Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

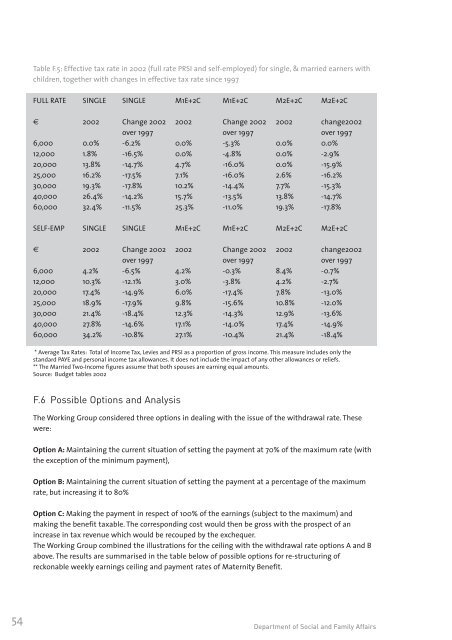

Table F.5: Effective tax rate in 2002 (full rate PRSI and self-employed) for single, & marr<strong>ie</strong>d earners withchildren, together with changes in effective tax rate since 1997FULL RATE SINGLE SINGLE M1E+2C M1E+2C M2E+2C M2E+2C€ 2002 Change 2002 2002 Change 2002 2002 change2002over 1997 over 1997 over 19976,000 0.0% -6.2% 0.0% -5.3% 0.0% 0.0%12,000 1.8% -16.5% 0.0% -4.8% 0.0% -2.9%20,000 13.8% -14.7% 4.7% -16.0% 0.0% -15.9%25,000 16.2% -17.5% 7.1% -16.0% 2.6% -16.2%30,000 19.3% -17.8% 10.2% -14.4% 7.7% -15.3%40,000 26.4% -14.2% 15.7% -13.5% 13.8% -14.7%60,000 32.4% -11.5% 25.3% -11.0% 19.3% -17.8%SELF-EMP SINGLE SINGLE M1E+2C M1E+2C M2E+2C M2E+2C€ 2002 Change 2002 2002 Change 2002 2002 change2002over 1997 over 1997 over 19976,000 4.2% -6.5% 4.2% -0.3% 8.4% -0.7%12,000 10.3% -12.1% 3.0% -3.8% 4.2% -2.7%20,000 17.4% -14.9% 6.0% -17.4% 7.8% -13.0%25,000 18.9% -17.9% 9.8% -15.6% 10.8% -12.0%30,000 21.4% -18.4% 12.3% -14.3% 12.9% -13.6%40,000 27.8% -14.6% 17.1% -14.0% 17.4% -14.9%60,000 34.2% -10.8% 27.1% -10.4% 21.4% -18.4%* Average Tax Rates: Total of Income Tax, Lev<strong>ie</strong>s and PRSI as a proportion of gross income. This measure includes only thestandard PAYE and personal income tax allowances. It does not include the impact of any other allowances or rel<strong>ie</strong>fs.** The Marr<strong>ie</strong>d Two-Income figures assume that both spouses are earning equal amounts.Source: Budget tables 2002F.6 Possible Options and AnalysisThe Working Group considered three options in dealing with the issue of the withdrawal rate. Thesewere:Option A: Maintaining the current situation of setting the payment at 70% of the maximum rate (withthe exception of the minimum payment),Option B: Maintaining the current situation of setting the payment at a percentage of the maximumrate, but increasing it to 80%Option C: Making the payment in respect of 100% of the earnings (subject to the maximum) andmaking the benefit taxable. The corresponding cost would then be gross with the prospect of anincrease in tax revenue which would be recouped by the exchequer.The Working Group combined the illustrations for the ceiling with the withdrawal rate options A and Babove. The results are summarised in the table below of possible options for re-structuring ofreckonable weekly earnings ceiling and payment rates of Maternity Benefit.54Department of <strong>Social</strong> and Family Affairs