Auditor independence and non-audit services - ICAEW

Auditor independence and non-audit services - ICAEW

Auditor independence and non-audit services - ICAEW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

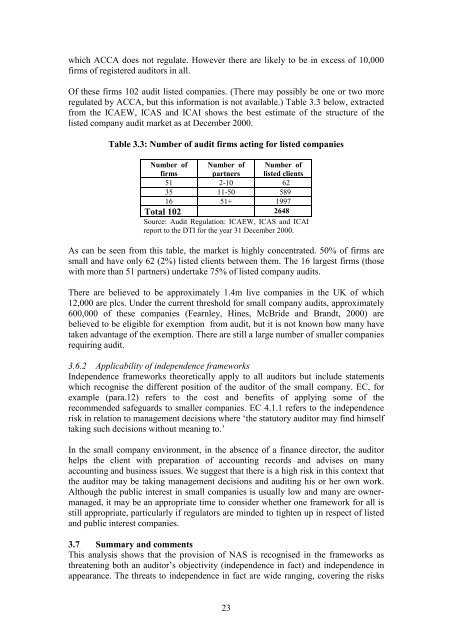

which ACCA does not regulate. However there are likely to be in excess of 10,000firms of registered <strong>audit</strong>ors in all.Of these firms 102 <strong>audit</strong> listed companies. (There may possibly be one or two moreregulated by ACCA, but this information is not available.) Table 3.3 below, extractedfrom the <strong>ICAEW</strong>, ICAS <strong>and</strong> ICAI shows the best estimate of the structure of thelisted company <strong>audit</strong> market as at December 2000.Table 3.3: Number of <strong>audit</strong> firms acting for listed companiesNumber offirmsNumber ofpartnersNumber oflisted clients51 2-10 6235 11-50 58916 51+ 1997Total 102 2648Source: Audit Regulation: <strong>ICAEW</strong>, ICAS <strong>and</strong> ICAIreport to the DTI for the year 31 December 2000.As can be seen from this table, the market is highly concentrated. 50% of firms aresmall <strong>and</strong> have only 62 (2%) listed clients between them. The 16 largest firms (thosewith more than 51 partners) undertake 75% of listed company <strong>audit</strong>s.There are believed to be approximately 1.4m live companies in the UK of which12,000 are plcs. Under the current threshold for small company <strong>audit</strong>s, approximately600,000 of these companies (Fearnley, Hines, McBride <strong>and</strong> Br<strong>and</strong>t, 2000) arebelieved to be eligible for exemption from <strong>audit</strong>, but it is not known how many havetaken advantage of the exemption. There are still a large number of smaller companiesrequiring <strong>audit</strong>.3.6.2 Applicability of <strong>independence</strong> frameworksIndependence frameworks theoretically apply to all <strong>audit</strong>ors but include statementswhich recognise the different position of the <strong>audit</strong>or of the small company. EC, forexample (para.12) refers to the cost <strong>and</strong> benefits of applying some of therecommended safeguards to smaller companies. EC 4.1.1 refers to the <strong>independence</strong>risk in relation to management decisions where ‘the statutory <strong>audit</strong>or may find himselftaking such decisions without meaning to.’In the small company environment, in the absence of a finance director, the <strong>audit</strong>orhelps the client with preparation of accounting records <strong>and</strong> advises on manyaccounting <strong>and</strong> business issues. We suggest that there is a high risk in this context thatthe <strong>audit</strong>or may be taking management decisions <strong>and</strong> <strong>audit</strong>ing his or her own work.Although the public interest in small companies is usually low <strong>and</strong> many are ownermanaged,it may be an appropriate time to consider whether one framework for all isstill appropriate, particularly if regulators are minded to tighten up in respect of listed<strong>and</strong> public interest companies.3.7 Summary <strong>and</strong> commentsThis analysis shows that the provision of NAS is recognised in the frameworks asthreatening both an <strong>audit</strong>or’s objectivity (<strong>independence</strong> in fact) <strong>and</strong> <strong>independence</strong> inappearance. The threats to <strong>independence</strong> in fact are wide ranging, covering the risks23