Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

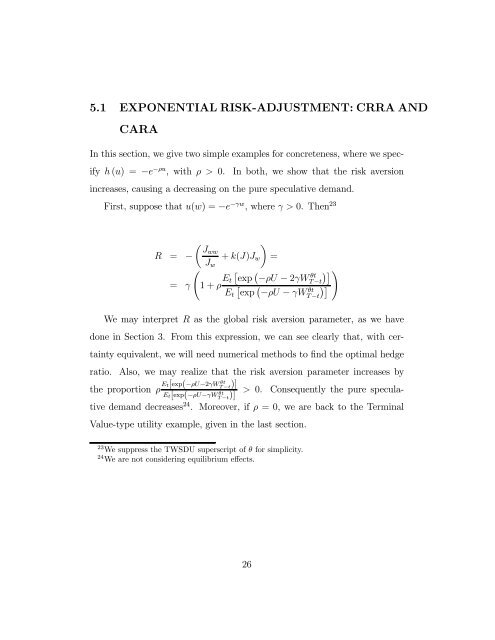

5.1 EXPONENTIAL RISK-ADJUSTMENT: CRRA ANDCARAIn this section, we give two simple examples for concreteness, where we specifyh (u) =−e −ρu ,<strong>with</strong>ρ > 0. In both, we show that the risk aversionincreases, causing a decreasing on the pure speculative demand.First, suppose that u(w) =−e −γw ,whereγ > 0. Then 23µ JwwR = − + k(J)J w =Jà w£ ¡exp −ρU − 2γWθt= γ1+ρ E tT −tE t£exp¡−ρU − γWθtT −t¢¤ !We may interpret R as the global risk aversion parameter, as we havedone in Section 3. From this expression, we can see clearly that, <strong>with</strong> certaintyequivalent, we will need numerical methods to find the optimal hedgeratio. Also, we may realize that the risk aversion parameter increases bythe proportion ρ E t[exp(−ρU−2γWT θt−t)]> 0. Consequently the pure speculativedemand decreases 24 . Moreover, if ρ = 0, we are back to theE t[exp(−ρU−γWT θt−t)]TerminalValue-type utility example, given in the last section.¢¤23 We suppress the TWSDU superscript of θ for simplicity.24 We are not considering equilibrium effects.26