Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

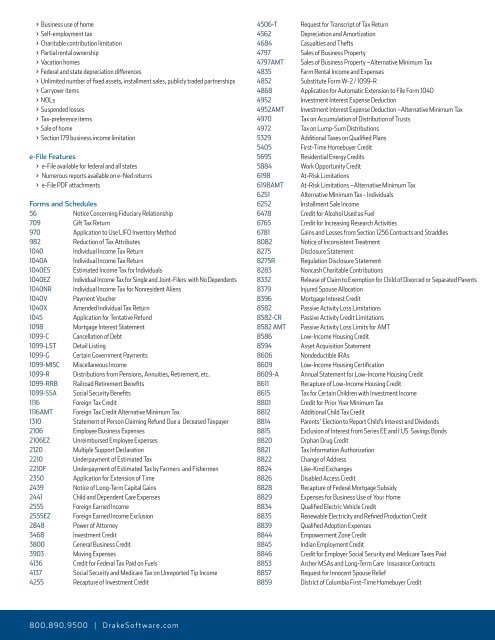

Business use of home> Self-employment tax> Charitable contribution limitation> Partial rental ownership> Vacation homes> <strong>Federal</strong> and state depreciation differences> Unlimited number of fixed assets, installment sales, publicly traded partnerships> Carryover items> NOLs> Suspended losses> Tax-preference items> Sale of home> Section 179 business income limitatione-File Features> e-File available for federal and all states> Numerous reports available on e-filed returns> e-File PDF attachmentsForms and Schedules56 Notice Concerning Fiduciary Relationship709 Gift Tax Return970 Application to Use LIFO Inventory Method982 Reduction of Tax Attributes1040 Individual Income Tax Return1040AIndividual Income Tax Return1040ESEstimated Income Tax for Individuals1040EZIndividual Income Tax for Single and Joint-Filers with No Dependents1040NRIndividual Income Tax for Nonresident Aliens1040VPayment Voucher1040XAmended Individual Tax Return1045 Application for Tentative Refund1098 Mortgage Interest Statement1099-C Cancellation of Debt1099-LST Detail Listing1099-G Certain Government Payments1099-MISC Miscellaneous Income1099-R Distributions from Pensions, Annuities, Retirement, etc.1099-RRB Railroad Retirement Benefits1099-SSA Social Security Benefits1116 Foreign Tax Credit1116AMT Foreign Tax Credit Alternative Minimum Tax1310 Statement of Person Claiming Refund Due a Deceased Taxpayer2106 Employee Business Expenses2106EZUnreimbursed Employee Expenses2120 Multiple Support Declaration2210 Underpayment of Estimated Tax2210FUnderpayment of Estimated Tax by Farmers and Fishermen2350 Application for Extension of Time2439 Notice of Long-Term Capital Gains2441 Child and Dependent Care Expenses2555 Foreign Earned Income2555EZForeign Earned Income Exclusion2848 Power of Attorney3468 Investment Credit3800 General Business Credit3903 Moving Expenses4136 Credit for <strong>Federal</strong> Tax Paid on Fuels4137 Social Security and Medicare Tax on Unreported Tip Income4255 Recapture of Investment Credit4506-T Request for Transcript of Tax Return4562 Depreciation and Amortization4684 Casualties and Thefts4797 Sales of Business Property4797AMT Sales of Business Property –Alternative Minimum Tax4835 Farm Rental Income and Expenses4852 Substitute Form W-2 / 1099-R4868 Application for Automatic Extension to File Form 10404952 Investment Interest Expense Deduction4952AMT Investment Interest Expense Deduction –Alternative Minimum Tax4970 Tax on Accumulation of Distribution of Trusts4972 Tax on Lump-Sum Distributions5329 Additional Taxes on Qualified Plans5405 First-Time Homebuyer Credit5695 Residential Energy Credits5884 Work Opportunity Credit6198 At-Risk Limitations6198AMT At-Risk Limitations –Alternative Minimum Tax6251 Alternative Minimum Tax - Individuals6252 Installment Sale Income6478 Credit for Alcohol Used as Fuel6765 Credit for Increasing Research Activities6781 Gains and Losses from Section 1256 Contracts and Straddles8082 Notice of Inconsistent Treatment8275 Disclosure Statement8275RRegulation Disclosure Statement8283 Noncash Charitable Contributions8332 Release of Claim to Exemption for Child of Divorced or Separated Parents8379 Injured Spouse Allocation8396 Mortgage Interest Credit8582 Passive Activity Loss Limitations8582-CR Passive Activity Credit Limitations8582 AMT Passive Activity Loss Limits for AMT8586 Low-Income Housing Credit8594 Asset Acquisition Statement8606 Nondeductible IRAs8609 Low-Income Housing Certification8609-A Annual Statement for Low-Income Housing Credit8611 Recapture of Low-Income Housing Credit8615 Tax for Certain Children with Investment Income8801 Credit for Prior Year Minimum Tax8812 Additional Child Tax Credit8814 Parents’ Election to Report Child’s Interest and Dividends8815 Exclusion of Interest from Series EE and I US Savings Bonds8820 Orphan Drug Credit8821 Tax Information Authorization8822 Change of Address8824 Like-Kind Exchanges8826 Disabled Access Credit8828 Recapture of <strong>Federal</strong> Mortgage Subsidy8829 Expenses for Business Use of Your Home8834 Qualified Electric Vehicle Credit8835 Renewable Electricity and Refined Production Credit8839 Qualified Adoption Expenses8844 Empowerment Zone Credit8845 Indian Employment Credit8846 Credit for Employer Social Security and Medicare Taxes Paid8853 Archer MSAs and Long-Term Care Insurance Contracts8857 Request for Innocent Spouse Relief8859 District of Columbia First-Time Homebuyer Credit800.890.9500 | <strong>Drake</strong><strong>Software</strong>.com