tiaa-cref self-directed brokerage account customer account agreement

tiaa-cref self-directed brokerage account customer account agreement

tiaa-cref self-directed brokerage account customer account agreement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TIAA-CREF SELF-DIRECTED BROKERAGE ACCOUNTCUSTOMER ACCOUNT AGREEMENTFor Use Within an Employer-Sponsored Retirement PlanJUNE 2011This Self-Directed Brokerage Account Customer Agreement (“Agreement”) contains the important terms and conditionsgoverning your Self-Directed TIAA-CREF Brokerage Account, which is carried by Pershing LLC, a wholly owned subsidiaryof The Bank of New York. Please read this Agreement carefully and retain for future reference.BROKERAGE ACCOUNTS ARE PROVIDED BY TIAA-CREFINDIVIDUAL & INSTITUTIONAL SERVICES, LLC, MEMBERFINRA, SIPC. BROKERAGE ACCOUNTS ARE CARRIED BYPERSHING, LLC, A SUBSIDIARY OF THE BANK OF NEWYORK COMPANY, INC., MEMBER FINRA, NYSE, SIPC.I. GENERAL TERMS AND CONDITIONS1. “I”, “me”, and “my” refer to the individual signingthe <strong>customer</strong> <strong>account</strong> application. “TIAA-CREF”refers to TIAA-CREF Brokerage Services, adivision of TIAA-CREF Individual & InstitutionalServices, LLC and/or Pershing LLC, the entityTIAA-CREF has designated as its clearing firm.2. I understand that I have been authorized by myemployer (the “Plan Sponsor”), or other planfiduciary, to establish a <strong>self</strong>-<strong>directed</strong> <strong>brokerage</strong><strong>account</strong> (“Account”) as an investment optionunder my employer-sponsored retirement planor 403(b) plan or arrangement (“Plan”). I agreenot to take any action that exceeds the authoritygranted to me under the Plan. By opening anAccount, I understand that I am establishing a<strong>self</strong>-<strong>directed</strong> <strong>brokerage</strong> <strong>account</strong> with TIAA-CREFthrough the Plan. The Account will be establishedin the name of the Trustee and/or Custodianof the Plan for my benefit, and I shall directall investments in my Account. I shall be fullyresponsible for all investment decisions relatingto my Account. I understand and accept the risksof investing through an individual <strong>brokerage</strong><strong>account</strong> and accept responsibility for any lossesI may incur as a result of such investments. Iunderstand that it is my responsibility to followall requirements for trading with TIAA-CREFand that if I refuse to comply, TIAA-CREF may,at its option, refuse to execute transactionsfor my Account or terminate the Account. Iunderstand that before placing any order, I amresponsible for ensuring that the transaction willbe in compliance with all TIAA-CREF policies,my Plan’s policies and any regulatory requirements.TIAA-CREF has no obligation to ensurecompliance prior to accepting an order.3. I represent that the information I have providedon my <strong>account</strong> application is accurate. I will notifyTIAA-CREF of any change to the informationprovided on my <strong>account</strong> application withinthirty (30) days of such change. I will promptlynotify TIAA-CREF if I become a director, 10percent beneficial shareholder, or an affiliateof a publicly traded company. I will promptlynotify TIAA-CREF if I become an employee ofany securities exchange, a member firm of anysecurities exchange or the FINRA.4. I acknowledge that as a <strong>self</strong>-<strong>directed</strong> investor,I am responsible for deciding whether my<strong>brokerage</strong> transactions are suitable investmentsin light of my particular circumstances, andthat neither the Plan Sponsor, TIAA-CREF, theCustodian nor the Trustee, as the case may be, isresponsible for advising or determining whethermy transactions are suitable. I acknowledge andagree that I may not use this <strong>account</strong> to invest inmunicipal securities, option contracts, purchaseon margin and/or to engage in any investmentin which the risk of loss may exceed the value1

of my Account. If the Plan is subject to InternalRevenue Code Section 403(b), I understand andagree that I may only invest in shares of mutualfunds. TIAA-CREF may provide me with marketdata or research relating to securities and securitiesmarkets, but does not guarantee the accuracy,completeness, or timeliness of such information.Such market data or research is not personalizedor in any way tailored to my personal financialcircumstances or investment objectives. Neitherthe Plan Sponsor, TIAA-CREF, the Trustee northe Custodian, as the case may be, provides legalor tax advice with respect to the Account.5. I acknowledge that I will be charged a commissionon all transactions and other <strong>account</strong>-related feesin accordance with the standard TIAA-CREFfee schedule as in effect from time to time. Iacknowledge that TIAA-CREF reserves the rightto require me to maintain a minimum <strong>account</strong>balance, in addition to minimum requirementsfor initial and subsequent purchases. I acknowledgethat TIAA-CREF will participate in certainrevenue-sharing arrangements in connectionwith certain mutual funds available through theFund Central No Transaction Fee Program andthe money market sweep vehicle.6. I acknowledge that any amounts I transfer tomy Account from the Plan will be automaticallytransferred to a money market fund (“Fund”)selected by the Plan Sponsor or other namedfiduciary of the Plan. I may subsequently reinvestthose amounts in my Account as I choose. Iacknowledge TIAA-CREF will purchase Fundshares with any cash balances remaining in myAccount at the conclusion of each business day.This activity will be reflected on my quarterly<strong>account</strong> statement in lieu of a daily confirmation.I have received and read a copy of the Fund prospectus,which contains a complete description,and details of its fees and operation.7. I acknowledge that I must instruct TIAA-CREFby telephone or online means to liquidateinvestments in my Plan <strong>account</strong> and transferthe resulting funds to my Account. I acknowledgethat any such liquidation and transfer maytake several days to complete. I acknowledgethat TIAA-CREF may transfer funds from myPlan <strong>account</strong>, without notice, to my Account ifnecessary to cover outstanding debit balances inmy Account, or that TIAA-CREF may liquidatemy most recent purchase in my Account in orderto cover any outstanding debit balances. In connectionwith the establishment of my Account,TIAA-CREF may accept from the Plan Sponsoron my behalf any instructions or authorizationsnecessary to facilitate the transfer of amountsand/or securities under the Plan from <strong>account</strong>(s)held with custodian(s) other than TIAA-CREF tomy Account.8. I acknowledge TIAA-CREF may reject, cancelor modify any securities transactions that I haveentered at any time, for any reason and withoutprior notice to me. TIAA-CREF may suspend orterminate my Account at any time for any reasonand without prior notice to me. I shall have 30days from receiving notice of termination of myAccount to transfer all holdings from withinmy Account to my Plan <strong>account</strong>. Should I fail tocomplete this transfer within 30 days, I directTIAA-CREF to liquidate the Account holdingsand make the transfer on my behalf. In the eventmy Account is liquidated, I agree to be liablefor any resulting losses and costs incurred byTIAA-CREF. I may close my Account at any timeby giving TIAA-CREF signed written notice. Iacknowledge that my Plan may require that anyamount transferred from my Account back to myPlan <strong>account</strong> be first transferred into the CREFMoney Market Fund, and that I am free thereafterto reallocate this amount within my Plan as Ichoose and as allowed by the Plan.9. I authorize TIAA-CREF to accept my oralinstructions for the purchase and sale of securities.I acknowledge TIAA-CREF will not accept securitiesorders sent via electronic or regular mail.I acknowledge TIAA-CREF may record telephoneconversations to verify information concerningthe handling of my Account. I acknowledge whenI change any instruction on a limit order, I amresponsible for canceling my original order. If Ifail to do so, I understand that I will be responsiblefor any loss, including applicable commissioncharges. I am responsible for knowing the statusof my pending orders and any duplication by meof a pending order will be considered authorizedby me.2

10. I acknowledge that TIAA-CREF will send all communicationsto me at the mailing address I provideon my <strong>account</strong> application, or at such other addressas I may subsequently provide to TIAA-CREF inwriting, and that all communications so sent shallbe deemed delivered, whether actually receivedor not. I acknowledge that I have a duty to timelyreview any confirmations or <strong>account</strong> statementsfor accuracy. Information provided on confirmationsor statements shall be deemed conclusive andaccepted by me unless I object in writing within ten(10) days of receipt.11. I acknowledge that federal law requires thatTIAA-CREF verify my identity by obtaining myname, date of birth, address, and governmentissuedidentification number before opening myAccount. This information is necessary to helpthe government fight the funding of terrorismand money laundering activities. TIAA-CREFmay gather and verify this information withrespect to any other person authorized to effecttransactions in my Account. TIAA-CREF mayrestrict and/or close my Account if TIAA-CREFcannot verify this information. TIAA-CREF willnot be responsible for any loss resulting from myfailure to provide this information, or from anyrelated restriction or closing of my Account.12. I acknowledge that I will pay in full for securities Ipurchase by the settlement date. For transactionsnot paid for by settlement date, TIAA-CREFshall have the right, without notice to me, to sellsecurities purchased.13. TIAA-CREF shall have a lien against my assetsheld at Pershing for any outstanding balanceowed by me and has the right to sell any securityin my <strong>account</strong> to satisfy any debt, except whereprohibited by law. TIAA-CREF may also transfersecurities or other property from any of my<strong>account</strong>s, whether individual or joint, to any ofmy other <strong>account</strong>s in order to satisfy deficienciesin any of my <strong>account</strong>s, except where prohibitedby law. I grant TIAA-CREF the right of set-offin satisfaction of any debt in my <strong>account</strong>, exceptwhere prohibited by law. I agree to pay any costsor expenses incurred by TIAA-CREF, includingreasonable attorney’s fees, that result from myfailure to properly settle any securities transactionsor pay any debt.14. Should my Plan allow for the purchase of individualequities, I understand that “penny stocks”(generally defined as any equity security pricedbelow $5 a share) are generally consideredhigh-risk investments and should be purchasedpurely for speculation. I represent that any orderI place for penny stocks was not solicited byTIAA-CREF and was solely my decision.15. Should my Plan allow for the purchase ofindividual equities, I acknowledge that variousfederal and state laws or regulations maybe applicable to transactions in my Accountregarding restricted securities, as defined byapplicable securities law and regulation. It ismy responsibility to notify you if my Accountcontains restricted securities and to ensurethat any transaction I effect will conform to allapplicable laws and regulations. I understandthat transactions in restricted securities maytake longer to process than transactions involvingunrestricted securities.16. This Agreement contains a pre-disputearbitration clause. By signing an arbitration<strong>agreement</strong>, the parties agree as follows:• All parties to this Agreement are givingup the right to sue each other in court,including the right to a trial by jury, exceptas provided by the rules of the arbitrationforum in which a claim is filed.• Arbitration awards are generally final andbinding; a party’s ability to have a courtreverse or modify an arbitration awardis very limited.• The ability of the parties to obtaindocuments, witness statements and otherdiscovery is generally more limited inarbitration than in court proceedings.• The arbitrators do not have to explainthe reason(s) for their award unless inan eligible case, a joint request for anexplained decision has been submittedby all parties to the panel at least 20 daysprior to the first scheduled hearing date.• The panel of arbitrators will typicallyinclude a minority of arbitrators who wereor are affiliated with the securities industry.• The rules of some arbitration forums mayimpose time limits for bringing a claim inarbitration. In some cases, a claim that isineligible for arbitration may be broughtin court.• The rules of the arbitration forumin which the claim is filed, andany amendments thereto, shall beincorporated into this <strong>agreement</strong>.3

IT IS AGREED THAT ANY CONTROVERSYTHAT SHALL ARISE BETWEEN THEACCOUNT HOLDER AND TIAA-CREF ORPERSHING (INCLUDING BUT NOT LIMITEDTO CONTROVERSIES CONCERNINGTHIS OR ANY OTHER ACCOUNT HELDWITH TIAA-CREF OR PERSHING) SHALLBE SUBMITTED TO ARBITRATIONBEFORE THE NEW YORK STOCKEXCHANGE, INC. OR THE FINANCIALINDUSTRY REGULATORY AUTHORITY,IN ACCORDANCE WITH THE RULESOF THE SELECTED ORGANIZATION.ARBITRATION MUST BE COMMENCEDBY SERVICE UPON THE OTHER PARTY OFA WRITTEN DEMAND FOR ARBITRATIONOR A WRITTEN NOTICE OF INTENTIONTO ARBITRATE, THEREIN ELECTING THEARBITRATION TRIBUNAL. THE ACCOUNTHOLDER MAY ELECT IN THE FIRSTINSTANCE WHETHER ARBITRATIONSHALL BE CONDUCTED BEFORE THENYSE OR FINRA, BUT IN THE EVENTTHE ACCOUNT HOLDER DOES NOT MAKESUCH ELECTION WITHIN FIVE (5) DAYSOF SUCH DEMAND OR NOTICE, THENTHE ACCOUNT HOLDER AUTHORIZESTIAA-CREF OR PERSHING TO MAKE SUCHELECTION ON BEHALF OF THE ACCOUNTHOLDER. NO PERSON SHALL BRINGPUTATIVE OR CERTIFIED CLASS ACTIONTO ARBITRATION, NOR SEEK TO ENFORCEANY PRE-DISPUTE ARBITRATIONAGREEMENT AGAINST ANY PERSON WHOHAS INITIATED IN COURT A PUTATIVECLASS ACTION; OR WHO IS A MEMBEROF A PUTATIVE CLASS AND WHO HASNOT OPTED OUT THE CLASS WITHRESPECT TO ANY CLAIMS ENCOMPASSEDBY THE PUTATIVE CLASS ACTIONUNTIL: (i) THE CLASS CERTIFICATION ISDENIED; (ii) THE CLASS IS DECERTIFIED;OR (iii) THE CUSTOMER IS EXCLUDEDFROM THE CLASS BY THE COURT.SUCH FORBEARANCE TO ENFORCE ANAGREEMENT TO ARBITRATE SHALL NOTCONSTITUTE A WAIVER OF ANY RIGHTSUNDER THIS AGREEMENT EXCEPT TOTHE EXTENT STATED HEREIN.17. I acknowledge that TIAA-CREF will not be liablefor loss caused directly or indirectly by war,terrorism, civil unrest, natural disaster, governmentrestrictions, interruptions of communications,exchanges or market rulings, orother conditions beyond TIAA-CREF’s control.TIAA-CREF shall not be liable for any direct,indirect, incidental, special or consequentialdamages that may arise from its provisionof services to me. Neither the Plan Sponsor,TIAA-CREF, the Custodian nor the Trustee,as the case may be, shall be liable for anylosses incurred with respect to my investmentselection and performance of the assets in myAccount. TIAA-CREF shall have no responsibilityfor questioning my investment decisions.My Plan Sponsor may restrict certain securitiesfrom being available for investment in myAccount. I alone am responsible for knowingand complying with these restrictions. Neitherthe Plan Sponsor, TIAA-CREF, the Trustee northe Custodian, as the case may be, will monitorwhether my trading activity is permissibleunder the Plan documents or consistent withthe Employee Retirement Income Security Actof 1974, as amended, the Internal Revenue Codeof 1986 or state law.18. Should my Plan allow for the purchase of individualequities, I acknowledge TIAA-CREF isobligated by federal securities laws to providemy name, address and holdings information toissuers of those securities upon request, unlessI instruct TIAA-CREF in writing not to do so.19. I acknowledge that to deter frequent tradingwithin mutual funds, TCBS’s clearing firm,Pershing, may assess a short-term redemptionfee of $50 against any transaction that resultsin mutual fund shares being held for less thansix months. This fee is in addition to any shorttermredemption fee or restriction the underlyingmutual fund family may independently assessagainst the same transaction. Both TCBS andPershing reserve the right to restrict accessto the purchase of mutual fund shares withinany <strong>account</strong> deemed at their sole discretionto engage in excessive or abusive short-termtrading patterns.4

20. If any provision of this Agreement is held invalidor unenforceable for any reason, such provisionshall be fully severable, and this Agreement shallbe enforced and construed as if such provisionhad never comprised a part of this Agreement.21. I acknowledge that this Agreement cannot bemodified by conduct and no failure on the part ofTIAA-CREF or Pershing at any time to enforce itsrights hereunder to the greatest extent permittedshall in any way be deemed to waive, modify, orrelax all of the rights granted TIAA-CREF andPershing herein.22. I acknowledge my responsibility to review my<strong>brokerage</strong> <strong>account</strong> statements for accuracy andnotify TIAA-CREF within 30 days of receiptof any error. If I fail to notify TIAA-CREF ofany error within this time frame, the <strong>brokerage</strong><strong>account</strong> statement shall be presumed accurate.23. I acknowledge that this Agreement constitutesthe full and entire understanding between theparties with respect to the provisions herein,and that there are no oral or other <strong>agreement</strong>sin conflict herewith. I acknowledge TIAA-CREFreserves the right to modify this Agreementat any time by posting the revised terms andconditions on the TIAA-CREF BrokerageServices website at http://www.<strong>tiaa</strong>-<strong>cref</strong>.org/<strong>brokerage</strong>/pdf/pensionsdacaa.pdf or upon writtennotice to me. I acknowledge that I am responsiblefor regularly checking for updates. My continuedmaintenance of my <strong>account</strong> subsequent to anyposted modification or written notice constitutesmy acceptance of the revised Agreement.24. I acknowledge that use of the telephone,Internet, or any other electronic system, andsoftware provided for use in accessing myAccount information is used at my sole risk. Ifurther acknowledge that neither TIAA-CREF,its vendors providing data, information, orother services, including but not limited to anyexchange (collectively, “service providers”),warrant that the service will be uninterruptedor error free and that TIAA-CREF does notmake any warranty as to the results that maybe obtained from any of these systems. I furtheracknowledge that the telephone, Internet, andother electronic systems are provided on an as-isand as-available basis, without warranties ofany kind, either expressed or implied, including,without limitation those of merchant ability andfitness for a particular purpose, other than thosewarranties which are implied by and incapable ofexclusion, restriction or modification under thelaws applicable to this Agreement.No service provider will be liable in any way tome or any other person for inaccuracy, error,or delay in, or omission of any data, informationor message or the transmission or delivery ofany data, information or message, or any lossor damages arising from or occasioned by:any inaccuracy, error, delay or omission, nonperformance,interruption in data due to neglector omission by any service provider, any “forcemajeure” (e.g., flood, extraordinary weathercondition, earthquake, or other act of God, fire,war, insurrection, riot, labor dispute, accident,action of government, communications, powerfailure, or equipment or software malfunction),or any other cause beyond the reasonable controlof any service provider.25. I acknowledge receipt of the TIAA-CREFprivacy policy.26. I acknowledge that complaints regarding myAccount are to be mailed to: TIAA-CREF, P.O.Box 1280, Charlotte, North Carolina 28201 or Imay call 800 927-3059.II. ROLE OF PERSHINGTIAA-CREF retained Pershing to act as a clearingbroker for TIAA-CREF and provide certain recordkeepingand operational services, which may includeexecution and settlement of securities transactions,and custody of securities and cash balances. Theseservices are provided under a written ClearingAgreement between Pershing and TIAA-CREF.The respective roles of Pershing and TIAA-CREF,as defined within the Clearing Agreement, areoutlined below.1. In general, Pershing is only responsible forthose services provided at the request ordirection of TIAA-CREF as contemplatedby the Clearing Agreement.2. Pershing will create computer-based <strong>account</strong>records on the <strong>account</strong> holder’s behalf insuch name(s) and with such address(es) asTIAA-CREF directs.5

3. Pershing will process orders for the purchase,sale, or transfer of securities for the <strong>account</strong> asTIAA-CREF directs. Pershing is not obligated toaccept orders for securities transactions directlyfrom the <strong>account</strong> holder and will do so only inexceptional circumstances.4. Pershing will receive and deliver cash and securitiesfor the <strong>account</strong> and will record such receiptsand deliveries according to information providedeither by TIAA-CREF or directly, in writing, bythe <strong>account</strong> holder.5. Pershing will hold in custody securities and cashreceived for the <strong>account</strong>, and will collect anddisburse dividends and interest and processreorganization and voting instructions withrespect to securities held in custody. Pershingis responsible for the custody of cash andsecurities only after it comes into Pershing’sphysical possession or control.6. Pershing will prepare and transmit to the <strong>account</strong>holder or provide facilities to TIAA-CREF for thepreparation and transmission of confirmationsof trades. Pershing will prepare and transmit tothe <strong>account</strong> holder periodic <strong>account</strong> statementssummarizing the transaction history.7. In connection with all of the functions thatPershing performs, Pershing maintains the booksand records required by law and by businesspractice. Pershing will provide TIAA-CREF withwritten reports of all transactions processed forthe <strong>account</strong> to enable it to carry out its responsibilitiesunder the Clearing Agreement. Pershingwill assist the <strong>account</strong> holder and TIAA-CREFwith any discrepancies or errors that may occurin the processing of transactions for the <strong>account</strong>.8. PERSHING DOES NOT CONTROL,AUDIT, OR OTHERWISE SUPERVISETHE ACTIVITIES OF TIAA-CREF OR ITSEMPLOYEES. PERSHING DOES NOT VERIFYINFORMATION PROVIDED BY TIAA-CREFREGARDING THE ACCOUNT OR TRANSAC-TIONS PROCESSED FOR THE ACCOUNTNOR UNDERTAKE RESPONSIBILITY FORREVIEWING THE APPROPRIATENESS OFTRANSACTIONS ENTERED BY TIAA-CREFON THE ACCOUNT HOLDER’S BEHALF.9. The Clearing Agreement does not encompasstransactions in commodities futures contractsor investments other than marketable securities,which Pershing normally processes on recognizedexchanges and over-the-counter markets.10. In furnishing its services under the ClearingAgreement, Pershing may use and rely uponthe services of clearing agencies, automatic dataprocessing vendors, proxy processing, transferagents, securities pricing services, and othersimilar organizations.11. This statement addresses the basic allocationof functions regarding the handling of theAccount. It is not meant as a definitiveenumeration of every possible circumstance, butonly as a general disclosure.6

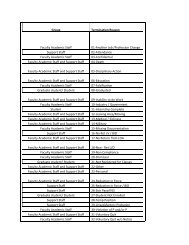

COMMISSION AND FEE SCHEDULENot all fees will apply or are pertinent to all employer-sponsored plans. See individual plan for investment option details.EQUITIESEquity NotesOnlinewww.<strong>tiaa</strong>-<strong>cref</strong>.org/<strong>brokerage</strong>Equity Trades – $19.95Clients with TIAA-CREF<strong>brokerage</strong> assets over$500,000 1 – $15.95Automated Telephone System(ATS) 800 842-2252$35 $55Client Service Assistance800 927-3059Fees shown reflect stock prices greater than $1 per share. Orders to buy shares pricedunder $1 will not be accepted.BONDS & CDsU.S. Treasury SecuritiesNew issues (at auction)Existing issuesMunicipal bonds, governmentagency bonds, unlisted (over-thecounter,or OTC) corporate bonds,and mortgage-backed securitiesBonds and CDs are available via Client Service Assistance . Please call 800 927-3059for more information.$50 per transaction$1 per $1,000 face amount, $50 minimum$50 + $2 per bondCertificates of DepositNew issuesSale before MaturityNo commission. Purchase minimums of $5,000 (interest rate reflects issuing bank’s fee).$35 per transaction (actual value may be less than par due to early redemption)MUTUAL FUNDSNo-transaction-fee (NTF) funds• Minimum initial investment $500; some funds may have higher initial investment minimums.Minimum additional investment $500.• Short-term redemptions fee: $50 minimum for shares held less than six months (waived forshares transferred from another <strong>brokerage</strong> firm or financial institution).Transaction-fee (TF) funds• Dollar cost averaging transactions, no fee; minimum transaction $100.• Transaction fee $35 per trade regardless of order size.• Minimum initial and additional investments typically based on amount listed in thefund’s prospectus.• Dollar cost averaging transactions, no fee; minimum transaction $100.• Exchanges: $8 per trade regardless of order size.ACCOUNT MAINTENANCE FEESAnnual <strong>account</strong> maintenance fee $401 Household assets held in Brokerage Services. Contact your Brokerage Consultant to determine householding eligibility.TIAA-CREF Brokerage Services, a division of TIAA-CREF Individual & Institutional Services, LLC, reserves the right to change thisfee and commission schedule at its discretion, subject to notification in accordance with applicable laws and regulations.7

This page is intentionally Blank.8A12134 BRKSDACAA (06/11)