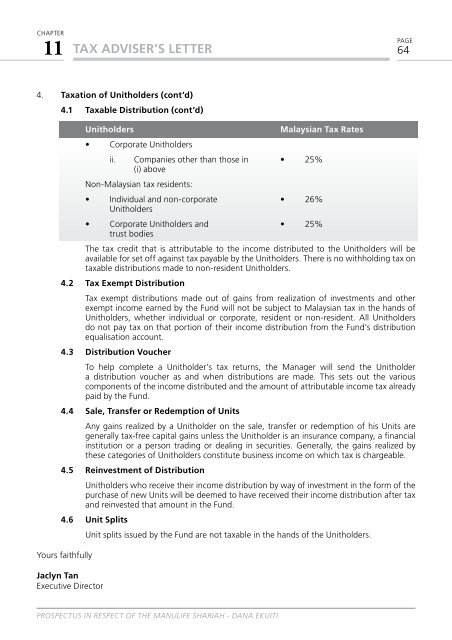

chapter11 TAX ADVISER’S LETTERpage644. Taxation of Unitholders (cont’d)4.1 Taxable Distribution (cont’d)UnitholdersMalaysian Tax Rates• Corporate Unitholdersii. Companies other than those in • 25%(i) abovenon-Malaysian tax residents:• Individual and non-corporate • 26%Unitholders• Corporate Unitholders and • 25%trust bodiesThe tax credit that is attributable to the income distributed to the Unitholders will beavailable for set off against tax payable by the Unitholders. There is no withholding tax ontaxable distributions made to non-resident Unitholders.4.2 Tax Exempt DistributionTax exempt distributions made out of gains from realization of investments and otherexempt income earned by the Fund will not be subject to Malaysian tax in the hands ofUnitholders, whether individual or corporate, resident or non-resident. All Unitholdersdo not pay tax on that portion of their income distribution from the Fund’s distributionequalisation account.4.3 Distribution VoucherTo help complete a Unitholder’s tax returns, the Manager will send the Unitholdera distribution voucher as and when distributions are made. This sets out the variouscomponents of the income distributed and the amount of attributable income tax alreadypaid by the Fund.4.4 Sale, Transfer or Redemption of Unitsany gains realized by a Unitholder on the sale, transfer or redemption of his Units aregenerally tax-free capital gains unless the Unitholder is an insurance company, a financialinstitution or a person trading or dealing in securities. Generally, the gains realized bythese categories of Unitholders constitute business income on which tax is chargeable.4.5 Reinvestment of DistributionUnitholders who receive their income distribution by way of investment in the form of thepurchase of new Units will be deemed to have received their income distribution after taxand reinvested that amount in the Fund.4.6 Unit SplitsYours faithfullyJaclyn TanExecutive DirectorUnit splits issued by the Fund are not taxable in the hands of the Unitholders.<strong>Prospectus</strong> in respect of the <strong>Manulife</strong> Shariah - Dana Ekuiti