Ananda Krishnan Exiting? - Charts

Ananda Krishnan Exiting? - Charts

Ananda Krishnan Exiting? - Charts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

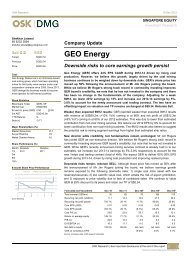

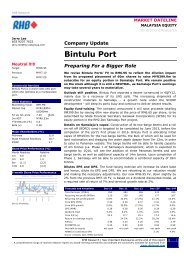

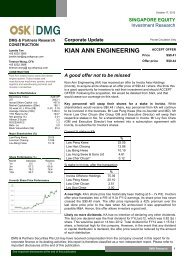

Corporate News Flash, 10 June 2013Maxis (MAXIS MK)Neutral (Maintained)Communications - Telecommunications Target Price: MYR7.15Market Cap: US$16,359m Price: MYR6.75<strong>Ananda</strong> <strong>Krishnan</strong> <strong>Exiting</strong>?MacroRisksGrowth ValueVol m7.17.06.96.86.76.66.56.46.36.2 3530252015105Jun-12Aug-12Source: BloombergPrice CloseOct-12Avg Turnover (MYR/US)Maxis (MAXIS MK)Relative to FTSE Bursa Malaysia KLCI Index (RHS)See important disclosures at the end of this reportDec-12Feb-13Apr-1310710510310199979593918942.7m/14.0mCons. Upside (%) - 4.1Upside (%) 5.952-wk Price low/high (MYR) 6.30 - 7.05Free float (%) 22Shareholders (%)Maxis Communications 65.0Employees Provident Fund 6.7Permodalan Nasional Berhad 6.5Shariah compliantLim Tee Yang CFA +603 9280 2172lim.tee.yang@rhb.com.myThe media reported a speculation that <strong>Ananda</strong> <strong>Krishnan</strong> may sell his29% effective stake in Maxis for MYR35bn or MYR16/share, more thandouble its current market value. We are neutral to the speculation asthis involves the holding company, MCB instead of Maxis. Note thatMCB also has mobile operations in India and Indonesia, which partlyexplains the high valuations. Maintain NEUTRAL on Maxis.♦ <strong>Ananda</strong> exiting Maxis? The media reported over the weekend that thereis speculation, although not for the first time, that T <strong>Ananda</strong> <strong>Krishnan</strong> maysell his controlling stake in Maxis. These rumours were fueled by the“house-cleaning” exercise in Maxis involving the departure of several topmanagement staff and that <strong>Ananda</strong>’s 29% effective stake in Maxis couldfetch MYR35bn or MYR16/share (market value is MYR14.8bn).<strong>Ananda</strong> owns 45% (via Usaha Tegas Sdn Bhd) in the holding company,Maxis Communications Bhd (MCB), which in turn owns 65% in Maxis.The other shareholders of MCB are Saudi Telecom (25%) and certainbumputra shareholders (30%).♦ Impact to share price. We are neutral to the speculation as this involvesthe holding company, MCB instead of Maxis. We found it difficult to seeany party who has the financial capability to acquire <strong>Ananda</strong>’s stake orthe willingness to pay more than double what Maxis is currently tradingat. Note that MCB also has mobile operations in India and Indonesia,which partly explains the high valuations. Besides that, <strong>Ananda</strong> may notneed the cash given that he had sold Tanjong Energy Holdings to 1Malaysia Development Bhd (1MDB) for MYR8.5bn last year.♦ Changes to strategic plans? With no CEO and an internalreorganization at the top, we doubt there will be any changes to Maxis’strategic plans even if a new party acquires <strong>Ananda</strong>’s stake.♦ Investment case. We maintain NEUTRAL on Maxis with unchangedDCF-derived fair value of MYR7.15 (WACC=7.5%, TG=1.5%). We expectearnings growth to remain tepid as margins may still be at risk if devicesubsidies escalate or cost discipline is not maintained. But dividendyields of 5.9% look attractive based on FY13 DPS forecast of 40 sen.Forecasts and Valuations Dec-10 Dec-11 Dec-12 Dec-13F Dec-14FTotal turnover (MYRm) 8,869 8,800 8,967 9,279 9,470Reported net profit (MYRm) 2,295 2,527 1,856 2,090 2,107Recurring net profit (MYRm) 2,295 2,188 2,045 2,090 2,107Recurring net profit growth (%) 2.8 (4.7) (6.5) 2.2 0.8Core EPS (MYR) 0.31 0.29 0.27 0.28 0.28DPS (MYR) 0.40 0.40 0.40 0.40 0.40Dividend Yield (%) 5.9 5.9 5.9 5.9 5.9Core P/E (x) 22.1 23.1 24.8 24.2 24.0Return on average equity (%) 26.1 30.2 24.5 31.7 37.0P/B (x) 5.84 6.26 7.18 8.25 9.65P/CF (x) 13.2 14.8 16.2 14.2 14.0EV/EBITDA (x) 12.6 12.8 13.5 12.7 12.5Net debt to equity (%) 48.6 62.7 82.8 104.6 133.6Our vs consensus EPS (%) (3.2) (8.5)Source: Company data, RHB EstimatesPowered by Enhanced Datasystems’ EFA TM Platform

Maxis (MAXIS MK)10 June 2013Recommendation ChartPrice Close7.5Recommendations & Target Price7.0NR6.306.205.755.655.755.656.005.655.655.505.906.307.406.906.56.05.5Buy Neutral Sell TradingTake Profit5.0BuyNov-09 Oct-10 Sep-11 Aug-12Source: RHB Estimates, BloombergNot RatedDate Recommendation Target Price Price2013-06-07 Neutral 7.15 6.752013-05-13 Neutral 6.90 7.012013-03-12 Neutral 6.90 6.542013-03-07 Neutral 6.90 6.472013-02-27 Neutral 6.90 6.362012-11-29 Neutral 7.40 6.452012-10-12 Neutral 7.40 7.022012-09-11 Neutral 7.40 6.782012-09-03 Neutral 7.40 6.982012-07-09 Neutral 6.30 6.45Source : RHB Estimates, BloombergSee important disclosures at the end of this report 2

RHB Guide to Investment RatingsBuy: Share price may exceed 10% over the next 12 monthsTrading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertainNeutral: Share price may fall within the range of +/- 10% over the next 12 monthsTake Profit: Target price has been attained. Look to accumulate at lower levelsSell: Share price may fall by more than 10% over the next 12 monthsNot Rated: Stock is not within regular research coverageDisclosure & DisclaimerAll research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation orwarranty, express or implied, as to its accuracy, completeness or correctness. No part of this report is to be construed as an offer or solicitation of an offerto transact any securities or financial instruments whether referred to herein or otherwise. This report is general in nature and has been prepared forinformation purposes only. It is intended for circulation to the clients of RHB and its related companies. Any recommendation contained in this report doesnot have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This report is for theinformation of addressees only and is not to be taken in substitution for the exercise of judgment by addressees, who should obtain separate legal orfinancial advice to independently evaluate the particular investments and strategies.RHB, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions insecurities of the company(ies) covered in this research report or any securities related thereto, and may from time to time add to, or dispose off, or may bematerially interested in any such securities. Further, RHB, its affiliates and related companies do and seek to do business with the company(ies) coveredin this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies),may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant investment banking, advisory orunderwriting services for or relating to such company(ies), as well as solicit such investment, advisory or other services from any entity mentioned in thisresearch report.RHB and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arisefrom any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damagesare alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.The term “RHB” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned specifically herein belowand shall refer to RHB Research Institute Sdn Bhd, its holding company, affiliates, subsidiaries and related companies.All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for any purpose without priorconsent of RHB and RHB accepts no liability whatsoever for the actions of third parties in this respect.MalaysiaThis report is published and distributed in Malaysia by RHB Research Institute Sdn Bhd (233327-M), Level 11, Tower One, RHB Centre, Jalan Tun Razak,50400 Kuala Lumpur, a wholly-owned subsidiary of RHB Investment Bank Berhad (RHBIB), which in turn is a wholly-owned subsidiary of RHB CapitalBerhad.SingaporeThis report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned subsidiary of DMG &Partners Securities Pte Ltd, a joint venture between Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary of Deutsche Bank Group) and OSK InvestmentBank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity is referred to as “RHBIB”, which in turn is a whollyownedsubsidiary of RHB Capital Berhad). DMG & Partners Securities Pte Ltd is a Member of the Singapore Exchange Securities Trading Limited. DMG &Partners Securities Pte Ltd may have received compensation from the company covered in this report for its corporate finance or its dealing activities; thisreport is therefore classified as a non-independent report.As of 29 May 2013, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have proprietary positionsin the securities covered in this report, except for:a) -As of 29 May 2013, none of the analysts who covered the securities in this report has an interest in such securities, except for:a) -Special Distribution by RHBWhere the research report is produced by an RHB entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore, it is only distributedto "Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are notan "Institutional Investor", "Expert Investor" or "Accredited Investor", this research report is not intended for you and you should disregard this researchreport in its entirety. In respect of any matters arising from, or in connection with this research report, you are to contact our Singapore Office, DMG &Partners Securities Pte Ltd.Hong KongThis report is published and distributed in Hong Kong by RHB OSK Securities Hong Kong Limited (“RHBSHK”) (formerly known as OSK Securities HongKong Limited), a subsidiary of OSK Investment Bank Berhad, Malaysia which have since merged into RHB Investment Bank Berhad (the merged entity isreferred to as “RHBIB”), which in turn is a wholly-owned subsidiary of RHB Capital Berhad.RHBSHK, RHBIB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the subject company.RHBSHK, RHBIB and/or other affiliates may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtaincompensation for investment banking services from the subject company.3

Risk Disclosure StatementsThe prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely thatlosses will be incurred rather than profit made as a result of buying and selling securities. Past performance is not a guide to future performance. RHBSHKdoes not maintain a predetermined schedule for publication of research and will not necessarily update this reportIndonesiaThis report is published and distributed in Indonesia by PT RHB OSK Securities Indonesia (formerly known as PT OSK Nusadana Securities Indonesia), asubsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-ownedsubsidiary of RHB Capital Berhad.ThailandThis report is published and distributed in Thailand by RHB OSK Securities (Thailand) PCL (formerly known as OSK Securities (Thailand) PCL), asubsidiary of OSK Investment Bank Berhad, Malaysia, which have since merged into RHB Investment Bank Berhad, which in turn is a wholly-ownedsubsidiary of RHB Capital Berhad.Other JurisdictionsIn any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance with the law andregulations of the jurisdictions.Kuala Lumpur Hong Kong SingaporeMalaysia Research OfficeRHB Research Institute Sdn BhdLevel 11, Tower One, RHB CentreJalan Tun RazakKuala LumpurMalaysiaTel : +(60) 3 9280 2185Fax : +(60) 3 9284 8693RHB OSK Securities Hong Kong Ltd.(formerly known as OSK SecuritiesHong Kong Ltd.)12th FloorWorld-Wide House19 Des Voeux RoadCentral, Hong KongTel : +(852) 2525 1118Fax : +(852) 2810 0908DMG & PartnersSecurities Pte. Ltd.10 Collyer Quay#09-08 Ocean Financial CentreSingapore 049315Tel : +(65) 6533 1818Fax : +(65) 6532 6211Jakarta Shanghai Phnom PenhPT RHB OSK Securities Indonesia(formerly known as PT OSK Nusadana SecuritiesIndonesia)Plaza CIMB Niaga14th FloorJl. Jend. Sudirman Kav.25Jakarta Selatan 12920, IndonesiaTel : +(6221) 2598 6888Fax : +(6221) 2598 6777RHB OSK (China) Investment Advisory Co. Ltd.(formerly known as OSK (China) InvestmentAdvisory Co. Ltd.)Suite 4005, CITIC SquareSuite 4005, CITIC Square1168 Nanjing West RoadShanghai 20041ChinaTel : +(8621) 6288 9611Fax : +(8621) 6288 9633BangkokRHB OSK Indochina Securities Limited(formerly known as OSK Indochina Securities Limited)No. 1-3, Street 271Sangkat Toeuk Thla, Khan Sen SokPhnom PenhCambodiaTel: +(855) 23 969 161Fax: +(855) 23 969 171RHB OSK Securities (Thailand) PCL(formerly known as OSK Securities (Thailand) PCL)10th Floor, Sathorn Square Office Tower98, North Sathorn Road,SilomBangrak, Bangkok 10500ThailandTel: +(66) 862 9999Fax : +(66) 108 09994