Download Report - Independent Evaluation Group - World Bank

Download Report - Independent Evaluation Group - World Bank

Download Report - Independent Evaluation Group - World Bank

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

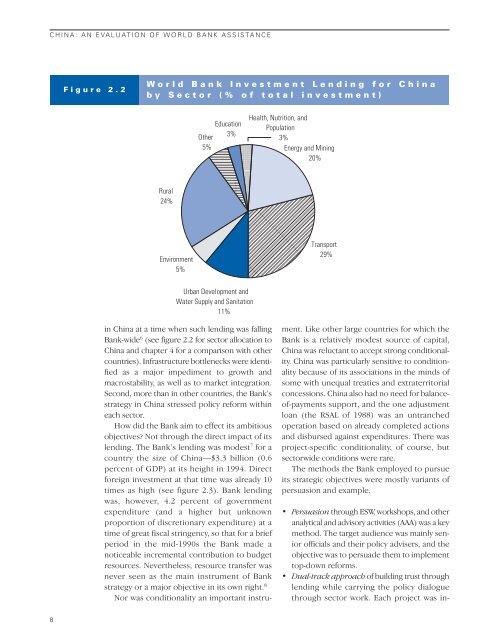

CHINA: AN EVALUATION OF WORLD BANK ASSISTANCEFigure 2.2<strong>World</strong> <strong>Bank</strong> Investment Lending for Chinaby Sector (% of total investment)Other5%Education3%Health, Nutrition, andPopulation3%Energy and Mining20%Rural24%Environment5%Transport29%Urban Development andWater Supply and Sanitation11%in China at a time when such lending was falling<strong>Bank</strong>-wide 6 (see figure 2.2 for sector allocation toChina and chapter 4 for a comparison with othercountries). Infrastructure bottlenecks were identifiedas a major impediment to growth andmacrostability, as well as to market integration.Second, more than in other countries, the <strong>Bank</strong>’sstrategy in China stressed policy reform withineach sector.How did the <strong>Bank</strong> aim to effect its ambitiousobjectives? Not through the direct impact of itslending. The <strong>Bank</strong>’s lending was modest 7 for acountry the size of China—$3.3 billion (0.6percent of GDP) at its height in 1994. Directforeign investment at that time was already 10times as high (see figure 2.3). <strong>Bank</strong> lendingwas, however, 4.2 percent of governmentexpenditure (and a higher but unknownproportion of discretionary expenditure) at atime of great fiscal stringency, so that for a briefperiod in the mid-1990s the <strong>Bank</strong> made anoticeable incremental contribution to budgetresources. Nevertheless, resource transfer wasnever seen as the main instrument of <strong>Bank</strong>strategy or a major objective in its own right. 8Nor was conditionality an important instrument.Like other large countries for which the<strong>Bank</strong> is a relatively modest source of capital,China was reluctant to accept strong conditionality.China was particularly sensitive to conditionalitybecause of its associations in the minds ofsome with unequal treaties and extraterritorialconcessions. China also had no need for balanceof-paymentssupport, and the one adjustmentloan (the RSAL of 1988) was an untranchedoperation based on already completed actionsand disbursed against expenditures. There wasproject-specific conditionality, of course, butsectorwide conditions were rare.The methods the <strong>Bank</strong> employed to pursueits strategic objectives were mostly variants ofpersuasion and example.• Persuasion through ESW, workshops, and otheranalytical and advisory activities (AAA) was a keymethod. The target audience was mainly seniorofficials and their policy advisers, and theobjective was to persuade them to implementtop-down reforms.• Dual-track approach of building trust throughlending while carrying the policy dialoguethrough sector work. Each project was in-8