Financial Statements 2003 - National Bank of Kuwait

Financial Statements 2003 - National Bank of Kuwait

Financial Statements 2003 - National Bank of Kuwait

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

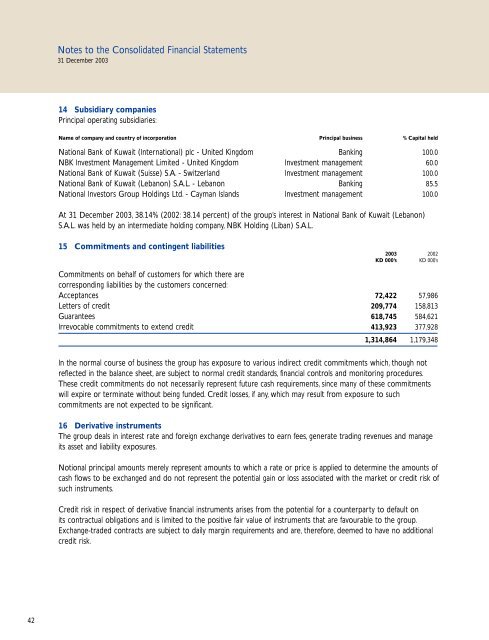

Notes to the Consolidated <strong>Financial</strong> <strong>Statements</strong>31 December <strong>2003</strong>14 Subsidiary companiesPrincipal operating subsidiaries:Name <strong>of</strong> company and country <strong>of</strong> incorporation Principal business % Capital held<strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> (International) plc - United Kingdom <strong>Bank</strong>ing 100.0NBK Investment Management Limited - United Kingdom Investment management 60.0<strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> (Suisse) S.A. - Switzerland Investment management 100.0<strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> (Lebanon) S.A.L. - Lebanon <strong>Bank</strong>ing 85.5<strong>National</strong> Investors Group Holdings Ltd. - Cayman Islands Investment management 100.0At 31 December <strong>2003</strong>, 38.14% (2002: 38.14 percent) <strong>of</strong> the group’s interest in <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> (Lebanon)S.A.L. was held by an intermediate holding company, NBK Holding (Liban) S.A.L.15 Commitments and contingent liabilities<strong>2003</strong> 2002KD 000’s KD 000’sCommitments on behalf <strong>of</strong> customers for which there arecorresponding liabilities by the customers concerned:Acceptances 72,422 57,986Letters <strong>of</strong> credit 209,774 158,813Guarantees 618,745 584,621Irrevocable commitments to extend credit 413,923 377,9281,314,864 1,179,348In the normal course <strong>of</strong> business the group has exposure to various indirect credit commitments which, though notreflected in the balance sheet, are subject to normal credit standards, financial controls and monitoring procedures.These credit commitments do not necessarily represent future cash requirements, since many <strong>of</strong> these commitmentswill expire or terminate without being funded. Credit losses, if any, which may result from exposure to suchcommitments are not expected to be significant.16 Derivative instrumentsThe group deals in interest rate and foreign exchange derivatives to earn fees, generate trading revenues and manageits asset and liability exposures.Notional principal amounts merely represent amounts to which a rate or price is applied to determine the amounts <strong>of</strong>cash flows to be exchanged and do not represent the potential gain or loss associated with the market or credit risk <strong>of</strong>such instruments.Credit risk in respect <strong>of</strong> derivative financial instruments arises from the potential for a counterparty to default onits contractual obligations and is limited to the positive fair value <strong>of</strong> instruments that are favourable to the group.Exchange-traded contracts are subject to daily margin requirements and are, therefore, deemed to have no additionalcredit risk.42