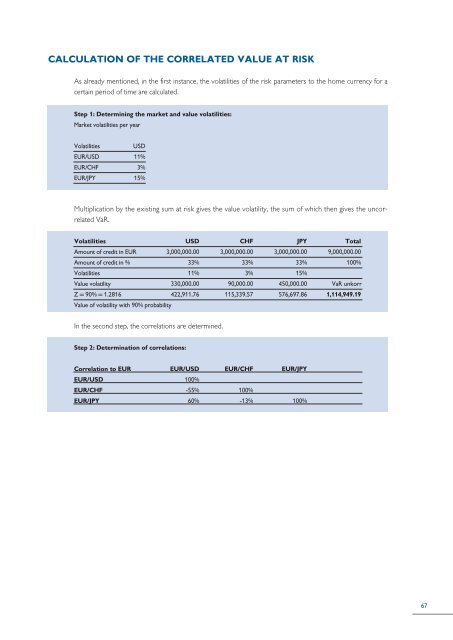

CALCULATION OF THE CORRELATED VALUE AT RISKAs already mentioned, <strong>in</strong> the first <strong>in</strong>stance, the volatilities of the risk parameters to the home <strong>currency</strong> for acerta<strong>in</strong> period of time are calculated.Step 1: Determ<strong>in</strong><strong>in</strong>g the market <strong>and</strong> value volatilities:Market volatilities per yearVolatilitiesUSDEUR/USD 11%EUR/CHF 3%EUR/JPY 15%Multiplication by the exist<strong>in</strong>g sum at risk gives the value volatility, the sum of which then gives the uncorrelatedVaR.Volatilities USD CHF JPY TotalAmount of credit <strong>in</strong> EUR 3,000,000.00 3,000,000.00 3,000,000.00 9,000,000.00Amount of credit <strong>in</strong> % 33% 33% 33% 100%Volatilities 11% 3% 15%Value volatility 330,000.00 90,000.00 450,000.00 VaR unkorrZ = 90% = 1.2816 422,911.76 115,339.57 576,697.86 1,114,949.19Value of volatility with 90% probabilityIn the second step, the correlations are determ<strong>in</strong>ed.Step 2: Determ<strong>in</strong>ation of correlations:Correlation to EUR EUR/USD EUR/CHF EUR/JPYEUR/USD 100%EUR/CHF -55% 100%EUR/JPY 60% -13% 100%67

The calculation of the correlated VaR is done us<strong>in</strong>g the follow<strong>in</strong>g variance/covariance method formula.Calculation of the correlated value at risk:VaR p = Value at risk of the portfolioVaR n = Volatility values of the components of the portfolioC n = Correlation coefficients of the components of the portfolioValue vol USD 2 108,900,000,000.00Value vol CHF 2 8,100,000,000.00Var USD 2 202,500,000,000.002* Corr EURUSD/EURCHF* Value vol JPY* Value vol CHF 32,670,000,000.002* Corr EURJPY/EURUSD* Value vol JPY* Value vol USD 178,200,000,000.002* Corr EURCHF/EURJPY* Value vol USD* Value vol CHF 10,530,000,000.00Total 454,500,000,000.00Square root = VaR 674,166.15Z = 90% = 1.28155079437419 863,978.17VaR correlated 863,978.17The <strong>in</strong>dividual value volatilities are squared <strong>and</strong> connected to one another with the respective correlations.The sum of the risk factors is multiplied by the confidence level.The square root of the sum gives the correlated value at risk.The risk position improves enormously even <strong>in</strong> a simple credit portfolio when the correlations are taken <strong>in</strong>toconsideration. F<strong>in</strong>d<strong>in</strong>g the optimal portfolio is therefore only a question of optimis<strong>in</strong>g the portfolio.The volatilities <strong>and</strong> correlations of the major currencies can be found <strong>in</strong> Group Treasury’sMorn<strong>in</strong>g Mail.THE PATH TO AN OPTIMAL PORTFOLIOThe volatilities <strong>and</strong> correlations have been determ<strong>in</strong>ed. We have also found an <strong>in</strong>itial value for the value at riskof our portfolio.Next we want to improve this value by restructur<strong>in</strong>g the portfolio. Based on the above data, a simple exampleshows: With a foreign <strong>currency</strong> portfolio that is equally distributed with each <strong>currency</strong> form<strong>in</strong>g 1/3 of theportfolio, we have a VaR of EUR 879,493.12.68