instruments in interest-rate, currency and ... - Volksbank AG

instruments in interest-rate, currency and ... - Volksbank AG

instruments in interest-rate, currency and ... - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

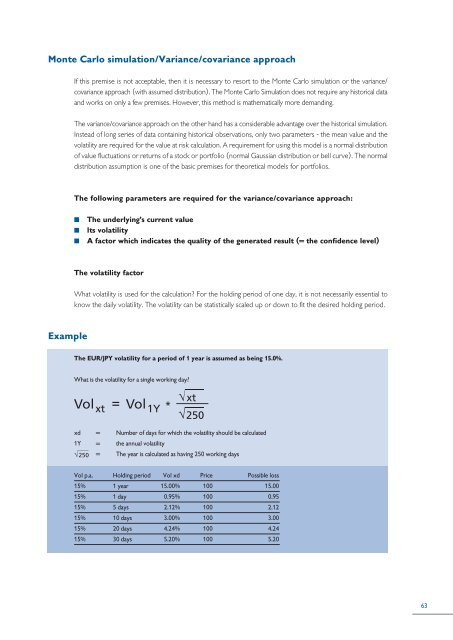

Monte Carlo simulation/Variance/covariance approachIf this premise is not acceptable, then it is necessary to resort to the Monte Carlo simulation or the variance/covariance approach (with assumed distribution). The Monte Carlo Simulation does not require any historical data<strong>and</strong> works on only a few premises. However, this method is mathematically more dem<strong>and</strong><strong>in</strong>g.The variance/covariance approach on the other h<strong>and</strong> has a considerable advantage over the historical simulation.Instead of long series of data conta<strong>in</strong><strong>in</strong>g historical observations, only two parameters - the mean value <strong>and</strong> thevolatility are required for the value at risk calculation. A requirement for us<strong>in</strong>g this model is a normal distributionof value fluctuations or returns of a stock or portfolio (normal Gaussian distribution or bell curve). The normaldistribution assumption is one of the basic premises for theoretical models for portfolios.The follow<strong>in</strong>g parameters are required for the variance/covariance approach:nnnThe underly<strong>in</strong>g’s current valueIts volatilityA factor which <strong>in</strong>dicates the quality of the gene<strong>rate</strong>d result (= the confidence level)The volatility factorWhat volatility is used for the calculation? For the hold<strong>in</strong>g period of one day, it is not necessarily essential toknow the daily volatility. The volatility can be statistically scaled up or down to fit the desired hold<strong>in</strong>g period.ExampleThe EUR/JPY volatility for a period of 1 year is assumed as be<strong>in</strong>g 15.0%.What is the volatility for a s<strong>in</strong>gle work<strong>in</strong>g day?xd = Number of days for which the volatility should be calculated1Y = the annual volatility= The year is calculated as hav<strong>in</strong>g 250 work<strong>in</strong>g daysVol p.a. Hold<strong>in</strong>g period Vol xd Price Possible loss15% 1 year 15.00% 100 15.0015% 1 day 0.95% 100 0.9515% 5 days 2.12% 100 2.1215% 10 days 3.00% 100 3.0015% 20 days 4.24% 100 4.2415% 30 days 5.20% 100 5.2063