Q1-2009 Press release - Cogeco

Q1-2009 Press release - Cogeco

Q1-2009 Press release - Cogeco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

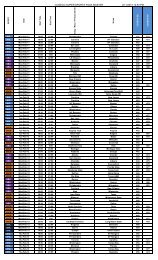

The cash flows of the discontinued operations were as follows:- 5 -Quarters ended November 30,($000)2008 2007$ $(unaudited) (unaudited)Cash flow from operating activities – (5,743)Cash flow from investing activities – (85)Cash flow from financing activities – 5,828Cash flow from discontinued operations – –Continuing OperationsRGU growth in the cable sectorDuring the quarter ended November 30, 2008, the consolidated number of RGU increased by 52,714, or 1.9% to reach2,769,588 RGU, on target to attain the Company’s annual RGU growth projections of 100,000 net additions issued onOctober 29, 2008, which represents approximately 3.7%, for the fiscal year ending August 31, <strong>2009</strong>.Revenue and operating income from continuing operations before amortization growthFor the first quarter of fiscal <strong>2009</strong>, revenue increased by $48.1 million, or 18.5%, to reach $308.4 million while operatingincome before amortization grew by $24.5 million, or 24.5%, to reach $124.7 million.Free cash flowIn the first quarter of fiscal <strong>2009</strong>, COGECO generated free cash flow of $21.8 million compared to $23 million for the sameperiod last year. This decrease results mainly from the cable sector and is attributable to an increase in capitalexpenditures and deferred charges to support HD and Digital Television services as well as to acquire a power generatorfor the newly acquired Canadian data communications subsidiary, and by the impact of the rapid appreciation of the USdollar over the Canadian dollar. This increase was partly offset by the increase in cash flow from operations resultingprimarily from the improvement of the Company’s operating income before amortization.OPERATING RESULTS – CONSOLIDATED OVERVIEWQuarters ended November 30,($000, except percentages) 2008 2007 (1) Change$ $ %(unaudited) (unaudited)Revenue 308,375 260,255 18.5Operating costs 183,671 160,081 14.7Operating income from continuing operations before amortization 124,704 100,174 24.5Operating margin (2) 40.4% 38.5%(1)Certain comparative figures have been reclassified to conform to the current year’s presentation. Financial information for the previous year has been restated toreflect the termination of our investment in the TQS Group, which is no longer consolidated since December 18, 2007 (see note 14 to the consolidated financialstatement), and to reflect the presentation of foreign exchange gains or losses as financial expense instead of operating costs.(2)Operating margin does not have a standardized definition prescribed by Canadian GAAP and therefore, may not be comparable to similar measures presentedby other companies. For more details, please consult the “Non-GAAP financial measures” section.