instruments in interest-rate, currency and ... - Volksbank AG

instruments in interest-rate, currency and ... - Volksbank AG

instruments in interest-rate, currency and ... - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

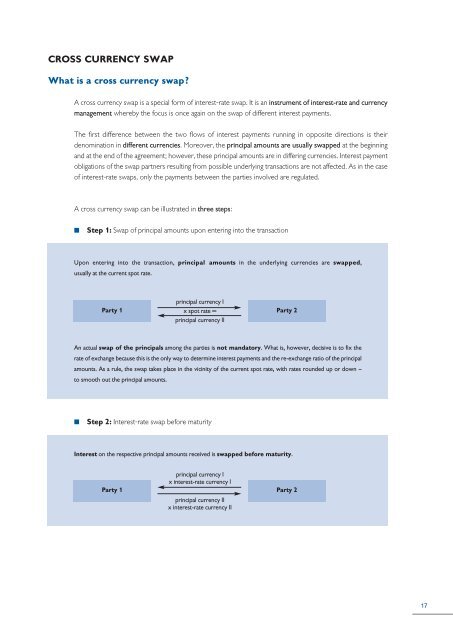

CROSS CURRENCY SWAPWhat is a cross <strong>currency</strong> swap?A cross <strong>currency</strong> swap is a special form of <strong>in</strong>terest-<strong>rate</strong> swap. It is an <strong>in</strong>strument of <strong>in</strong>terest-<strong>rate</strong> <strong>and</strong> <strong>currency</strong>management whereby the focus is once aga<strong>in</strong> on the swap of different <strong>in</strong>terest payments.The first difference between the two flows of <strong>in</strong>terest payments runn<strong>in</strong>g <strong>in</strong> opposite directions is theirdenom<strong>in</strong>ation <strong>in</strong> different currencies. Moreover, the pr<strong>in</strong>cipal amounts are usually swapped at the beg<strong>in</strong>n<strong>in</strong>g<strong>and</strong> at the end of the agreement; however, these pr<strong>in</strong>cipal amounts are <strong>in</strong> differ<strong>in</strong>g currencies. Interest paymentobligations of the swap partners result<strong>in</strong>g from possible underly<strong>in</strong>g transactions are not affected. As <strong>in</strong> the caseof <strong>in</strong>terest-<strong>rate</strong> swaps, only the payments between the parties <strong>in</strong>volved are regulated.A cross <strong>currency</strong> swap can be illust<strong>rate</strong>d <strong>in</strong> three steps:nStep 1: Swap of pr<strong>in</strong>cipal amounts upon enter<strong>in</strong>g <strong>in</strong>to the transactionUpon enter<strong>in</strong>g <strong>in</strong>to the transaction, pr<strong>in</strong>cipal amounts <strong>in</strong> the underly<strong>in</strong>g currencies are swapped,usually at the current spot <strong>rate</strong>.Party 1pr<strong>in</strong>cipal <strong>currency</strong> Ix spot <strong>rate</strong> =pr<strong>in</strong>cipal <strong>currency</strong> IIParty 2An actual swap of the pr<strong>in</strong>cipals among the parties is not m<strong>and</strong>atory. What is, however, decisive is to fix the<strong>rate</strong> of exchange because this is the only way to determ<strong>in</strong>e <strong>in</strong>terest payments <strong>and</strong> the re-exchange ratio of the pr<strong>in</strong>cipalamounts. As a rule, the swap takes place <strong>in</strong> the vic<strong>in</strong>ity of the current spot <strong>rate</strong>, with <strong>rate</strong>s rounded up or down –to smooth out the pr<strong>in</strong>cipal amounts.nStep 2: Interest-<strong>rate</strong> swap before maturityInterest on the respective pr<strong>in</strong>cipal amounts received is swapped before maturity.Party 1pr<strong>in</strong>cipal <strong>currency</strong> Ix <strong>in</strong>terest-<strong>rate</strong> <strong>currency</strong> Ipr<strong>in</strong>cipal <strong>currency</strong> IIx <strong>in</strong>terest-<strong>rate</strong> <strong>currency</strong> IIParty 217