Form 706Estate & Generation-Skipping Transfer Tax ReturnsQuick <strong>Fact</strong>s· Supports all 21 schedules· Performs comprehensive calculations for charitabledeductions, marital deductions, taxable giftreconciliation, and Section 6166 deferred payments· Option to have entries on Estate Property screen flow to Schedule MForms and Schedules706-A Additional Estate Tax Return706 Estate and Generation-Skipping Transfer Tax Return706-CECertificate of Payment of Foreign Death Tax706-QDT Estate Tax Return for Qualified Domestic Trusts712 Life Insurance Statement4768 Application for Extension to Pay Estate Taxes8822 Change of AddressCONTContinuation ScheduleSCH ASchedule A, Real EstateSCH A-1Schedule A-1, Section 2032A ValuationSCH BSCH CSCH DSCH ESCH FSCH GSCH HSCH ISCH JSCH KSCH LSCH MSCH OSCH PSCH QSCH RSCH R-1SCH USchedule B, Stocks and BondsSchedule C, Mortgages, Notes, and CashSchedule D, Insurance on the Decedent’s LifeSchedule E, Jointly Owned PropertySchedule F, Miscellaneous PropertySchedule G, Transfers During Decedent’s LifeSchedule H, Powers of AppointmentSchedule I, AnnuitiesSchedule J, Funeral ExpensesSchedule K, DebtsSchedule L, Net Losses during AdministrationSchedule M, Bequests to Surviving SpouseSchedule O, Charitable GiftsSchedule P, Credit for Foreign Death TaxesSchedule Q, Credit for Tax on Prior TransfersSchedule R, Generation-Skipping Transfer TaxGeneration-Skipping Transfer Tax Payment VoucherSchedule U, Qualified Conservation Easement ExclusionForm 709Gift Tax ReturnsQuick <strong>Fact</strong>s> Taxpayer name and address information transfers from the 1040 to the 709> Will flow automatically to the tax forms> Automatically generates returns for a husband and wife> Fast entry of recurring gifts during the yearForm 990Exempt Organization Tax ReturnsComprehensive Calculations> Split gifts> Tracks the use of the unified credit> Each donee’s annual exclusion> Charitable deduction> Gifts to a qualified state tuition programQuick <strong>Fact</strong>s> Includes Forms 990-EZ, 990-N, 990-PF, 990-T, and 990-W> Supports required schedules, worksheets, and statements forForms 990, 990-EZ, 990-PF, and 990-T> Same Officer and Independent Contractor screens used forForm 990, 990-EZ, and 990-PF> Imports trial balance information from QuickBooks ®> Hyperlinks from screen to screen for data entry> Override and adjustment mapping resource in FAQ> Foreign address input, printing, and e-file> Pre-defined IRC elections> <strong>Drake</strong> custom trial balance import modelComprehensive Calculations> Auto-balance of retained earnings or fund balances> 990-T corporation and trust tax calculations> Schedule A - 2% excess contribution calculatione-File Features> e-File available at no additional cost> e-File PDF attachments> Numerous reports on e-filed returns available> Form 990-T and related credits are not e-fileable> Extensions for all Form 990 types> Additional three-month extensionForms and Schedules990 Organization Exempt from Income Tax990-EZOrganization Exempt from Income Tax - Short Form990-N e-Postcard for Small Exempt Organizations990-PFOrganization Exempt from Income Tax - Private Foundation990-T Exempt Organization Business Income Tax Return1118 Foreign Tax Credit - Corporations (and related schedules)2848 Power of Attorney3115 Application for Change in Accounting Method3800 General Business Credit4136 Credit for <strong>Federal</strong> Tax Paid on Fuels4562 Depreciation and Amortization4720 Return of Certain Excise Taxed Under IRC 41 & 425471 Information Return for a Foreign Corporation (and related schedules)5884 Work Opportunity Credit6478 Alcohol Used as Fuel Credit8027 Employer’s annual Information Return of Tip Income & Allocated Tips8586 Low-Income Housing Credit8609 Low-Income Housing Credit Allocation and Certification8609AAnnual Statement for Low-Income Housing Credit8697 Interest Computation Under the Look-Back Method8821 Tax Information Authorization8822BChange of Address Form – Business8826 Disabled Access Credit8845 Indian Employment Credit800.890.9500 | <strong>Drake</strong><strong>Software</strong>.com

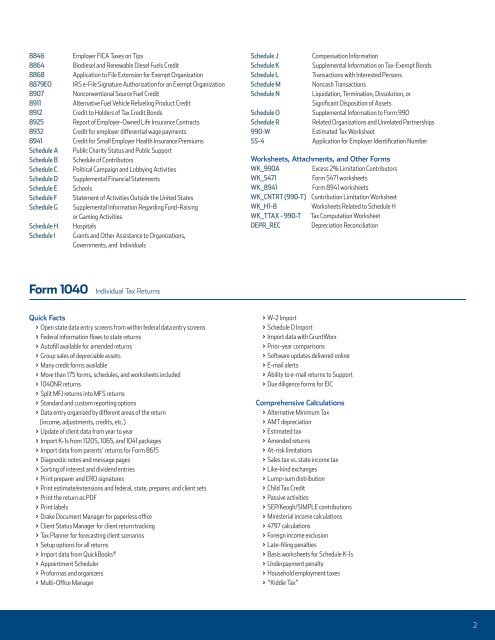

8846 Employer FICA Taxes on Tips8864 Biodiesel and Renewable Diesel Fuels Credit8868 Application to File Extension for Exempt Organization8879EO IRS e-File Signature Authorization for an Exempt Organization8907 Nonconventional Source Fuel Credit8911 Alternative Fuel Vehicle Refueling Product Credit8912 Credit to Holders of Tax Credit Bonds8925 Report of Employer-Owned Life Insurance Contracts8932 Credit for employer differential wage payments8941 Credit for Small Employer Health Insurance PremiumsSchedule A Public Charity Status and Public SupportSchedule B Schedule of ContributorsSchedule C Political Campaign and Lobbying ActivitiesSchedule D Supplemental Financial StatementsSchedule E SchoolsSchedule F Statement of Activities Outside the United StatesSchedule G Supplemental Information Regarding Fund-Raisingor Gaming ActivitiesSchedule H HospitalsSchedule I Grants and Other Assistance to Organizations,Governments, and IndividualsSchedule JCompensation InformationSchedule KSupplemental Information on Tax-Exempt BondsSchedule LTransactions with Interested PersonsSchedule MNoncash TransactionsSchedule NLiquidation, Termination, Dissolution, orSignificant Disposition of AssetsSchedule O Supplemental Information to Form 990Schedule RRelated Organizations and Unrelated Partnerships990-W Estimated Tax WorksheetSS-4Application for Employer Identification NumberWorksheets, Attachments, and Other FormsWK_990AExcess 2% Limitation ContributorsWK_5471Form 5471 worksheetsWK_8941Form 8941 worksheetsWK_CNTRT (990-T) Contribution Limitation WorksheetWK_H1-8Worksheets Related to Schedule HWK_TTAX - 990-T Tax Computation WorksheetDEPR_RECDepreciation ReconciliationForm 1040Individual Tax ReturnsQuick <strong>Fact</strong>s> Open state data entry screens from within federal data entry screens> <strong>Federal</strong> information flows to state returns> Autofill available for amended returns> Group sales of depreciable assets> Many credit forms available> More than 175 forms, schedules, and worksheets included> 1040NR returns> Split MFJ returns into MFS returns> Standard and custom reporting options> Data entry organized by different areas of the return(income, adjustments, credits, etc.)> Update of client data from year to year> Import K-1s from 1120S, 1065, and 1041 packages> Import data from parents’ returns for Form 8615> Diagnostic notes and message pages> Sorting of interest and dividend entries> Print preparer and ERO signatures> Print estimate/extensions and federal, state, preparer, and client sets> Print the return as PDF> Print labels> <strong>Drake</strong> Document Manager for paperless office> Client Status Manager for client return tracking> Tax Planner for forecasting client scenarios> Setup options for all returns> Import data from QuickBooks ®> Appointment Scheduler> Proformas and organizers> Multi-Office Manager> W-2 Import> Schedule D Import> Import data with GruntWorx> Prior-year comparisons> <strong>Software</strong> updates delivered online> E-mail alerts> Ability to e-mail returns to Support> Due diligence forms for EICComprehensive Calculations> Alternative Minimum Tax> AMT depreciation> Estimated tax> Amended returns> At-risk limitations> Sales tax vs. state income tax> Like-kind exchanges> Lump-sum distribution> Child Tax Credit> Passive activities> SEP/Keogh/SIMPLE contributions> Ministerial income calculations> 4797 calculations> Foreign income exclusion> Late-filing penalties> Basis worksheets for Schedule K-1s> Underpayment penalty> Household employment taxes> “Kiddie Tax”2