Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Dynamic Hedging with Stochastic Differential Utility

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

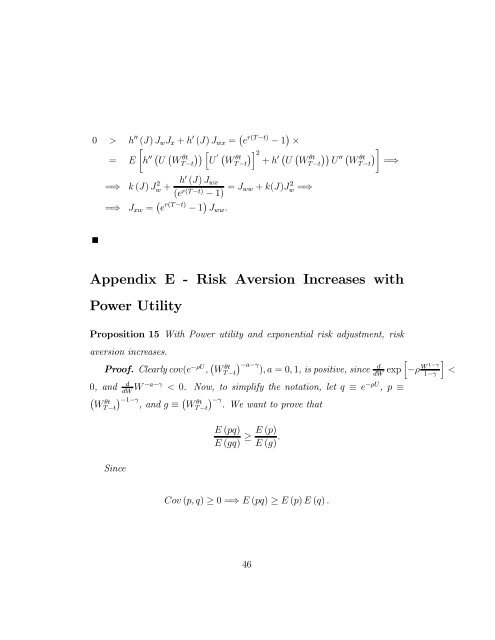

0 > h 00 (J) J w J x + h 0 (J) J wx = ¡ e r(T −t) − 1 ¢ ×·= E h ¡ 00 U ¡ ¢¢ h ¡ ¢ iWT θt−t U 0 2 ¡WθtT −t + h0U ¡ W θt=⇒ k (J) Jw 2 + h0 (J) J wx(e r(T −t) − 1) = J ww + k(J)Jw 2 =⇒=⇒ J xw = ¡ e r(T −t) − 1 ¢ J ww .T −t¢¢ ¡ ¢¸U00WT θt−t =⇒Appendix E - Risk Aversion Increases <strong>with</strong>Power <strong>Utility</strong>Proposition 15 With Power utility and exponential risk adjustment, riskaversion increases.Proof. Clearly cov(e −ρU , ¡ ¢ hWT θt −a−γ−t ),a=0, 1, is positive, since d exp −ρ W 1−γdW 1−γ0, and d W −a−γ < 0. Now, to simplify the notation, let q ≡ e −ρU , p ≡dW¡ ¢Wθt −1−γT −t ,andg ≡ ¡ WT −t¢ θt −γ. We want to prove thatSinceE (pq)E (gq) ≥ E (p)E (g) .i