Finance Act 2010 - TRA

Finance Act 2010 - TRA

Finance Act 2010 - TRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

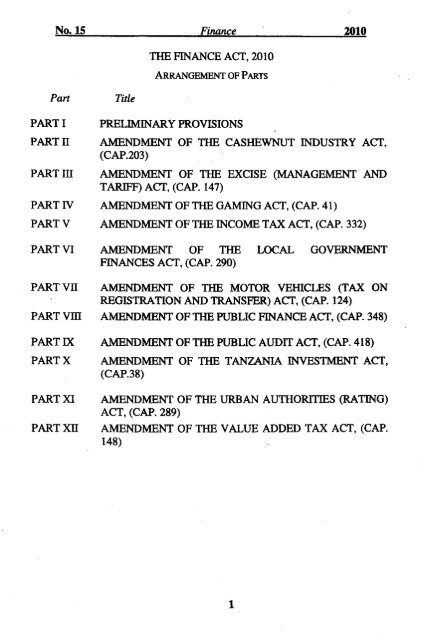

THE FINANCE ACT, <strong>2010</strong>ARRANGEMENTOF PARTSPART IPARTllPARTlYPART VPRELIMINARYPROVISIONSAMENDMENT OF THE CASHEWNUT INDUSTRY ACT,(CAP.203)AMENDMENT OF THE EXCISE (MANAGEMENT ANDTARIFF) ACT, (CAP. 147)AMENDMENT OF THE GAMING ACT, (CAP. 41)AMENDMENT OF THE INCOME TAX ACT, (CAP. 332)AMENDMENT OF THE LOCAL GOVERNMENTFINANCES ACT, (CAP. 290)AMENDMENT OF THE MOTOR VEIllCLES (TAX ONREGIS<strong>TRA</strong>TION AND <strong>TRA</strong>NSFER) ACT, (CAP. 124)AMENDMENT OF THE PUBLIC FINANCE ACT, (CAP. 348)PART IXPART XAMENDMENT OF THE PUBLIC AUDIT ACT, (CAP. 418)AMENDMENT OF THE TANZANIA INVESTMENT ACT,(CAP.38)AMENDMENT OF THE URBAN AUTHORITIES (RATING)ACT, (CAP. 289)AMENDMENT148)OF THE VALUE ADDED TAX ACT, (CAP.

..~ ..., President...... ~~~.J~l.~~ ..An <strong>Act</strong> to impose and a1t~rcertain taxes, duties, levies, fees andto amend certain written laws relating to the collectionand management of public revenues.PART 1PRELIMINARYPROVISIONS2. The provisions of the various Parts of this <strong>Act</strong> shall bedeemed to have come into operation on the 1Sl day of July, <strong>2010</strong>.PART IIAMENDMENT OFTHE CASHEWNUT INDUSTRY Acr,(CAP.203)CommencementConstructionCap.2033. This Part shall be read as one with the CashewnutIndustry <strong>Act</strong>, hereinafter referred to as the "principal <strong>Act</strong>".

Additionof section17A4. The principal <strong>Act</strong> is amended by adding immediatelyafter section 17 the following new section:"Payment 17A.-(1) A person who exports raw_~export cashewnuts shall pay an export levy to be.!I('!Y ~Qmputed and collected by the Tanzania RevenueAuthority at the Tate of 15 percentum of the FOBv~e or the amount equivalent to US dollars onehU~ sixty per metric tone, whichever ishigher.(2) The total amount of export levy collectedunder subsection (1) shall be distributed, in such amanner that:(a) 65% would be remitted to the CashewnutsIndustry Development Trust Fund; and(b) 35% would be remitted to the ConsolidatedFund.(3) The Minister shall, in consultation withstakeholders, make regulations prescribing amechanism for distribution and use of the levycollected in terms of subparagraph (a)amongst cashewnuts stakeholders."PARTIDAMENDMENT OF THE EXCISE (MANAGEMENT AND TARIFF) ACT, (CAP. 147)ConstructionCap.147Amendmentofsection 2Amendmentofsection1225. This Part shall be read as one with the Excise(Management and Tariff) <strong>Act</strong>, hereinafter referred to as the"principal <strong>Act</strong>".6. The principal <strong>Act</strong> is amended in section 2, by insertingin its appropriate alphabetical order the following newdefinition:"Minister" means the Minister responsible for finance;"7. The principal <strong>Act</strong> is amended in section 122(1), bydeleting the word "authority" and substituting for it the word"Minister" .

Amendmentofsection1248. The principal <strong>Act</strong> is amended in section 124(3), bydeleting the phrase "mobile phone services" and substitutingfor it the word "airtime".Amendmentofthe FourthSchedule9. The Fourth Schedule to the principal <strong>Act</strong> is amendedby deleting the rates of excise duty specified in the FifthColumn which are currently imposed on items specified in theThird Column and substituting for them the rates specified inthe Sixth Column:"FOURTH SCHEDULEH.s.Code Description Unit Old Excise NewHeading No. Rates ExciseRates22.02 Waters, including mineralwaters and aerated waters,containing added sugar orother sweetening matter or0Oavoured, and other nonalcoholicbeverages, notincluding fruit or vegetable2202.10.00juices of headin2 20.09- Waters, including L Tshs. 58 Tshs.63mineral waters and aerated per litre perUtrewaters, containing addedsugar or other sweeteningmatter or flavoured2202.90.00 -Other L Tsh 58.00 Tshs. 63per litre per litre22.03 Beer made from malt L2203.00.10 ••- Stout and porter Tshs. 354 Tshs.per litre 382 perlitre2203.00.90 ••• Other L Tshs. Tshs.354.00 per 382 perlitre litre22.04 Wine of fresh grapes, Lincluding fortified wines;grape must other than thatof headinJl20.09 .• Sparkling wine2204.10.90 --other Tshs. Tshs.1,132.00 1,223per litre per litre

- Other wine; grape must L Tsbs. Tshs.with fermentation prevented 1,132.00 1,223or arrested by the addition perDtre perUtreof alcohol:-0 In containers holding 2 Ior less2204.21.90 _•• Other L Tshs. Tshs.1,132.00 1,223perDtre perUtre2204.29.90 --- Other Tsbs. Tshs.1,132.00 1,223per Utre per litre• Other grape must2204.30.90 --other Tshs. Tshs.1,132.00 1,223per litre per litre22.05 Vermouth and other wine of Lfresh grapes flavoured withoJanb; or lI1"ODJ8tic substances.- In containers holding 2 I2205.10.90or less--- Other Tsbs. Tshs.. 1,2231,132.002205.90.90 _0. Other LDerlitre per litreTsbs. Tshs.1,132.00 1,223perUtre per litre22.06 Other fermented beverages(for example, cider, perry,mead); mixtures offermented beverages andmixtures of fermentedbeverages and non-aicohoUcbeverages, not elsewherespecified or included.2206.00.30 ···-Beer made from 100% L Tshs. Tsbs.local unmalted cereals 209.00 per 226 perlitre litre22.08 Undenatured ethyl alcohol Iof an alcoholic strength byvolume of less than 80% vol;spirits, liqueurs and other2208.20.00spirituous beveraees.- Spirits obtained by L Tshs. 1,678 Tshs.distilling grape wine or per litre 1,812grape marcper litre2208.30.00 • Whiskies I Tshs. 1,678 Tshs.per litre 1,812per litre

2208.40.00 • Rum and other spirits I Tshs.l,678 Tshs.obtained by distiIIing per litre 1,812fermented sugar-cane per litreproducts2208.50.00 - Gin and Geneva I Tshs.l,678 Tshs.per Jitre 1,812perJitre2208.60.00 • Vodka I Tshs.l,678 Tshs.per litre 1,812perlitre2208.70.00 - Liqueurs and cordials I Tshs. Tshs.1,678per 1,812pelitre rlitre- Other: I2208.90.10 ._. Distilled Spirits (e.g., Tshs.l,678 Tshs.Konyagi, Uganda Waragi) per litre 1,812per litre2208.90.90 --- Other I Tshs.l,678 Tshs.per litre 1,812oer litre24.02 Cigars, cheroots, cigarillos Iand cigarettes, of tobacco orof tobacco substitutes.- Ciga~es containingtobacco:2402.20.10 -··without filter tip and mil Tshs. Tshs.containing domestic tobacco 5,749.00 6,289exceediDl!:75% oermil per mil---with filter tip and mil. Tshs. 13, Tshs.containing domestic tobacco 564 per 14,649exceediDl!:75% litre per mil2402.20.90 •- Other mil. Tshs. Tshs•24,633 per 26,604mil per mil24.03 Other manufactured tobacco mil.and manufactured tobaccosubstitutes; "homogenised"or "reconstituted" tobacco;tobacco extracts andessences.-- Smoking tobacco,whether or not containingtoba£Co substitutes in anyproportion2403.10.10 ···cut rag/fiUer Tshs. 12, Tshs.444.00 per 13,436kg per mil

27.10 Petroleum oils and oilsobtained from bitumiDiousminerals, other than crude;preparations not elsewherespecified or included,containing by weight70% ormore of petroleum oils or ofoils obtained ~bituminous minerals, theseoils being the basicconstituents of thepreparation· wasteoils.2710.19.41 -- Residual fuel oils I(marine, furnace and similarfuel oils) of a Kinematicviscosityof 125centistrokes2710.19A2 ---- Residual fuel oils I(marine, furnace and similarfuel oils) of a Kinematicof 180centistrokes2710.19A3 --- Residual fuel oils I(marine, furnace and similarfuel oils) of a Kinematicviscosityof 280centistrokesPART IVAMENDMENT OF THE GAMINGAcr, (CAP. 41)Tshs. 97 Tshs. 80per Htre per litreTshs. 97 Tshs. 80per Htre per litreTshs. 97 Tshs. 80perHtre perlitre"ConstructionCap. 41AmendmentoftheSecondSchedule10. This Part shall be read as one with the Gaming <strong>Act</strong>, hereinafterreferred to as the "principal <strong>Act</strong>".11. The principal <strong>Act</strong> is amended in the Second Schedule, by-(a) deleting figure "16000/=" appearing in column 2 of itemI and substituting for it figure "32,000/="; and(b) adding immediately after item 2 the following new item:"3. Forty Thirteenpercentofgrossgamingrevenue."machinessitePART VAMENDMENT OF THE INCOME TAX ACT, (CAP. 332)Constru- 12. This Part shall be read as one with the Income Tax <strong>Act</strong>,ction hereinafter referred to as the "principal <strong>Act</strong>".Cap. 332

Amendmentofsection11Amendmentofsection12Additionofsection80A13. The principal <strong>Act</strong> is amended in section 11, by-(a) inserting immediately after subsection (3) thefollowing new subsection:"(4) In the case of mining operation, whereseparate and distinct mining operations are carriedon by the same person in different mining licenceareas, the mines shall be treated as separate miningoperations.";(b) renumbering subsection (4) as subsection (5);(c) deleting the word "or" appearing at the end of subparagraph(d);(d) deleting a ''full stop" appearing at the end of subparagraph(e) and substituting for it a word ",or";and(e) adding immediately after sub-paragraph (e) ofsubsection (5) as renumbered the following newsubparagraph:"(f) "mining operation" shall not includeexploration activities conducted outside themining licence area which shall beaccumulated and allowed when thecommercial operations commence."14. The principal <strong>Act</strong> is amended in section 12 by deletingsubsections (2) and (3) and substituting for them the following newsubsection-"(2) The total amount of interest that an exempt-controlledresident entity may deduct in accordance with section 11(2) fora year of income shall not exceed the sum of interest equivalentto debt-to-equity ratio of 70 to 30."15. The principal <strong>Act</strong> is amended by adding immediately aftersection 80 the following new section:"Obligationtoissuereceipt80A.-(l) A person who receives any payment of anamount of five thousand shillings or more in respect ofgoods sold or services rendered by him in the ordinarycourse of his business shall, notwithstanding any custom inany trade or any provision to the contrary in this <strong>Act</strong> orany other written law or an agreement between the partiesto a sale or a contract of services, as the case may be, issuea receipt to the person making the payment.

(2) A person issuing the receipt shall be required toenter or cause to be entered in the receipt and its duplicatecopy the following particulars:(a) the date on which the payment is made;(b) full name and address of the person who sold thegoods or rendered the services, as the case may be;(c) full description of the goods sold or the servicesrendered and a statement of the quantity and valueof the goods or, in the case of services, the amountcharged in respect of the services rendered;(d) full name and address of the person to whom thegoods were sold or to whom the services wererendered, as the case may be;(e) a Tax Identification Number (TIN); and(f) such other particulars as the Commissioner may, bynotice in writing, specify from time to· time for thepurposes of this section".(3) Every person who issues a receipt in accordancewith preceding provisions of this section shall be requiredto retain in his records the duplicate copy of every receiptissued by him and shan, unless the Commissioner directsotherwise, preserve that copy for a period of not less thanfive years after the year of income to which the receiptrelates."Amendmentofsection83AAmendmentofsection98Amendmentofsection10016. The principal <strong>Act</strong> is amended in section 83A, by deletingthe word "Government" wherever it appear in that section andsubstituting for it the word "Corporation".17. The principal <strong>Act</strong> is amended in section 98, by addingimmediately after subsection (2) the following new subsection:"(3) Any person who receives any payment and fails toissue a receipt in accordance with the requirement of section80A, commits an offence and shall, upon conviction, be liableto a fine not exceeding two million shillings or to imprisonmentfor a term not exceeding twelve months or to both."18. The principal <strong>Act</strong> is amended in section 100(1), by addingimmediately after the phrase "statutory rate", the phrase "plus 5%per annum" appearing the third line."

Amendmentofsection134AmendmentofSection14519. The principal <strong>Act</strong> is amended by adding immediately aftersection 134 the following new subsection:"(3) An approved Tax Consultant who knowingly orrecklessly aids, abets, conceals or induces a taxpayer to file amisleading or fraudulent statement commits an offence under this<strong>Act</strong>".20. The principal <strong>Act</strong> is amended in section 145, by insertingthe phrase "Subject to the provisions of section 11(4), (5) (f) andsection 12(2)" between the figure "145(1)" and the word "Part ill."AmendmentoftheFirstSchedule21. The First Schedule to the principal <strong>Act</strong> is amended inparagraph 1(l) by deleting the table to that paragraph andsubstituting for it the following table -Annual Taxable IncomeTax rateWhere income does not exceedNILSh.l,620,OOO/=Where total income exceeds Sh. 1,620,0001= 14% of the amount in excessbut does not exceed Sh. 4,320,000/= of Sh. 1,620,000/=Where total income exceeds Sh. 4,320,000/= Sh. 378,0001= plus 20% of thebut does not exceed Sh. 6,480,000/=amount in excess ofSh. 4,320,000/=Where total income exceeds Sh. 6,480,000/= Sh. 810,0001= plus 25% of thebut does not exceed Sh. 8,640,000/=amount in excess ofSh. 6,480,000/=Where total income exceeds Sh. 8,640,000/= Sh. 1,350,000/= plus 30% ofthe amount in excess ofSh. 8,640,000/=PART VIAMENDMENTOFTHELOCALGOVERNMENTFINANCESACT, (CAP. 290)Construction 22.This Part shall be read as one with the LocalCap.290 Government <strong>Finance</strong>s <strong>Act</strong> hereinafter referred to as the"principal <strong>Act</strong>••.••Amendment 23.The Schedule to the principal <strong>Act</strong> is amended byoftheSchedule deleting the contents of item 1 and substituting for them thefoUowing-

"I.Produce Cess on buyers(a) Crop cess ranging from3% to 5% of farm gateprice;(b) Forest produce cess-cap5% of farm gate priceor b volume at soprceon sales of timber,charcoal. logs, mirunda,firewood, poles andthieses (fito)."• Cess sellers• Cess on timberproducts e.g. furnitureand the likePART VIIAMENDMENT OF THE MOTOR VEHICLES (TAX ON REGIS<strong>TRA</strong>TIONAND <strong>TRA</strong>NSFER) ACT, (CAP.l24)ConstructionCap. 124Amentlmentof the FirstSchedule24. This Part shall be read as one with .the MotorVehicles (Tax on Registration and Transfer) <strong>Act</strong> hereinafterreferred to as the "principal <strong>Act</strong>".25 The First Schedu)e to the principal <strong>Act</strong> is amendedin paragraph 1, by deleting~(a) the phrase "one hundred twenty thousandshillings (Shs.120,OOOI=)" appearing insubparagraph (3), and substituting for it thephrase "one hundred fifty thousand shillings(150,0001=); and(b) the phrase "thirty five thousand shillings(35,0001=)" appearing in subparagraph (4),and substituting for it the phrase ''forty fivethousand shillings (45,0001=).PARTVITIAMENDMENT OF THE PuBLIC FINANCE ACT, (CAP.348)ConstructionCap.34826. The principal <strong>Act</strong> is amended by-(a) inserting the phrase "Local GovernmentAuthority" between the words "Government"and "and" appearing in section 7(2);(b) inserting the phrase "and officers appointed

Amendmentof section 7Addition ofnew Part Vunder section 36 of the Local Government <strong>Finance</strong>s<strong>Act</strong>" between the words "General" and "and"appearing in section 4 in relation to the definition ofthe term "accounting officer."27. The principal <strong>Act</strong> is amended in section 7(2) byinserting the phrase "Local Government Authority" betweenthe words "Government" and "and" appearing in the fourthline.28 .-( 1) The principal <strong>Act</strong> is amended by -(a) inserting immediately after Part IV thefollowing new Part:InternalAuditorGeneral"PART VOFFICE OF INTERNAL AUDITOR GENERALFunctionsof InternalAuditorGeneral37.-(1) There shall be an InternalAuditor General under the Ministryresponsible for finance.(2) The Internal AuditorGeneral shall be appointed by thePresident from amongst qualifiedpersons in accountancy, auditing orfinancial matters on such terms andconditions to be specified in the letterof appointment.38.-(1) The Internal AuditorGeneral shall be responsible to thePaymaster General for-(a) developing internalaudit policies, rules,standards, manuals,circulars andguidelines;(b) reviewing andappraising complianceto laid down laws,

egulations, standards,systems and proceduresin Ministries,Departments,GovernmentInstitutions, Regions,Local Governmenti\uthorities,executiveagencies and donorfunded projects; and(c) ensuring control andproper accountabilityof public monies andproperty.(2) For the purposes of subsection(1), the Internal i\uditor Generalshall-(a) scrutinize and compile auditreports from Ministries,Department, GovernmentInstitutions, Regions, LocalGovernment i\uthorities,executive agencies and donorfunded projects and shallprepare a summary of majoraudit observations andrecommendations and submitthe same to the PaymasterGeneral for further action;(b) undertake continuous AuditRisk Management;(c) develop and supervise theimplementation of InternalAudit Strategy;(d) develop, implement andreview i\nnual i\uditProgramme;

(e) liaise with the Controller andAuditor General, AccountantGeneral, AccountingOfficers, and ProfessionalStandards SettingsAuthoritieson audit matters;(f) manage and control thequality of operations of theaudit cadre and enhancecapacity of AuditCommittees;(g) evaluate theeffectiveness of AuditCommittees inMinistries,Departments,GovernmentInstitutions, Regions,Local GovernmentAuthorities andexecutive agencies;(h) facilitate thedevelopment ofinternal audit cadre;(i) review and appraise-(i) budgetplanning andimplementation with a viewto promotingcompliancewith nationalgoals andobjectives;

Officen;ofInternalAuditorGeneralDivision(ii) technicalreports ondevelopmentinitiatives;(iii) works, goodsoffered andservices suppliedto the Governmentfrom developmentand recurrentbudgets anddetermine theirvalue for money;(j) prepare audit reports and advisethe Government on interventionmeasures towards ensuringvalues for money on publicexpenditure;(k) make follow up on the agreedaudit recommendations andrequired corrective actions;(1) undertake special andinvestigative audits;(m) review, monitor, evaluate andrecommend on systems ofGovernment revenue collectionsfor proper accountability; and(n) participate in the hearingsand render advice to therelevant Parliamentary OversightCommittees.39. There shall be internal audit officersof academic qualifications and experience in theirfields of study of such number and titles as maybe necessary for effective performance of thefunctions of the Internal Auditor GeneralDivision."

(b)renumberingParts V, VI and VII as Parts VI, VIIand VIII, respectively;and(c) renumbering sections 37 to 45 as sections 40 to 48,respectively.PART IXAMENDMENT OF THE PuBLIC AUDIT ACT, (CAP. 418)ConstructionCap. 418Amendmentof section 2729. This Part shall be read as one with the Public Audit<strong>Act</strong>, hereinafter referred to as the "principal <strong>Act</strong>".30. The principal <strong>Act</strong> is amended by repealing section 27and substituting for it the following new section:"Fore- 27.-(1) Where, in the course of forensicnsicaudit audit or any other audit, the officer of theNational Audit Office suspects commission offraud or any related offences, he shallimmediately report the matter to the Controllerand Auditor General for determination of theaudit.(2) The Controller and Auditor Generalshall, after studying the matter, report the fraudor any related offences to an appropriateinvestigative organ and serve a notice to theDirector of Public Prosecutions.(3) The investigative organ that has receivedthe report from the Controller and AuditorGeneral shall investigate the matter withinsixty days and forward the file of the case tothe Director of Public Prosecutions.(4) In case where the investigative organ isunable to finish investigation within therequired time, it shall be the duty of thatinvestigative organ to seek extension of timefrom the Director of Public Prosecutions.

(5) Where the investigation is complete,the results shall be submitted to the Director ofPublic Prosecutions for consideration andprosecution according to relevant written laws.(6) Notwithstanding the provisions ofsubsection (5), if in the opinion of the Directorof Public Prosecutions the case is not tenablein law, he shall give reason for such opinionand shall make recommendations onalternative measures for redress, if any, to theinvestigative organ and send a copy to theController and Auditor General.(7) The Controller and Auditor Generalmay, after receiving the copy referred to insubsection (6), apply the measuresrecommended to pursue and enforce alternativemeasures of redress as recommended by theDirector of Public Prosecutions."PART XAMENDMENT OF THE TANZANIA INVEsTMENT ACT, (CAP. 38)ConstructionCap. 3831. This Part shall be read as one with the TanzaniaInvestment <strong>Act</strong> hereinafter referred to as the "principal <strong>Act</strong>."Amendmentof section 1932. The principal <strong>Act</strong> is amended in section 19 by addingimmediately after subsection (2) the following new subsection:"(3) The benefits conferred under subsection (2)shall not apply to motor vehicles manufactured ten yearsor more before importation."PART XIAMENDMENT TO THE URBAN AUTIIORITIES (RATINO) ACT, (CAP. 289)ConstroctionCap. 28933. This Part shall be read as one with the UrbanAuthorities (Rating) <strong>Act</strong>, hereinafter referred to as the

"principal <strong>Act</strong>".Amendmentof section 2834. The principal <strong>Act</strong> is amended in section 23 by -(a) adding immediately after subsection (2) thefollowing-"(3) A person of, or above sixty years and a personliving with disabilities who has no soUrce of income shall beexempted from payment of property tax for one livingresidential rateable property.(4) The local government authorities shallestablish a mechanism for betterimplementation of subsection (3)."(b) renumbering subsections (3), (4) and (5) assubsections (5), (6) and (7) respectively.PARTXllAMENDMENT OFTIffi VALUE ADDED TAX Acr, (CAP. 148)ConstructionCap. 148Amendmentof section 2GN.No.192 of <strong>2010</strong>Amendmentof section 535. This Part shall be read as one with the ValueAdded Tax <strong>Act</strong> hereinafter referred to as the "principal<strong>Act</strong>". .36. The principal <strong>Act</strong> is amended in section 2 byinserting in its appropriate alphabetical order the followingdefinition:''fiscal receipt" means a fiscal document printed byelectronic fiscal device for the customer of goods orservices supplied to him bearing the contents specifiedunder the Value Added Tax (Electronic Fiscal Devices)Regulations, <strong>2010</strong>;."37. The principal <strong>Act</strong> is amended in section 5(2) bydeleting the word "goods" appearing at the end of thatsubsection and substituting for it the word "services".

Amendmentof section 1138. The principal <strong>Act</strong> is amended in section 11 byadding immediately after subsection (2) the following newsubsections-"(3) The relief granted under subsection (l) shall notapply to motor vehicles manufactured ten years or morebefore importation.(4) Subsection (3) shall not apply to religiousorganizations. "Amendmentof section 13Amendmentofsection 16Amendmentof section 2939. The principal <strong>Act</strong> is amended in section 13(4) by-(a) adding immediately after the word "thereon"appearing at the end of that subsection thephrase "excluding VAT";(b) adding a new subsection (5) as follows:"(5) The word "premium" as used insubsection (4), means the value of airtimetopped on to a subscriber over the actualvalue of airtime paid for."; and(c) renumbering subsections (5) and (6) assubsections (6) and (7).40. The principal <strong>Act</strong> is amended in section 16, by -(a)(b)adding the words" or fiscal receipts"immediately after the words "tax invoice"wherever they appear in the section thephrase "or fiscal receipts" ; andadding immediately after subsection (4) thefollowing new subsection:"(5) Any cost incurred by a taxableperson during initial purchase of an EFDfrom an Approved Supplier shall be deemedto be an input tax."41. The principal <strong>Act</strong> is amended in section 29, by-(a) adding the words " fiscal receipt"immediately after the words ''tax invoice"appearing in subsection (1);

Amendmentof section 47Amendmentof the FirstScheduleAmendmentof theSecondSchedule(b) deleting the word "receipt" appearing insubsection (2) and substituting for it thewords ''fiscal receipts";(c) deleting the phrase ''five hundred thousand"and substituting for it the words "Onemillion"; and(d) inserting immediately after subsection (3) thefollowing new subsection:"(4) Every person who purchase anygoods or services shall be require to demand afiscal receipt from the person who receivesthe payment."42. The principal <strong>Act</strong> is amended in section 47(1) bydeleting that subsection and substituting for it thefollowing:"(1) Any person who willfully or fraudulentlycommits or omits to do any action which has theeffect of evading tax or recovering tax, commits anoffence and upon conviction shall be liable to a fineof twice the amount of tax involved in thecommission of the offence or to pay five millionshillings, whichever amount is higher, or toimprisonment for a term of two years or to both."43. The First Schedule to the principal <strong>Act</strong> is amendedby adding immediately after item 13 the following newitems:"14. The supply of edible oil by a localprocessor of edible oil using local oil seeds.15. The supply of layers mash, broilers mash andhay by a local manufacturer of animal or poultryfeeds."44. The Second Schedule to the principalamended-(a)(b)in item 5, by deleting sub-item (3);in item 13, by:(i) deleting a ''full stop" at the end of theitem and inserting a "comma";

(ii) adding immediately after a "comma",the following phrase "mowers andhay making machine.";(c) in item 27, by designating its contents assubparagraph (1);(d) by adding immediately after sub-item (1) thefollowing new sub-items:"(2) The supply of intra-transportservice from the farm to the processingplant of sugar cane, sisal or tea.(3)The supply of breeding services."(e) in item 28, by-(a) deleting the word "and" appearingimmediately after the word "tanks" andinserting thereafter a "comma"; and(b) deleting a "full-stop" appearing at theend and inserting immediately after theword "cans" the following phrase "milkpumps, milk hoses, milk pasteurizers,butter churns, cream separators,homogenizers, cheese vat and cheesepressers, compressor used inrefrigerating equipment, storage tanks,tankers fitted with a cooling device, aircondition machines incorporating arefrigerating unit and a valve forreversal of the cooling cycle."(f) by deleting item 30 and substituting for it thefollowing new items:''30. Livestock farmingOil cakes (mashudu), layers mash, broilersmash and hay.31. Packaging materialPackaging material for fruit juice anddairy products."Amendmentof the ThirdSchedule45. The Third Schedule to the principal <strong>Act</strong> isamended-

(a) by deleting item 8 and substituting for it thefollowing item:"8. The importation by or supply to aregistered licensed exploration,prospecting, mineral assaying, drilling ormining company having a miningdevelopment agreement with theGovernment which provided for relief fromtaxation of goods or services for exclusiveuse in exploration, prospecting, drilling ormining activities executed before 1SI July,2009.8A. The importation by or supply toa registered licensed exploration orprospecting company, of goods which ifimported or supplied would be eligible forrelief from duty under the customs lawsand services for exclusive use inexploration or prospecting of petroleum orgas."(b) by adding immediately after item 19 the followingnew item:"19A. The supply of buildingmaterials and construction services bythe developer licensed under the ExportProcessing Zones <strong>Act</strong>."; and(c) by adding immediately after item 30 the followingnew items:"31. The importation or supply ofgreenhouse to horticulture grower.32(1). Supply of goods and servicesto the organized farming for thepurposes of building irrigation canals,construction of road networks,godowns and similar storages in thefarms.

(2) The relief provided in sub-item(l) shall only apply to goods andservices approved by the Ministerresponsible for agriculture afterinspection of the area has been done bythe agriculture officer."Passed in the National Assembly o~ the 15 th June, <strong>2010</strong>..................... ~