banif finance, ltd.

banif finance, ltd.

banif finance, ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

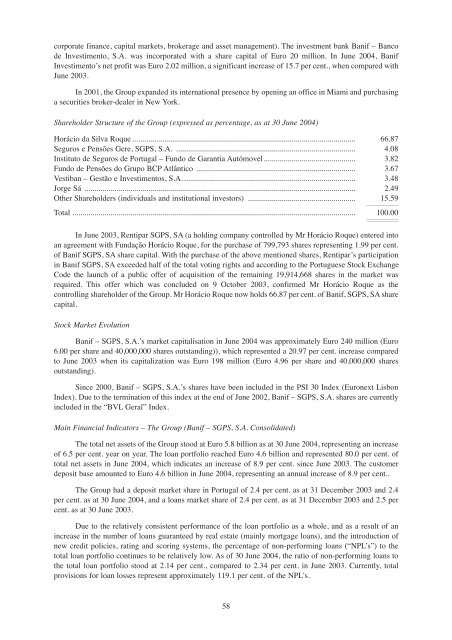

corporate <strong>finance</strong>, capital markets, brokerage and asset management). The investment bank Banif – Bancode Investimento, S.A. was incorporated with a share capital of Euro 20 million. In June 2004, BanifInvestimento’s net profit was Euro 2.02 million, a significant increase of 15.7 per cent., when compared withJune 2003.In 2001, the Group expanded its international presence by opening an office in Miami and purchasinga securities broker-dealer in New York.Shareholder Structure of the Group (expressed as percentage, as at 30 June 2004)Horácio da Silva Roque ................................................................................................................ 66.87Seguros e Pensões Gere, SGPS, S.A. .......................................................................................... 4.08Instituto de Seguros de Portugal – Fundo de Garantia Autómovel.............................................. 3.82Fundo de Pensões do Grupo BCP Atlântico ................................................................................ 3.67Vestiban – Gestão e Investimentos, S.A....................................................................................... 3.48Jorge Sá ........................................................................................................................................ 2.49Other Shareholders (individuals and institutional investors) ...................................................... 15.591111Total .............................................................................................................................................. 100.001111In June 2003, Rentipar SGPS, SA (a holding company controlled by Mr Horácio Roque) entered intoan agreement with Fundação Horácio Roque, for the purchase of 799,793 shares representing 1.99 per cent.of Banif SGPS, SA share capital. With the purchase of the above mentioned shares, Rentipar’s participationin Banif SGPS, SA exceeded half of the total voting rights and according to the Portuguese Stock ExchangeCode the launch of a public offer of acquisition of the remaining 19,914,668 shares in the market wasrequired. This offer which was concluded on 9 October 2003, confirmed Mr Horácio Roque as thecontrolling shareholder of the Group. Mr Horácio Roque now holds 66.87 per cent. of Banif, SGPS, SA sharecapital.Stock Market EvolutionBanif – SGPS, S.A.’s market capitalisation in June 2004 was approximately Euro 240 million (Euro6.00 per share and 40,000,000 shares outstanding)), which represented a 20.97 per cent. increase comparedto June 2003 when its capitalization was Euro 198 million (Euro 4.96 per share and 40,000,000 sharesoutstanding).Since 2000, Banif – SGPS, S.A.’s shares have been included in the PSI 30 Index (Euronext LisbonIndex). Due to the termination of this index at the end of June 2002, Banif – SGPS, S.A. shares are currentlyincluded in the “BVL Geral” Index.Main Financial Indicators – The Group (Banif – SGPS, S.A. Consolidated)The total net assets of the Group stood at Euro 5.8 billion as at 30 June 2004, representing an increaseof 6.5 per cent. year on year. The loan portfolio reached Euro 4.6 billion and represented 80.0 per cent. oftotal net assets in June 2004, which indicates an increase of 8.9 per cent. since June 2003. The customerdeposit base amounted to Euro 4.6 billion in June 2004, representing an annual increase of 8.9 per cent..The Group had a deposit market share in Portugal of 2.4 per cent. as at 31 December 2003 and 2.4per cent. as at 30 June 2004, and a loans market share of 2.4 per cent. as at 31 December 2003 and 2.5 percent. as at 30 June 2003.Due to the relatively consistent performance of the loan portfolio as a whole, and as a result of anincrease in the number of loans guaranteed by real estate (mainly mortgage loans), and the introduction ofnew credit policies, rating and scoring systems, the percentage of non-performing loans (“NPL’s”) to thetotal loan portfolio continues to be relatively low. As of 30 June 2004, the ratio of non-performing loans tothe total loan portfolio stood at 2.14 per cent., compared to 2.34 per cent. in June 2003. Currently, totalprovisions for loan losses represent approximately 119.1 per cent. of the NPL’s.58