Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

Federal Fact Sheets - Drake Software

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

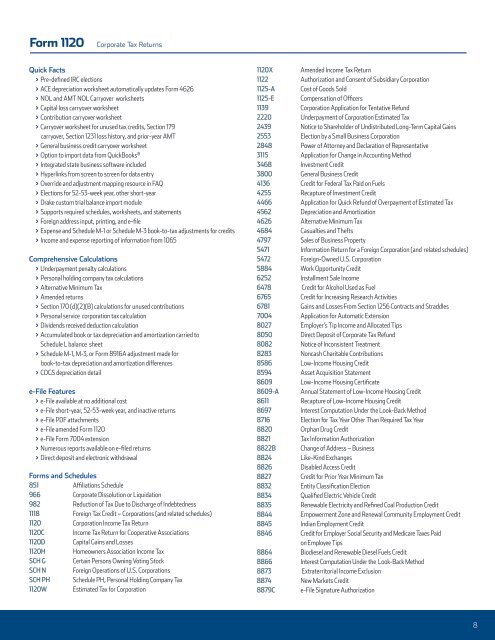

Form 1120Corporate Tax ReturnsQuick <strong>Fact</strong>s> Pre-defined IRC elections> ACE depreciation worksheet automatically updates Form 4626> NOL and AMT NOL Carryover worksheets> Capital loss carryover worksheet> Contribution carryover worksheet> Carryover worksheet for unused tax credits, Section 179carryover, Section 1231 loss history, and prior-year AMT> General business credit carryover worksheet> Option to import data from QuickBooks ®> Integrated state business software included> Hyperlinks from screen to screen for data entry> Override and adjustment mapping resource in FAQ> Elections for 52-53-week year, other short-year> <strong>Drake</strong> custom trial balance import module> Supports required schedules, worksheets, and statements> Foreign address input, printing, and e-file> Expense and Schedule M-1 or Schedule M-3 book-to-tax adjustments for credits> Income and expense reporting of information from 1065Comprehensive Calculations> Underpayment penalty calculations> Personal holding company tax calculations> Alternative Minimum Tax> Amended returns> Section 170 (d)(2)(B) calculations for unused contributions> Personal service corporation tax calculation> Dividends received deduction calculation> Accumulated book or tax depreciation and amortization carried toSchedule L balance sheet> Schedule M-1, M-3, or Form 8916A adjustment made forbook-to-tax depreciation and amortization differences> COGS depreciation detaile-File Features> e-File available at no additional cost> e-File short-year, 52-53-week year, and inactive returns> e-File PDF attachments> e-File amended Form 1120> e-File Form 7004 extension> Numerous reports available on e-filed returns> Direct deposit and electronic withdrawalForms and Schedules851 Affiliations Schedule966 Corporate Dissolution or Liquidation982 Reduction of Tax Due to Discharge of Indebtedness1118 Foreign Tax Credit – Corporations (and related schedules)1120 Corporation Income Tax Return1120CIncome Tax Return for Cooperative Associations1120DCapital Gains and Losses1120HHomeowners Association Income TaxSCH GCertain Persons Owning Voting StockSCH NForeign Operations of U.S. CorporationsSCH PHSchedule PH, Personal Holding Company Tax1120WEstimated Tax for Corporation1120XAmended Income Tax Return1122 Authorization and Consent of Subsidiary Corporation1125-A Cost of Goods Sold1125-E Compensation of Officers1139 Corporation Application for Tentative Refund2220 Underpayment of Corporation Estimated Tax2439 Notice to Shareholder of Undistributed Long-Term Capital Gains2553 Election by a Small Business Corporation2848 Power of Attorney and Declaration of Representative3115 Application for Change in Accounting Method3468 Investment Credit3800 General Business Credit4136 Credit for <strong>Federal</strong> Tax Paid on Fuels4255 Recapture of Investment Credit4466 Application for Quick Refund of Overpayment of Estimated Tax4562 Depreciation and Amortization4626 Alternative Minimum Tax4684 Casualties and Thefts4797 Sales of Business Property5471 Information Return for a Foreign Corporation (and related schedules)5472 Foreign-Owned U.S. Corporation5884 Work Opportunity Credit6252 Installment Sale Income6478 Credit for Alcohol Used as Fuel6765 Credit for Increasing Research Activities6781 Gains and Losses From Section 1256 Contracts and Straddles7004 Application for Automatic Extension8027 Employer’s Tip Income and Allocated Tips8050 Direct Deposit of Corporate Tax Refund8082 Notice of Inconsistent Treatment8283 Noncash Charitable Contributions8586 Low-Income Housing Credit8594 Asset Acquisition Statement8609 Low-Income Housing Certificate8609-A Annual Statement of Low-Income Housing Credit8611 Recapture of Low-Income Housing Credit8697 Interest Computation Under the Look-Back Method8716 Election for Tax Year Other Than Required Tax Year8820 Orphan Drug Credit8821 Tax Information Authorization8822BChange of Address – Business8824 Like-Kind Exchanges8826 Disabled Access Credit8827 Credit for Prior Year Minimum Tax8832 Entity Classification Election8834 Qualified Electric Vehicle Credit8835 Renewable Electricity and Refined Coal Production Credit8844 Empowerment Zone and Renewal Community Employment Credit8845 Indian Employment Credit8846 Credit for Employer Social Security and Medicare Taxes Paidon Employee Tips8864 Biodiesel and Renewable Diesel Fuels Credit8866 Interest Computation Under the Look-Back Method8873 Extraterritorial Income Exclusion8874 New Markets Credit8879Ce-File Signature Authorization8