PUBLIC POWER CORPORATION S.A. AND SUBSIDIARIESNOTES TO THE FINANCIAL STATEMENTSACCORDING TO INTERNATIONAL FINANCIAL REPORTING STANDARDSAS ENDORSED BY THE EUROPEAN UNION<strong>December</strong> <strong>31</strong>, <strong>2010</strong>(All amounts in thousands of Euro, unless otherwise stated - except for share and per share data)12. TRANSMISSION – DISTRIBUTION SPIN OFF (CONTINUED)In October <strong>2010</strong>, the Parent Company’s Board of Directors decided to transfer the operation of the network, theprovision of network services throughout the country, as well as the activity of the Non –Interconnected Islands’operator, to a PPCs’ 100% subsidiary. All of PPC’s properties, as well as the pertinent to the above mentionedactivities, assets and liabilities will be transferred to the above mentioned subsidiary, with the exception of thenetwork’s fixed assets and the Distribution’s installations, which will remain in PPC’s ownership.In October <strong>2010</strong>, PPC’s Board of Directors also decided to transfer the activities of the Transmission of Electricity(currently performed by PPC’s Transmission Business Unit) to its wholly owned subsidiary “PPCTelecommunications” (whose Articles of Incorporation will be amended, accordingly). Also approved the transferto the subsidiary of all the Parent Company’s assets, which functionally belong to the activities of theTransmission’s Division as well as assets and liabilities coherent with the activities of the above mentionedDivision.In <strong>December</strong> <strong>2010</strong>, the Parent Company’s Board of Directors, decided to initiate the procedures for the transfer ofall the activities of the Transmission Division, in order of the personnel, currently in place in the Division’s units –and the fixed assets to be transferred and integrated in its wholly owned subsidiary “PPC Telecommunications”.By the same Decision, <strong>January</strong> 1 st , 2011 was set as the date for the census of the assets to be transferred to theTransmission subsidiary.In <strong>December</strong> <strong>2010</strong>, PPC’s Board of Directors decided to convene PPC’s Extraordinary Shareholders’ GeneralAssembly in order to a) approve the transfer of the activity of the General Division of Transmission to a whollyowned PPC subsidiary and b) approve the transfer of the General Division of Distribution as well as the activitiesof the Operator of the Non – Interconnected Islands to a wholly owned PPC subsidiary.In <strong>December</strong> <strong>2010</strong>, the Parent Company’s Board of Directors, has approved that the activities of Distribution ofElectricity, the General Division of Distribution and the Non – Interconnected Islands’ Operator, the personnelassigned to them as well as the fixed assets (with the exception of the network’s fixed assets which will remainPPC’s ownership) will be conceded to PPC’s wholly owned subsidiary “PPC Rhodes S.A.”. Also, determined<strong>January</strong> 1 st , 2011 as the date of the census of the fixed assets to be contributed to the Disposal group as well asthe preparation of the respective balance sheet..On <strong>December</strong> 30 th , <strong>2010</strong> PPC’s Extraordinary Shareholders’ General Assembly was convened and the followingwere decided:It has approved, in principal, the transfer of all activities of the Transmission of Electricity, exercised by PPC’sGeneral Division of Transmission to its wholly owned subsidiary “PPC Telecommunications” (whose articles ofincorporation will be amended accordingly), as well as the initiation of the appropriate procedures.It has also approved, in principal, the transfer of all activities of the Distribution of Electricity, exercised by PPC’sGeneral Division of Distribution and the Operator of the Non Interconnected Islands to its wholly owned subsidiary“PPC Rhodes S.A.” (whose articles of incorporation will be amended accordingly), as well as the initiation of theappropriate procedures.The Parent Company considers that during the preparation of <strong>Financial</strong> Statements as of <strong>December</strong> <strong>31</strong> st , <strong>2010</strong>IFRS 5 “Non-current Assets Held for Sale and Discontinued Operations” cannot be implemented taking underconsideration that the Law that will incorporate the European Directive and will define the structure as well as theactivities of the new companies (Transmission System Operator and Independent Distribution System Operator)has not yet been ratified by the Greek Parliament up to the publication of the <strong>Financial</strong> Statements.The Parent Company considers that completion, ratification and implementation of the Law will define thestructure and the activities of the new companies as well as relations with the Parent Company and consequentlywill then be in a position to evaluate whether IFRS 5 can be applied.13. INCOME TAXES (CURRENT AND DEFERRED)GroupCompany<strong>2010</strong> 2009 <strong>2010</strong> 2009Current income taxes 207,821 115,877 204,519 114,064Deferred income taxes (36,085) 142,201 (35,810) 142,737Provision for additional taxes 11,044 41,702 10,920 41,452Total income tax expense 182,780 299,780 179,629 298,253Companies of the Group that have their residence in Greece are subject to an income tax of 24%.Based on the legislative regime on <strong>December</strong> <strong>31</strong> st , <strong>2010</strong> the tax rate for the year 2014 will be reduced to 20%,decreasing by 1 percentage point every year.Tax returns are filed annually but the profits or losses declared for tax purposes remain provisional until such time,as the tax authorities examine the returns and the records of the taxpayer and a final assessment is issued.83

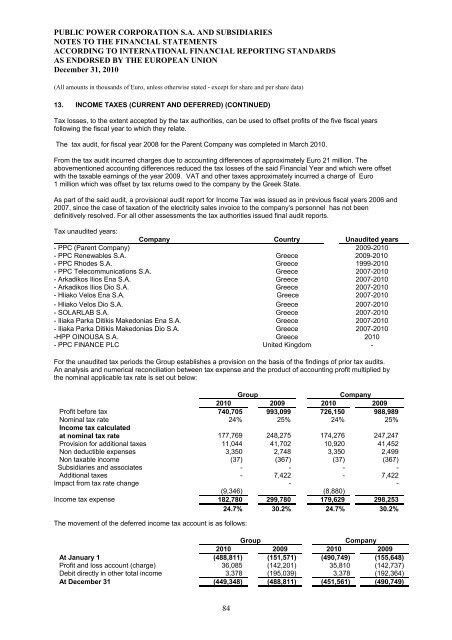

PUBLIC POWER CORPORATION S.A. AND SUBSIDIARIESNOTES TO THE FINANCIAL STATEMENTSACCORDING TO INTERNATIONAL FINANCIAL REPORTING STANDARDSAS ENDORSED BY THE EUROPEAN UNION<strong>December</strong> <strong>31</strong>, <strong>2010</strong>(All amounts in thousands of Euro, unless otherwise stated - except for share and per share data)13. INCOME TAXES (CURRENT AND DEFERRED) (CONTINUED)Tax losses, to the extent accepted by the tax authorities, can be used to offset profits of the five fiscal yearsfollowing the fiscal year to which they relate.The tax audit, for fiscal year 2008 for the Parent Company was completed in March <strong>2010</strong>.From the tax audit incurred charges due to accounting differences of approximately Euro 21 million. Theabovementioned accounting differences reduced the tax losses of the said <strong>Financial</strong> Year and which were offsetwith the taxable earnings of the year 2009. VAT and other taxes approximately incurred a charge of Euro1 million which was offset by tax returns owed to the company by the Greek State.As part of the said audit, a provisional audit report for Income Tax was issued as in previous fiscal years 2006 and2007, since the case of taxation of the electricity sales invoice to the company’s personnel has not beendefinitively resolved. For all other assessments the tax authorities issued final audit reports.Tax unaudited years:Company Country Unaudited years- PPC (Parent Company) 2009-<strong>2010</strong>- PPC Renewables S.A. Greece 2009-<strong>2010</strong>- PPC Rhodes S.A. Greece 1999-<strong>2010</strong>- PPC Telecommunications S.A. Greece 2007-<strong>2010</strong>- Arkadikos Ilios Ena S.A. Greece 2007-<strong>2010</strong>- Arkadikos Ilios Dio S.A. Greece 2007-<strong>2010</strong>- Hliako Velos Ena S.A. Greece 2007-<strong>2010</strong>- Hliako Velos Dio S.A. Greece 2007-<strong>2010</strong>- SOLARLAB S.A. Greece 2007-<strong>2010</strong>- Iliaka Parka Ditikis Makedonias Ena S.A. Greece 2007-<strong>2010</strong>- Iliaka Parka Ditikis Makedonias Dio S.A. Greece 2007-<strong>2010</strong>-HPP OINOUSA S.A.- PPC FINANCE PLCGreeceUnited Kingdom<strong>2010</strong>-For the unaudited tax periods the Group establishes a provision on the basis of the findings of prior tax audits.An analysis and numerical reconciliation between tax expense and the product of accounting profit multiplied bythe nominal applicable tax rate is set out below:GroupCompany<strong>2010</strong> 2009 <strong>2010</strong> 2009Profit before tax 740,705 993,099 726,150 988,989Nominal tax rate 24% 25% 24% 25%Income tax calculatedat nominal tax rate 177,769 248,275 174,276 247,247Provision for additional taxes 11,044 41,702 10,920 41,452Non deductible expenses 3,350 2,748 3,350 2,499Non taxable income (37) (367) (37) (367)Subsidiaries and associates - - - -Additional taxes - 7,422 - 7,422Impact from tax rate change--(9,346)(8,880)Income tax expense 182,780 299,780 179,629 298,25324.7% 30.2% 24.7% 30.2%The movement of the deferred income tax account is as follows:GroupCompany<strong>2010</strong> 2009 <strong>2010</strong> 2009At <strong>January</strong> 1 (488,811) (151,571) (490,749) (155,648)Profit and loss account (charge) 36,085 (142,201) 35,810 (142,737)Debit directly in other total income 3,378 (195,039) 3,378 (192,364)At <strong>December</strong> <strong>31</strong> (449,348) (488,811) (451,561) (490,749)84