Finance Act 2010 - TRA

Finance Act 2010 - TRA

Finance Act 2010 - TRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

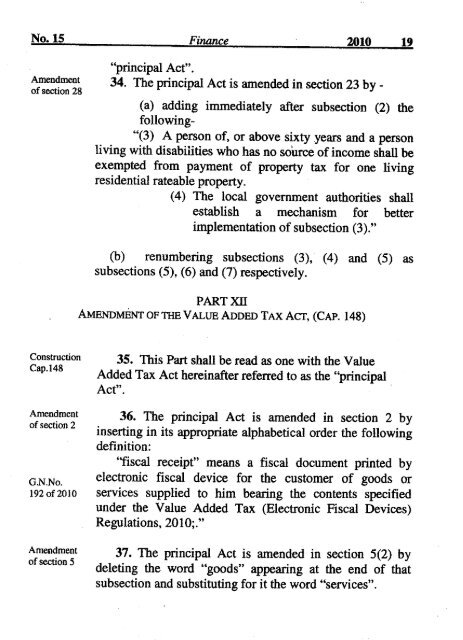

"principal <strong>Act</strong>".Amendmentof section 2834. The principal <strong>Act</strong> is amended in section 23 by -(a) adding immediately after subsection (2) thefollowing-"(3) A person of, or above sixty years and a personliving with disabilities who has no soUrce of income shall beexempted from payment of property tax for one livingresidential rateable property.(4) The local government authorities shallestablish a mechanism for betterimplementation of subsection (3)."(b) renumbering subsections (3), (4) and (5) assubsections (5), (6) and (7) respectively.PARTXllAMENDMENT OFTIffi VALUE ADDED TAX Acr, (CAP. 148)ConstructionCap. 148Amendmentof section 2GN.No.192 of <strong>2010</strong>Amendmentof section 535. This Part shall be read as one with the ValueAdded Tax <strong>Act</strong> hereinafter referred to as the "principal<strong>Act</strong>". .36. The principal <strong>Act</strong> is amended in section 2 byinserting in its appropriate alphabetical order the followingdefinition:''fiscal receipt" means a fiscal document printed byelectronic fiscal device for the customer of goods orservices supplied to him bearing the contents specifiedunder the Value Added Tax (Electronic Fiscal Devices)Regulations, <strong>2010</strong>;."37. The principal <strong>Act</strong> is amended in section 5(2) bydeleting the word "goods" appearing at the end of thatsubsection and substituting for it the word "services".