RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

RiskAssist Flexi3 Product Disclosure Statement - AWB Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

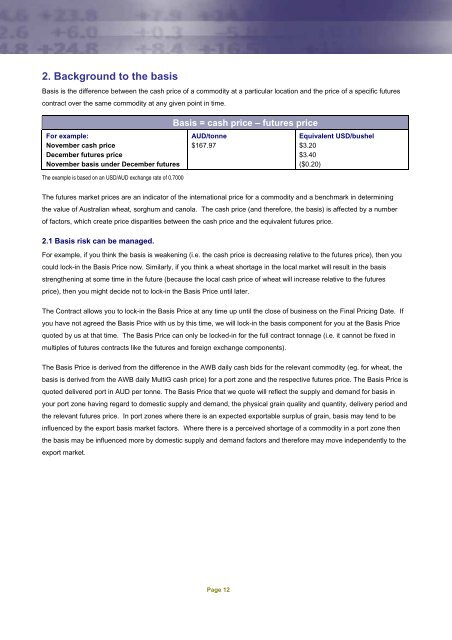

2. Background to the basisBasis is the difference between the cash price of a commodity at a particular location and the price of a specific futurescontract over the same commodity at any given point in time.For example:November cash priceDecember futures priceNovember basis under December futuresThe example is based on an USD/AUD exchange rate of 0.7000Basis = cash price – futures priceAUD/tonne$167.97Equivalent USD/bushel$3.20$3.40($0.20)The futures market prices are an indicator of the international price for a commodity and a benchmark in determiningthe value of Australian wheat, sorghum and canola. The cash price (and therefore, the basis) is affected by a numberof factors, which create price disparities between the cash price and the equivalent futures price.2.1 Basis risk can be managed.For example, if you think the basis is weakening (i.e. the cash price is decreasing relative to the futures price), then youcould lock-in the Basis Price now. Similarly, if you think a wheat shortage in the local market will result in the basisstrengthening at some time in the future (because the local cash price of wheat will increase relative to the futuresprice), then you might decide not to lock-in the Basis Price until later.The Contract allows you to lock-in the Basis Price at any time up until the close of business on the Final Pricing Date. Ifyou have not agreed the Basis Price with us by this time, we will lock-in the basis component for you at the Basis Pricequoted by us at that time. The Basis Price can only be locked-in for the full contract tonnage (i.e. it cannot be fixed inmultiples of futures contracts like the futures and foreign exchange components).The Basis Price is derived from the difference in the <strong>AWB</strong> daily cash bids for the relevant commodity (eg. for wheat, thebasis is derived from the <strong>AWB</strong> daily MultiG cash price) for a port zone and the respective futures price. The Basis Price isquoted delivered port in AUD per tonne. The Basis Price that we quote will reflect the supply and demand for basis inyour port zone having regard to domestic supply and demand, the physical grain quality and quantity, delivery period andthe relevant futures price. In port zones where there is an expected exportable surplus of grain, basis may tend to beinfluenced by the export basis market factors. Where there is a perceived shortage of a commodity in a port zone thenthe basis may be influenced more by domestic supply and demand factors and therefore may move independently to theexport market.Page 12