Backdating Executive Option Grants - Nanyang Technological ...

Backdating Executive Option Grants - Nanyang Technological ...

Backdating Executive Option Grants - Nanyang Technological ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

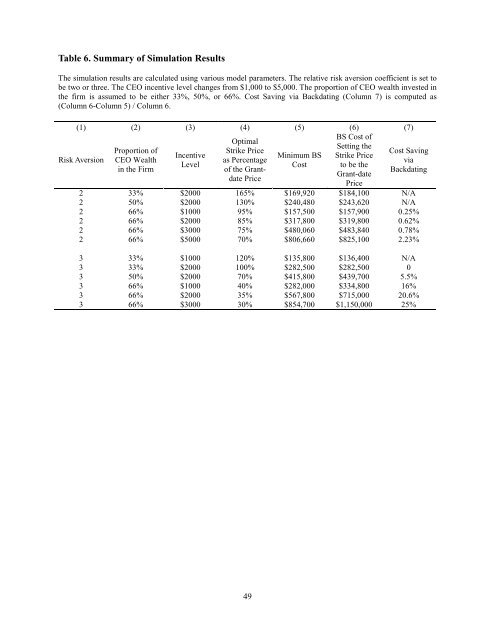

Table 6. Summary of Simulation ResultsThe simulation results are calculated using various model parameters. The relative risk aversion coefficient is set tobe two or three. The CEO incentive level changes from $1,000 to $5,000. The proportion of CEO wealth invested inthe firm is assumed to be either 33%, 50%, or 66%. Cost Saving via <strong>Backdating</strong> (Column 7) is computed as(Column 6-Column 5) / Column 6.(1) (2) (3) (4) (5) (6) (7)BS Cost ofOptimalSetting theProportion ofStrike PriceIncentiveMinimum BS Strike PriceCEO Wealthas PercentageLevelCost to be thein the Firmof the GrantdatePriceGrant-datePriceRisk AversionCost Savingvia<strong>Backdating</strong>2 33% $2000 165% $169,920 $184,100 N/A2 50% $2000 130% $240,480 $243,620 N/A2 66% $1000 95% $157,500 $157,900 0.25%2 66% $2000 85% $317,800 $319,800 0.62%2 66% $3000 75% $480,060 $483,840 0.78%2 66% $5000 70% $806,660 $825,100 2.23%3 33% $1000 120% $135,800 $136,400 N/A3 33% $2000 100% $282,500 $282,500 03 50% $2000 70% $415,800 $439,700 5.5%3 66% $1000 40% $282,000 $334,800 16%3 66% $2000 35% $567,800 $715,000 20.6%3 66% $3000 30% $854,700 $1,150,000 25%49