RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

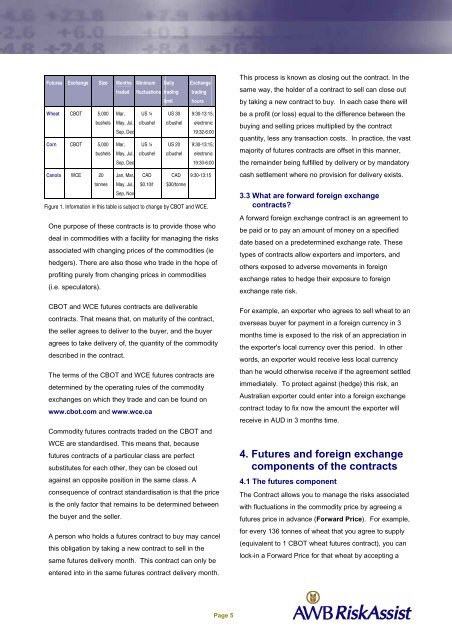

Futures Exchange Size Months Minimum Daily Exchangetraded fluctuations tradinglimittradinghoursWheat CBOT 5,000bushelsMar,May, Jul,Sep, DecCorn CBOT 5,000 Mar,bushels May, Jul,Sep, DecCanola WCE 20 Jan, Mar,tonnes May, Jul,US ¼c/bushelUS ¼c/bushelCAD$0.10/tUS 30c/bushelUS 20c/bushelCAD$30/tonne9:30-13:15;electronic19:32-6:009:30-13:15;electronic19:30-6:009:30-13:15Sep, NovFigure 1. Information in this table is subject to change by CBOT and WCE.One purpose of these contracts is to provide those whodeal in commodities with a facility for managing the risksassociated with changing prices of the commodities (iehedgers). There are also those who trade in the hope ofprofiting purely from changing prices in commodities(i.e. speculators).CBOT and WCE futures contracts are deliverablecontracts. That means that, on maturity of the contract,the seller agrees to deliver to the buyer, and the buyeragrees to take delivery of, the quantity of the commoditydescribed in the contract.The terms of the CBOT and WCE futures contracts aredetermined by the operating rules of the commodityexchanges on which they trade and can be found onwww.cbot.com and www.wce.caCommodity futures contracts traded on the CBOT andWCE are standardised. This means that, becausefutures contracts of a particular class are perfectsubstitutes for each other, they can be closed outagainst an opposite position in the same class. Aconsequence of contract standardisation is that the priceis the only factor that remains to be determined betweenthe buyer and the seller.A person who holds a futures contract to buy may cancelthis obligation by taking a new contract to sell in thesame futures delivery month. This contract can only beentered into in the same futures contract delivery month.This process is known as closing out the contract. In thesame way, the holder of a contract to sell can close outby taking a new contract to buy. In each case there willbe a profit (or loss) equal to the difference between thebuying and selling prices multiplied by the contractquantity, less any transaction costs. In practice, the vastmajority of futures contracts are offset in this manner,the remainder being fulfilled by delivery or by mandatorycash settlement where no provision for delivery exists.3.3 What are forward foreign exchangecontracts?A forward foreign exchange contract is an agreement tobe paid or to pay an amount of money on a specifieddate based on a predetermined exchange rate. Thesetypes of contracts allow exporters and importers, andothers exposed to adverse movements in foreignexchange rates to hedge their exposure to foreignexchange rate risk.For example, an exporter who agrees to sell wheat to anoverseas buyer for payment in a foreign currency in 3months time is exposed to the risk of an appreciation inthe exporter's local currency over this period. In otherwords, an exporter would receive less local currencythan he would otherwise receive if the agreement settledimmediately. To protect against (hedge) this risk, anAustralian exporter could enter into a foreign exchangecontract today to fix now the amount the exporter willreceive in AUD in 3 months time.4. Futures and foreign exchangecomponents of the contracts4.1 The futures componentThe Contract allows you to manage the risks associatedwith fluctuations in the commodity price by agreeing afutures price in advance (Forward Price). For example,for every 136 tonnes of wheat that you agree to supply(equivalent to 1 CBOT wheat futures contract), you canlock-in a Forward Price for that wheat by accepting aPage 5