Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

Developing a Fully Inclusive Social Insurance Model - Welfare.ie

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

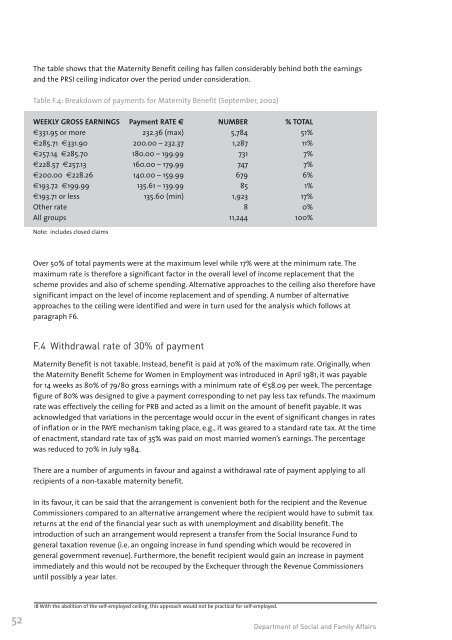

The table shows that the Maternity Benefit ceiling has fallen considerably behind both the earningsand the PRSI ceiling indicator over the period under consideration.Table F.4: Breakdown of payments for Maternity Benefit (September, 2002)WEEKLY GROSS EARNINGS Payment RATE € NUMBER % TOTAL€331.95 or more 232.36 (max) 5,784 51%€285.71 €331.90 200.00 – 232.37 1,287 11%€257.14 €285.70 180.00 – 199.99 731 7%€228.57 €257.13 160.00 – 179.99 747 7%€200.00 €228.26 140.00 – 159.99 679 6%€193.72 €199.99 135.61 – 139.99 85 1%€193.71 or less 135.60 (min) 1,923 17%Other rate 8 0%All groups 11,244 100%Note: includes closed claimsOver 50% of total payments were at the maximum level while 17% were at the minimum rate. Themaximum rate is therefore a significant factor in the overall level of income replacement that thescheme provides and also of scheme spending. Alternative approaches to the ceiling also therefore havesignificant impact on the level of income replacement and of spending. A number of alternativeapproaches to the ceiling were identif<strong>ie</strong>d and were in turn used for the analysis which follows atparagraph F6.F.4 Withdrawal rate of 30% of paymentMaternity Benefit is not taxable. Instead, benefit is paid at 70% of the maximum rate. Originally, whenthe Maternity Benefit Scheme for Women in Employment was introduced in April 1981, it was payablefor 14 weeks as 80% of 79/80 gross earnings with a minimum rate of €58.09 per week. The percentagefigure of 80% was designed to give a payment corresponding to net pay less tax refunds. The maximumrate was effectively the ceiling for PRB and acted as a limit on the amount of benefit payable. It wasacknowledged that variations in the percentage would occur in the event of significant changes in ratesof inflation or in the PAYE mechanism taking place, e.g., it was geared to a standard rate tax. At the timeof enactment, standard rate tax of 35% was paid on most marr<strong>ie</strong>d women’s earnings. The percentagewas reduced to 70% in July 1984.There are a number of arguments in favour and against a withdrawal rate of payment applying to allrecip<strong>ie</strong>nts of a non-taxable maternity benefit.In its favour, it can be said that the arrangement is conven<strong>ie</strong>nt both for the recip<strong>ie</strong>nt and the RevenueCommissioners compared to an alternative arrangement where the recip<strong>ie</strong>nt would have to submit taxreturns at the end of the financial year such as with unemployment and disability benefit. Theintroduction of such an arrangement would represent a transfer from the <strong>Social</strong> <strong>Insurance</strong> Fund togeneral taxation revenue (i.e. an ongoing increase in fund spending which would be recovered ingeneral government revenue). Furthermore, the benefit recip<strong>ie</strong>nt would gain an increase in paymentimmediately and this would not be recouped by the Exchequer through the Revenue Commissionersuntil possibly a year later.5218 With the abolition of the self-employed ceiling, this approach would not be practical for self-employed.Department of <strong>Social</strong> and Family Affairs