Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

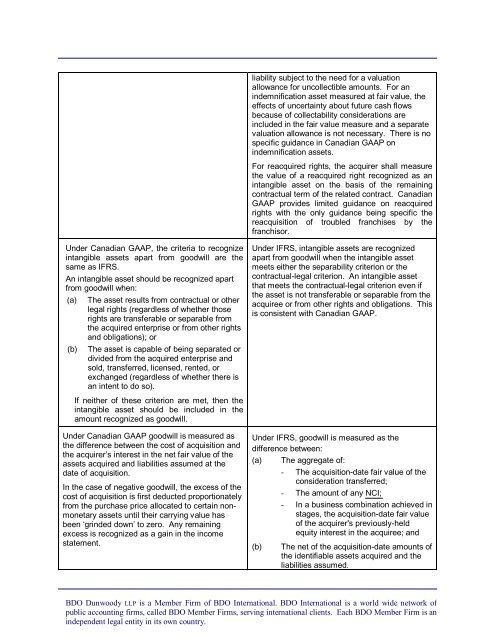

liability subject to the need for a valuationallowance for uncollectible amounts. For anindemnification asset measured at fair value, theeffects of uncertainty about future cash flowsbecause of collectability considerations areincluded in the fair value measure and a separatevaluation allowance is not necessary. There is nospecific guidance in <strong>Canadian</strong> <strong>GAAP</strong> onindemnification assets.For reacquired rights, the acquirer shall measurethe value of a reacquired right recognized as anintangible asset on the basis of the remainingcontractual term of the related contract. <strong>Canadian</strong><strong>GAAP</strong> provides limited guidance on reacquiredrights with the only guidance being specific thereacquisition of troubled franchises by thefranchisor.Under <strong>Canadian</strong> <strong>GAAP</strong>, the criteria to recognizeintangible assets apart from goodwill are thesame as <strong>IFRS</strong>.An intangible asset should be recognized apartfrom goodwill when:(a)(b)The asset results from contractual or otherlegal rights (regardless of whether thoserights are transferable or separable fromthe acquired enterprise or from other rightsand obligations); orThe asset is capable of being separated ordivided from the acquired enterprise andsold, transferred, licensed, rented, orexchanged (regardless of whether there isan intent to do so).Under <strong>IFRS</strong>, intangible assets are recognizedapart from goodwill when the intangible assetmeets either the separability criterion or thecontractual-legal criterion. An intangible assetthat meets the contractual-legal criterion even ifthe asset is not transferable or separable from theacquiree or from other rights and obligations. Thisis consistent with <strong>Canadian</strong> <strong>GAAP</strong>.If neither of these criterion are met, then theintangible asset should be included in theamount recognized as goodwill.Under <strong>Canadian</strong> <strong>GAAP</strong> goodwill is measured asthe difference between the cost of acquisition andthe acquirer’s interest in the net fair value of theassets acquired and liabilities assumed at thedate of acquisition.In the case of negative goodwill, the excess of thecost of acquisition is first deducted proportionatelyfrom the purchase price allocated to certain nonmonetaryassets until their carrying value hasbeen ‘grinded down’ to zero. Any remainingexcess is recognized as a gain in the incomestatement.Under <strong>IFRS</strong>, goodwill is measured as thedifference between:(a) The aggregate of:(b)- The acquisition-date fair value of theconsideration transferred;- The amount of any NCI;- In a business combination achieved instages, the acquisition-date fair valueof the acquirer's previously-heldequity interest in the acquiree; andThe net of the acquisition-date amounts ofthe identifiable assets acquired and theliabilities assumed.BDO Dunwoody LLP is a Member Firm of BDO International. BDO International is a world wide network ofpublic accounting firms, called BDO Member Firms, serving international clients. Each BDO Member Firm is anindependent legal entity in its own country.