Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

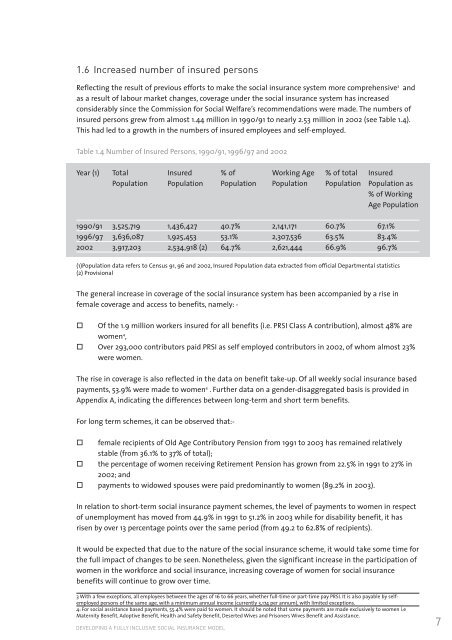

1.6 Increased number of insured personsReflecting the result of previous efforts to make the social insurance system more comprehensive 3 andas a result of labour market changes, coverage under the social insurance system has increasedconsiderably since the Commission for <strong>Social</strong> <strong>Welfare</strong>’s recommendations were made. The numbers ofinsured persons grew from almost 1.44 million in 1990/91 to nearly 2.53 million in 2002 (see Table 1.4).This had led to a growth in the numbers of insured employees and self-employed.Table 1.4 Number of Insured Persons, 1990/91, 1996/97 and 2002Year (1) Total Insured % of Working Age % of total InsuredPopulation Population Population Population Population Population as% of WorkingAge Population1990/91 3,525,719 1,436,427 40.7% 2,141,171 60.7% 67.1%1996/97 3,636,087 1,925,453 53.1% 2,307,536 63.5% 83.4%2002 3,917,203 2,534,918 (2) 64.7% 2,621,444 66.9% 96.7%(1)Population data refers to Census 91, 96 and 2002, Insured Population data extracted from official Departmental statistics(2) ProvisionalThe general increase in coverage of the social insurance system has been accompan<strong>ie</strong>d by a rise infemale coverage and access to benefits, namely: -" Of the 1.9 million workers insured for all benefits (i.e. PRSI Class A contribution), almost 48% arewomen 4 ," Over 293,000 contributors paid PRSI as self employed contributors in 2002, of whom almost 23%were women.The rise in coverage is also reflected in the data on benefit take-up. Of all weekly social insurance basedpayments, 53.9% were made to women 4 . Further data on a gender-disaggregated basis is provided inAppendix A, indicating the differences between long-term and short term benefits.For long term schemes, it can be observed that:-" female recip<strong>ie</strong>nts of Old Age Contributory Pension from 1991 to 2003 has remained relativelystable (from 36.1% to 37% of total);" the percentage of women receiving Retirement Pension has grown from 22.5% in 1991 to 27% in2002; and" payments to widowed spouses were paid predominantly to women (89.2% in 2003).In relation to short-term social insurance payment schemes, the level of payments to women in respectof unemployment has moved from 44.9% in 1991 to 51.2% in 2003 while for disability benefit, it hasrisen by over 13 percentage points over the same period (from 49.2 to 62.8% of recip<strong>ie</strong>nts).It would be expected that due to the nature of the social insurance scheme, it would take some time forthe full impact of changes to be seen. Nonetheless, given the significant increase in the participation ofwomen in the workforce and social insurance, increasing coverage of women for social insurancebenefits will continue to grow over time.3 With a few exceptions, all employees between the ages of 16 to 66 years, whether full-time or part-time pay PRSI. It is also payable by selfemployedpersons of the same age, with a minimum annual income (currently 3,174 per annum), with limited exceptions.4: For social assistance based payments, 55.4% were paid to women. It should be noted that some payments are made exclusively to women i.eMaternity Benefit, Adoptive Benefit, Health and Safety Benefit, Deserted Wives and Prisoners Wives Benefit and Assistance.DEVELOPING A FULLY INCLUSIVE SOCIAL INSURANCE MODEL7