can have an effect on employment. The arguments mirror those of the Commission on Taxation (1982)which concluded, with one member dissenting, that “compulsory social insurance contributions are moreappropriately regarded as a tax”, on the basis that they are a compulsory payment to Government andnot directly related to benefits received and that they are included in the classification of taxespublished by international bod<strong>ie</strong>s such as the IMF as well as in National Income Accounts; TheCommission recommended a single social security tax in place of social insurance contributions, to belev<strong>ie</strong>d on all income, at a single rate. This v<strong>ie</strong>w was not shared by the Commission on <strong>Social</strong> <strong>Welfare</strong>(1986); it regarded social insurance contributions as having a significant insurance dimension.Financing the social insurance systemThe system maintains a relationship between labour force status, earnings from work, contributionsmade and, finally, entitlement to benefits in the event of certain specif<strong>ie</strong>d contingenc<strong>ie</strong>s (such as illness,unemployment or old age). As with many social insurance systems throughout the world, the Irishsocial insurance system is based on the “Pay As You Go" principle, whereby current contributors fundthe pensions and benefits of present recip<strong>ie</strong>nts i.e. previous contributors, while also building upentitlement to their own future benefits, in turn paid for by future contributors.Contributions paid under Pay Related <strong>Social</strong> <strong>Insurance</strong> (PRSI) by employers, employees, the selfemployed and voluntary contributors are paid into the <strong>Social</strong> <strong>Insurance</strong> Fund (SIF) 1 . The Fund thenfinances the payment of social insurance payments such as short-term benefits and long-termpensions. The system is not strictly actuarially based insofar that there is no direct link at the individuallevel between contributions and potential benefits. However, the existence of a separate <strong>Social</strong><strong>Insurance</strong> Fund means that such a link can be made at the wider level given the nature of the SIF andPRSI contributions are earmarked for particular social insurance benefits. They are not generally used forpurposes other than payment of benefits and are therefore not the same as taxes, dut<strong>ie</strong>s or othercharges which are used to finance Exchequer expenditure generally. In recent years, the first actuarialrev<strong>ie</strong>w of the system was undertaken and such rev<strong>ie</strong>ws are required under social welfare legislationevery five years, so as to gauge the overall long-term sustainability and costs of the system,independently of the broader Government financial picture (Govt. of Ireland, 2002a).The SIF comprises a current account and an investment account. The Minister for <strong>Social</strong> and FamilyAffairs manages and controls the current account of the Fund while the Minister for Finance managesand controls the investment account. Benefits payments are paid from the current account. To theextent that annual income is not required for benefit payments, it is retained in the investment accountand this finance together with the accumulated surplus form previous years, is transferred to theinvestment account which is managed by the Minister for Finance (through the National TreasuryManagement Agency). Both the income arising from these investments and the capital is available forcurrent payments if and when required. The Comptroller and Auditor General has responsibility forauditing, on a yearly basis, the accounts of the SIF.Trends in income and expenditureTable 1.1 compares total social insurance expenditure with total social welfare expenditure over the pastnumber of years. From 1991 to 2003, social insurance expenditure increased by 251%; it now accountsfor almost 46% of total social welfare spending, or almost 55% excluding Child Benefit. The main reasonfor the increase was the rise in the real value of benefits, as well as an increase in the numbers ofpensioners and recip<strong>ie</strong>nts.1 While the Health Contribution and the Industrial Training (Apprenticeship) Levy are collected with PRSI, these mon<strong>ie</strong>s are not used for <strong>Social</strong><strong>Insurance</strong> purposes and have no connection with the SIF.DEVELOPING A FULLY INCLUSIVE SOCIAL INSURANCE MODEL3

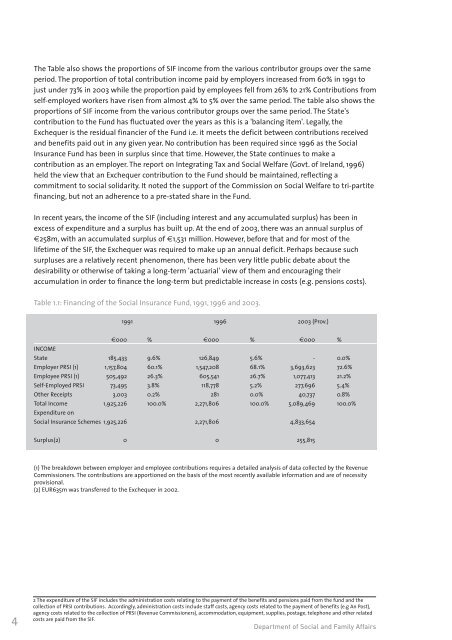

The Table also shows the proportions of SIF income from the various contributor groups over the sameperiod. The proportion of total contribution income paid by employers increased from 60% in 1991 tojust under 73% in 2003 while the proportion paid by employees fell from 26% to 21% Contributions fromself-employed workers have risen from almost 4% to 5% over the same period. The table also shows theproportions of SIF income from the various contributor groups over the same period. The State'scontribution to the Fund has fluctuated over the years as this is a 'balancing item'. Legally, theExchequer is the residual financ<strong>ie</strong>r of the Fund i.e. it meets the deficit between contributions receivedand benefits paid out in any given year. No contribution has been required since 1996 as the <strong>Social</strong><strong>Insurance</strong> Fund has been in surplus since that time. However, the State continues to make acontribution as an employer. The report on Integrating Tax and <strong>Social</strong> <strong>Welfare</strong> (Govt. of Ireland, 1996)held the v<strong>ie</strong>w that an Exchequer contribution to the Fund should be maintained, reflecting acommitment to social solidarity. It noted the support of the Commission on <strong>Social</strong> <strong>Welfare</strong> to tri-partitefinancing, but not an adherence to a pre-stated share in the Fund.In recent years, the income of the SIF (including interest and any accumulated surplus) has been inexcess of expenditure and a surplus has built up. At the end of 2003, there was an annual surplus of€258m, with an accumulated surplus of €1,531 million. However, before that and for most of thelifetime of the SIF, the Exchequer was required to make up an annual deficit. Perhaps because suchsurpluses are a relatively recent phenomenon, there has been very little public debate about thedesirability or otherwise of taking a long-term 'actuarial' v<strong>ie</strong>w of them and encouraging theiraccumulation in order to finance the long-term but predictable increase in costs (e.g. pensions costs).Table 1.1: Financing of the <strong>Social</strong> <strong>Insurance</strong> Fund, 1991, 1996 and 2003.1991 1996 2003 (Prov.)€000 % €000 % €000 %INCOMEState 185,433 9.6% 126,849 5.6% - 0.0%Employer PRSI (1) 1,157,804 60.1% 1,547,208 68.1% 3,693,623 72.6%Employee PRSI (1) 505,492 26.3% 605,541 26.7% 1,077,413 21.2%Self-Employed PRSI 73,495 3.8% 118,778 5.2% 277,696 5.4%Other Receipts 3,003 0.2% 281 0.0% 40,737 0.8%Total Income 1,925,226 100.0% 2,271,806 100.0% 5,089,469 100.0%Expenditure on<strong>Social</strong> <strong>Insurance</strong> Schemes 1,925,226 2,271,806 4,833,654Surplus(2) 0 0 255,815(1) The breakdown between employer and employee contributions requires a detailed analysis of data collected by the RevenueCommissioners. The contributions are apportioned on the basis of the most recently available information and are of necessityprovisional.(2) EUR635m was transferred to the Exchequer in 2002.42 The expenditure of the SIF includes the administration costs relating to the payment of the benefits and pensions paid from the fund and thecollection of PRSI contributions. Accordingly, administration costs include staff costs, agency costs related to the payment of benefits (e.g An Post),agency costs related to the collection of PRSI (Revenue Commissioners), accommodation, equipment, suppl<strong>ie</strong>s, postage, telephone and other relatedcosts are paid from the SIF.Department of <strong>Social</strong> and Family Affairs