- Page 1 and 2:

TAKSONOMI TIL IFRSOversigt og vejle

- Page 3 and 4:

Således læses IFRS Taksonomien Il

- Page 5 and 6:

[110.00] Generel information om år

- Page 7 and 8:

Udtalelse om ledelsesberetningenBes

- Page 9 and 10:

Ledelsens ansvar for årsregnskabet

- Page 11 and 12:

To regnskabsår tilbagememberØkono

- Page 13 and 14:

Pengestrømme fra investeringsaktiv

- Page 15 and 16:

Identifikation af medlem af direkti

- Page 17 and 18:

Immaterielle aktiver under udviklin

- Page 19 and 20:

DepositaLangfristede forudbetalinge

- Page 21 and 22:

Andre langfristede ikke-finansielle

- Page 23 and 24:

Andre kortfristede tilgodehavender

- Page 25 and 26:

Kortfristede indskud, der er klassi

- Page 27 and 28:

Aktiver i alt(X) instantIAS 1 2011-

- Page 29 and 30:

Anden virksomhedskapitalEgenkapital

- Page 31 and 32:

Andre langfristede hensatte forplig

- Page 33 and 34:

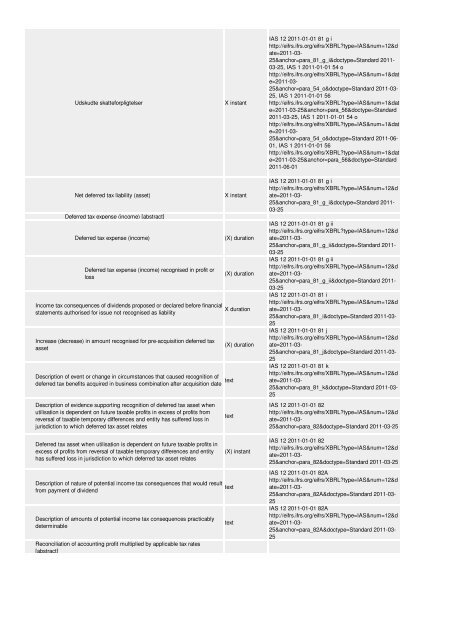

Udskudte skatteforpligtelserX insta

- Page 35 and 36:

Kortfristede hensatte forpligtelser

- Page 37 and 38:

Forpligtelser med taget i afhændel

- Page 39 and 40:

KontorudstyrMaterielle efterforskni

- Page 41 and 42:

Immaterielle aktiver og goodwill i

- Page 43 and 44:

HandelsvarerProduktionsomkostninger

- Page 45 and 46:

Andre anfordringsindskudIndeståend

- Page 47 and 48:

Overført resultat i altOverkurs ve

- Page 49 and 50:

Gældsforpligtelser til nærtståen

- Page 51 and 52:

Finansielle forpligtelser målt til

- Page 53 and 54:

Reserve for ændringer i dagsværdi

- Page 55 and 56:

Andre indtægterX durationIAS 1 201

- Page 57 and 58:

Resultat i datterselskaberResultat

- Page 59 and 60:

Årets resultat som kan henføres t

- Page 61 and 62:

Råvarer og hjælpematerialer(X) du

- Page 63 and 64:

Resultat af primær drift (EBIT)For

- Page 65 and 66:

Skat af årets resultat af ophørte

- Page 67 and 68:

Gevinst (tab) på valutakursdiffere

- Page 69 and 70:

Øvrig totalindkomst efter skat, Si

- Page 71 and 72:

Øvrig totalindkomst efter skat på

- Page 73 and 74:

Årets resultatElementer af øvrig

- Page 75 and 76:

Øvrig totalindkomst før skat for

- Page 77 and 78:

Øvrig totalindkomst før skat for

- Page 79 and 80:

Øvrig totalindkomst, før skatSkat

- Page 81 and 82:

Øvrig totalindkomstTilbageførsel

- Page 83 and 84:

Udbetalinger til og vedrørende ans

- Page 85 and 86:

Andre udbetalinger til anskaffelse

- Page 87 and 88:

Betalte (modtagne) skatter klassifi

- Page 89 and 90:

Betalte udbytterX durationIAS 7 201

- Page 91 and 92:

Pengestrømme fra (anvendt i) drift

- Page 93 and 94:

Regulering af urealiserede valutaku

- Page 95 and 96:

Pengestrømme fra driftsaktiviteter

- Page 97 and 98:

Udbetalinger for futures, terminsko

- Page 99 and 100:

Udbetalinger til andre egenkapitali

- Page 101 and 102:

Nettostigning (fald) i likvider(X)

- Page 103 and 104:

Reserve af valutakursforskelle ved

- Page 105 and 106:

Nuværende indregningTidligere indr

- Page 107 and 108:

Årets resultatØvrig totalindkomst

- Page 109 and 110:

Egenkapital ultimo[710.000] Opgøre

- Page 111 and 112:

Skat af årets resultat af fortsæt

- Page 113 and 114:

Vej- og jernbaneanlægLedningsnetHa

- Page 115 and 116:

GoodwillImmaterielle aktiver og goo

- Page 117 and 118:

Kortfristede tilgodehavender fra sa

- Page 119 and 120:

Langfristede finansielle aktiver m

- Page 121 and 122:

Varebeholdninger i altLikvide behol

- Page 123 and 124:

Kortfristede afledte finansielle ak

- Page 125 and 126:

Langfristede hensatte forpligtelser

- Page 127 and 128:

Kortfristet del af langfristede lå

- Page 129 and 130:

Gældsforpligtelser til nærtståen

- Page 131 and 132:

Langfristede forpligtelser, ydelses

- Page 133 and 134:

Akkumuleret øvrig totalindkomstAnd

- Page 135 and 136:

Aktiver(X) instantIAS 1 2011-01-01

- Page 137 and 138:

Omsætning hidrørende fra udveksli

- Page 139 and 140:

Gevinst (tab) på afhændelse af in

- Page 141 and 142:

Omsætning og driftsindtægterDrift

- Page 143 and 144:

Personaleomkostninger(X) durationIA

- Page 145 and 146:

Payments to suppliers for goods and

- Page 147 and 148:

Cash flows from (used in) decrease

- Page 149 and 150:

Proceeds from non-current borrowing

- Page 151 and 152:

Increase (decrease) through convers

- Page 153 and 154:

Disclosure of expenses by nature [t

- Page 155 and 156:

Disclosure of tax receivables and p

- Page 157 and 158:

Description of accounting policy fo

- Page 159 and 160:

Legal form of entityCountry of inco

- Page 161 and 162:

Explanation of fact and basis for p

- Page 163 and 164:

Maturity [axis]Aggregated time band

- Page 165 and 166:

Kortfristet leverandørgældX insta

- Page 167 and 168:

Disclosure of objectives, policies

- Page 169 and 170:

Increase (decrease) in dividends pa

- Page 171 and 172:

Explanation of seasonality or cycli

- Page 173 and 174:

Changes in tax rates or tax laws en

- Page 175 and 176:

Percentage of voting equity interes

- Page 177 and 178:

Gain recognised in bargain purchase

- Page 179 and 180:

Carrying amount, accumulated deprec

- Page 181 and 182:

Increase (decrease) through other c

- Page 183 and 184:

Business combinations [member]Aggre

- Page 185 and 186:

Description of nature of obligation

- Page 187 and 188:

Name of ultimate parent of groupNam

- Page 189 and 190:

Sales of property and other assets,

- Page 191 and 192:

Description of other transactions t

- Page 193 and 194:

Explanation of cross references to

- Page 195 and 196:

[822.100] Materielle anlægsaktiver

- Page 197 and 198:

Gross carrying amount [member]Accum

- Page 199 and 200:

Increase (decrease) through transfe

- Page 201 and 202:

Disclosure of detailed information

- Page 203 and 204:

Gains (losses) for period included

- Page 205 and 206:

Equity investments [member]Financia

- Page 207 and 208:

Description of nature of counterpar

- Page 209 and 210:

Internal credit grades [axis]Intern

- Page 211 and 212:

Finansielle forpligtelser målt til

- Page 213 and 214:

Description of reason for using pre

- Page 215 and 216:

Gains (losses) on financial assets

- Page 217 and 218:

Gains (losses) on financial instrum

- Page 219 and 220:

Losses arising from derecognition o

- Page 221 and 222:

Financial instruments whose fair va

- Page 223 and 224:

Sensitivity analysis for types of m

- Page 225 and 226:

Aggregated time bands [member]Not l

- Page 227 and 228:

Analysis of financial assets that a

- Page 229 and 230:

Later than one month and not later

- Page 231 and 232:

Aggregated time bands [member]Not l

- Page 233 and 234:

Net amounts for pay-floating (recei

- Page 235 and 236:

Later than one year [member]Later t

- Page 237 and 238:

Description of nature of transferre

- Page 239 and 240:

Factoring of receivables [member]Se

- Page 241 and 242:

Aggregated time bands [member]Not l

- Page 243 and 244:

Purchased call options [member]Guar

- Page 245 and 246:

Copyrights, patents and other indus

- Page 247 and 248:

Amortisation method, intangible ass

- Page 249 and 250:

Intangible assets acquired by way o

- Page 251 and 252:

At cost [member]Carrying amount, ac

- Page 253 and 254:

Depreciation, biological assetsImpa

- Page 255 and 256:

Measurement [axis]Aggregated measur

- Page 257 and 258:

Investment property at beginning of

- Page 259 and 260:

Investment property at end of perio

- Page 261 and 262:

Description of nature and extent of

- Page 263 and 264:

Disclosure of significant investmen

- Page 265 and 266: Name of associateCountry of incorpo

- Page 267 and 268: Proportion of ownership interest in

- Page 269 and 270: Associates [member]Associates not a

- Page 271 and 272: Description of reason why using dif

- Page 273 and 274: Net cash flows from (used in) finan

- Page 275 and 276: Disclosure of other provisions [tab

- Page 277 and 278: Expected reimbursement, other provi

- Page 279 and 280: Indication of other forms of govern

- Page 281 and 282: Intangible assets other than goodwi

- Page 283 and 284: Description of discount rates used

- Page 285 and 286: Explanation of goodwill not allocat

- Page 287 and 288: [832.600] LeasingkontrakterAmount b

- Page 289 and 290: Maturity [axis]Aggregated time band

- Page 291 and 292: Future finance charge on finance le

- Page 293 and 294: Aggregated time bands [member]Not l

- Page 295 and 296: Description of material leasing arr

- Page 297 and 298: Revenue recognised on exchanging co

- Page 299 and 300: Disclosure of number and weighted a

- Page 301 and 302: Information on how incremental fair

- Page 303 and 304: Increase (decrease) through settlem

- Page 305 and 306: Total increase (decrease) in reimbu

- Page 307 and 308: Øvrig totalindkomst efter skat på

- Page 309 and 310: Description of basis used to determ

- Page 311 and 312: Description of nature of terminatio

- Page 313 and 314: Skat af sikring af pengestrømme af

- Page 315: Temporary differences associated wi

- Page 319 and 320: Assets arising from insurance contr

- Page 321 and 322: Explanation of effect of changes in

- Page 323 and 324: Description of objectives, policies

- Page 325 and 326: Description of instruments with pot

- Page 327 and 328: Likvide beholdninger(X) instantIAS

- Page 329 and 330: Cash flows from (used in) maintaini

- Page 331 and 332: Andre reservermemberIAS 1 2011-01-0

- Page 333 and 334: Øvrig totalindkomst efter skat, va

- Page 335 and 336: Øvrig totalindkomst efter skat på

- Page 337 and 338: Par value per shareExplanation of f

- Page 339 and 340: Reserve af valutakursforskelle ved

- Page 341 and 342: Description of nature of interest i

- Page 343 and 344: OmsætningRevenues from transaction

- Page 345 and 346: Other material non-cash items(X) du

- Page 347 and 348: ForpligtelserX instantIAS 1 2011-01

- Page 349 and 350: OmsætningX durationIAS 18 2011-01-

- Page 351: OmsætningX durationIAS 18 2011-01-