Q1-2009 Press release - Cogeco

Q1-2009 Press release - Cogeco

Q1-2009 Press release - Cogeco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

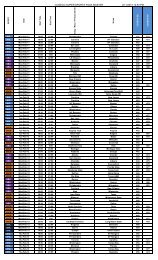

- 30 -COGECO INC.Notes to Consolidated Financial StatementsNovember 30, 2008(unaudited)(amounts in tables are in thousands of dollars, except number of shares and per share data)9. Capital StockAuthorized, an unlimited numberPreferred shares of first and second rank, issuable in series and non-voting, except when specified in the Articles ofIncorporation of the Company or in the Law.Multiple voting shares, 20 votes per share.Subordinate voting share, 1 vote per share.November 30, 2008 August 31, 2008$ $Issued1,842,860 multiple voting shares 12 1214,897,586 subordinate voting shares 120,037 120,037120,049 120,049Stock-based plansThe Company offers, for the benefit of its employees and those of its subsidiaries, an Employee Stock Purchase Planand a Stock Option Plan for certain executives, which are described in the Company’s annual consolidated financialstatements. During the first quarter of <strong>2009</strong> and 2008, no stock options were granted to employees by COGECO Inc.However, the Company’s subsidiary, <strong>Cogeco</strong> Cable Inc., granted 133,381 stock options (97,214 in 2007) with anexercise price of $34.46 ($49.82 in 2007), of which 29,711 stock options (22,683 in 2007) were granted to COGECOInc.’s employees. The Company records compensation expense for options granted on or after September 1, 2003.As a result, a compensation expense of $101,000 ($320,000 in 2007) was recorded for the three month period endedNovember 30, 2008.The fair value of stock options granted by the Company’s subsidiary, <strong>Cogeco</strong> Cable Inc., for the three months periodended November 30, 2008 was $8.96 ($12.88 in 2007) per option. The fair value was estimated at the grant date forpurposes of determining the stock-based compensation expense using the binomial option pricing model based onthe following assumptions:2008 2007% %Expected dividend yield 1.40 0.90Expected volatility 29 27Risk-free interest rate 4.22 4.25Expected life in years 4.0 4.0