RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

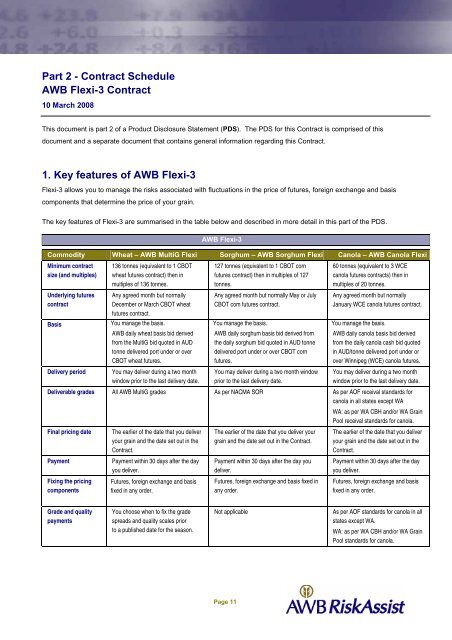

Part 2 - Contract Schedule<strong>AWB</strong> Flexi-3 Contract10 March 2008This document is part 2 of a <strong>Product</strong> <strong>Disclosure</strong> <strong>Statement</strong> (PDS). The PDS for this Contract is comprised of thisdocument and a separate document that contains general information regarding this Contract.1. Key features of <strong>AWB</strong> Flexi-3Flexi-3 allows you to manage the risks associated with fluctuations in the price of futures, foreign exchange and basiscomponents that determine the price of your grain.The key features of Flexi-3 are summarised in the table below and described in more detail in this part of the PDS.<strong>AWB</strong> Flexi-3Commodity Wheat – <strong>AWB</strong> MultiG Flexi Sorghum – <strong>AWB</strong> Sorghum Flexi Canola – <strong>AWB</strong> Canola FlexiMinimum contractsize (and multiples)Underlying futurescontractBasisDelivery period136 tonnes (equivalent to 1 CBOTwheat futures contract) then inmultiples of 136 tonnes.Any agreed month but normallyDecember or March CBOT wheatfutures contract.You manage the basis.<strong>AWB</strong> daily wheat basis bid derivedfrom the MultiG bid quoted in AUDtonne delivered port under or overCBOT wheat futures.You may deliver during a two monthwindow prior to the last delivery date.127 tonnes (equivalent to 1 CBOT cornfutures contract) then in multiples of 127tonnes.Any agreed month but normally May or JulyCBOT com futures contract.You manage the basis.<strong>AWB</strong> daily sorghum basis bid derived fromthe daily sorghum bid quoted in AUD tonnedelivered port under or over CBOT cornfutures.You may deliver during a two month windowprior to the last delivery date.60 tonnes (equivalent to 3 WCEcanola futures contracts) then inmultiples of 20 tonnes.Any agreed month but normallyJanuary WCE canola futures contract.You manage the basis.<strong>AWB</strong> daily canola basis bid derivedfrom the daily canola cash bid quotedin AUD/tonne delivered port under orover Winnipeg (WCE) canola futures.You may deliver during a two monthwindow prior to the last delivery date.Deliverable grades All <strong>AWB</strong> MultiG grades As per NACMA SOR As per AOF receival standards forcanola in all states except WAFinal pricing datePaymentFixing the pricingcomponentsThe earlier of the date that you deliveryour grain and the date set out in theContract.Payment within 30 days after the dayyou deliver.Futures, foreign exchange and basisfixed in any order.The earlier of the date that you deliver yourgrain and the date set out in the Contract.Payment within 30 days after the day youdeliver.Futures, foreign exchange and basis fixed inany order.WA: as per WA CBH and/or WA GrainPool receival standards for canola.The earlier of the date that you deliveryour grain and the date set out in theContract.Payment within 30 days after the dayyou deliver.Futures, foreign exchange and basisfixed in any order.Grade and qualitypaymentsYou choose when to fix the gradespreads and quality scales priorto a published date for the season.Not applicableAs per AOF standards for canola in allstates except WA.WA: as per WA CBH and/or WA GrainPool standards for canola.Page 11