Finance Act 2010 - TRA

Finance Act 2010 - TRA

Finance Act 2010 - TRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

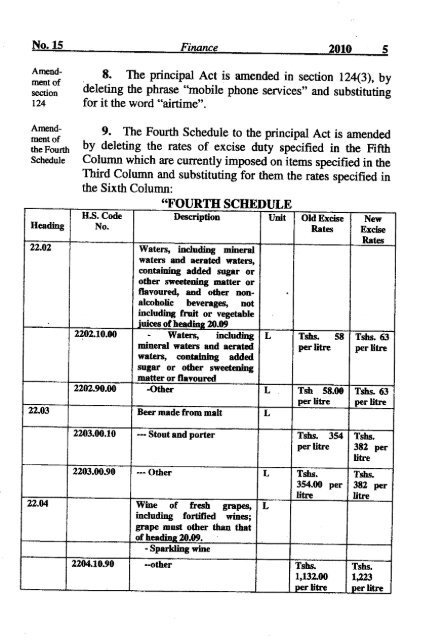

Amendmentofsection1248. The principal <strong>Act</strong> is amended in section 124(3), bydeleting the phrase "mobile phone services" and substitutingfor it the word "airtime".Amendmentofthe FourthSchedule9. The Fourth Schedule to the principal <strong>Act</strong> is amendedby deleting the rates of excise duty specified in the FifthColumn which are currently imposed on items specified in theThird Column and substituting for them the rates specified inthe Sixth Column:"FOURTH SCHEDULEH.s.Code Description Unit Old Excise NewHeading No. Rates ExciseRates22.02 Waters, including mineralwaters and aerated waters,containing added sugar orother sweetening matter or0Oavoured, and other nonalcoholicbeverages, notincluding fruit or vegetable2202.10.00juices of headin2 20.09- Waters, including L Tshs. 58 Tshs.63mineral waters and aerated per litre perUtrewaters, containing addedsugar or other sweeteningmatter or flavoured2202.90.00 -Other L Tsh 58.00 Tshs. 63per litre per litre22.03 Beer made from malt L2203.00.10 ••- Stout and porter Tshs. 354 Tshs.per litre 382 perlitre2203.00.90 ••• Other L Tshs. Tshs.354.00 per 382 perlitre litre22.04 Wine of fresh grapes, Lincluding fortified wines;grape must other than thatof headinJl20.09 .• Sparkling wine2204.10.90 --other Tshs. Tshs.1,132.00 1,223per litre per litre