Introductory Document - Colombo Stock Exchange

Introductory Document - Colombo Stock Exchange

Introductory Document - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

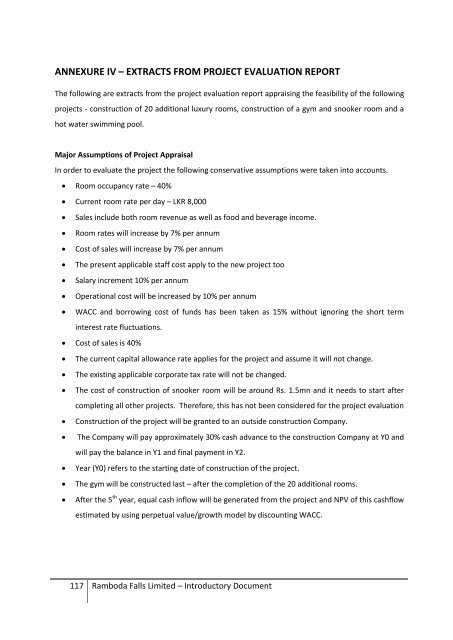

ANNEXURE IV – EXTRACTS FROM PROJECT EVALUATION REPORTThe following are extracts from the project evaluation report appraising the feasibility of the followingprojects - construction of 20 additional luxury rooms, construction of a gym and snooker room and ahot water swimming pool.Major Assumptions of Project AppraisalIn order to evaluate the project the following conservative assumptions were taken into accounts. Room occupancy rate – 40% Current room rate per day – LKR 8,000 Sales include both room revenue as well as food and beverage income. Room rates will increase by 7% per annum Cost of sales will increase by 7% per annum The present applicable staff cost apply to the new project too Salary increment 10% per annum Operational cost will be increased by 10% per annum WACC and borrowing cost of funds has been taken as 15% without ignoring the short terminterest rate fluctuations. Cost of sales is 40% The current capital allowance rate applies for the project and assume it will not change. The existing applicable corporate tax rate will not be changed. The cost of construction of snooker room will be around Rs. 1.5mn and it needs to start aftercompleting all other projects. Therefore, this has not been considered for the project evaluation Construction of the project will be granted to an outside construction Company. The Company will pay approximately 30% cash advance to the construction Company at Y0 andwill pay the balance in Y1 and final payment in Y2. Year (Y0) refers to the starting date of construction of the project. The gym will be constructed last – after the completion of the 20 additional rooms. After the 5 th year, equal cash inflow will be generated from the project and NPV of this cashflowestimated by using perpetual value/growth model by discounting WACC.117 Ramboda Falls Limited – <strong>Introductory</strong> <strong>Document</strong>