ifwla - Warehousing and Logistics International

ifwla - Warehousing and Logistics International

ifwla - Warehousing and Logistics International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 Conference ReportUntapping the supplychain potential ofSri LankaThe Chartered Institute of <strong>Logistics</strong> & Transport – Sri Lanka’s recent annual conference showcased thevalue of logistics <strong>and</strong> the untapped potential of logistics <strong>and</strong> supply chain in Sri Lanka. H Nilès PererareportsChartered Institute of <strong>Logistics</strong> & Transport– Sri Lanka (CILT-SL) hosted its annual<strong>International</strong> Conference in Colombo onthe 28th October 2011. Choosing “Success ofDelivery” as the theme for the day, the eventshowcased the value of logistics <strong>and</strong> theuntapped potential in logistics <strong>and</strong> supply chainin Sri Lanka.The <strong>International</strong> Conference unfolded in front of apacked house with the participation of distinguishedguests ranging from the President of Chartered Institute of<strong>Logistics</strong> & Transport <strong>International</strong>, Professor Alan WallerOBE to government ministers. Six presentations were madeduring the course of the day on how logistics has helpedthe growth of six different fields, namely retail chain, airline,garment manufacturing, Business Process Outsourcing(BPO), shipping <strong>and</strong> academic sectors.According to the Chief Guest, Dr. SarathAmunugama, Senior Minister in <strong>International</strong> MonetaryCo-operation, the government is committed to makingSri Lanka the “Miracle of Asia” by 2016 by making it aregional hub in five disciplines including maritime <strong>and</strong>air. The world’s busiest seaway falling a few nauticalmiles away from the Sri Lankan shore was cited as oneof the key ingredients in transforming Sri Lanka to thesaid hub status. Dr. Amunugama also praised theChinese Premier Wen Jiabao’s vision of making transport& logistics a driver of China’s growth, <strong>and</strong> elaboratedthat the Sri Lankan government plans to followthe example. He was very appreciative of CILT-SL <strong>and</strong>its commitment to taking logistics & supply chain in SriLanka to a higher level. He wanted the CILT-SL to be akey player in guiding <strong>and</strong> supporting the country inbecoming a logistics hub in the near future. The seniorminister went onto say “in this case, logistics <strong>and</strong> transportbecomes absolutely crucial – we need to reform<strong>and</strong> improve the transportation sector for our country<strong>and</strong> we look forward to even greater cooperation <strong>and</strong>achievement from CILT-SL in the future”.Professionalism in Supply ChainProfessor Alan Waller OBE, the President ofChartered Institute of <strong>Logistics</strong> & Transport<strong>International</strong> delivered the keynote address of the day.He highlighted the value of CILT Sri Lanka to CILT<strong>International</strong> <strong>and</strong> the importance of developing professionalismin this budding field. It was his opinion thatCILT has a major role to play in doing so <strong>and</strong>expressed great joy about the steps taken by CILT-SL inthis regard.Professor Waller discussed how globalisation <strong>and</strong> competitionhas influenced the boom of the Supply Chainindustry at large, which has become a game changer inthe modern world. This has created newer global marketswith added dem<strong>and</strong>s from the customers. He reiterated thefact that supply chain should be seen as a value addingfunction rather than a necessary evil which eats into anorganisation’s profit margins.He went on to say “the concept of the free movementof goods, people <strong>and</strong> money is a regional modelclearly replicated in other areas <strong>and</strong> Europe has certainlyled the world in developing a seamless logisticsIssue No. 3www.<strong>ifwla</strong>.com

Conference Report 9capability” citing that Sri Lankacan use the blueprints set byEurope in its quest to become alogistics hub. Professor Waller wasalso confident that the presentEurozone crisis was only a blip in theradar <strong>and</strong> will not affect the growth ofthe supply chains the world over.Sustainability of business was cited as a majorconcern with the recent green wave that has arisenin the world. But Professor Waller was clear that it doesnot mean “hugging trees”. He spoke about giving morepower to supply chain managers across organisationsto perform in their roles. He presented his findings onhow a supply chain expert with good communication<strong>and</strong> leadership skills can innovate while finding hithertounseen solutions to add value to the organisation.<strong>Logistics</strong> in Retailing: Key for SuccessNext up was Ranjit Page, Managing Director &Deputy Chairman of Cargills (Ceylon) PLC, ownerof Cargills Food City. In his presentation “‘<strong>Logistics</strong> inRetailing: Key for Success” he spoke about the criticalrole of logistics, not only in the success of the company,but also in empowering the farming communitiesacross the nation. Mr. Page elaborated on how heembarked on implementing logistics in 1999 to sustaina retail chain that was running with low returns despitethe opposition from within the organisation. He highlightedwastage of produce during transport as a blackhole that many organisations fail to see. It was thisunderst<strong>and</strong>ing that drove Page <strong>and</strong> Cargills to collectproduce straight from the farmers by establishing collectioncentres. Cargills did not stop there. They wenton to distribute plastic crates among the farming communitiesto reduce wastage during transportation to thecollection centres. Cargills had to facestiff opposition from the established cartels<strong>and</strong> middlemen in its journey to the top, includingthe bombing of one of its retail stores, but Page stoodtrue to cause as he felt “Cargills was notdepriving anybody”.Cargills has gone beyond being just aretailer to being a manufacturer. According to Page,“no retailer in the world today to my knowledge getsinvolved in manufacturing, but we have done it in SriLanka <strong>and</strong> through it we have been able to ensure thatthe wastage that happens along the supply chainbetween the farmer <strong>and</strong> the consumer is reduced. Wecreate processing value addition, the value we bring tothe farmers <strong>and</strong> to the consumers”. In addition to thisthe extensive research <strong>and</strong> development work <strong>and</strong> themodern information technology utilisation has madeCargills a major player in the Sri Lankan economy. Thiswas further emphasised when Page disclosed thatCargills amounts to 1.7% of the national agriculturalproduce which can be bought at a static price across171 stores located across the isl<strong>and</strong> republic.Page made it very clear that Cargills is not a charity,<strong>and</strong> are concerned about their bottom line. However,Cargills’ aim was to earn good profits while doing justiceto its suppliers as well as consumers by streamliningits supply chain. Page remarked that the purpose ofCargills is to “help Sri Lankans spend less on food” ashe closed his presentation emphasising that the futuresustenance of food lies with supply chain management<strong>and</strong> reduction of wastage.Success of Air Hub: Need for IntegrationG.T. Jayaseelan, Chief Marketing Officer of SriLankan Airlines delivered his thoughts on how tomake Sri Lanka a regional air hub. He highlighted thewww.<strong>ifwla</strong>.comIssue No.3

10 Conference Reportclose knit relationship between tourism <strong>and</strong> the growthof air traffic in Sri Lanka. The government plans toattract 2.5 million tourists by the year 2015 puts inplace many challenges to Sri Lankan Airlines, thenational carrier, which accounts for approximately halfthe passenger movement to <strong>and</strong> from Sri Lanka. Hewent on to share how Emirates had played a criticalrole in making Dubai the undisputed aviation hub ofthe Middle East since its inception in 1985 <strong>and</strong> showcasedthat Sri Lankan Airlines could be the catalyst thatmakes Sri Lanka the undisputed aviation hub in theIndian subcontinent.Mr. Jayaseelan also remarked that the rapid growthof the Indian <strong>and</strong> Chinese markets pose a great opportunityfor Sri Lanka to become an aviation hub by puttingthe required infrastructure in place.Three important ingredients indentified, to attain thehub status were - coordinated schedule, strategic location<strong>and</strong> good airport facilities. Unlike the success storiesin Frankfurt Am Main <strong>and</strong> London, Sri Lanka wishesto entwine tourism as a key player in becoming anair transport hub. The flight schedules of Sri LankanAirlines need to be revised so as to allow foreign transitpassengers to use Sri Lanka <strong>and</strong> Sri Lankan as theirpreferred transit airport <strong>and</strong> airline.ABOVE:In order to achieve that, Sri Lankan Professor Alanis also planning to work closely with Waller OBE, theMihin Lanka, the government owned President ofbudget carrier, to facilitate seamless Charteredtransfers. Sri Lankan has already set Institute ofinto motion an aircraft replacement <strong>Logistics</strong> &programme where they are procuringstate of the art Airbuses to <strong>International</strong>Transportincrease the frequency <strong>and</strong> destinationscovered by the national carrier. ered the(right) deliv-Jayaseelan stated that thekeynoteB<strong>and</strong>aranaike <strong>International</strong> Airportaddress of thein Colombo should take steps today.face the imminent capacity crunchbeyond 2011 while praising theconstruction of the isl<strong>and</strong>’s second international airportwhich is being built in the outskirts of Hambantota inthe deep south of the country.Jayaseelan conceded that Sri Lankan has failed tomake significant inroads in the recent increase of passengernumbers at the airport but reiterated that theywill try harder. Sri Lanka’s strategic location near India,China <strong>and</strong> Indonesia was cited as a big advantage notIssue No. 3www.<strong>ifwla</strong>.com

12 Conference Reportonly in becoming a transit point but also as a touristdestination. Sri Lankan is planning a major expansionin 2016 to target all these market segments.The Chief Marketing Officer also pointed out thateffective rail <strong>and</strong> road linkages are of great importanceto making the hub strategy a reality. However whenasked whether Sri Lankan would work in t<strong>and</strong>em withother institutions to make the rail <strong>and</strong> road links a realityhe reiterated that Sri Lankan had decided to stick toits core business for the time being <strong>and</strong> establish itselfas a preferred airline in the aviation industry.Speed to marketMahesh Amalean, Chairman of MAS Holdings, aChemical Engineer who turned the family knittingbusiness into a US$ 970 million revenue per annumentity was the next to preside the lectern. He started offby conceding that he had very little regard for logistics& supply chain <strong>and</strong> its importance to the business whenhe began a few decades ago. Amalean went on toshare how he stumbled across the fact that logisticscould be used for MAS’s advantage rather than consideringit a necessary evil. Presently MAS Holdings, whichis a key supplier of world renowned br<strong>and</strong>s such asVictoria’s Secret, Nike, Marks & Spencers <strong>and</strong> manyother iconic fashion br<strong>and</strong>s, considers logistics <strong>and</strong> supplychain as one of its core competences. The value oflogistics <strong>and</strong> supply chain is such that MAS has managedto stamp a regional & global presence in therecent years, especially by investing in plants in India,China & Bangladesh <strong>and</strong> offices in London, New York& Hong Kong.Amalean laid emphasis on the part supply chain &information technology has to play in the success of amodern day organisation <strong>and</strong> commended the roleplayed by CILT-SL in promoting these aspects amongthe industry. He elaborated on how MAS considersinnovation a key part of its success adding that investingin talent, training & development <strong>and</strong> R&D being ofgreat importance. That, along with its strong values,has made MAS one of the most sought after employersamong the youth of Sri Lanka.As part of the presentation, Amalean highlighted thecompany’s commitment towards the development of SriLanka. He was very proud to share that MAS was planningto launch two production plants in Kilinocchi, inthe Northern Province, thereby creating much neededemployment among the youth of the war ravishedregion as well as being a welcome addition to thecountry’s insurgent economy. Amalean also spokeabout how MAS stood with Sri Lanka in the darkesthours of the nation, such as the Asian Tsunami in 2004.None of this would have been possible if MAS chose tostick with manufacturing excellence instead of usingnew concepts such as supply chain to streamline operations<strong>and</strong> increase profitability.Amalean revealed how the introduction of MASOperating System, which was inspired by a visit toJapan to witness the streamlined operations at manufacturingplants, helped them to emerge from the globalfinancial crisis without any major setbacks.MAS changed its philosophy drastically <strong>and</strong> usedsupply chain as a vantage point to build relationships.Amalean remarked “We localised regions, changed oursuppliers <strong>and</strong> took control <strong>and</strong> managed our productright from the doorstep of our supplier. At the sametime we looked at how we can reduce the outwardbound speed at which we took our goods to our customers.The customers played a larger role as it wastheir need, but, we engaged with them to expedite theoutward bound service”. In addition, MAS introduced adem<strong>and</strong> pull strategy which further streamlined operations.These measures helped reduce the internalprocesses at MAS by reducing the average productiontime of over 50 days to somewhere between 14-18days. This was a major achievement for MAS as it wasa critical success against the Chinese manufacturerswho were threatening to eat into MAS’s business.In 2008 MAS had 44 customers, however today theyhave only 16 customers. By having a narrow market<strong>and</strong> penetrating deeper into it, MAS has strengthenedits ties to its customers <strong>and</strong> shared a larger percentageof its supplier needs. Amalean reiterated that to be thebest in class the organisation needs to constantly adaptto be aligned with the requirements of the customer.Amalean called for reforms in the Sri Lankan logisticssystem, including the formation of a new regulatorybody to oversee logistics. He observed that the CustomsOrdinance of the country needs to be revised to facilitateseamless goods movements. Another point thatreceived the scrutiny of Amalean was the lengthypaperwork required in Sri Lanka to clear or exportcargo. This was cited as a major step, if taken, to thebenefit of all stakeholders involved in the trade.Amalean elaborated on Sri Lanka’s “tremendousopportunity” to become a regional apparel centre <strong>and</strong>that MAS was willing to take the initiative given that thenecessary groundwork is available.What is Success?: <strong>Logistics</strong> in BPOsAfter a brief recess for lunch the <strong>International</strong>Conference recommenced with the presentation ofDr. Arul Sivagananathan, Managing Director of HayleysBusiness Solutions <strong>International</strong>.Sri Lanka was revealed as one of the growing BPOdestinations in the world, but Dr. Sivagananathan wasquick to add that Sri Lanka only had a 0.1% share ofthe global industry that was worth US$ 450 billion in2010. While Sri Lanka has lagged behind, countrieslike Philippines <strong>and</strong> Vietnam have made major stridesin increasing their BPO market share. Although Dr.Sivagananathan conceded that BPOs will not createIssue No. 3www.<strong>ifwla</strong>.com

Conference Report 13many millions of jobs, it was cited as an industry whichyields high revenues. He went on to remark that BPOsare an area which tends to grow in times of a recessionor economic crisis. Dr. Sivagananathan laid down thatSri Lanka will require increased infrastructure, governmentsupport <strong>and</strong> service maturity in order to establishitself as a serious BPO destination.He also quoted that the lack of the required skills,outside Colombo, was a cause for concern for theindustry despite the opportunities. Another key factorfor the growth of the industry is high quality IT infrastructurethat would facilitate the high speed turnaroundtime of the industry. The importance of a strongtransport infrastructure was also cited as a key requirementfor growth as a predominant share of the work iscarried out at night where over 50% of the employeesare females. Dr. Sivagananathan also pointed out thatin other countries BPOs are operated via the internetfrom the homes of the employees but Sri Lanka is yet toembrace this philosophy which will bring down embeddedcosts drastically. This st<strong>and</strong>s to give a cost advantageto the Sri Lankan BPO industry if implemented.Hayleys has recently set up its first BPO centre inJaffna, the capital of the once war torn NorthernProvince <strong>and</strong> urged the government to provide specialincentives to take BPOs to places outside of the commercialcapital Colombo.It was pointed out that parallels should be drawnfrom countries such as China <strong>and</strong> Philippines whereregulation <strong>and</strong> investment in the IT sector <strong>and</strong> establishmentof IT Parks laid foundation to success. This wassuggested as a necessary step to further consolidate thebearing of the local BPO market. Dr. Sivagananathanwas optimistic that by carrying out the suggestedchanges <strong>and</strong> with a labour law change to facilitatefewer holidays <strong>and</strong> giving females the freedom to workduring night shifts Sri Lanka can go a long way inbecoming a BPO hub in the years to come.Dr. Sivagananathan’s presentation opened eyesamong many who had not thought of BPOs as anindustry that relies heavily on logistics.What it takes to be the Number One?: The Past<strong>and</strong> the FuturePrithwijit Maitra, Senior General Manager of MaerskIndia Cluster Operations was the next on h<strong>and</strong> todisseminate his knowledge on the challenges in theshipping industry.www.<strong>ifwla</strong>.com Issue No. 3

Advertorial 15www.intlcargo.us<strong>International</strong> CargoJim Martin gives an insight into the companyINTERNATIONAL CARGO wasformed at the beginning of thenew Millennium by a team ofseasoned freight professionals who,between them, possess over 110years of combined experience in themulti-global freight industry. Allshare the same approach tobusiness ethics, the same positiveattitude towards developing <strong>and</strong>maintaining a range of servicesdesigned to ensure customersatisfaction.Through its U.S. based operation, <strong>and</strong>through an independent worldwide networkof agents <strong>and</strong> partners, INTERNATIONALCARGO offers a multitude of logisticssolutions.• Export• Import• Air• Ocean• Overl<strong>and</strong>• Customs Brokerage• <strong>Warehousing</strong>• Documentation• InsuranceThe options are many <strong>and</strong> varied.Questions asked by the Warehouse<strong>International</strong> editorial team:Tell us Jim what is your role in the company.PARTNER IN THE BUSINESS , SALES ANDMARKETING IS THE ROLEWhat specialist services do <strong>International</strong>Cargo offer its clients?DDU/PACKING/WAREHOUSE/ PROJECTWORK/WE THINK OUTSIDE THE BOX ALLTHE TIME, DOMESTIC TRUCKIN / GOVPROJECTS / SERVICE ALL THE US BASESEACH DAY/BIG INTO VEHICLES / TRUCKAND CARS .From your experience what should acustomer expect from its logistics/ freightsupplier?ONE PHONE CALL IT DOES IT ALL, DONTHAVE TO WORRY , WE WILL TAKE CAREOF EVERTHING: ‘’ YOU DO WHAT YOUDO AND WE DO WHAT WE DO’’How long how has <strong>International</strong> Cargo’ssister company, Fast Track <strong>Logistics</strong>, beenoperating <strong>and</strong> what are its specialist areas?8 YEARS SPECIALSIE IN FTL/GOVAUTIONS/ PACKING AND SHIPPINGWhat future challenges can you see for thesector <strong>and</strong> how are <strong>International</strong> Cargopreparing for these?WE ARE SMALL AND FLEXIBLE ENOUGHTO BE ABLE TO MOVE WITH THE TIMES,WE WILL DO ANYTHING TO GET OURCUSTOMERS TRUSTINTERNATIONAL CARGO can also offer,through its sister company, Fast Track<strong>Logistics</strong>, domestic US transportationservices, go to www.fasttracklogistics.netAnd your background in the freight sector?28 YEARS IN THE GAME, SPENT 26 YEARSIN USA PROMOTING BUSINESS BETWEENUS / UKwww.<strong>ifwla</strong>.com Autumn 2011

16 Financial ReportsWith the latest financial reporting season upon us, Analytiqa’s Mark O’Bornick has taken a look atthe results of some of the world’s leading 3PLs to identify the latest trends <strong>and</strong> performance issues intheir contract logistics operationsMixed resultsChallenging market conditions inFrance led to margin pressure atKuehne + NagelIn the first nine months 2011, the Kuehne + NagelGroup delivered stable results despite divergent economicconditions <strong>and</strong> slowing market growth. Netearnings improved by 1.1% (currency adjusted: by15.6%) whilst EBITDA was 2.4% below (currency adjusted:11.5%) the figure of the previous year’s period.Turnover decreased by 3.8% (currency adjusted:increased by 10.1%) to CHF14,598.0 million.In Contract <strong>Logistics</strong>, net invoiced turnover declinedby 5.7% (currency adjusted: increased by 7.9%). Thefocal point of the business unit’s strategy has been theexpansion of services for multinational customers <strong>and</strong>the consolidation at strategic logistics hubs. The integrationof contract logistics services into end-to-endsolutions has been an integral part of this strategicapproach. The challenging market conditions in Franceled to margin pressure, restructuring measures <strong>and</strong> anegative impact on results. Compared with the previousyear’s period, EBITDA in contract logistics was reducedby 11.5%; currency adjusted it remained stable. TheEBITDA margin decreased from 4.1 to 3.7%.Continued upward trends in logisticsat Norbert DentressangleQ3 at Norbert Dentressangle saw the Transport <strong>and</strong><strong>Logistics</strong> businesses demonstrating satisfactoryorganic growth, with the Freight Forwarding businesson track to generate euro 100.0 million in annual revenue.The Company’s operating margin continues toimprove, with a strong like-for-like performance. In thefirst nine months of 2011, Norbert Dentressangle’sconsolidated revenue totalled €2,640.0 million, up24.9% on a published basis <strong>and</strong> 6.1% on a like-for-likebasis.<strong>Logistics</strong> revenue grew 25.8% on a published basis,to reach euro1,155.0 million, thanks to the integrationof TDG, which continued to increase its contribution toNorbert Dentressangle’s revenue stream following itsconsolidation into the Group as of 1 April 2011. On alike-for-like basis, logistics revenue at NorbertDentressangle increased by 4.1% in the first ninemonths of 2011, with a continued uptrend reportednotably in the UK, Norbert Dentressangle's leadinglogistics market. Q3 <strong>Logistics</strong> revenues grew 33.2% onthe same period of 2010, to reach euro424.0 million,representing 3.8% organic growth.Higher volumes <strong>and</strong> new businessboost operating revenue at RyderIn the US, Ryder System, Inc. has reported Q3 earningsfrom continuing operations of US$56.9 million,up 44.0% from the year-earlier period. Total revenuefor Q3, 2011 was US$1.57 billion, up 19.0%, reflectingthe benefit of acquisitions <strong>and</strong> organic growth.In the Supply Chain Solutions (SCS) business segment,Q3, 2011 total revenue was US$406.1 million,up 26.0% from the comparable period in 2010.Operating revenue (revenue excluding subcontractedtransportation) was US$326.8 million, up 26.0% comparedwith the same quarter a year ago. SCS total revenue<strong>and</strong> operating revenue comparisons benefitedfrom the acquisition of Total Logistic Control (TLC) inDecember of 2010. Operating revenue also benefitedfrom higher volumes <strong>and</strong> new business.The SCS business segment’s pre-tax earnings in thethird quarter of 2011 were US$22.4 million, up 47.0%from the same quarter of 2010. The improvement wasdriven by the TLC acquisition, higher volumes <strong>and</strong> newbusiness, partially offset by increased compensationrelatedexpenses.DSV sees excess warehouse capacitycontributing to fierce pricecompetitionFor the nine month period to 30 September 2011,DSV reported a 4.2% increase in revenue, reachingDKK32,787.0 million. Operating profit before specialitems (EBITA) increased 12.1%, corresponding to anEBITA margin of 5.6% (2010: 5.2%).In the Solutions division (contract logistics), operatingprofit before special items increased 5.1% in 9M, 2011through organic growth. Increased dem<strong>and</strong> for warehousesolutions continued, but excess capacity stillcaused fierce price competition. Revenue in the divisiongrew by 2.1% over the same period of 2010 to reachIssue No. 3www.<strong>ifwla</strong>.com

Financial Reports 17DKK3,738.0 million (DKK3,434.0 million excludingintercompany revenue), as the EBITA margin reached5.5% in 9M, 2011, against 5.3% in 9M, 2010.Q3 saw good <strong>and</strong> stable results in the Solutions division,with particularly strong performances fromBenelux, Italy <strong>and</strong> Sweden. The division is rolling out anew IT platform which will increase productivity <strong>and</strong>efficiency <strong>and</strong> it also has a strong pipeline of customers,especially in the pharmaceuticals sector in theBenelux <strong>and</strong> France, <strong>and</strong> the electronics sector in theBenelux region.Asia-Pacific, Life Sciences &Healthcare <strong>and</strong> Automotive drivegrowth at DHL Supply ChainDeutsche Post DHL boosted revenues <strong>and</strong> significantlyimproved its profitability in Q3, 2011.Compared with the previous year, Group revenuesincreased by 2.5% to euro13.1 billion between July <strong>and</strong>September. All of the Group's divisions contributed tothe Company's strong performance:At euro3.3 billion, revenues produced by the SUPPLYCHAIN division during Q3, 2011 remained at lastyear's level. However, this figure reflects the division'sactual operating performance only to a limited extent.Adjusted for exchange-rate <strong>and</strong> consolidation effects,such as the divestment of a subsidiary in the US thatwas not part of the division's core business, revenuesgenerated by the SUPPLY CHAINABOVE:division actually rose by 6.2% duringQ3.Group’s transfor-WincantonGrowth was fuelled in particular mation from aby significant growth in the Asia- pan-EuropeanPacific region as well as the Life supply chainSciences & Healthcare <strong>and</strong> solution providerAutomotive sectors. At euro280.0to a UK &million, the volume of new contractsconcluded with new <strong>and</strong> business is nowIrel<strong>and</strong> focusedexisting customers remained very well underway.high. The margin gains achievedin these new contracts also underscoredthe division's ongoing successful performance. Afurther demonstration of this success was the steep risein operating earnings. EBIT rose from euro83.0 millionin Q3, 2010 to euro99.0 million in 2011, reflecting anincrease of nearly 20.0%.Contract <strong>Logistics</strong> boosts Q3 results atCEVACEVA <strong>Logistics</strong> has reported Q3, 2011 revenue ofeuro1.76 billion <strong>and</strong> EBITDA of euro86.0 million,up year-on-year by 1.2% <strong>and</strong> 5.8% respectively, at constantexchange rates. A good performance in Contract<strong>Logistics</strong> was partly offset by lower rates <strong>and</strong> volumes inFreight Management. Q3 saw continued good progressin Contract <strong>Logistics</strong> (CL), which grew revenue 2.5%www.<strong>ifwla</strong>.comIssue No.3

18 Financial Reportsyear-on-year. CEVA’s EBITDA margin increased yearon-yearfrom 4.7% to 4.9%. This was driven particularlyby improvements in leveraging the Company’s FreightManagement network <strong>and</strong> in improving CL contracts.With external markets remaining volatile, however,CEVA expects the uncertainty of the last few months tocontinue.High price of diesel impacts Contractlogistics earnings at LogwinIn spite of the slowdown in economic momentum, theLogwin Group generated sales of euro1,009.2 millionin the first nine months of the year, maintaining thesame level as the previous year. Operating income(EBIT) increased by 23.7% to euro23.8 million. TheCompany’s Solutions business segment generated salesof euro542.7 million in the first nine months of 2011,exceeding the previous year’s figure by 5.5%. A majorcontribution was made by the special networks operatingunder Transport <strong>and</strong> Retail Networks, as well asGeneral Cargo activities. The latter benefited in particularfrom continued growth in the automotive sector.Contract logistics activities showed satisfactory developmentprimarily due to the well-filled order books of customersin industry-related fields. However, continuinghigh capacity-related freight rates <strong>and</strong> the continuinghigh price of diesel had a negative effect on earnings.Operating income (EBIT)amounted to euro7.7 million,which was slightly below the figurefor the previous year (2010:euro8.1 million). The figure forthe comparative period in 2010,however, still included proceedsfrom the sale of fringe activitiesin the amount of euro0.7 million.The 9M operating marginfell to 1.4%, from 1.6% in thesame period of 2010.ABOVE: NorbertDentressangle’soperating margincontinues toimprove, with astrong like-for-likeperformance.Wincanton’s transformation beginsWincanton has announced its results for the sixmonths to 30 September 2011. Revenue at itscontinuing operations was £625.4 million, down 8.1%against last year. Underlying operating profit at thecontinuing operations was £22.3 million, down 11.2%representing a decrease of £2.8 million compared withlast year. This resulted in overall margins of 3.6%, inline with the equivalent six months last year (2010:3.7%) <strong>and</strong> the 3.5% for the full year ended March2011. The total operating result for the period afterexceptionals <strong>and</strong> amortisation of acquired intangiblesof £5.0 million (2010: £5.5 million) was a loss of£66.5 million (2010: £20.6 million profit). After netIssue No. 3www.<strong>ifwla</strong>.com

20 Financial Reportsfinancing charges of £9.0 million (2010: £8.9 million)the profit before tax for the year is a loss of £75.5 million(2010: £11.7 million profit).The Group’s transformation from a pan-Europeansupply chain solution provider to a UK & Irel<strong>and</strong>focused business is now well underway. The Group’sstrategy is to achieve a clear leadership position in theUK & Irel<strong>and</strong> market based on expertise in solutiondesign <strong>and</strong> operational capabilities in warehousing,multi-modal transport <strong>and</strong> specialist services across abroad range of market sectors such as retail, defence,consumer goods, construction, milk <strong>and</strong> energy.The major variances in the UK & Irel<strong>and</strong> half year’sperformance have been within Wincanton’s Foodservicebusiness <strong>and</strong> as a result of the disposal of Recycling inAugust 2010. Whilst Wincanton made good progress inwinning <strong>and</strong> renewing business, these developmentswere offset by reduced volumes in the Container logisticssector <strong>and</strong> by two retail customers going intoadministration.In July 2011, Wincanton completed the sale of theNetherl<strong>and</strong>s business <strong>and</strong> in August 2011 it completedthe sales of the German Road operations <strong>and</strong> of thebusinesses in Central & Eastern Europe. It announcedthe proposed sale of its remaining Mainl<strong>and</strong> Europeanoperations to Rhenus, a transaction scheduled to completelater this year. Wincanton is also undertaking aphased withdrawal from its Foodservice business, whichhas been loss making for some time. On completion ofthese two remaining steps, it will have exited from all ofthe sub-scale or underperforming areas of its business.The greatest challenge in terms of achieving profitablegrowth lies in areas of the contract logistics businesssuch as the traditional retail <strong>and</strong> consumer goodscontracts <strong>and</strong> the more mature milk <strong>and</strong> fuel tankeroperations. At the extreme, the basic open book warehousecontract is a commodity service <strong>and</strong> marginshave declined year on year. While these services continueto be an important part of Wincanton’s businessmix, it will focus on driving margin improvements byadding value through additional services, streamliningcustomers’ supply chains or providing systems capabilitiesthat will help them manage challenges presentedby multi-channel retailing.Elsewhere.... some of the industry’s larger 3PLs presenteda mixed set of results, with revenues <strong>and</strong>profits, up or down, depending on where you look.APL <strong>Logistics</strong> reported Q3 revenue of US$333.0 million,up 10.0% from a year ago. Q3 Core EBIT wasUS$16.0 million, down 11.0% from a year ago. Yearto-datein 2011, APL <strong>Logistics</strong> has reported revenue ofUS$1.0 billion, up 15.0% from 2010. The Companyachieved its highest average weekly revenue ever duringQ3, but at the same time, it is actively managingcosts as a reflection of uncertain economic conditions.At Panalpina, <strong>Logistics</strong> net forwarding revenues fell4.5% in Q3, 2011 to CHF210.0 million <strong>and</strong> in the 9Mperiod increased by 2.6% to reach CHF667.0 million.Gross profits fell 8.0% in Q3, to CHF81.0 million <strong>and</strong>decreased by 3.3% in the 9M period, to CHF261.0 million.Year-to-date, Damco’s Supply chain managementvolumes were 3.0% lower than in the same period in2010 due to a relatively weak consumer dem<strong>and</strong> inNorth America <strong>and</strong> Europe.Menlo Worldwide <strong>Logistics</strong> sustained its quarterlyearnings momentum. Stable customer volumes <strong>and</strong>good cost controls enabled Menlo to deliver growth innet revenues <strong>and</strong> profits, as dem<strong>and</strong> for high-valuecontract logistics <strong>and</strong> supply chain management servicescontinued to gain traction. For Q3, 2011, MenloWorldwide <strong>Logistics</strong> reported revenue of US$417.1 million,an increase of 12.7% from the prior year thirdquarter.The quarter benefited from increased revenuein both transportation management <strong>and</strong> warehousemanagement services. Net revenue reached US$154.7million, a 9.9% increase from the previous year thirdquarter. Operating income of US$12.7 million wascompared to an operating loss of US$6.3 million in Q3of last year.About AnalytiqaAnalytiqa assists companies across the global supplychain to recognise growth <strong>and</strong> profit in challenging<strong>and</strong> competitive markets.Analytiqa achieves this through the provision ofmarket reports, custom research, advisory services,white papers, supply chain consulting <strong>and</strong> executivesearch services.From Latin America to Asia, across North America<strong>and</strong> Europe, the Middle East <strong>and</strong> Africa, Analytiqa’ssupply chain expertise encompasses the completeend-to-end supply chain, from freight managementto home delivery, through airlines <strong>and</strong> shippinglines, freight forwarders, road <strong>and</strong> rail transport,3PL <strong>and</strong> courier <strong>and</strong> express services.Analytiqa adds value to in-house <strong>and</strong> outsourcedsupply chains by providing high quality <strong>and</strong> commerciallyrelevant market research, customer <strong>and</strong>competitor insight, <strong>and</strong> business development tools.Testimonials from the industry’s leading playersprovide evidence of our ability to add value to aclient’s business <strong>and</strong> these can be seen onwww.analytiqa.comAnalytiqa’s range of innovative services makeboth financial <strong>and</strong> operational contributions to theprofitability of supply chains across the globe, alldelivered through Analytiqa Interactive (www.analytiqa-interactive.com)to provide you with a greaterROI on your investmentIssue No. 3www.<strong>ifwla</strong>.com

22 AutomationDave Bull, business development manager at Dematic, explains how the profile of automation ischanging as solutions offer greater accessibility, flexibility <strong>and</strong> resilience as well as a faster return oninvestmentAutomation’schanging profileSay the word ‘Automation’ <strong>and</strong> many in thelogistics world will immediately think ofAutomated Storage <strong>and</strong> Retrieval Systems(ASRS). This established technology allows fordense storage of both pallets via automatedstacker cranes allowing heights of up to 40metres <strong>and</strong> for smaller unit loads, such as totesor full cases, in miniload <strong>and</strong> multi-shuttle systems.However the profile of automation is changing, particularlyin retail. With most retailers now having someform of Internet business many distribution centres nowserve multichannel retail operations supplying stores<strong>and</strong> internet orders – both to the customer’s home <strong>and</strong>as a ‘click <strong>and</strong> collect’ operation, where the onlineorder is being picked up in the store.So technologies that are likely to have an impact onautomated warehousing over the next couple of yearswill be those that can provide solutions for maintaininghigh customer service levels in multichannel operations– particularly those that have increased their e-commercevolumes rapidly. These technologies includemulti-shuttle systems. Although not new these systemsare still very much an emerging technology <strong>and</strong> theuses for which they are deployed are constantly evolving.Very much interlinked with shuttle technology areIssue No 3www.<strong>ifwla</strong>.com

Automation 23While traditionally picking has beenthe most labour intensive activity withina warehouse, <strong>and</strong> has seen the biggestefficiency gains through capitalinvestment in automation, other areasare emerging that can give a good ROIas automation technology becomes moreflexible <strong>and</strong> accessible. Thepacking process is one such area ripe forimprovement, especially withine-commerce operationsthe very high productivity ‘Goods to Person (GTP) stations’,which allow picking rates in excess of 800 linesper hour per operator. Both of these technologies areideally suited to single item picking <strong>and</strong> thereforeInternet retailing.While traditionally picking has been the most labourintensive activity within a warehouse, <strong>and</strong> has seen thebiggest efficiency gains through capital investment inautomation, other areas are emerging that can give agood ROI as automation technology becomes moreflexible <strong>and</strong> accessible. The packing process is onesuch area ripe for improvement, especially within e-commerce operations.Automation is also changing its profile in terms ofscale. Improved accessibility to automation means thatthe solution is no longer synonymous with large investment<strong>and</strong> systems integration. Entry level technologiessuch as voice picking or laser guided trucks can providean almost instant win <strong>and</strong> a base from which customerscan then ramp up the level of automation overthe years as their business grows. These ‘pockets’ ofautomation, often referred to as ‘mechanisation’ canprovide specific, immediate <strong>and</strong> obvious benefits suchas a simple transport conveyor linking two processes ora st<strong>and</strong>alone ASRS store for minimising the storagefootprint. It has become essential for a systems integratorto offer these less complex systems, which are moreattractive on a price point, in addition to having acapability to provide a fully integrated automated system.Dematic, for example, is well known as a large systemsintegrator but its products division, which offerscustomers simple automated solutions such as voice,conveying <strong>and</strong> pick to light, is thriving. These solutionscan be implemented without major upheaval <strong>and</strong>require only a relatively small investment. If you can tella customer that they will get their investment back in12 months time <strong>and</strong> then reap pure profit, they will seeopting for the automated route as less of a challenge.These solutions also present an entry level develop-www.<strong>ifwla</strong>.com Issue No 3

24 Automation“It is important for customers to be able to speak through their accountmanager to somebody involved in modernisation <strong>and</strong> upgrades todiscuss ideas <strong>and</strong> costs for such enquiries. By putting together a concept<strong>and</strong> costings <strong>and</strong> then explaining <strong>and</strong> demonstrating its features,benefits <strong>and</strong> the return on investment, they can help customers removeobsolescence <strong>and</strong> refurbish equipment to extend the life of their currentsystems to ensure they continue to meet business objectives thus ensuringthat their automated solution’s profile does not resemble that of awhite elephant.”Dave Bull, Dematic (left)ment route for small companies on a growth path,allowing them to start with a relatively small investmentin automation, such as voice picking, then graduate toWarehouse Management Software before stepping upto a small conveyor system.When investing in any kind of automation it is vitalto look at the total cost of ownership rather than theinitial purchase price. The full lifecycle costs should belaid out in detail, including factors, such as power consumption,which are critical to ensure a system’s ‘green’credentials are fully understood.To give the customer full visibility of the full life cyclecost of a system most service contracts are now negotiatedas part of the main bid process. If you are investinga great deal of money in automation to improvematerial flows it is absolutely vital that downtime isminimised <strong>and</strong> peak performance maintained so thatthe systems deliver their full productivity, accuracy <strong>and</strong>cost reduction benefits <strong>and</strong> continue to do so wellbeyond the payback period. Today’s automated systemsare hugely reliable yet any mechanised systemneeds to be regularly maintained <strong>and</strong> serviced to deliveroptimal performance <strong>and</strong> uptime.Automated warehousing systems will play a centralrole in the support of increasingly complex supplychains <strong>and</strong> will also form the foundation for futuredevelopment. This means that making price-baseddecisions for short term savings by selecting automatedsolutions with reduced maintenance <strong>and</strong> service packageswill only increase the risk of extended downtime<strong>and</strong> decreased productivity. Ultimately this will result ingreater costs over the long term. Looking back just fiveyears ago few companies considered the customerservice side of their automated system investment.Today’s increasingly competitive supply chains howeverhave banished complacency <strong>and</strong> customers are takinga more holistic approach <strong>and</strong> so customer service forautomation is becoming the key differentiator.Successful businesses do not st<strong>and</strong> still <strong>and</strong> keepingup with growth-based change means keeping an eyeon the future - particularly for a customer that hasstepped on the first rung of ladder with their investmentin simple automation. In a further example of howautomation has developed, a systems provider shouldnow continue to work in partnership with its client <strong>and</strong>anticipate any ongoing system <strong>and</strong> training needs aswell as supporting any requests for upgrades <strong>and</strong> modernisation.This may mean updating software or controls;it could see individual components or modulesbeing replaced or upgraded; it might also require newsolutions - for example, a customer having started inthe shallow end of automation now needs to put a further1000 pallets through its warehouse or wishes toreduce the number of staff required for picking.It is important for customers to be able to speakthrough their account manager to somebodyinvolved in modernisation <strong>and</strong> upgrades to discussideas <strong>and</strong> costs for such enquiries. By puttingtogether a concept <strong>and</strong> costings <strong>and</strong> then explaining<strong>and</strong> demonstrating its features, benefits <strong>and</strong> thereturn on investment, they can help customersremove obsolescence <strong>and</strong> refurbish equipment toextend the life of their current systems to ensure theycontinue to meet business objectives thus ensuring thattheir automated solution’s profile does not resemblethat of a white elephant.Issue No 3www.<strong>ifwla</strong>.com

26 AutomationWarehouse automation frequently fails to live up to expectations. However, Andrew Robinson ofUnipart Expert Practices (UEP) argues this should never arise if the correct approach is taken <strong>and</strong> a strictmethodology applied - one that takes an ‘end-to-end’ view of the supply chain.How to ensurepayback onautomationImplementing an automated warehouse is acomplex, expensive <strong>and</strong> sometimes risky venture.According to a recent survey conductedby Cranfield University into 27 warehouseautomation projects, ‘there are real concernsabout disruption to the ongoing operation inthe short-term <strong>and</strong> the degree of future flexibilityin the longer-term’ (1)An investment in automation - whether it is a storage<strong>and</strong> retrieval system, sortation project, order forwardingprocess or, for that matter, any other activity - may notnecessarily slash costs, eliminate bottlenecks or boostcapacity in the ways expected. Indeed, quite the oppositecan happen.The resultant soul searching <strong>and</strong> identification of asuitable scapegoat is a painful process for all. So, arethere some general rules on how this can all be avoided?Can you make sure your automation project paysbackin an acceptable timescale <strong>and</strong> delivers what youexpect?The first question to ask - <strong>and</strong> the one most frequentlyforgotten - is ‘do I really need to automate theprocess?’ Baker <strong>and</strong> Halim (1) cite three key motivatingfactors for implementing automation:• To accommodate growth• To reduce operating costs• To improve customer serviceHowever, none of these reasons necessarily requirean automated solution. Significantimprovements in all three can frequently be achievedby redesigning existing business processes.For a given, repeatable, task applying automationcan typically achieve higher levels of productivity than amanual solution. It is this productivity gain that normallysits at the heart of any justification for a piece of automatedequipment. The constraints of a manual process- be it the speed of people, space needed to completethe work, presentation of material to the operative, orremoval of work-in-progress - means the manualprocess usually has a finite capacity. By adding a levelof automation the intention is to remove that constraint;either fewer things happen or those things that happendo so faster <strong>and</strong> with greater reliability. However, asBaker <strong>and</strong> Halim point out, this may be at the cost offlexibility in the long term.There are two steps to ensuring payback on anautomation project. The first is to see if an improvementcould be made to the current manual process that alleviatesthe constraint without the need for investment inautomation. The second is to invest in a way thatensures productivity levels go up in the way intended.Let us take each of these steps in turn. Improving manualprocesses As any ‘lean’ practitioner will tell you, alarge proportion of the activity involved in a process isnon value adding. By analysing what happens in theoperation <strong>and</strong> gaining an in-depth underst<strong>and</strong>ing ofwhat needs to be done, as opposed to what actuallyhappens, the elements that are not required can beidentified. Typically these fall into the categories of ‘Theseven wastes’: Transportation, Inventory, Motion,Waiting, Over processing, Over production <strong>and</strong>Defects.These are sometimes remembered by the acronymTIM WOOD (or WOODE if environmental waste isadded).By tackling these wastes in a systematic way, it isusually possible to increase capacity, reduce costs <strong>and</strong>improve flexibility. Making a heavy investment inautomation <strong>and</strong> then simply continuing to do the samewasteful activities but at a faster rate is not money wellissue No 3www.warehousinglogisticsinternational.com

Automation 27spent. There is no benefit in financing non valueadding activities. If the manual process has been fullyinvestigated <strong>and</strong> action taken to remove waste, therewill be a sound basis against which to measure theexpected benefits of automation.However, by improving the current (manual) performance,capital investment in automation will be lessattractive. But, it does ensure that the investmentappraisal is against a sound base <strong>and</strong> increases theprobability of achieving the benefits identified in thebusiness case. So if, having explored the manualprocesses, you are still of the opinion that automationoffers the answer, you can now proceed.Getting the full pictureThe automated systems supplier has confirmed thecapacity <strong>and</strong> given you run rates. These have beenreduced for start-ups, changeovers <strong>and</strong> down time. Youhave all sorts of stats <strong>and</strong> specs <strong>and</strong> have gone to see<strong>and</strong> touch some of the kit in a working environment.You have no doubt that it will do ‘what it says on thetin’. You have even explored how the machinery isgoing to remove travel or other waste, making yourprocesses leaner. What can possibly st<strong>and</strong> in the way ofthat pat on the back for a job well done as the benefitsstart rolling in? Well, the first port of call, as with themanual improvements, is to underst<strong>and</strong> the currentprocesses. Are there any complexities that needunearthing sooner rather than later? It might be thatwhat appears to be a st<strong>and</strong>ard repeatable process thatlends itself to automation has all sorts of exceptions<strong>and</strong> variations. It may be that, ‘that leaflet to be includedwith the order shouldn’t go with the exports, <strong>and</strong>certainly not to that major customer, who needs to havehis own, different shaped insert instead’.Other questions need to be asked too. Are thereoccasionally products to be h<strong>and</strong>led that fall outsidethe capability of the machinery? Is that barcode alwayson the top, except for the ones from supplier ‘X’, whoonly charges half the amount of the other suppliers butslaps the barcode on the side? While on the subject ofvariation, are the volumes to be h<strong>and</strong>led subject tovariation across the week or year? If so, the automationwill need to cope with peak, even if this means it isunderutilised during the remainder of the year.Furthermore, are the current processes really the onesto be understood? Nothing ever st<strong>and</strong>s still <strong>and</strong> theautomated equipment is going to be used in the future,not today. What if volumes rocket <strong>and</strong> the machinerycan not cope with dem<strong>and</strong>? Can additional units bebolted on or is it a matter of throwing it away <strong>and</strong>starting again? And what happens if the product rangechanges to items that are bigger or smaller, or that arepackaged differently? It may be that the profile of worksimply changes, so orders arriving in peak need to beprocessed <strong>and</strong> out-the-door more quickly than thewww.warehousinglogisticsinternational.com Issue No 3

28 Automationmachinery is capable of. No automated solution c<strong>and</strong>eal with any <strong>and</strong> every eventuality, but it is necessaryto explore likely future business changes <strong>and</strong> the impactthese would have. It would be a bad decision to investin new equipment only to find that in three years’ timeit can only h<strong>and</strong>le a small percentage of the throughput.Underst<strong>and</strong>ing the system interfacesThis new piece of equipment will need to fit with otherprocesses upstream <strong>and</strong> downstream. When lookingat the solution, you will need to underst<strong>and</strong> how thesesystems will interface, in terms of people, product <strong>and</strong>data. Does the machinery need a steady feed of materialsor is there a buffer? Is additional software neededto get the automation’s software to talk to your warehousemanagement system (WMS)?When underst<strong>and</strong>ing the new world that will existafter investment, the processes sitting either side of thenew operation are critical to calculating the productivityof the whole. One of these may well become the newconstraint on capacity once the current constraint iseliminated by automation. Unless you know how theseprocesses are going to behave there may be surprisesregarding payback.Although you can never know everything about howthe automated system will work in your operation, thereare some obvious ways to reduce the risk. Are therereference sites that the automation supplier can showyou? How similar is this to your own operation? If youare leading the way <strong>and</strong> there is no existing instance ofthe technology being used as you intend you may wantto consider simulation. Simulation software can go along way to replicating the expected complexities of theoperation <strong>and</strong> can verify likely productivity levels. It canalso help in scenario planning. What if volumes staythe same but order size halves? What if we have tostart picking singles rather than cases? What if a newproduct range is introduced? What if a customer wantssome form of customisation? A simulation can test thesolution’s sensitivity to such changes.So you have a clear underst<strong>and</strong>ing of how theautomation is going to be used, what else will be happeningaround it, how the operation will cope withexceptions <strong>and</strong> business changes. You have doneeverything to ensure that the automation is highly productive,well integrated <strong>and</strong> flexible. Are there anyunexpected costs that might be incurred? Have you factoredin those costs beyond the purchase price that youmight expect to be associated with a project of thissize? For example, additional maintenance, purchasingof spares or training of additional staff.Plan for disruptionInevitably, there will be disruption to the existing operationbefore you are up <strong>and</strong> running. There will be aperiod of testing <strong>and</strong> bedding in of new processes duringwhich productivity is likely to fall rather than rise.Additional space may be needed during the implementation.And there are changes to running costs to consider.Will you be using more or less consumables?Finally, if the main aim was to save money throughhigher productivity, this is normally only realised oncepeople have been deployed elsewhere, left through naturalwastage or are made redundant. If the first twoare not options, then the costs of redundancy need tobe built into the payback calculation. The new operationmay require a workforce with different skills, suchas maintenance engineers or software programmers,<strong>and</strong> these people will need to be recruited <strong>and</strong> trained.Once you have a full underst<strong>and</strong>ing of both one-off<strong>and</strong> on-going costs associated with the change you arethen in a position to get the agreement of the decisionmakers.A controlled stepThere are strong arguments for undertaking a moveto automation. However concerns over the risks ofwhat is often considered a leap into the unknown canhold back investment. To make the change less of aleap <strong>and</strong> more of a controlled step, a systematicapproach is called for, summarised in the diagram(left).First underst<strong>and</strong> the process, then identify the bottlenecksto that process, assess what can be improvedmanually before evaluating the options for automation.As part of that evaluation ensure you have a full pictureof the costs <strong>and</strong> an awareness of what will make theinvestment redundant. In a world where nothing staysstill for long this might be range, volumes, customerexpectations or a host of other variables.While certainty is never achievable some risks canbe mitigated through flexibility, phased investment <strong>and</strong>modular designs. By working through the optionsobjectively <strong>and</strong> systematically the business can make arational decision over the expected payback on theinvestment.Andrew Robinson is a Senior Consultant at UnipartExpert PracticesReferences(1) Baker, Peter <strong>and</strong> Halim, Zaheed, Supply ChainManagement: An international journal. Volume 12,Number 2, 2007(2) Supply Chain Consultancy White Paper 4 of4Current Process Automated Solution AnalyseUnderst<strong>and</strong> Improve Process improvement withoutautomation Assess options Evaluate range of scenariosselect supplier plan implementation Approach to ensuringpayback on automationIssue No 3www.warehousinglogisticsinternational.com

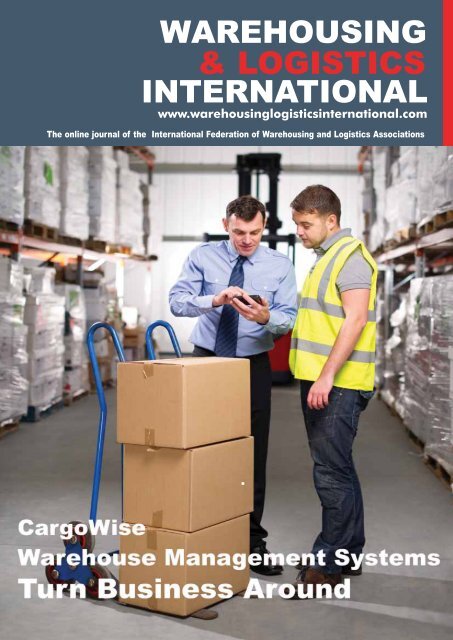

30 Cover StoryWarehouse managementsystems turnbusinesses aroundMark O’Connell, Product Manager for CargoWise, considers the benefits that an intergatedwarehouse management system can bring to a businessIn these challenging economic times logisticsoperators like all businesses are under pressureto do more with less. Many have in factmothballed facilities altogether. Personnel costsin particular are one area where warehouseoperators are under pressure to economise.A robust warehouse management system can deliverthe economies of scale <strong>and</strong> streamline the process tohelp companies improve, or at the very least, improvetheir bottom line.Earlier this year the UK <strong>Warehousing</strong> Associationwarned that the industry faces a looming skills shortage.To meet this challenge £3.25 million has beenallocated through the Skills Funding Agency to theNational Skills Academy for <strong>Logistics</strong>. However thelogistics industry must do more to promote the image oflogistics as a skilled profession that involves workingwith leading edge technology. A recent survey of thirdpartylogistics operators found that Europe <strong>and</strong> theAsia-Pacific region are particularly affected by a shortageof both operational <strong>and</strong> managerial talent.Information technology, already an integral componentof most supply chain processes, will become a criticalaspect of all logistics activity as the industry is compelledto do more with fewer albeit higher-skilled personnel.Even when the global economy revives, the “leanlogistics” business model embraced in the wake of thedownturn as means of self-preservation will likely continuea key strategy for minimising risk on the one h<strong>and</strong>whilst maximising ROI on the other. The CEO of amajor logistics service provider recently commented thatthe industry has become “leaner <strong>and</strong> more adaptive” injust the last few years <strong>and</strong> better positioned to take aproactive approach to innovation which would providethe basis for future growth. This has been particularlyvisible at Small-to-Medium Enterprise level where smalleroperations have taken the opportunity to outmanoeuvrelarger competition.Lean processesIndeed, the adoption of lean processes by supplychain users such as manufacturers <strong>and</strong> retailers virtuallyobligates the providers of supply chain services tomaintain a similarly trim operational profile. For allparticipants in the supply chain the key objectives oflean logistics are waste reduction <strong>and</strong> minimisation offuture expenditure. Both of these objectives are attainablethrough cost-effective technological solutions.Warehouses <strong>and</strong> distribution centres are more thanjust a way point between different stages of the supplychain, which we often speak of as if it were a neat linearflow from sender to receiver. But the truth of courseis that it is more like a network.Warehouses <strong>and</strong> DCs are the nodes in this networkwhich prevent it from descending into chaos. Multiplestreams of cargo flow converge on these nodes wherethey are disentangled <strong>and</strong> allowed to diverge fromeach other heading in the right direction.It is not a job for just anybody, an attentive mind <strong>and</strong>an organised approach to work is required. This makesthe task all the more difficult to manage as the numberof eyes, <strong>and</strong> minds, on the job is reduced. Worse, thetrend is for logistics operations to become more ratherthan less complex.Increasingly, technology is making up for the missingh<strong>and</strong>s, eyes, <strong>and</strong> to some extent minds on the warehousefloor. In much of the developed world at least,innovations as simple as bar codes to more sophisticatedRFID mobile devices have long taken over the workIssue No. 3www.warehousinglogisticsinternational.com

Cover Story 31once done by pen <strong>and</strong> paper whilst automated materialh<strong>and</strong>ling <strong>and</strong> more recently autonomous robotic systemshave quite literally been taking much of the legwork out of picker’s jobs.In April this year, UK retailer John Lewis reported significantgrowth in its online sales thanks in no smallpart to efficiencies achieved through the automation ofits main distribution centre in Milton Keynes.Though battery powered minions navigatingamongst the racks <strong>and</strong> pallets like the “Scutters” fromRed Dwarf is a visually impressive demonstration of theadvance of logistics technology, the most significantadvances as a far as the industry is concerned are lesstangible. An effective Warehouse Management System(WMS) is vital to the functioning of a modern logisticscentre. A lean logistics strategy obligates logistics servicesproviders to place more <strong>and</strong> more reliance on technologicalapproaches to optimising their processes. Theimperative to minimise waste <strong>and</strong> inefficiency dem<strong>and</strong>sa single picture of both in-bound <strong>and</strong> out-bound logistics.Thus in the context of market conditions that makea lean logistics strategy all but obligatory, an integratedwarehouse management system looks less a luxury thanan asset without which the physical infrastructure itself iscommercially moribund.The four major benefits of an integrated WMS are:(1) Client Visibility.Freight often moves through a network of one or manysupply chains where the warehouse serves as just onecomponent of the network. Having an integrated WMSallows clients complete visibility of their freight as itmoves from one entity to the next; for example fromWarehouse to Forwarding.(2) Planning.If the Warehouse has visibility of pending receipts, forexample through access to an <strong>International</strong> ForwardingPurchase Order module, the warehouse can better planreceiving resources <strong>and</strong> space for more efficient processing.(3) Lower cost to implement <strong>and</strong> train.With a single system approach Warehouses don’t needto externally source essential or value add modules forfunctions such as: Accounting, Workflow, DocumentManagement <strong>and</strong> Customer Relations Management.They do not need to learn, run <strong>and</strong> manage a myriadof different systems often requiring different hardware<strong>and</strong> configurations. This saves considerable costs inunnecessary IT overheads such as training <strong>and</strong> hardware.(4) Departments can be centralised for the<strong>Logistics</strong> Service Provider.You no longer need a separate department forWarehouse Customer Service, data entry or Sales.These functions can be consolidated with a single systemapproach. This allows for one Customer Service orData Entry department using one system with visibility toall the information they need to make decisions for thegood of the entire business.Pick the right systemIt is of course important to pick the WMS solution thatis right for your business. Like any procurement decisionit should be taken at the boardroom level, able togrow with you as your business enters new markets <strong>and</strong>the challenges that come with it. Most importantly, thosewho will be using the system must be trained to extractthe maximum value from it.The ROI from a well-chosen <strong>and</strong> implemented WMScan be dramatic <strong>and</strong> swift. One recent UK adopter ofwww.warehousinglogisticsinternational.comIssue No.3

32 Cover StoryPhoto courtesy of iForcethe CargoWise ediEnterprise solution, which includedas part of a scaled modular package theediWarehouseManager module, increased the volumeof material h<strong>and</strong>led in its pick <strong>and</strong> pack warehouse sodramatically that overall turn-overs rose 25% in lessthan a year after the system went live.Such gains are not just the fruit of additional businessthat can be taken on when all of a company’sresources are mobilised. Integrated WMS’s can generatesignificant savings from reduced h<strong>and</strong>ling errorswith the reduction in time <strong>and</strong> financial penalties thatfollow.WMSs however are no longer just a means of trackinginventory. They have evolved into sophisticatedmanagement tools capable of tracking variables suchas the time taken to complete tasks <strong>and</strong> utilisation ofresources. They can even play a role in tailoring servicesto particular clients, demonstrating not only flexibilityin their own role but also the ability to give that flexibilityto any part of the business.Although a WMS is an integral part a logistics centrescore infrastructure, its non-physical nature meansprocurement options are flexible. In fact “procurement”in the traditional sense might not even be necessary.What if it were possible to enjoy the benefits without theoverheads <strong>and</strong> need to sustain non-core technologicalcompetencies? With the arrival of Hosted solutions suchas those provided by CargoWise this is already possible.A ready solution for the challenges aheadRecent years have seen difficult times for businessesof all kinds, but for the logistics industry in particularthere has been a watershed moment. To thrive in thecoming decade the industry will need to be as dynamic<strong>and</strong> agile as it has ever been. This means taking leadershipin fostering the talent pool <strong>and</strong> proactively seekingout the most effective technology to enable that talentto deliver value to the business.CargoWise st<strong>and</strong>s ready to meet the WMS requirementsof the industry now <strong>and</strong> into the future. TheEnterprise solution with its WarehouseManager modulecan provide, if needed, not just an integrated WMS butthe whole system with which it is integrated.ABOUT CARGOWISECargoWise is a global leader in logistics technologysolutions that improve visibility,efficiency, quality of service<strong>and</strong> profitability. CargoWise isrenowned for its next-generationsolutions, including ediEnterprise,the industry’s only single platformsupply chain logistics managementsystem with global capability.More than 65,000 usersacross a customer community of3,500 sites in 65+ countriesmove goods through the globalsupply chain daily usingCargoWise solutions.Founded in 1994, CargoWise is headquarteredin Australia. Its team of more than 200employees operates worldwide from officesacross the U.S., Europe <strong>and</strong> Asia.For more information visitwww.cargowise.com, or contact us at: marketing@cargowise.comIssue No. 3www.warehousinglogisticsinternational.com

New focus onlogistics atCeBITHannover. As the world’s most important eventfor the digital economy, CeBIT is set to focusmore strongly than previously on the topic oflogistics. In future, the “<strong>Logistics</strong> IT” platform inHall 5 will offer manufacturers of logistics softwarenew presentation opportunities in the formof a group display <strong>and</strong> a forum.“<strong>Logistics</strong> services are based on highly dynamic <strong>and</strong>complex processes – the use of powerful IT solutions iscrucial for enhancing efficiency <strong>and</strong>, most importantly,for making new <strong>and</strong> intelligent solutions available tousers without delay. In the past, many providers oflogistics systems have exhibited at CeMAT, which takesplace every three years. That’s too long for such a fastmovingindustry. Thanks to the professional assistanceof the CeMAT organizers, we’re delighted that we cannow offer these providers an extra annual platform,”reports Frank Pörschmann, responsible for CeBIT atDeutsche Messe AG.Exhibitors will include the software firm PSI <strong>Logistics</strong>from Berlin. Its Managing Director, Wolfgang Albrecht,is one of the driving forces behind the new logistics ITplatform: “As software manufacturers with short innovationcycles, we need another trade show alongsideCeMAT at which we <strong>and</strong> other leading suppliers canexhibit new products on an annual basis. CeBIT is idealfor this purpose. It’s where we can meet IT decisionmakersfrom the industries that are relevant to us.”CeBIT already uses the ERP-AREA, the Auto-ID/RFIDForum & Solutions Park <strong>and</strong> the Cloud ComputingWorld platforms to present topics from the logisticsindustry.The <strong>Logistics</strong> IT group display <strong>and</strong> the forum will beorganized by Deutsche Messe AG’s CeMAT team.“Looking ahead to CeBIT, we will make use of ourproven industry know-how <strong>and</strong> bring about synergiesthat will benefit the exhibiting companies,” confirmsPörschmann.www.cebit.dewww.warehousinglogisticsinternational.com

34 North AmericaCompeting as aContainer Gateway toNorth AmericaDespite the recent economic downturn North America will remain the major market destination of productsfrom low cost manufacturing countries in Asia for decades to come Garl<strong>and</strong> Chow, PhD, considerskey socio-economic factors <strong>and</strong> business trends affecting the US supply chainNorth America will remain the major marketdestination of products from low costmanufacturing countries in Asia fordecades to come. Despite the recent economicdownturn, every forecast predicts trade fromAsia to resume its growth. The role <strong>and</strong> competitivenessof Port Metro Vancouver (PMV) to efficiently<strong>and</strong> effectively enable Asian products toreach their final destination in North America isone aspect of Port Metro 2050. An underst<strong>and</strong>ingof key socio-economic factors <strong>and</strong> businesstrends affecting off shore trade <strong>and</strong> the supplychain helps build scenarios for strategic planning.PMV competes as a gateway with other NorthAmerican commercial ports in trans-Pacific trade lanes.To more accurately categorize trade patterns <strong>and</strong> theassociated logistics requirements, Asia should bedefined as being comprised of three distinct zones ofproduction: North Asia, South East Asia <strong>and</strong> South Asia.On the North American side, commercial <strong>and</strong> supplyrelations are best distinguished regionally according togeographic sub-sections that include: Northern,Eastern, Southern, Western <strong>and</strong> Central regions.Competitive Position of Pacific Northwest (PNW)Ports <strong>and</strong> PMVThe PNW ports of Seattle, Tacoma (U.S.) <strong>and</strong>Vancouver (Canada) are geographically closer thanLA/LB, to North Asia, the origin of the majority of Asia’sexports. The PNW ports have a sizeable local marketfor Asian produced goods, possess deep water portcapacity, <strong>and</strong> are reasonably close to north <strong>and</strong> centralU.S. Ocean rates <strong>and</strong> schedules do not always reflectthe shorter distance to the PNW ports as more vesselscan completely load or unload in LA/LB resulting inmore frequent direct service. In addition, negotiatedrates for large shippers including freight forwarders areoften equalized across the west coast ports. The PNWports are a good choice for time sensitive freight movingeastward to destinations in the U.S north central(Chicago) <strong>and</strong> U.S. south Central (Memphis). Some ofthe growth in the PNW ports can be attributed to shippersseeking alternatives to the chronic congestion inLA/LB. But as container movement from Asia peaked in2006 <strong>and</strong> 2007, PNW ports have also suffered fromincreasing capacity utilization <strong>and</strong> congestion. The economicdownturn has decreased port usage however,<strong>and</strong> capacity utilization is no longer a significant differentiationfactor between gateway ports at this time.Asian freight exported to Canadian destinations canbe consolidated with U.S. based freight throughAmerican ports. But as Canadian volume increases forthe individual shipper, the shipper may find that directmovement of this freight through Canadian ports couldimprove transit time. U.S. railroad service from U.S.ports lack operations in Central <strong>and</strong> Eastern Canada<strong>and</strong> must interchange with Canadian railroads to enterthat market. This changeover increases transit timewhile also reducing reliability, which is inherent in anyinterchange of equipment between rail lines. In contrast,Canadian railroads have coordinated operationsinto major U.S. hubs <strong>and</strong> markets including Chicago<strong>and</strong> Memphis. Combined, the short ocean transit,seamless rail access to the U.S., comparable l<strong>and</strong> transportation<strong>and</strong> absence of fees such as the HarborMaintenance Tax, improves Canadian gateway competitionfor U.S. bound traffic.Issue No. 3www.warehousinglogisticsinternational.com

North America 35Access to this U.S. heartl<strong>and</strong> is increasingly importantas population <strong>and</strong> industry continues to outperformother geographic sections of the United States. The singlelocation for a distribution centre which would reachthe largest U.S. population was Bloomington, IN <strong>and</strong>now has shifted further south to Henderson, Ky. Themajority of new auto plants are opening in this region.In other words, the U.S. destinations where PNW portsincluding PMV are competitive are growth markets.Inter-port Competitiveness is ultimatelyMeasured by Total <strong>Logistics</strong> Cost of the RoutingLocation gets PMV into the competitive area but theactual freight is delivered by the transportation systemsconnecting origins in Asia <strong>and</strong> the destinations inNorth America. Shippers ultimately choose their routingson based on the door to door logistics costsincurred, the total logistics cost. Total logistics costincludes direct transport costs, inventory costs <strong>and</strong> thecosts of service failure such as stock out, lost sales <strong>and</strong>down time costs. These costs are largely dependent onthe capacity of the transportation <strong>and</strong> logistics infrastructure<strong>and</strong> how well the logistics service providers utilizethat capacity.Thus the following factors must be considered:• Port capacity improvements• Panama Canal expansion• Rail capacity improvements• Highway capacity improvements• Cost recovery fees such as Harbor Maintenance Tax• Shipping line scheduling <strong>and</strong> port strategies (OceanCarrier Service Deployment Strategies)• Transport Chain Management (coordination <strong>and</strong> collaboration)• Labor <strong>and</strong> Union industrial relations environment• Environmental <strong>and</strong> l<strong>and</strong> use constraints• Gateway Related Fees• Security barriersLong Run Competiveness is ultimately determinedby Origin <strong>and</strong> Destination of TrafficShifting trade patterns may be more significant thanthe initiatives of gateway competitors in determiningthe competitiveness of an individual gateway <strong>and</strong> corridor.This is because; the Asia Pacific GatewayCorridor’s (APGC) location advantage is positioned forfreight originating in North <strong>and</strong> South East Asia tonorthern <strong>and</strong> central North America. If freight growthshifts to other origin–destination trade corridors, theAPGC is disadvantaged in receiving North Americanimports due to its location.Some of the key factors that are going to affectwhere products will be produced for import into NorthAmerica are:• wage rates• exchange rates• fuel/transportation costs.• Export subsidies (China VAT rebate)• Internalization of carbon emission externalities as abusiness cost.• Dem<strong>and</strong> driven supply chain strategyIn fact, the convergence of the first four factors hasresulted in the Total L<strong>and</strong>ed Cost of producing selectedproducts in Mexico <strong>and</strong> delivering to the U.S. marketlower then manufacturing in China <strong>and</strong> for other products,lower in India or other South Asian countries thanin China (see box). For the foreseeable future, perhapsmany decades, China will remain the overall low costwww.warehousinglogisticsinternational.comIssue No.3