disciplinary handbook: volume v - Supreme Court - State of Ohio

disciplinary handbook: volume v - Supreme Court - State of Ohio

disciplinary handbook: volume v - Supreme Court - State of Ohio

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

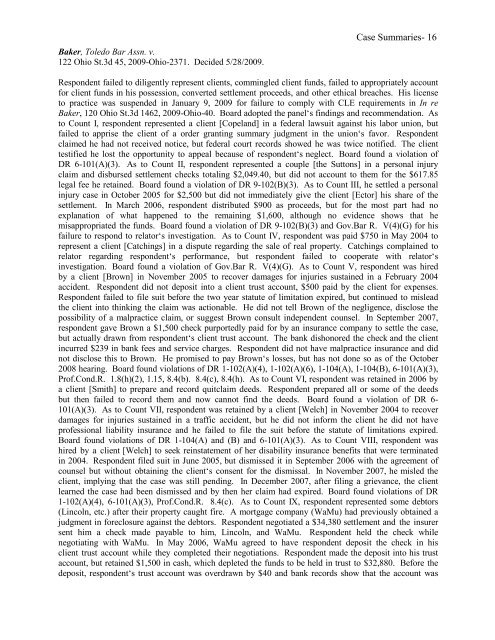

Baker, Toledo Bar Assn. v.122 <strong>Ohio</strong> St.3d 45, 2009-<strong>Ohio</strong>-2371. Decided 5/28/2009.Case Summaries- 16Respondent failed to diligently represent clients, commingled client funds, failed to appropriately accountfor client funds in his possession, converted settlement proceeds, and other ethical breaches. His licenseto practice was suspended in January 9, 2009 for failure to comply with CLE requirements in In reBaker, 120 <strong>Ohio</strong> St.3d 1462, 2009-<strong>Ohio</strong>-40. Board adopted the panel‘s findings and recommendation. Asto Count I, respondent represented a client [Copeland] in a federal lawsuit against his labor union, butfailed to apprise the client <strong>of</strong> a order granting summary judgment in the union‘s favor. Respondentclaimed he had not received notice, but federal court records showed he was twice notified. The clienttestified he lost the opportunity to appeal because <strong>of</strong> respondent‘s neglect. Board found a violation <strong>of</strong>DR 6-101(A)(3). As to Count II, respondent represented a couple [the Suttons] in a personal injuryclaim and disbursed settlement checks totaling $2,049.40, but did not account to them for the $617.85legal fee he retained. Board found a violation <strong>of</strong> DR 9-102(B)(3). As to Count III, he settled a personalinjury case in October 2005 for $2,500 but did not immediately give the client [Ector] his share <strong>of</strong> thesettlement. In March 2006, respondent distributed $900 as proceeds, but for the most part had noexplanation <strong>of</strong> what happened to the remaining $1,600, although no evidence shows that hemisappropriated the funds. Board found a violation <strong>of</strong> DR 9-102(B)(3) and Gov.Bar R. V(4)(G) for hisfailure to respond to relator‘s investigation. As to Count IV, respondent was paid $750 in May 2004 torepresent a client [Catchings] in a dispute regarding the sale <strong>of</strong> real property. Catchings complained torelator regarding respondent‘s performance, but respondent failed to cooperate with relator‘sinvestigation. Board found a violation <strong>of</strong> Gov.Bar R. V(4)(G). As to Count V, respondent was hiredby a client [Brown] in November 2005 to recover damages for injuries sustained in a February 2004accident. Respondent did not deposit into a client trust account, $500 paid by the client for expenses.Respondent failed to file suit before the two year statute <strong>of</strong> limitation expired, but continued to misleadthe client into thinking the claim was actionable. He did not tell Brown <strong>of</strong> the negligence, disclose thepossibility <strong>of</strong> a malpractice claim, or suggest Brown consult independent counsel. In September 2007,respondent gave Brown a $1,500 check purportedly paid for by an insurance company to settle the case,but actually drawn from respondent‘s client trust account. The bank dishonored the check and the clientincurred $239 in bank fees and service charges. Respondent did not have malpractice insurance and didnot disclose this to Brown. He promised to pay Brown‘s losses, but has not done so as <strong>of</strong> the October2008 hearing. Board found violations <strong>of</strong> DR 1-102(A)(4), 1-102(A)(6), 1-104(A), 1-104(B), 6-101(A)(3),Pr<strong>of</strong>.Cond.R. 1.8(h)(2), 1.15, 8.4(b). 8.4(c), 8.4(h). As to Count VI, respondent was retained in 2006 bya client [Smith] to prepare and record quitclaim deeds. Respondent prepared all or some <strong>of</strong> the deedsbut then failed to record them and now cannot find the deeds. Board found a violation <strong>of</strong> DR 6-101(A)(3). As to Count VII, respondent was retained by a client [Welch] in November 2004 to recoverdamages for injuries sustained in a traffic accident, but he did not inform the client he did not havepr<strong>of</strong>essional liability insurance and he failed to file the suit before the statute <strong>of</strong> limitations expired.Board found violations <strong>of</strong> DR 1-104(A) and (B) and 6-101(A)(3). As to Count VIII, respondent washired by a client [Welch] to seek reinstatement <strong>of</strong> her disability insurance benefits that were terminatedin 2004. Respondent filed suit in June 2005, but dismissed it in September 2006 with the agreement <strong>of</strong>counsel but without obtaining the client‘s consent for the dismissal. In November 2007, he misled theclient, implying that the case was still pending. In December 2007, after filing a grievance, the clientlearned the case had been dismissed and by then her claim had expired. Board found violations <strong>of</strong> DR1-102(A)(4), 6-101(A)(3), Pr<strong>of</strong>.Cond.R. 8.4(c). As to Count IX, respondent represented some debtors(Lincoln, etc.) after their property caught fire. A mortgage company (WaMu) had previously obtained ajudgment in foreclosure against the debtors. Respondent negotiated a $34,380 settlement and the insurersent him a check made payable to him, Lincoln, and WaMu. Respondent held the check whilenegotiating with WaMu. In May 2006, WaMu agreed to have respondent deposit the check in hisclient trust account while they completed their negotiations. Respondent made the deposit into his trustaccount, but retained $1,500 in cash, which depleted the funds to be held in trust to $32,880. Before thedeposit, respondent‘s trust account was overdrawn by $40 and bank records show that the account was