Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong>31 December <strong>2003</strong>6 Investment securities<strong>2003</strong> 2002KD 000’s KD 000’sHeld for trading 47,369 -Held to maturity 35,936 53,564Available for sale 634,489 652,828717,794 706,3927 <strong>Kuwait</strong> government debt bondsThe Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> purchased resident <strong>Kuwait</strong>i and GCC customers’ debts existing at 1 August 1990, inaddition to related interest up to 31 December 1991, on behalf <strong>of</strong> the Government <strong>of</strong> <strong>Kuwait</strong> in accordance withDecree 32/92 and Law 41/93, as amended, in respect <strong>of</strong> the purchase by the Government <strong>of</strong> such debts and theprocedure for their collection.The purchase value <strong>of</strong> these debts was determined in accordance with the Decree and has been settled by the issue <strong>of</strong>bonds, with a value date <strong>of</strong> 31 December 1991 and maturing over a maximum period <strong>of</strong> twenty years from the date <strong>of</strong>issuance. During <strong>2003</strong> there was a net redemption <strong>of</strong> KD 31 million (2002: KD 44 million). Interest is at a rate fixedsemi-annually by the Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>, and is payable semi-annually in arrears.The average rate <strong>of</strong> interest paid bythe Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> for <strong>2003</strong> was 1.89% (2002: 2.67 percent).Under the terms <strong>of</strong> the purchase agreement with the Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>, the amount <strong>of</strong> the bonds will beadjusted in respect <strong>of</strong> any difference arising, once the balances <strong>of</strong> the related debts have been agreed with thecustomers concerned.The group, therefore, has a contingent liability in this regard.8 Other assets<strong>2003</strong> 2002KD 000’s KD 000’sInterest receivable 42,340 33,133Sundry debtors and prepayments 5,550 4,959Other 7,686 29,16555,576 67,2579 Certificates <strong>of</strong> deposit issuedThe certificates <strong>of</strong> deposit outstanding at the balance sheet date amounted to KD 220 million (2002: KD 84.5 million).These certificates <strong>of</strong> deposit bear interest payable at maturity at rates ranging from 2.375% to 2.5% per annum (2002:2.375% to 2.875% per annum). All certificates <strong>of</strong> deposit issued and outstanding are maturing within periods up to 4months from the balance sheet date.10 Floating rate bonds issuedOn 19 February 2002, the bank issued floating rate bonds with a principal amount <strong>of</strong> US$ 450 million at an issue price<strong>of</strong> 100%.The bonds bear interest at the rate <strong>of</strong> 0.25% per annum above the London inter-bank <strong>of</strong>fered rate for threemonth US dollar deposits, payable quarterly in arrears.The bonds are in bearer form in denomination <strong>of</strong>US$ 100,000 and are redeemable at par on or before 19 February 2005.40

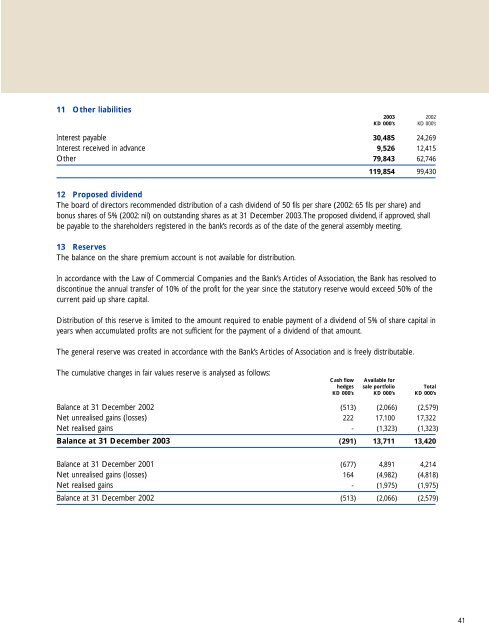

Main HeadingMain heading sub copy11 Other liabilities<strong>2003</strong> 2002KD 000’s KD 000’sInterest payable 30,485 24,269Interest received in advance 9,526 12,415Other 79,843 62,746119,854 99,43012 Proposed dividendThe board <strong>of</strong> directors recommended distribution <strong>of</strong> a cash dividend <strong>of</strong> 50 fils per share (2002: 65 fils per share) andbonus shares <strong>of</strong> 5% (2002: nil) on outstanding shares as at 31 December <strong>2003</strong>.The proposed dividend, if approved, shallbe payable to the shareholders registered in the bank’s records as <strong>of</strong> the date <strong>of</strong> the general assembly meeting.13 ReservesThe balance on the share premium account is not available for distribution.In accordance with the Law <strong>of</strong> Commercial Companies and the <strong>Bank</strong>’s Articles <strong>of</strong> Association, the <strong>Bank</strong> has resolved todiscontinue the annual transfer <strong>of</strong> 10% <strong>of</strong> the pr<strong>of</strong>it for the year since the statutory reserve would exceed 50% <strong>of</strong> thecurrent paid up share capital.Distribution <strong>of</strong> this reserve is limited to the amount required to enable payment <strong>of</strong> a dividend <strong>of</strong> 5% <strong>of</strong> share capital inyears when accumulated pr<strong>of</strong>its are not sufficient for the payment <strong>of</strong> a dividend <strong>of</strong> that amount.The general reserve was created in accordance with the <strong>Bank</strong>’s Articles <strong>of</strong> Association and is freely distributable.The cumulative changes in fair values reserve is analysed as follows:Cash flow Available forhedges sale portfolio TotalKD 000’s KD 000’s KD 000’sBalance at 31 December 2002 (513) (2,066) (2,579)Net unrealised gains (losses) 222 17,100 17,322Net realised gains - (1,323) (1,323)Balance at 31 December <strong>2003</strong> (291) 13,711 13,420Balance at 31 December 2001 (677) 4,891 4,214Net unrealised gains (losses) 164 (4,982) (4,818)Net realised gains - (1,975) (1,975)Balance at 31 December 2002 (513) (2,066) (2,579)41