Auditor independence and non-audit services - ICAEW

Auditor independence and non-audit services - ICAEW

Auditor independence and non-audit services - ICAEW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

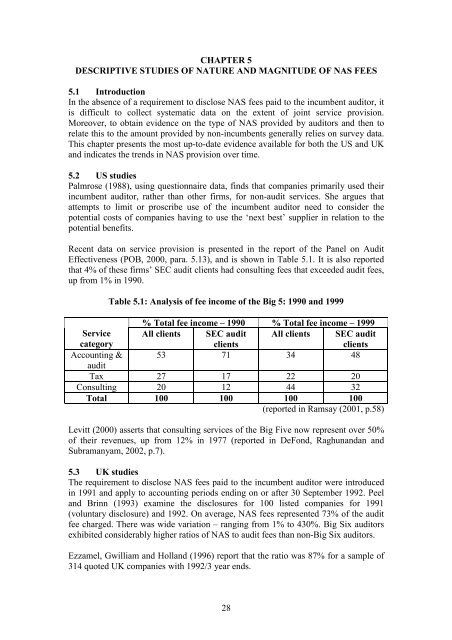

CHAPTER 5DESCRIPTIVE STUDIES OF NATURE AND MAGNITUDE OF NAS FEES5.1 IntroductionIn the absence of a requirement to disclose NAS fees paid to the incumbent <strong>audit</strong>or, itis difficult to collect systematic data on the extent of joint service provision.Moreover, to obtain evidence on the type of NAS provided by <strong>audit</strong>ors <strong>and</strong> then torelate this to the amount provided by <strong>non</strong>-incumbents generally relies on survey data.This chapter presents the most up-to-date evidence available for both the US <strong>and</strong> UK<strong>and</strong> indicates the trends in NAS provision over time.5.2 US studiesPalmrose (1988), using questionnaire data, finds that companies primarily used theirincumbent <strong>audit</strong>or, rather than other firms, for <strong>non</strong>-<strong>audit</strong> <strong>services</strong>. She argues thatattempts to limit or proscribe use of the incumbent <strong>audit</strong>or need to consider thepotential costs of companies having to use the ‘next best’ supplier in relation to thepotential benefits.Recent data on service provision is presented in the report of the Panel on AuditEffectiveness (POB, 2000, para. 5.13), <strong>and</strong> is shown in Table 5.1. It is also reportedthat 4% of these firms’ SEC <strong>audit</strong> clients had consulting fees that exceeded <strong>audit</strong> fees,up from 1% in 1990.Table 5.1: Analysis of fee income of the Big 5: 1990 <strong>and</strong> 1999% Total fee income – 1990 % Total fee income – 1999ServicecategoryAll clients SEC <strong>audit</strong>clientsAll clients SEC <strong>audit</strong>clientsAccounting & 53 71 34 48<strong>audit</strong>Tax 27 17 22 20Consulting 20 12 44 32Total 100 100 100 100(reported in Ramsay (2001, p.58)Levitt (2000) asserts that consulting <strong>services</strong> of the Big Five now represent over 50%of their revenues, up from 12% in 1977 (reported in DeFond, Raghun<strong>and</strong>an <strong>and</strong>Subramanyam, 2002, p.7).5.3 UK studiesThe requirement to disclose NAS fees paid to the incumbent <strong>audit</strong>or were introducedin 1991 <strong>and</strong> apply to accounting periods ending on or after 30 September 1992. Peel<strong>and</strong> Brinn (1993) examine the disclosures for 100 listed companies for 1991(voluntary disclosure) <strong>and</strong> 1992. On average, NAS fees represented 73% of the <strong>audit</strong>fee charged. There was wide variation – ranging from 1% to 430%. Big Six <strong>audit</strong>orsexhibited considerably higher ratios of NAS to <strong>audit</strong> fees than <strong>non</strong>-Big Six <strong>audit</strong>ors.Ezzamel, Gwilliam <strong>and</strong> Holl<strong>and</strong> (1996) report that the ratio was 87% for a sample of314 quoted UK companies with 1992/3 year ends.28