Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Business Combinations - IFRS Canadian GAAP Differences Series

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

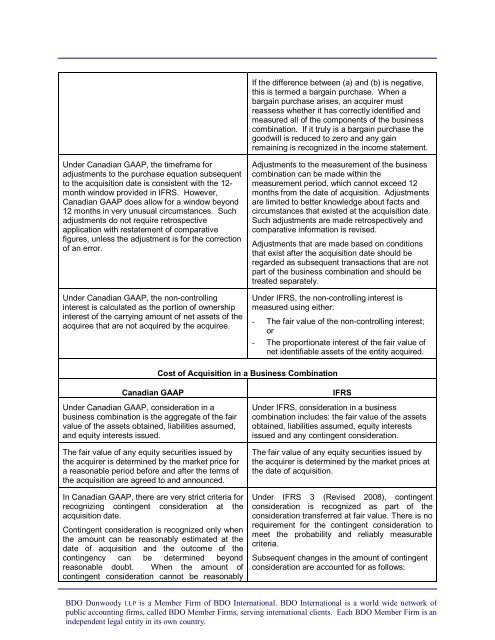

If the difference between (a) and (b) is negative,this is termed a bargain purchase. When abargain purchase arises, an acquirer mustreassess whether it has correctly identified andmeasured all of the components of the businesscombination. If it truly is a bargain purchase thegoodwill is reduced to zero and any gainremaining is recognized in the income statement.Under <strong>Canadian</strong> <strong>GAAP</strong>, the timeframe foradjustments to the purchase equation subsequentto the acquisition date is consistent with the 12-month window provided in <strong>IFRS</strong>. However,<strong>Canadian</strong> <strong>GAAP</strong> does allow for a window beyond12 months in very unusual circumstances. Suchadjustments do not require retrospectiveapplication with restatement of comparativefigures, unless the adjustment is for the correctionof an error.Under <strong>Canadian</strong> <strong>GAAP</strong>, the non-controllinginterest is calculated as the portion of ownershipinterest of the carrying amount of net assets of theacquiree that are not acquired by the acquiree.Adjustments to the measurement of the businesscombination can be made within themeasurement period, which cannot exceed 12months from the date of acquisition. Adjustmentsare limited to better knowledge about facts andcircumstances that existed at the acquisition date.Such adjustments are made retrospectively andcomparative information is revised.Adjustments that are made based on conditionsthat exist after the acquisition date should beregarded as subsequent transactions that are notpart of the business combination and should betreated separately.Under <strong>IFRS</strong>, the non-controlling interest ismeasured using either:- The fair value of the non-controlling interest;or- The proportionate interest of the fair value ofnet identifiable assets of the entity acquired.Cost of Acquisition in a <strong>Business</strong> Combination<strong>Canadian</strong> <strong>GAAP</strong>Under <strong>Canadian</strong> <strong>GAAP</strong>, consideration in abusiness combination is the aggregate of the fairvalue of the assets obtained, liabilities assumed,and equity interests issued.The fair value of any equity securities issued bythe acquirer is determined by the market price fora reasonable period before and after the terms ofthe acquisition are agreed to and announced.In <strong>Canadian</strong> <strong>GAAP</strong>, there are very strict criteria forrecognizing contingent consideration at theacquisition date.Contingent consideration is recognized only whenthe amount can be reasonably estimated at thedate of acquisition and the outcome of thecontingency can be determined beyondreasonable doubt. When the amount ofcontingent consideration cannot be reasonably<strong>IFRS</strong>Under <strong>IFRS</strong>, consideration in a businesscombination includes: the fair value of the assetsobtained, liabilities assumed, equity interestsissued and any contingent consideration.The fair value of any equity securities issued bythe acquirer is determined by the market prices atthe date of acquisition.Under <strong>IFRS</strong> 3 (Revised 2008), contingentconsideration is recognized as part of theconsideration transferred at fair value. There is norequirement for the contingent consideration tomeet the probability and reliably measurablecriteria.Subsequent changes in the amount of contingentconsideration are accounted for as follows:BDO Dunwoody LLP is a Member Firm of BDO International. BDO International is a world wide network ofpublic accounting firms, called BDO Member Firms, serving international clients. Each BDO Member Firm is anindependent legal entity in its own country.