Standard Guidelines Anti-Money Laundering and Counter Financing ...

Standard Guidelines Anti-Money Laundering and Counter Financing ...

Standard Guidelines Anti-Money Laundering and Counter Financing ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

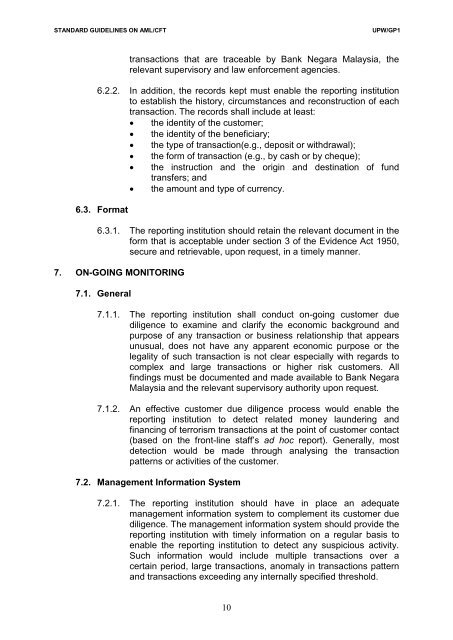

STANDARD GUIDELINES ON AML/CFTUPW/GP1transactions that are traceable by Bank Negara Malaysia, therelevant supervisory <strong>and</strong> law enforcement agencies.6.2.2. In addition, the records kept must enable the reporting institutionto establish the history, circumstances <strong>and</strong> reconstruction of eachtransaction. The records shall include at least: the identity of the customer; the identity of the beneficiary; the type of transaction(e.g., deposit or withdrawal); the form of transaction (e.g., by cash or by cheque); the instruction <strong>and</strong> the origin <strong>and</strong> destination of fundtransfers; <strong>and</strong> the amount <strong>and</strong> type of currency.6.3. Format6.3.1. The reporting institution should retain the relevant document in theform that is acceptable under section 3 of the Evidence Act 1950,secure <strong>and</strong> retrievable, upon request, in a timely manner.7. ON-GOING MONITORING7.1. General7.1.1. The reporting institution shall conduct on-going customer duediligence to examine <strong>and</strong> clarify the economic background <strong>and</strong>purpose of any transaction or business relationship that appearsunusual, does not have any apparent economic purpose or thelegality of such transaction is not clear especially with regards tocomplex <strong>and</strong> large transactions or higher risk customers. Allfindings must be documented <strong>and</strong> made available to Bank NegaraMalaysia <strong>and</strong> the relevant supervisory authority upon request.7.1.2. An effective customer due diligence process would enable thereporting institution to detect related money laundering <strong>and</strong>financing of terrorism transactions at the point of customer contact(based on the front-line staff’s ad hoc report). Generally, mostdetection would be made through analysing the transactionpatterns or activities of the customer.7.2. Management Information System7.2.1. The reporting institution should have in place an adequatemanagement information system to complement its customer duediligence. The management information system should provide thereporting institution with timely information on a regular basis toenable the reporting institution to detect any suspicious activity.Such information would include multiple transactions over acertain period, large transactions, anomaly in transactions pattern<strong>and</strong> transactions exceeding any internally specified threshold.10