Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

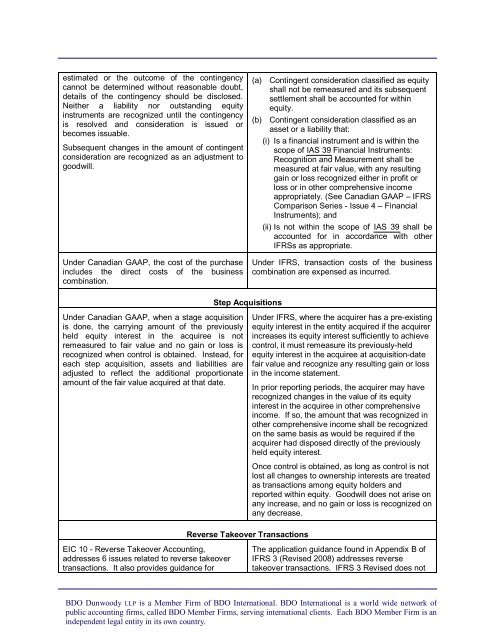

estimated or the outcome of the contingencycannot be determined without reasonable doubt,details of the contingency should be disclosed.Neither a liability nor outstanding equityinstruments are recognized until the contingencyis resolved and consideration is issued orbecomes issuable.Subsequent changes in the amount of contingentconsideration are recognized as an adjustment togoodwill.Under <strong>Canadian</strong> <strong>GAAP</strong>, the cost of the purchaseincludes the direct costs of the businesscombination.(a) Contingent consideration classified as equityshall not be remeasured and its subsequentsettlement shall be accounted for withinequity.(b) Contingent consideration classified as anasset or a liability that:(i) Is a financial instrument and is within thescope of IAS 39 Financial Instruments:Recognition and Measurement shall bemeasured at fair value, with any resultinggain or loss recognized either in profit orloss or in other comprehensive incomeappropriately. (See <strong>Canadian</strong> <strong>GAAP</strong> – <strong>IFRS</strong>Comparison <strong>Series</strong> - Issue 4 – FinancialInstruments); and(ii) Is not within the scope of IAS 39 shall beaccounted for in accordance with other<strong>IFRS</strong>s as appropriate.Under <strong>IFRS</strong>, transaction costs of the businesscombination are expensed as incurred.Step AcquisitionsUnder <strong>Canadian</strong> <strong>GAAP</strong>, when a stage acquisitionis done, the carrying amount of the previouslyheld equity interest in the acquiree is notremeasured to fair value and no gain or loss isrecognized when control is obtained. Instead, foreach step acquisition, assets and liabilities areadjusted to reflect the additional proportionateamount of the fair value acquired at that date.Under <strong>IFRS</strong>, where the acquirer has a pre-existingequity interest in the entity acquired if the acquirerincreases its equity interest sufficiently to achievecontrol, it must remeasure its previously-heldequity interest in the acquiree at acquisition-datefair value and recognize any resulting gain or lossin the income statement.In prior reporting periods, the acquirer may haverecognized changes in the value of its equityinterest in the acquiree in other comprehensiveincome. If so, the amount that was recognized inother comprehensive income shall be recognizedon the same basis as would be required if theacquirer had disposed directly of the previouslyheld equity interest.Once control is obtained, as long as control is notlost all changes to ownership interests are treatedas transactions among equity holders andreported within equity. Goodwill does not arise onany increase, and no gain or loss is recognized onany decrease.Reverse Takeover TransactionsEIC 10 - Reverse Takeover Accounting,addresses 6 issues related to reverse takeovertransactions. It also provides guidance forThe application guidance found in Appendix B of<strong>IFRS</strong> 3 (Revised 2008) addresses reversetakeover transactions. <strong>IFRS</strong> 3 Revised does notBDO Dunwoody LLP is a Member Firm of BDO International. BDO International is a world wide network ofpublic accounting firms, called BDO Member Firms, serving international clients. Each BDO Member Firm is anindependent legal entity in its own country.