Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

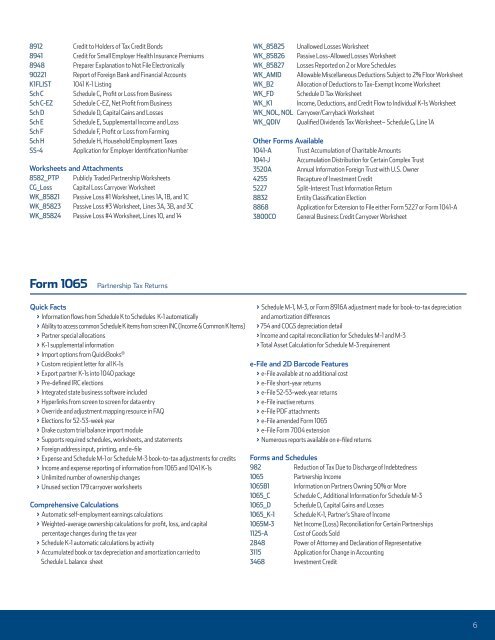

8912 Credit to Holders of Tax Credit Bonds8941 Credit for Small Employer Health Insurance Premiums8948 Preparer Explanation to Not File Electronically90221 Report of Foreign Bank and Financial AccountsK1FLIST1041 K-1 ListingSch CSchedule C, Profit or Loss from BusinessSch C-EZ Schedule C-EZ, Net Profit from BusinessSch DSchedule D, Capital Gains and LossesSch ESchedule E, Supplemental Income and LossSch FSchedule F, Profit or Loss from FarmingSch HSchedule H, Household Employment TaxesSS-4Application for Employer Identification NumberWorksheets and Attachments8582_PTP Publicly Traded Partnership WorksheetsCG_Loss Capital Loss Carryover WorksheetWK_85821 Passive Loss #1 Worksheet, Lines 1A, 1B, and 1CWK_85823 Passive Loss #3 Worksheet, Lines 3A, 3B, and 3CWK_85824 Passive Loss #4 Worksheet, Lines 10, and 14WK_85825 Unallowed Losses WorksheetWK_85826 Passive Loss-Allowed Losses WorksheetWK_85827 Losses Reported on 2 or More SchedulesWK_AMID Allowable Miscellaneous Deductions Subject to 2% Floor WorksheetWK_B2Allocation of Deductions to Tax-Exempt Income WorksheetWK_FDSchedule D Tax WorksheetWK_K1Income, Deductions, and Credit Flow to Individual K-1s WorksheetWK_NOL, NOL Carryover/Carryback WorksheetWK_QDIV Qualified Dividends Tax Worksheet– Schedule G, Line 1AOther Forms Available1041-A Trust Accumulation of Charitable Amounts1041-J Accumulation Distribution for Certain Complex Trust3520AAnnual Information Foreign Trust with U.S. Owner4255 Recapture of Investment Credit5227 Split-Interest Trust Information Return8832 Entity Classification Election8868 Application for Extension to File either Form 5227 or Form 1041-A3800CO General Business Credit Carryover WorksheetForm 1065Partnership Tax ReturnsQuick <strong>Fact</strong>s> Information flows from Schedule K to Schedules K-1 automatically> Ability to access common Schedule K items from screen INC (Income & Common K Items)> Partner special allocations> K-1 supplemental information> Import options from QuickBooks ®> Custom recipient letter for all K-1s> Export partner K-1s into 1040 package> Pre-defined IRC elections> Integrated state business software included> Hyperlinks from screen to screen for data entry> Override and adjustment mapping resource in FAQ> Elections for 52-53-week year> <strong>Drake</strong> custom trial balance import module> Supports required schedules, worksheets, and statements> Foreign address input, printing, and e-file> Expense and Schedule M-1 or Schedule M-3 book-to-tax adjustments for credits> Income and expense reporting of information from 1065 and 1041 K-1s> Unlimited number of ownership changes> Unused section 179 carryover worksheetsComprehensive Calculations> Automatic self-employment earnings calculations> Weighted-average ownership calculations for profit, loss, and capitalpercentage changes during the tax year> Schedule K-1 automatic calculations by activity> Accumulated book or tax depreciation and amortization carried toSchedule L balance sheet> Schedule M-1, M-3, or Form 8916A adjustment made for book-to-tax depreciationand amortization differences> 754 and COGS depreciation detail> Income and capital reconciliation for Schedules M-1 and M-3> Total Asset Calculation for Schedule M-3 requiremente-File and 2D Barcode Features> e-File available at no additional cost> e-File short-year returns> e-File 52-53-week year returns> e-File inactive returns> e-File PDF attachments> e-File amended Form 1065> e-File Form 7004 extension> Numerous reports available on e-filed returnsForms and Schedules982 Reduction of Tax Due to Discharge of Indebtedness1065 Partnership Income1065B1Information on Partners Owning 50% or More1065_C Schedule C, Additional Information for Schedule M-31065_DSchedule D, Capital Gains and Losses1065_K-1 Schedule K-1, Partner’s Share of Income1065M-3 Net Income (Loss) Reconciliation for Certain Partnerships1125-A Cost of Goods Sold2848 Power of Attorney and Declaration of Representative3115 Application for Change in Accounting3468 Investment Credit6