Expanding the value proposition of Mobile Money

Expanding the value proposition of Mobile Money

Expanding the value proposition of Mobile Money

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

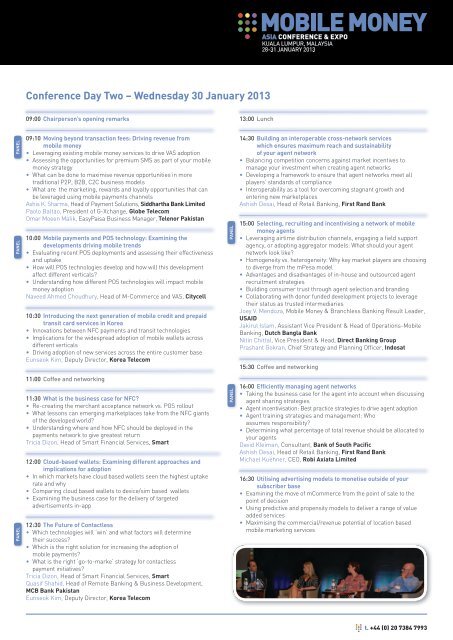

Conference Day Two – Wednesday 30 January 201309:00 Chairperson’s opening remarks13:00 LunchPANELPANEL09:10 Moving beyond transaction fees: Driving revenue frommobile money• Leveraging existing mobile money services to drive VAS adoption• Assessing <strong>the</strong> opportunities for premium SMS as part <strong>of</strong> your mobilemoney strategy• What can be done to maximise revenue opportunities in moretraditional P2P, B2B, C2C business models• What are <strong>the</strong> marketing, rewards and loyalty opportunities that canbe leveraged using mobile payments channelsAshis K. Sharma, Head <strong>of</strong> Payment Solutions, Siddhartha Bank LimitedPaolo Baltao, President <strong>of</strong> G-Xchange, Globe TelecomOmar Moeen Malik, EasyPaisa Business Manager, Telenor Pakistan10:00 <strong>Mobile</strong> payments and POS technology: Examining <strong>the</strong>developments driving mobile trends• Evaluating recent POS deployments and assessing <strong>the</strong>ir effectivenessand uptake• How will POS technologies develop and how will this developmentaffect different verticals?• Understanding how different POS technologies will impact mobilemoney adoptionNaveed Ahmed Choudhury, Head <strong>of</strong> M-Commerce and VAS, Citycell10:30 Introducing <strong>the</strong> next generation <strong>of</strong> mobile credit and prepaidtransit card services in Korea• Innovations between NFC payments and transit technologies• Implications for <strong>the</strong> widespread adoption <strong>of</strong> mobile wallets acrossdifferent verticals• Driving adoption <strong>of</strong> new services across <strong>the</strong> entire customer baseEunseok Kim, Deputy Director, Korea TelecomPANEL14:30 Building an interoperable cross-network serviceswhich ensures maximum reach and sustainability<strong>of</strong> your agent network• Balancing competition concerns against market incentives tomanage your investment when creating agent networks• Developing a framework to ensure that agent networks meet allplayers’ standards <strong>of</strong> compliance• Interoperability as a tool for overcoming stagnant growth andentering new marketplacesAshish Desai, Head <strong>of</strong> Retail Banking, First Rand Bank15:00 Selecting, recruiting and incentivising a network <strong>of</strong> mobilemoney agents• Leveraging airtime distribution channels, engaging a field supportagency, or adopting aggregator models: What should your agentnetwork look like?• Homogeneity vs. heterogeneity: Why key market players are choosingto diverge from <strong>the</strong> mPesa model• Advantages and disadvantages <strong>of</strong> in-house and outsourced agentrecruitment strategies• Building consumer trust through agent selection and branding• Collaborating with donor funded development projects to leverage<strong>the</strong>ir status as trusted intermediariesJoey V. Mendoza, <strong>Mobile</strong> <strong>Money</strong> & Branchless Banking Result Leader,USAIDJakirul Islam, Assistant Vice President & Head <strong>of</strong> Operations-<strong>Mobile</strong>Banking, Dutch Bangla BankNitin Chittal, Vice President & Head, Direct Banking GroupPrashant Gokran, Chief Strategy and Planning Officer, Indosat15:30 C<strong>of</strong>fee and networkingPANEL11:00 C<strong>of</strong>fee and networking11:30 What is <strong>the</strong> business case for NFC?• Re-creating <strong>the</strong> merchant acceptance network vs. POS rollout• What lessons can emerging marketplaces take from <strong>the</strong> NFC giants<strong>of</strong> <strong>the</strong> developed world?• Understanding where and how NFC should be deployed in <strong>the</strong>payments network to give greatest returnTricia Dizon, Head <strong>of</strong> Smart Financial Services, Smart12:00 Cloud-based wallets: Examining different approaches andimplications for adoption• In which markets have cloud based wallets seen <strong>the</strong> highest uptakerate and why• Comparing cloud based wallets to device/sim based wallets• Examining <strong>the</strong> business case for <strong>the</strong> delivery <strong>of</strong> targetedadvertisements in-app12:30 The Future <strong>of</strong> Contactless• Which technologies will ‘win’ and what factors will determine<strong>the</strong>ir success?• Which is <strong>the</strong> right solution for increasing <strong>the</strong> adoption <strong>of</strong>mobile payments?• What is <strong>the</strong> right ‘go-to-marke’ strategy for contactlesspayment initiatives?Tricia Dizon, Head <strong>of</strong> Smart Financial Services, SmartQuasif Shahid, Head <strong>of</strong> Remote Banking & Business Development,MCB Bank PakistanEunseok Kim, Deputy Director, Korea TelecomPANEL16:00 Efficiently managing agent networks• Taking <strong>the</strong> business case for <strong>the</strong> agent into account when discussingagent sharing strategies• Agent incentivisation: Best practice strategies to drive agent adoption• Agent training strategies and management: Whoassumes responsibility?• Determining what percentage <strong>of</strong> total revenue should be allocated toyour agentsDavid Kleiman, Consultant, Bank <strong>of</strong> South PacificAshish Desai, Head <strong>of</strong> Retail Banking, First Rand BankMichael Kuehner, CEO, Robi Axiata Limited16:30 Utilising advertising models to monetise outside <strong>of</strong> yoursubscriber base• Examining <strong>the</strong> move <strong>of</strong> mCommerce from <strong>the</strong> point <strong>of</strong> sale to <strong>the</strong>point <strong>of</strong> decision• Using predictive and propensity models to deliver a range <strong>of</strong> <strong>value</strong>added services• Maximising <strong>the</strong> commercial/revenue potential <strong>of</strong> location basedmobile marketing servicest. +44 (0) 20 7384 7993