Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

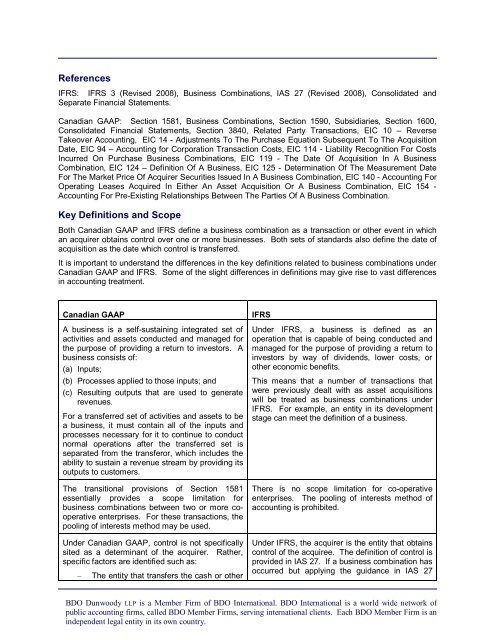

References<strong>IFRS</strong>: <strong>IFRS</strong> 3 (Revised 2008), <strong>Business</strong> <strong>Combinations</strong>, IAS 27 (Revised 2008), Consolidated andSeparate Financial Statements.<strong>Canadian</strong> <strong>GAAP</strong>: Section 1581, <strong>Business</strong> <strong>Combinations</strong>, Section 1590, Subsidiaries, Section 1600,Consolidated Financial Statements, Section 3840, Related Party Transactions, EIC 10 – ReverseTakeover Accounting, EIC 14 - Adjustments To The Purchase Equation Subsequent To The AcquisitionDate, EIC 94 – Accounting for Corporation Transaction Costs, EIC 114 - Liability Recognition For CostsIncurred On Purchase <strong>Business</strong> <strong>Combinations</strong>, EIC 119 - The Date Of Acquisition In A <strong>Business</strong>Combination, EIC 124 – Definition Of A <strong>Business</strong>, EIC 125 - Determination Of The Measurement DateFor The Market Price Of Acquirer Securities Issued In A <strong>Business</strong> Combination, EIC 140 - Accounting ForOperating Leases Acquired In Either An Asset Acquisition Or A <strong>Business</strong> Combination, EIC 154 -Accounting For Pre-Existing Relationships Between The Parties Of A <strong>Business</strong> Combination.Key Definitions and ScopeBoth <strong>Canadian</strong> <strong>GAAP</strong> and <strong>IFRS</strong> define a business combination as a transaction or other event in whichan acquirer obtains control over one or more businesses. Both sets of standards also define the date ofacquisition as the date which control is transferred.It is important to understand the differences in the key definitions related to business combinations under<strong>Canadian</strong> <strong>GAAP</strong> and <strong>IFRS</strong>. Some of the slight differences in definitions may give rise to vast differencesin accounting treatment.<strong>Canadian</strong> <strong>GAAP</strong>A business is a self-sustaining integrated set ofactivities and assets conducted and managed forthe purpose of providing a return to investors. Abusiness consists of:(a) Inputs;(b) Processes applied to those inputs; and(c) Resulting outputs that are used to generaterevenues.For a transferred set of activities and assets to bea business, it must contain all of the inputs andprocesses necessary for it to continue to conductnormal operations after the transferred set isseparated from the transferor, which includes theability to sustain a revenue stream by providing itsoutputs to customers.The transitional provisions of Section 1581essentially provides a scope limitation forbusiness combinations between two or more cooperativeenterprises. For these transactions, thepooling of interests method may be used.Under <strong>Canadian</strong> <strong>GAAP</strong>, control is not specificallysited as a determinant of the acquirer. Rather,specific factors are identified such as:– The entity that transfers the cash or other<strong>IFRS</strong>Under <strong>IFRS</strong>, a business is defined as anoperation that is capable of being conducted andmanaged for the purpose of providing a return toinvestors by way of dividends, lower costs, orother economic benefits.This means that a number of transactions thatwere previously dealt with as asset acquisitionswill be treated as business combinations under<strong>IFRS</strong>. For example, an entity in its developmentstage can meet the definition of a business.There is no scope limitation for co-operativeenterprises. The pooling of interests method ofaccounting is prohibited.Under <strong>IFRS</strong>, the acquirer is the entity that obtainscontrol of the acquiree. The definition of control isprovided in IAS 27. If a business combination hasoccurred but applying the guidance in IAS 27BDO Dunwoody LLP is a Member Firm of BDO International. BDO International is a world wide network ofpublic accounting firms, called BDO Member Firms, serving international clients. Each BDO Member Firm is anindependent legal entity in its own country.